Snowline Gold Expands Footprint of Widespread, Near-Surface Mineralization with Drill Results up to 308.8 m of 2.2 Grams Per Tonne Gold Including 180.3 M Of 3.2 grams per tonne gold from Surface at Its Valley Target, Rogue Project, Yukon

- Hole V-23-064 returned 308.8 m averaging 2.15 g/t Au, including 180.3 m of 3.23 g/t Au from surface (with the top 68.3 m averaging 5.03 g/t Au), showing strong continuity of multiple-gram-per-tonne, near-surface gold mineralization across gap in previous drilling

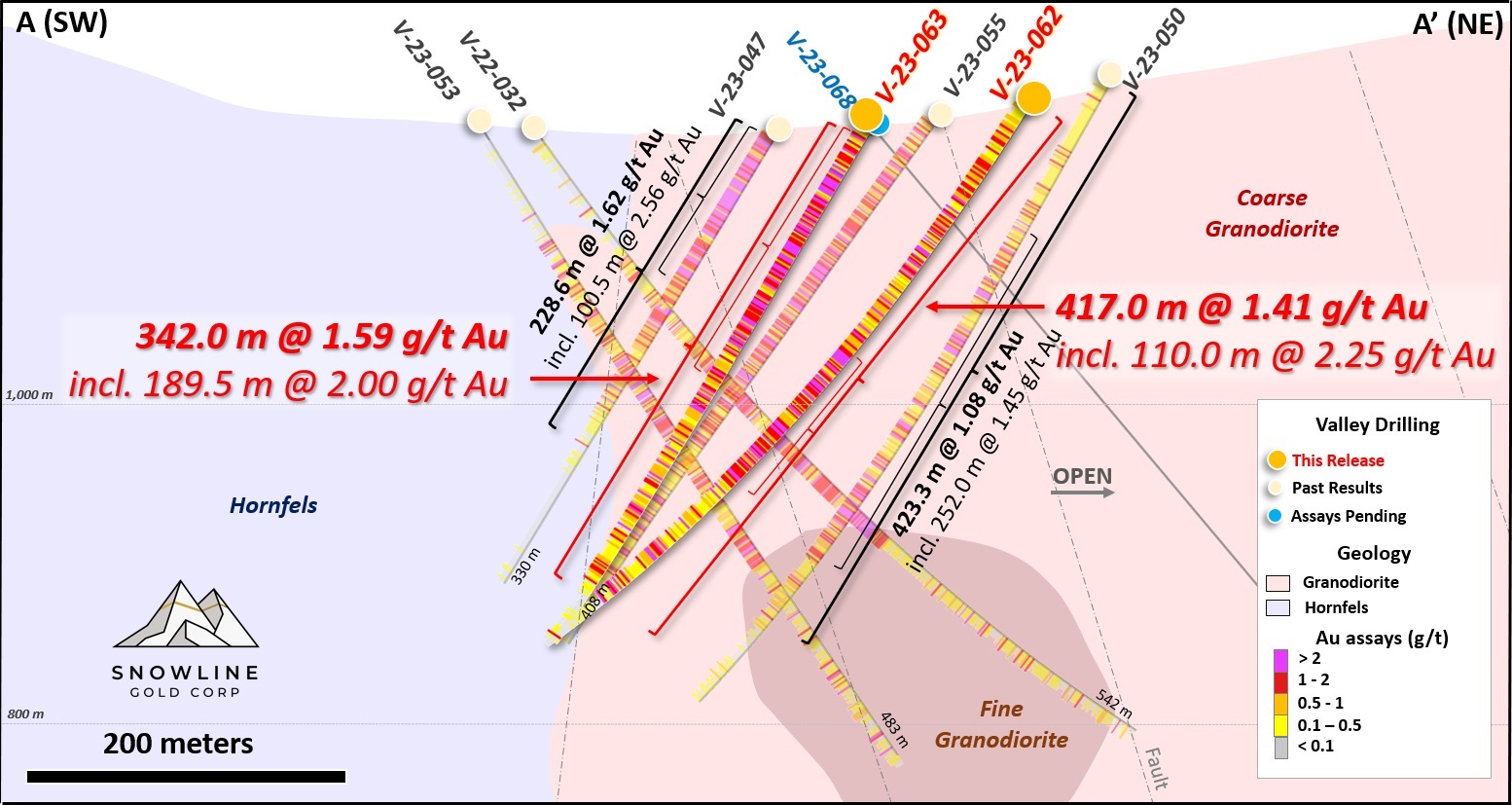

- Hole V-23-062 and V-23-063 show high grades and strong consistency in the northwestern part of the Valley target, returning 417.0 m averaging 1.41 g/t Au (including 2.25 g/t Au over 110.0 m) and 342.0 m averaging 1.59 g/t Au (including 2.00 g/t Au over 189.5 m) respectively, with both intervals beginning from surface

- Analytical results pending for 3,850 m from 11 holes (including one metallurgical hole at Valley) across two projects-Rogue and Tosh.

VANCOUVER, BC / ACCESSWIRE / January 3, 2024 / SNOWLINE GOLD CORP (TSXV:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce analytical results from additional exploration holes drilled during its 2023 exploration campaign in Canada's Yukon Territory. Hole V-23-064 returned 2.15 g/t Au over 308.8 m downhole, including 3.23 g/t Au over 180.3 m from surface, demonstrating strong consistency of near-surface, multiple-gram-per-tonne-gold mineralization within a gap in previous drilling at the Rogue Project's Valley target. Holes V-23-062 and V-23-063 were drilled in the northwestern part of the target and add dimensionality and consistency to known mineralization in that direction. Assays for more than 3,850 m of diamond drilling from Snowline's 2023 exploration efforts are forthcoming.

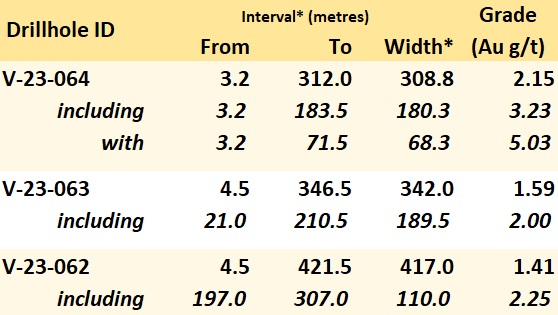

Table 1 -Highlight summary of Snowline's latest assay results. *Interval widths reported; true widths of the system are not yet known.

"The latest results from the Rogue Project's Valley target further emphasize the continuity of strong, near-surface gold mineralization present across a wide area," said Scott Berdahl, CEO & Director of Snowline. "V-23-064 is drilled through one of the largest remaining gaps in the central part of the target, carrying an average grade of >3 g/t Au over a 180 m downhole interval from surface. As is generally the case at Valley-and as seen in holes drilled in every direction around V-23-064-mineralization is remarkably consistent. Every single assay in the first 100 m downhole returned >1.0 g/t Au. On the high side, only three samples in V-23-064 returned >10 g/t Au, so the intervals are not heavily influenced by outliers but are carried instead by consistent grade. Additional holes V-23-062 and 063 bolster the known scale of the northern part of the system, where we are still chasing open boundaries to mineralization. With results for six holes remaining from the 2023 drill program at Valley, we are excited by the large robust mineral system taking shape at the target."

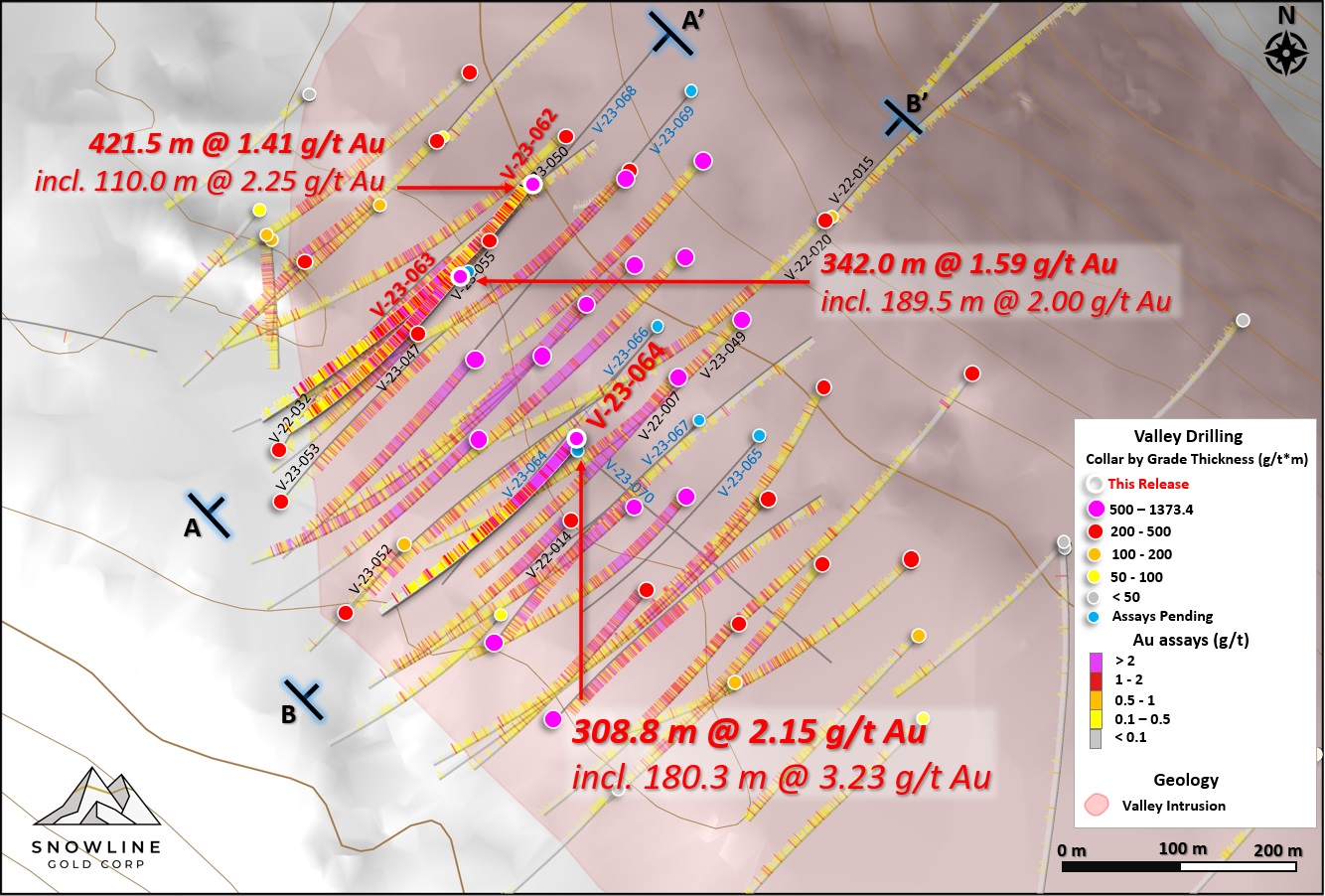

Figure 1 - Plan view of the Rogue Project's Valley target showing analytical results from previous and current drilling, along with drill traces of outstanding holes. Note that to display new results, current holes are plotted above previous holes regardless of relative depths. The system remains open in multiple directions, including to depth. Endpoints for sections A (Figure 3) and B (Figure 2) are indicated on the map.

HOLE V-23-064

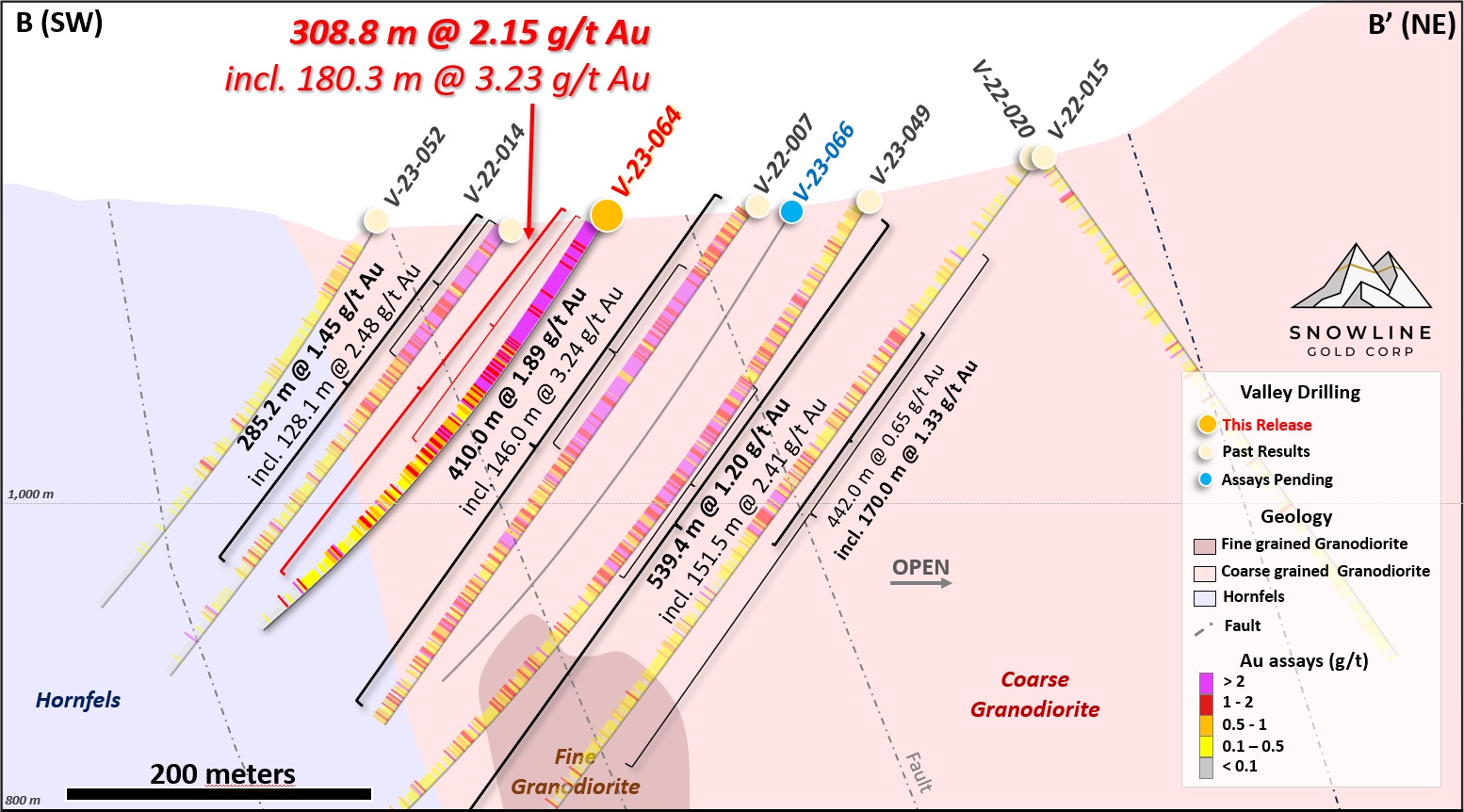

Hole V-23-064 is collared in coarse-grained granodiorite within the Valley intrusion roughly 66 m north of the nearest hole, V-22-014 (285.2 m @ 1.45 g/t Au including 128.2 m @ 2.48 g/t Au from surface, see Snowline news release dated November 15, 2022) and 85 m southeast of V-23-039 (553.8 m @ 2.48 g/t Au including 183.3 m @ 4.34 g/t Au from surface, see Snowline news release dated August 3, 2023).

The hole commences in strong, sheeted gold-bearing quartz vein mineralization (Figure 2) from bedrock surface at 3.2 m downhole and continues in predominantly strong mineralization until approximately 188 m downhole, near where the hole intersects a central, valley-parallel fault at 170 m downhole. Quartz vein densities and occurrences of visible gold drop off below the fault, but lower grade mineralization continues until the hole exits the intrusion into hornfels sedimentary rocks 309 m downhole. Multiple gold-bearing quartz vein orientations are present, with a dominant sheeted vein array striking northwest and steeply dipping to the northeast, as

commonly seen in the primary mineralized zone at Valley.

Figure 2 - Cross-section B, showing V-23-064 in the context of adjacent holes along or near to the cross section and a simplified, schematic geological model. The upper part of the hole returned consistently high gold grades, demonstrating continuity of strong mineralization through a gap in previous drilling. View looks northwest. Note that hole V-22-014 is located in the foreground of the section, and it exits the intrusion lower in the hole than suggested by its projection onto the geology of the current section. Similarly, V-23-052 is behind the section. See Figure 1 for collar locations in plan view.

Overall, the top 308.8 m downhole from bedrock surface averages 2.15 g/t Au, with an internal interval of 180.3 m averaging 3.23 g/t Au also beginning from surface. Within this, the highest grades are seen at or near surface, with the top 68.3 m downhole averaging 5.03 g/t Au. The presence of such high and consistent gold grades beginning at surface in a large gap in previous drilling further de-risks the mineral system at Valley, demonstrating strong continuity within the well-mineralized zone.

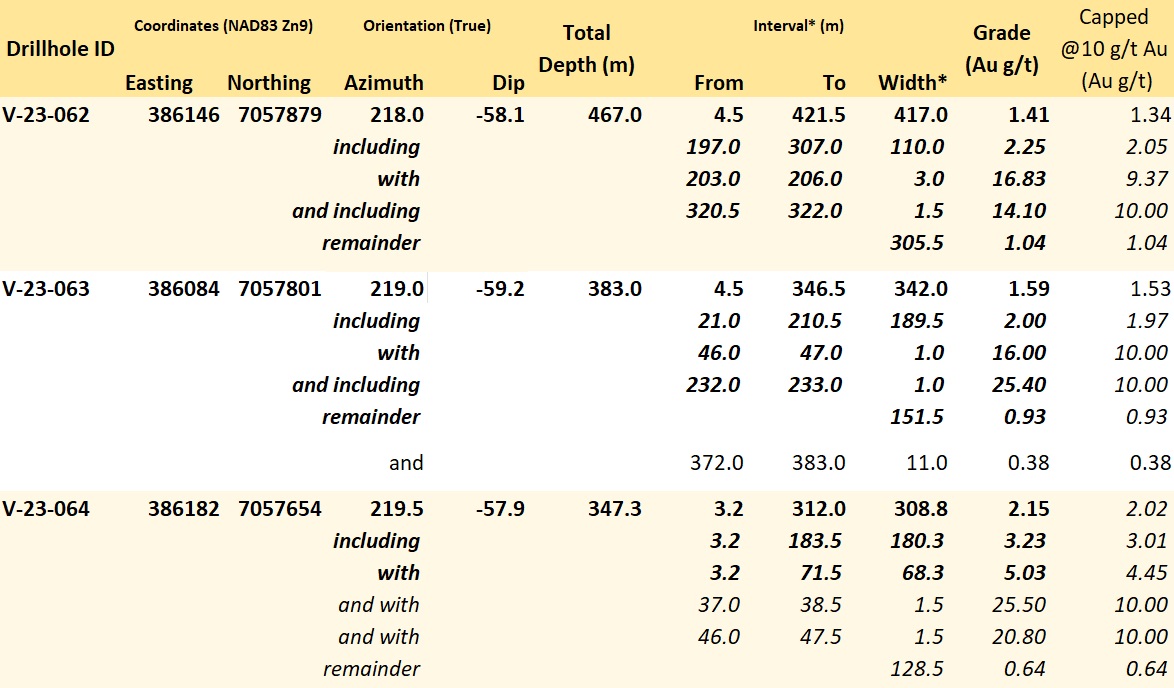

Table 2 - Summary of significant mineralization returned from current holes at Valley. The consistency of strong mineralization on the target is reinforced by the capped values in the rightmost column, wherein any assay result >10 g/t Au is replaced by 10.0 g/t Au to calculate the average interval grades. *Interval widths reported; true widths of the system are not yet known, with different vein generations, orientations, and grade distributions present within various intervals through the bulk tonnage gold target at Valley.

HOLES V-23-062 & V-23-063

Both V-23-062 and V-23-063 from part of a fence of holes across the northwestern part of the well-mineralized, near-surface corridor within the Valley intrusion (Figures 1 & 3). Both holes are collared in coarse grained granodiorite and continue in coarse grained granodiorite, with minor xenoliths and dikes of finer-grained intrusive rock, until exiting into hornfels sedimentary rocks from the southwestern edge of the intrusion.

The two holes exhibit the strongest mineralized intervals seen thus far within that fence, demonstrating the strength and scale of the system in this area. V-23-062 averages 1.41 g/t Au across 417.0 m downhole from bedrock surface (at 4.5 m downhole), with an internal interval of 2.25 g/t Au over 110.0 m, including 3.0 m averaging 16.83 g/t Au. V-23-063 averages 1.59 g/t Au over 342.0 m from bedrock surface (also at 4.5 m downhole), with an internal interval of 2.00 g/t Au over 189.5 m from 21.0 m downhole. Despite localized higher grades in both holes, mineralized intervals are carried by consistently anomalous gold values, as indicated by the high remainder values (excluding higher grade sub-intervals) along with the high capped values (limiting any assay to a maximum of 10 g/t Au) shown in Table 2.

Both V-23-062 and V-23-063 add breadth to the known extent of near-surface >1 g/t Au and > 2 g/t Au mineralization in the northwest part of the Valley gold system, which remains open.

Figure 3 - Cross-section B, showing V-23-062 & V-23-063 in the context of adjacent holes along section and a simplified, schematic geological model. Both holes, drilled as part of a fence across the northwestern part of the Valley target, demonstrates breadth of consistent mineralization perpendicular to the northwest strike of the system in this area. View looks northwest. See Figure 1 for section location.

REGIONAL DRILLING

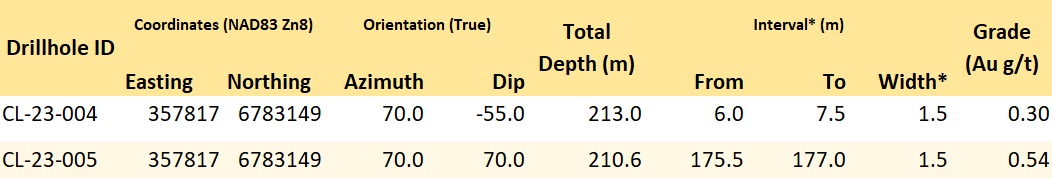

Cliff Project, Southwest Yukon

Analytical results have been received for an additional two holes from a Phase I drill program at Snowline Gold's Cliff Project, an orogenic gold project located in the southwestern Yukon. Elevated gold values were present in association with sparse quartz veins in the two holes, but the >1.0 g/t Au assays (up to 6.64 g/t Au over 1.9 m downhole) seen in previous holes from this drill program were not encountered in the current holes. A summary is provided in Table 3.

Table 3 - Summary of mineralization returned from current holes at Snowline's Cliff Project, an early-stage orogenic gold target located in the southwestern Yukon Territory. Various lesser intervals are present but not listed. *Interval widths reported; true widths have not been determined.

QA/QC

On receipt from the drill site NQ2-sized drill core was systematically logged for geological attributes, photographed and sampled at Snowline's 2023 field camp. Sample lengths as small as 0.5 m were used to isolate features of interest, but most samples within moderate to strong mineralization were 1.0 m in length; otherwise, a default 1.5 m downhole sample length was used. Core was cut in half lengthwise along a pre-determined line, with one half (same half, consistently, dictated by orientation line where present or by dominant vein orientation where absent) collected for analysis and one half stored as a record. Field duplicates were collected at regular intervals as ¼ core samples by splitting the ½ core sent for sampling, leaving a consistent record of half core material from duplicate and non-duplicate samples alike. Standard reference materials and blanks were inserted by Snowline personnel at regular intervals into the sample stream. Bagged samples were sealed with security tags to ensure integrity during transport. They were delivered by expeditor to Bureau Veritas' preparatory facility in Whitehorse, Yukon. Sample preparation was completed in Whitehorse, with analyses completed in Vancouver.

Similar procedures were employed on the Cliff Project, though drill core was transported to Whitehorse in advance of detailed logging and sampling.

Bureau Veritas is accredited to ISO/IEC 17025 and ISO9001 for quality management. Samples were crushed by BV to >

For the purposes of this release, mineralized intervals are defined as runs of mineralization with no break >5.0 m assaying <0.1 g/t Au, including any subsections thereof.

ERRATA

In compiling previously released drill hole information, the Company noticed typographical errors in the drill hole coordinates reported in news release summary tables for two holes from the 2022 field season, V-22-028 (February 3, 2023 release) and V-22-031 (December 2, 2022 release). For correct UTM coordinates for these collar sites, please refer to the Company's June 13, 2023 technical report on the Rogue Project. The typos appeared in the news release summary tables only and did not affect locations shown on plan maps nor the cross sections highlighting accompanying the tables in the same news releases.

ABOUT ROGUE

The Valley target on Snowline's flagship Rogue Project is a newly discovered, bulk tonnage style, reduced intrusion-related gold system (RIRGS), with geological similarities to multi-million-ounce deposits currently in production such as Kinross's Fort Knox Mine in Alaska and Victoria Gold's Eagle Mine in the Yukon. Early drill results demonstrate unusually high gold grades for such a system, present near surface across drill intersections of hundreds of metres. Gold is associated with bismuthinite and telluride minerals hosted in sheeted quartz vein arrays within and along the margins of a one-kilometer-scale, mid-Cretaceous aged Mayo-suite intrusion. Valley is an early-stage exploration project without a resource estimate, and while initial results are encouraging, the presence or absence of an economically viable orebody cannot be determined until additional work is completed.

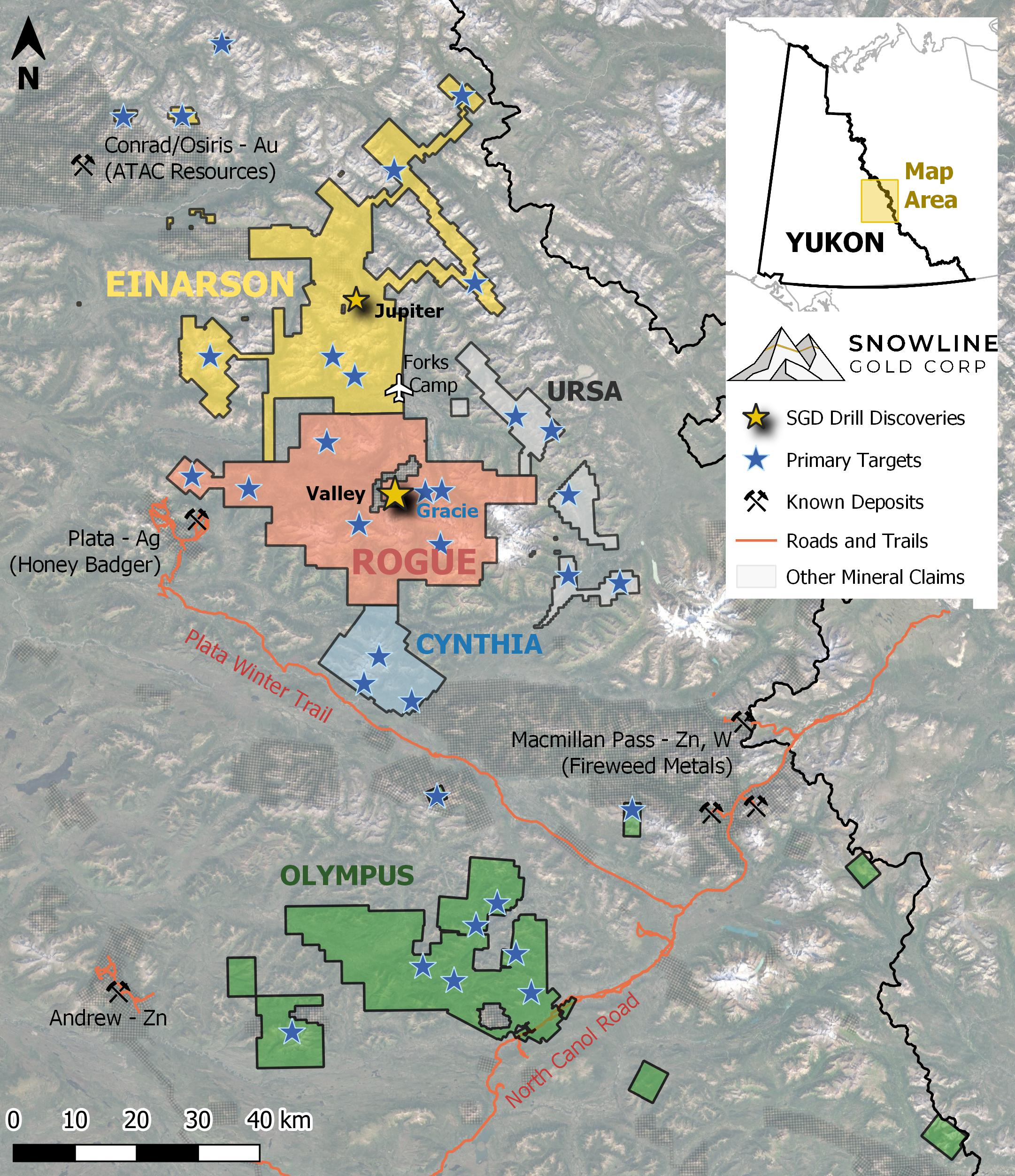

The Rogue Project area hosts multiple intrusions similar to Valley along with widespread gold anomalism in stream sediment, soil and rock samples. Elsewhere, RIRGS deposits are known to occur in clusters. The Rogue Project is thus considered by the Company to have district-scale potential for additional reduced intrusion-related gold systems.

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with an eight-project portfolio covering >333,000 ha. The Company is exploring its flagship >94,000 ha Rogue gold project in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross's Fort Knox Mine, Newmont's Coffee deposit, and Victoria Gold's Eagle Mine. The Company's first-mover land position and extensive database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

Figure 4 - Project location map for Snowline Gold's eastern Selwyn Basin properties: Rogue, Einarson, Ursa, Cynthia and Olympus. The Valley target is one of several prospective reduced intrusion-related gold targets on the broader 30 x 60 km Rogue Project.

QUALIFIED PERSON

Information in this release has been prepared under supervision of and approved by Thomas K. Branson, M.Sc., P. Geo., VP Exploration of Snowline Gold Corp, as Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the significance of analytical results, the discovery potential within the Valley intrusion, the potential for investors to participate in multiple future discoveries, the Rogue project having district-scale prospectivity, the creation of a new gold district and the Company's future plans and intentions. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View the original press release on accesswire.com