New S&P Global Market Intelligence Report Finds U.S. Community Bank Earnings are Expected to Fall 12% year-over-year in 2024

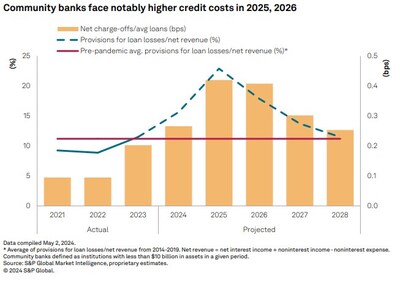

A new report from S&P Global Market Intelligence forecasts a 12% decline in U.S. community bank earnings year-over-year in 2024 due to margin pressure and higher credit costs. Despite expectations of a rebound in earnings by 2025 and 2026, community banks will face challenges from high-interest rates and deposit competition. Rate cuts by the Federal Reserve will provide modest relief in late 2024, but substantial decreases are necessary to lower deposit costs significantly. Community bank credit quality is expected to deteriorate in 2024 and continue weakening into 2025 and 2026, driven by higher delinquencies and losses in commercial real estate portfolios. However, this decline poses more of a hit to earnings than a threat to the institutions' safety and soundness.

- Earnings rebound expected in 2025 and 2026.

- Federal Reserve rate cuts to offer modest relief late 2024.

- Provisions for loan losses expected to decline in 2026, improving net interest margins.

- Earnings expected to fall by 12% year-over-year in 2024.

- Higher credit costs will continue to impact earnings negatively.

- Fierce deposit competition and higher interest rates will further pressure net interest margins.

- Credit quality to slip in 2024 and weaken further into 2025 and 2026, with increased delinquencies and losses in commercial real estate portfolios.

Higher for longer interest rates have put pressure on community banks' net interest margins and put deposits in the spotlight while changing the funding profile of community banks. Rate cuts by the Federal Reserve will offer modest relief in community banks' funding costs late in 2024, but more substantial rate cuts will be needed to drive deposits costs notably lower.

"Even as the market waits for the Federal Reserve to pivot to lower rates, most banks remain in a battle for deposits as rates remain higher for longer and regulators encourage banks to maintain liquidity. That continued focus on deposits will lead to additional margin pressure for community banks in 2024," said Nathan Stovall, director of financial institutions research at S&P Global Market Intelligence. "When deposit pricing pressures eventually ease, community banks will face a new headwind in the form of higher credit costs, serving as a modest headwind to earnings."

Key highlights from the report include:

- Fierce deposit competition should persist amid regulatory pressures and higher-for-longer interest rates as banks place a higher value on deposits than other forms of funding.

- Community bank credit quality will slip in 2024 and weaken further in 2025 and 2026, led by higher delinquencies and losses in commercial real estate portfolios, but the deterioration will serve as a hit to earnings rather than a threat to safety and soundness for most institutions.

- Along with an expected decline in interest rates, U.S. community bank earnings will rebound strongly in 2025 as net interest margins rebound and rise again in 2026 as provisions for loan losses decline.

To request a copy of the 2024 U.S. Community Bank Market Report, please contact press.mi@spglobal.com.

S&P Global Market Intelligence's opinions, quotes, and credit-related and other analyses are statements of opinion as of the date they are expressed and not statements of fact or recommendation to purchase, hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security.

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. Our team of experts delivers unrivaled insights and leading data and technology solutions, partnering with customers to expand their perspective, operate with confidence, and make decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/marketintelligence.

Media Contact

Katherine Smith

S&P Global Market Intelligence

+1 781 301 9311

katherine.smith@spglobal.com

press.mi@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/new-sp-global-market-intelligence-report-finds-us-community-bank-earnings-are-expected-to-fall-12-year-over-year-in-2024-302168442.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/new-sp-global-market-intelligence-report-finds-us-community-bank-earnings-are-expected-to-fall-12-year-over-year-in-2024-302168442.html

SOURCE S&P Global Market Intelligence

FAQ

What is the expected change in U.S. community bank earnings in 2024 according to SPGI?

When are U.S. community bank earnings expected to rebound, according to SPGI?

What factors are contributing to the decline in U.S. community bank earnings as reported by SPGI?

How will Federal Reserve rate cuts impact community banks according to SPGI?