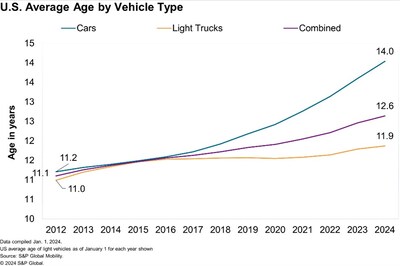

Average Age of Vehicles in the US Continues to Rise: 12.6 years in 2024, according to S&P Global Mobility

The average age of vehicles in the U.S. has hit a record 12.6 years in 2024, according to S&P Global Mobility. This trend, while showing signs of slowing, continues to present substantial opportunities for the automotive aftermarket sector. As vehicles age, the demand for repairs and services is projected to rise, with more than 110 million vehicles currently in the prime repair age range of 6-14 years. Vehicle scrappage rates remain stable at 4.6%, with a notable shift towards utility vehicles. The total U.S. vehicle fleet has grown to 286 million, including 3.2 million EVs, though EV adoption has seen slower growth than expected. Consumer preference for utility vehicles is reshaping the market, and the impact of COVID-19 continues to influence vehicle supply and age distribution.

- The average age of U.S. vehicles has reached a record 12.6 years, suggesting increased demand for aftermarket services.

- More than 110 million vehicles are in the prime repair age, expected to grow to 40% of the fleet by 2028, boosting aftermarket opportunities.

- The total U.S. vehicle fleet has increased to 286 million vehicles, up 2 million from the previous year.

- EV registrations surpassed one million units in 2023, with an overall increase of 52% compared to 2022.

- The rate of increase in vehicle age is slowing, potentially limiting future growth opportunities in the aftermarket sector.

- Vehicle scrappage rates remain stable, indicating that the influx of new vehicles is not sufficient to significantly change the average vehicle age.

- The growth of EV adoption has been slower than some automakers anticipated, posing potential challenges for future market expansion.

- Vehicles under the age of six have declined to less than 90 million, down from 98 million in 2019, indicating a shift towards an aging fleet.

Aftermarket opportunities abound as sweet spot continues to grow

This continues to improve business opportunities for companies in the aftermarket and vehicle service sector in the

"With average age growth, more vehicles are entering the prime range for aftermarket service, typically from 6 to 14 years of age," said Todd Campau, aftermarket practice lead at S&P Global Mobility. "With more than 110 million vehicles in that sweet spot -- reflecting nearly 38 percent of the fleet on the road -- we expect continued growth in the volume of vehicles in that age range to rise to an estimated 40 percent through 2028."

Two passenger cars scrapped for every new passenger car registration

Vehicle scrappage rates – the measure of vehicles exiting the active population – continue to hold steady. As of January 2024, the scrappage rate was

Looking at the mix of the fleet, since 2020, more than 27 million passenger cars exited the US vehicle population, while just over 13 million new passenger cars were registered. At the same time, over 26 million light trucks (including utilities) were scrapped and nearly 45 million were registered.

"Consumers have continued to demonstrate a preference for utility vehicles and manufacturers have adjusted their portfolio accordingly, which continues to reshape the composition of the fleet of vehicles in operation in the market," said Campau.

VIO grows to 286M, while EV VIO exceeds 3M

The US vehicle fleet surged to 286 million vehicles in operation (VIO) in January, up 2 million over 2023, but the distribution of vehicles by age is changing. Vehicles under the age of six accounted for 98M vehicles in 2019, or about 35 percent of VIO. Today they represent less than 90M vehicles and are not expected to reach that threshold again until 2028 when they will represent about

As a result, the primary driver of VIO growth will be vehicles in the aftermarket 'sweet spot' -- vehicles 6-14 years of age, and even older vehicles, that are expected to represent about

EVs on the road also continued to increase, with 3.2 million EVs in operation in January. 2023 EV registrations surpassed one million units for the first time and increased about

"We started to see headwinds in EV sales growth in late 2023, and though there will be some challenges on the road to EV adoption that could drive EV average age up, we still expect significant growth in share of electric vehicles in operation over the next decade," said Campau.

About S&P Global Mobility

At S&P Global Mobility, we provide invaluable insights derived from unmatched automotive data, enabling our customers to anticipate change and make decisions with conviction. Our expertise helps them to optimize their businesses, reach the right consumers, and shape the future of mobility. We open the door to automotive innovation, revealing the buying patterns of today and helping customers plan for the emerging technologies of tomorrow.

S&P Global Mobility is a division of S&P Global (NYSE: SPGI). S&P Global is the world's foremost provider of credit ratings, benchmarks, analytics and workflow solutions in the global capital, commodity, and automotive markets. With every one of our offerings, we help many of the world's leading organizations navigate the economic landscape so they can plan for tomorrow, today. For more information, visit www.spglobal.com/mobility.

Media Contact:

Michelle Culver

S&P Global Mobility

248.728.7496 or 248.342.6211

Michelle.culver@spglobal.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/average-age-of-vehicles-in-the-us-continues-to-rise-12-6-years-in-2024--according-to-sp-global-mobility-302152258.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/average-age-of-vehicles-in-the-us-continues-to-rise-12-6-years-in-2024--according-to-sp-global-mobility-302152258.html

SOURCE S&P Global Mobility

FAQ

What is the average age of vehicles in the U.S. in 2024?

How does the aging vehicle fleet impact the aftermarket sector?

What is the current vehicle scrappage rate in the U.S.?

How many electric vehicles (EVs) are currently in operation in the U.S.?

What is the projected share of vehicles in the prime repair age range by 2028?

How has the total U.S. vehicle fleet size changed recently?

What factors have influenced the age distribution of vehicles on the road?