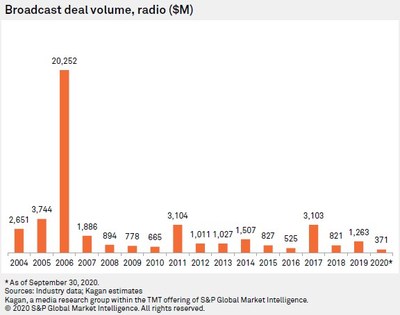

Q3 broadcast M&A market picks up pace in spite of COVID-19 pandemic

In Q3 2020, U.S. broadcast station M&A volume surged to $534.7 million, a significant increase from $90.3 million in Q2, attributed to COVID-19 recovery, according to Kagan, part of S&P Global Market Intelligence. The largest transaction was E.W. Scripps Co.'s acquisition of ION Media Holdings Inc. for $338.0 million. Other notable deals included Nexstar’s option for WPIX-DT at $75 million and TEGENA’s $19 million purchase of KMPX-DT. Overall, market activity rebounded strongly, with 63% of the quarter's total coming from the ION deal.

- Q3 2020 M&A volume reached $534.7 million, a significant rebound from $90.3 million in Q2.

- E.W. Scripps Co.'s acquisition of ION Media at $338 million is a key driver of the M&A activity.

- The number of transactions doubled compared to Q2, indicating increased market confidence.

- None.

NEW YORK, Oct. 30, 2020 /PRNewswire/ -- U.S. broadcast station mergers and acquisitions (M&A) volume reached a total of

The largest share of the deal volume came from the TV station part of E.W. Scripps Co.'s acquisition of ION Media Holdings Inc., announced Sept. 24. At an 8.7x forward seller's multiple, ION's 71 TV stations are worth

The second-largest TV deal was a purchase option for New York's WPIX-DT. In July, Nexstar Media Group Inc. transferred that option to its partner Mission Broadcasting Inc., which exercised the option for

In August, SJL Broadcast Management Corp. announced the sale of three Hawaiian TV stations to Entertainment Studios Inc. for

In the quarter's largest deal involving a single TV station, TEGNA Inc. in September announced the purchase of Estrella Media Inc.'s KMPX-DT in the Dallas-Ft. Worth market for

The top radio deal of the quarter was the announced

The second- and third-largest radio deals of the quarter both took place in the non-commercial realm, with Educational Media Foundation Inc. the buyer in both deals. In July, Educational Media Foundation announced the

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. We integrate financial and industry data, research and news into tools that help track performance, generate alpha, identify investment ideas, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities around the world use this essential intelligence to make business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), the world's foremost provider of credit ratings, benchmarks and analytics in the global capital and commodity markets, offering ESG solutions, deep data and insights on critical business factors. S&P Global has been providing essential intelligence that unlocks opportunity, fosters growth and accelerates progress for more than 160 years. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Amanda Oey

S&P Global Market Intelligence

Amanda.oey@spglobal.com

(212) 438-1904

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/q3-broadcast-ma-market-picks-up-pace-in-spite-of-covid-19-pandemic-301163535.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/q3-broadcast-ma-market-picks-up-pace-in-spite-of-covid-19-pandemic-301163535.html

SOURCE S&P Global Market Intelligence

FAQ

What was the total M&A volume for U.S. broadcast stations in Q3 2020?

What major acquisition occurred in the broadcast station sector in Q3 2020?

How much did Nexstar Media Group pay for WPIX-DT?

What was the percentage increase of broadcast M&A volume from Q2 to Q3 2020?