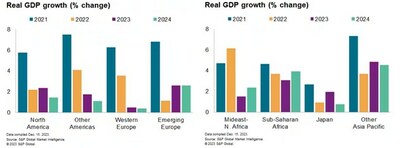

S&P Global Market Intelligence Forecasts Global Real GDP Growth of 2.3 percent in 2024

- None.

- None.

Insights

The forecast of lower global real GDP growth in 2024 is a critical indicator of the overall health of the global economy. A slowdown in growth can affect corporate earnings and investment decisions, potentially leading to a more cautious stance from businesses. This prediction may prompt companies to re-evaluate their expansion plans and could result in a tighter job market if firms decide to curb hiring. The impact on the stock market could be mixed; traditionally defensive sectors may see increased interest, while cyclical sectors could face headwinds.

The expectation of central bank policy rate cuts in advanced economies suggests that monetary authorities are aiming to stimulate economic activity amid subdued inflation. This could lower the cost of borrowing and encourage investment, but it also signals that central banks are concerned about the risk of an economic downturn. For businesses, this might mean cheaper financing options, but for the stock market, the long-term effects are uncertain as investors weigh the benefits of lower rates against the reasons prompting such cuts.

Regarding the U.S. dollar depreciation, this could have a significant impact on multinational companies by making exports more competitive but also increasing the cost of importing goods and services. For investors, currency movements can affect the returns on international investments and could influence portfolio allocation decisions.

The report's mention of geopolitical factors and the high number of elections suggests potential volatility and uncertainty in the market. Investors may need to prepare for abrupt policy changes and shifts in the business environment, which could affect international trade relations and market stability. Companies operating in multiple jurisdictions will need to be particularly vigilant and adaptable to navigate these changes.

The uneven progress on global energy transition indicates that there will be winners and losers in different regions and industries. Companies in the energy sector, as well as those in industries heavily dependent on energy, will need to closely monitor policy developments. This could lead to investment opportunities in regions like North America, where policy is supportive of the energy transition and challenges in regions lagging behind.

Lastly, the variable real estate market prospects highlight the need for real estate investors and companies in the construction and housing sectors to be discerning and strategic, focusing on markets with supportive supply constraints and steering clear of areas with anticipated price declines.

The potential central bank monetary policy pivot and consequent rate cuts could lead to a shift in investor sentiment and asset allocation. A reduction in policy rates typically encourages investors to move away from fixed-income securities and into equities, searching for higher yields. However, if rate cuts are perceived as a response to significant economic headwinds, the stock market reaction could be tempered by concerns over corporate profitability and economic stability.

Additionally, the forecasted appreciation of the yen against the U.S. dollar, due to a tightening Japanese monetary policy, could affect Japanese exporters by making their products more expensive abroad. Conversely, it may benefit importers and consumers within Japan. Investors in Japanese equities and international investors with exposure to the yen may need to reassess their positions.

The mention of rising non-performing loans raises concerns about credit quality and financial stability. An increase in non-performing loans could indicate underlying stress in the economy and may lead to tighter lending standards, affecting businesses' ability to finance operations and growth. It could also have repercussions for financial institutions and the broader stock market.

Top-10 Economic Predictions for 2024 highlight lower economic growth, inflation and policy rates

"The downward trend in inflation, which had stalled in mid-2023, has resumed and is expected to continue through 2024, consistent with rebalancing supply and demand," said Ken Wattret, Global Economist, S&P Global Market Intelligence.

As confidence builds that consumer price inflation rates will return to target, central bank policy rate cuts are forecast across advanced economies during 2024. "Monetary policy pivots look increasingly likely during the first half of 2024," said Wattret, "although recent market expectations of around 150 basis points of rate cuts in the

Other Top-10 predictions include:

- Central bank easing cycles are already well under way in many emerging economies and rate cuts are forecast to become more widespread during the first half of 2024.

- Mainland

China's economy will be supported by more accommodative policy, a gradual improvement of private-sector confidence and an expected bottoming out of the housing market downturn. - The

U.S. dollar will depreciate, consistent with weakerU.S. growth, narrowing interest rate differentials and the persistent large current-account deficit. The yen is expected to appreciate more against theU.S. dollar than many of its peers as tightening Japanese monetary policy bucks the global trend. - Some financial headwinds to growth will persist, including the adverse effect of rising non-performing loans on credit supply.

- Prospects for real estate prices will continue to vary across countries and sectors; supply constraints will support residential prices in some markets, although declines in

Western Europe are forecast to continue. - Geopolitical factors will remain an important source of risk and uncertainty, with approximately 80 major elections taking place across the world in 2024.

- Progress on global energy transition will remain uneven in 2024. Policy initiatives are supportive of investment growth in

North America , leaning against recessions in the region.

Additional analysis is available here. To request a copy of S&P Global Market Intelligence's Top 10 Economic Predictions for 2024, please contact press.mi@spglobal.com.

S&P Global Market Intelligence's opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Katherine Smith

S&P Global Market Intelligence

+1 781-301-9311

katherine.smith@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-forecasts-global-real-gdp-growth-of-2-3-percent-in-2024--302028754.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-market-intelligence-forecasts-global-real-gdp-growth-of-2-3-percent-in-2024--302028754.html

SOURCE S&P Global Market Intelligence

FAQ

What are the Top-10 Economic Predictions for 2024 by S&P Global Market Intelligence?

What is the forecast for global real GDP growth in 2024 compared to 2023?

What is the expected trend for inflation in 2024?

How will the U.S. dollar perform in 2024 according to the report?