S&P Global Commodity Insights Launches New Platts Price Assessments for Poultry, Beef

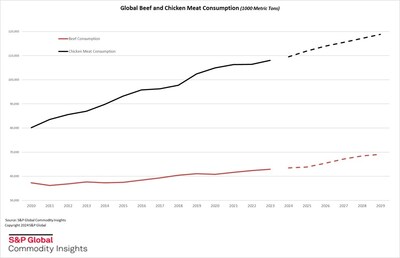

S&P Global Commodity Insights announced the launch of new Platts price assessments for poultry and beef markets in the Americas, Asia, and Middle East. This initiative, available via Platts Protein Daily, aims to enhance transparency in the food value chain by offering daily price insights for key cuts of poultry and beef. Seven new price assessments include values for chicken legs and breasts as well as beef forequarters and manufacturing beef. The expansion is expected to meet growing protein consumption demands and provide essential data for stakeholders such as farmers, producers, traders, processors, and end users. S&P Global forecasts a significant rise in global chicken and beef production by 2029, with notable increases in Asia, Latin America, and the US.

- Launch of seven new price assessments for poultry and beef markets.

- New daily assessments available via Platts Protein Daily.

- Enhanced transparency across the food value chain.

- Addresses growing protein consumption demands.

- Projections of an 8.97% increase in global chicken production by 2029.

- Projections of a 7.26% increase in global beef production by 2029.

- Notable production increases in Asia, Latin America, and the US.

- Decline in beef production expected in the European Union by 3.77% by 2029.

Insights

Platts' launch of new price assessments for poultry and beef markets represents a significant advancement in market transparency for the agricultural sector. These assessments will provide critical market data to a wide array of stakeholders, enabling them to make more informed decisions. For retail investors, it is essential to grasp the value of price transparency, as it mitigates market inefficiencies and enhances price discovery mechanisms. Historically, price assessments in commodities have led to more accurate pricing and improved market confidence, which can positively impact trading volumes and liquidity.

The move to include daily price assessments for various forms of poultry and beef across key regions may also signal potential growth opportunities within these markets. For instance, as global protein consumption rises, having reliable data on protein prices will aid in navigating demand and supply dynamics.

Short-term, this could lead to immediate adjustments in trading strategies and contract pricing for agricultural commodities. Long-term, the enhanced transparency could drive more investment into protein production and processing industries due to clearer market signals and reduced risk.

Rating: 1

The introduction of new Platts price assessments by S&P Global Commodity Insights is a noteworthy development for the agricultural commodities market. It will likely lead to a more robust pricing structure for poultry and beef, impacting the financial planning and budgeting processes of market participants. These assessments can be particularly beneficial for companies involved in hedging activities and those looking to minimize their exposure to price volatility.

For investors, the transparency offered by these assessments could lead to more predictable earnings for companies within the supply chain, potentially stabilizing stock performance in the agriculture sector. Additionally, this level of detail in pricing can aid in better financial forecasting and risk management for businesses reliant on these commodities.

Short-term benefits may include improved contract negotiations and pricing models. Long-term, the standardized pricing data will likely contribute to stronger market fundamentals and increased investor confidence in the sector.

Rating: 1

The launch of Platts Protein Daily with new price assessments for poultry and beef is poised to bring substantial benefits to agriculture economics. This development enhances price transparency and market efficiency, critical for economies dependent on agriculture. The detailed assessments allow for better analysis of market trends and supply chain dynamics, which is important for strategic planning and policy-making.

From an economic perspective, these assessments help in price stabilization and can potentially reduce market speculation. They also provide a benchmark for negotiations and contracts, leading to fairer pricing mechanisms and reducing the risk of market distortions.

In the short-term, greater price transparency can lead to more competitive market behavior, benefiting both producers and consumers. Long-term, it could encourage investment in agricultural infrastructure and innovation, driving sustainable growth within the sector.

Rating: 1

Furthers Transparency Across the Food Value Chain

- Platts Protein Daily Aimed at Beef & Poultry Buyers, Sellers, Processors in

The new price assessments will be available via the newly launched Platts Protein Daily, which will include news, insights and market fundamentals that inform those assessments.

Piero Carello, Global Pricing Director, Agriculture & Food, S&P Global Commodity Insights, said: "We're excited to be expanding to proteins, with seven new price assessments that will bring much needed transparency to the wider value chain of our animal feeds coverage of grains and oilseeds, allowing us for the first time to provide the broader spectrum cross-market price fundamentals and insights."

Platts Protein Daily will include a new global suite of poultry price assessments for the key cuts of one of the world's most accessible proteins, chicken, as well as daily price assessments for beef for

- Platts US Chicken Marker (USCM): a daily value in US dollars per metric ton ($/mt) of the chicken leg on a free carrier (FCA) basis

the United States , port ofSavannah, Georgia . - Platts Chicken Leg CFR North Asia: a daily value in $/mt of chicken leg delivered to

North Asia ,Tokyo port inJapan , on a cost and freight (CFR) basis. - Platts Chicken Breast CIF Middle East: a daily value in $/mt of the chicken breast delivered to the

Middle East , Jebel Ali port,UAE , on a cost, insurance and freight (CIF) basis. - Platts Chicken Leg FCA Brazil: a daily value in $/mt of the chicken leg on CFA basis

Brazil , port of Paranagua. - Platts Brazil Beef Marker (BBM): a daily value in US dollars per metric ton ($/mt) of the front forequarter of eight cuts (chuck ribs, chuck roll, chuck tender, neck, oyster bade, shoulder blade, brisket and shin) on an FCA basis, Santos, Brazil.

- Platts 90CL Beef CIF US: a daily value in $/mt of manufacturing beef,

90% chemical lean (90CL), deboned, boxed and frozen on a CIF basis,Philadelphia , Pennsylvania. - Platts 90CL Beef FCA Australia: A daily value in $/mt of manufacturing beef,

90% chemical lean, deboned, boxed and frozen on an FCA basis,Brisbane .

Dave Ernsberger, Head of Market Reporting & Trading Solutions, S&P Global Commodity Insights, said: "Per-capita consumption of proteins is on the rise and our expansion in protein further demonstrates our commitment to serve the ever-evolving needs of this market. We are not only adding price assessments for key markets, we are also building out analytics services to help better inform the supply and demand fundamentals that will inform prices going forward."

Global chicken production is set to increase

Today's chicken and beef price assessments are aimed at aiding all involved in the related agriculture supply chain, including farmers, producers, traders, processors, and end users.

For more details on the protein price assessments and price assessment processes, consult Platts specifications and methodology guidelines.

Platts Protein Daily will be accessible via S&P Global Commodity Insights products, platforms and services, including such as: S&P Global Commodity Insights Live and Platts Connect.

S&P Global Commodity Insights has been covering agriculture markets for more than 15 years, including Platts suite of existing assessments and benchmarks in grains, oilseeds, vegetable oils, animal feed & plant protein markets. For details of S&P Global Commodity Insights' protein and agriculture offerings, visit: agribusiness industry solutions.

Media Contacts:

Americas: Kathleen Tanzy + 1 917-331-4607, kathleen.tanzy@spglobal.com

EMEA: Paul Sandell + 44 (0)7816 180039, paul.sandell@spglobal.com

About S&P Global Commodity Insights

At S&P Global Commodity Insights, our complete view of global energy and commodity markets enables our customers to make decisions with conviction and create long-term, sustainable value.

We're a trusted connector that brings together thought leaders, market participants, governments, and regulators and we create solutions that lead to progress. Vital to navigating commodity markets, our coverage includes oil and gas, power, chemicals, metals, agriculture, shipping and energy transition. Platts® products and services, including leading benchmark price assessments in the physical commodity markets, are offered through S&P Global Commodity Insights. S&P Global Commodity Insights maintains clear structural and operational separation between its price assessment activities and the other activities carried out by S&P Global Commodity Insights and the other business divisions of S&P Global.

S&P Global Commodity Insights is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information visit https://www.spglobal.com/commodityinsights.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-commodity-insights-launches-new-platts-price-assessments-for-poultry-beef-302161556.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sp-global-commodity-insights-launches-new-platts-price-assessments-for-poultry-beef-302161556.html

SOURCE S&P Global Commodity Insights

FAQ

What new markets are covered by S&P Global's latest price assessments?

What is Platts Protein Daily?

What specific poultry price assessments are introduced?

What specific beef price assessments are introduced?

What is the expected growth in global chicken production by 2029?

What regions will see the highest increase in beef production by 2029?