SUPPLY CHAIN SPARE CAPACITY INCREASES FOR 3RD CONSECUTIVE MONTH AND NOW AT HIGHEST LEVEL SINCE JULY 2023 AS GLOBAL ECONOMIC WEAKNESS INTENSIFIES: GEP GLOBAL SUPPLY CHAIN VOLATILITY INDEX

Rhea-AI Summary

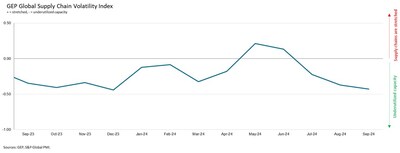

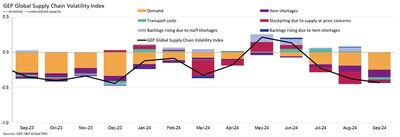

The GEP Global Supply Chain Volatility Index decreased to -0.43 in September, indicating the highest level of global supply chain spare capacity since July 2023. This rise in underutilized vendor capacity was driven by a further deterioration in global demand, with factory purchasing activity at its weakest year-to-date across all major continents.

Key findings include:

- North American supplier spare capacity increased significantly, with U.S. manufacturers lowering purchasing volumes aggressively

- Asian supply chain spare capacity rose to a year-to-date high, with China's factory procurement activity falling for the third straight month

- Europe's industrial recession intensified, reflecting challenges faced by major manufacturers

- Global transportation costs dipped to their lowest since July 2023

- Material shortages indicator fell to its lowest level since January 2020

Positive

- Global transportation costs decreased to their lowest level since July 2023

- Material shortages indicator fell to its lowest level since January 2020, indicating improved global raw material availability

- Labor supply is generally capable of meeting demand, with reports of staff shortages in line with historically typical levels

Negative

- GEP Global Supply Chain Volatility Index decreased to -0.43, its lowest level in 14 months

- Global demand for raw materials, commodities, and intermediate goods deteriorated more quickly in September

- Factory purchasing activity was at its weakest in the year-to-date across all major continents

- North American supplier spare capacity increased significantly, indicating a slowing U.S. economy

- China's factory procurement activity fell for the third straight month

- Europe's industrial recession intensified, reflecting challenges faced by major manufacturers

News Market Reaction

On the day this news was published, SPGI declined 1.22%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

North America factory purchasing activity deteriorates more quickly in September, with demand at its weakest year-to-date, signaling a quickly slowingU.S. economy- Factory procurement activity in

China fell for a third straight month, and devastation from Typhoon Yagi hit vendors feeding Southeast Asian markets likeVietnam Europe's industrial recession deepens, leading to an even larger increase in supplier spare capacity

The rise in underutilized vendor capacity was driven by a further deterioration in global demand. Factory purchasing activity was at its weakest in the year-to-date, with procurement trends in all major continents worsening in September and signaling gloomier prospects for economies heading into Q4.

Notably, supplier spare capacity shot up again in

In

"September is the fourth straight month of declining demand and the third month running that the world's supply chains have spare capacity, as manufacturing becomes an increasing drag on the major economies," explained Jagadish Turimella, president, GEP. "With the potential of a widening war in the

SEPTEMBER 2024 KEY FINDINGS

- DEMAND: Global demand for raw materials, commodities and other intermediate goods deteriorated more quickly in September, reflecting a stronger downturn in procurement activity across many major global economies, such as the

U.S. ,China andGermany . - INVENTORIES: In September, reports of stockpiling due to price or supply concerns remained below the long-term average.

- MATERIAL SHORTAGES: The item shortages indicator fell to its lowest level since January 2020, indicating improved global raw material availability as factories retrench.

- LABOR SHORTAGES: Reports of staff shortages leading to a rise in backlogs at manufacturers were in line with historically typical levels in September. This indicates that labor supply is generally capable of meeting demand.

- TRANSPORTATION: Global transportation costs once again dipped in September and were the lowest since July 2023.

REGIONAL SUPPLY CHAIN VOLATILITY

NORTH AMERICA : Index fell to a 15-month low of -0.78, from -0.62, signaling a further increase in spare vendor capacity. The U.S. market drove this, with the economyslowing ahead of the presidential election.EUROPE : Index fell to a nine-month low of -0.74, from -0.53, indicating a further intensification of the continent's industrial downturn.Germany continues to pull other parts of the region down with it.U.K. : Index fractionally rose to -0.12, from -0.14. TheU.K. is demonstrating some resilience to wider global economic headwinds — partly reflecting an ongoing post-election bounce.ASIA : Index at a year-to-date low of -0.36, down from -0.07, signalling the highest level of spare vendor capacity since December 2023. In addition to a slowing Chinese market, Typhoon Yagi dented supplier activity inSoutheast Asia .

For more information, visit www.gep.com/volatility.

Note: Full historical data dating back to January 2005 is available for subscription. Please contact economics@spglobal.com.

The next release of the GEP Global Supply Chain Volatility Index will be 8 a.m. ET, Nov. 12, 2024.

About the GEP Global Supply Chain Volatility Index

The GEP Global Supply Chain Volatility Index is produced by S&P Global and GEP. It is derived from S&P Global's PMI® surveys, sent to companies in over 40 countries, totaling around 27,000 companies. The headline figure is a weighted sum of six sub-indices derived from PMI data, PMI Comments Trackers and PMI Commodity Price & Supply Indicators compiled by S&P Global.

- A value above 0 indicates that supply chain capacity is being stretched and supply chain volatility is increasing. The further above 0, the greater the extent to which capacity is being stretched.

- A value below 0 indicates that supply chain capacity is being underutilized, reducing supply chain volatility. The further below 0, the greater the extent to which capacity is being underutilized.

For more information about the methodology, click here.

About GEP

GEP® delivers AI-powered procurement and supply chain solutions that help global enterprises become more agile and resilient, operate more efficiently and effectively, gain competitive advantage, boost profitability and increase shareholder value. Fresh thinking, innovative products, unrivaled domain expertise, smart, passionate people — this is how GEP SOFTWARE™, GEP STRATEGY™ and GEP MANAGED SERVICES™ together deliver procurement and supply chain solutions of unprecedented scale, power and effectiveness. Headquartered in

About S&P Global

S&P Global (NYSE: SPGI) S&P Global provides essential intelligence. We enable governments, businesses and individuals with the right data, expertise and connected technology so that they can make decisions with conviction. From helping our customers assess new investments to guiding them through ESG and energy transition across supply chains, we unlock new opportunities, solve challenges and accelerate progress for the world. We are widely sought after by many of the world's leading organizations to provide credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help the world's leading organizations plan for tomorrow, today.

Media Contacts | ||

Derek Creevey | Joe Hayes | S&P Global Market Intelligence |

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/supply-chain-spare-capacity-increases-for-3rd-consecutive-month-and-now-at-highest-level-since-july-2023-as-global-economic-weakness-intensifies-gep-global-supply-chain-volatility-index-302273459.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/supply-chain-spare-capacity-increases-for-3rd-consecutive-month-and-now-at-highest-level-since-july-2023-as-global-economic-weakness-intensifies-gep-global-supply-chain-volatility-index-302273459.html

SOURCE GEP