Sokoman’s Barge Drilling Program Delivers Strong Au Results Moosehead Project, Central Newfoundland

Sokoman Minerals Corp. (TSXV: SIC, OTCQB: SICNF) announced high-grade gold assays from the Moosehead Project, highlighting drill results such as MH-21-342 with 5.55 m of 56.58 g/t Au, including 3.10 m of 100 g/t Au. Additional drilling confirmed a strong high-grade zone open to surface and depth, with ongoing exploration efforts to connect mineralized zones. The Moosehead project continues to show potential for substantial mineralization, with plans for extensive drilling in winter. Assays are pending for other drilled areas, indicating further exploration success.

- High-grade assays reported, including 3.10 m at 100 g/t Au from MH-21-342.

- Strong near-surface Au values confirmed over good widths.

- Ongoing drilling aims to merge multiple gold zones into a single mineralized body.

- None.

Multiple shallow intercepts including 3.10 m of 100 g/t Au in MH-21-342

ST. JOHN’S,

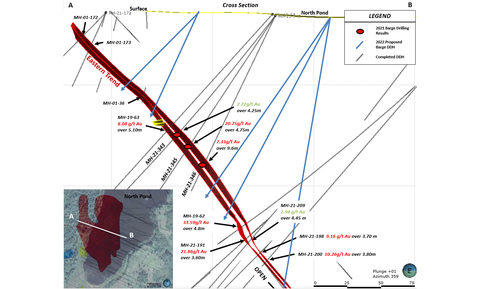

Cross Section Map -

Assay highlights include:

- MH-21-342 - 5.55 m of 56.58 g/t Au incl. 3.10 m of 100.00 g/t Au from 67.80 m

- MH-21-345 - 4.75 m of 20.75 g/t Au incl. 2.25 m of 39.57 g/t Au from 117.65 m

- MH-21-346 - 9.60 m of 7.33 g/t Au incl. 4.55 m of 12.98 g/t Au from 122.20 m

Also included are drill holes from the 75 Zone which has been extended to the north towards the Main Eastern Trend (MH-21-298), as well as holes from the southern limit of the Eastern Trend (MH-21-259 and MH-21-263) stepping southwards towards the 75 Zone (see attached drill plan). Additional drilling is planned to close the approximately 100 m gap between the two zones. Modelling is suggesting that shallow intercepts in the 75 Zone, including MH-21-298, 17.50 m downhole with 2.30 m at 9.75 g/t in 8.40 m of 3.35 g/t Au, may be a splay off the

The drilling confirms very shallow, high-grade, gold-bearing veins lying in the Main Eastern Trend, as well as in splays or offshoots from it, as shown in an expanded table of results included with this news release. Intersected, downhole, Au values quoted are thought to be 80

Modelling confirms that Moosehead Au mineralization is focused around the Eastern Trend and that mineralized offsets such as the Footwall Splay, may include others such as the 75 and South Pond Zones. An important goal for the remaining 50,000+ metres in the drilling program is to merge all of the zones into a single mineralized body.

Other gold mineralized areas:

253 Zone – located approximately 300 m to the east of the Eastern Trend – cut two zones of Au mineralization - 7.5 m of 0.31 g/t, 32 m downhole, and 1.78 g/t Au over 1.40 m, 54.8 m downhole, drilled last fall, require additional drilling to evaluate. Twelve (12) holes were drilled around hole 253 but due to logistical issues (streams and wetlands), were not able to properly test the zone. Assays for most holes are pending including the western-most hole (MH-20-273) which intersected quartz veining with two specks of visible gold noted. The 253 Zone is considered highly prospective as only 75 m of strike length has been tested, but most likely not tested properly, and the zone is mineralized, quartz float boulders with visible gold and high-grade Au values are found in the vicinity, and geophysics (VLF-EM) suggests a strike length of the structure, hosting the mineralized veins, of several kilometres. The 253 Zone is a separate structure and is not part of the Eastern Trend although the two zones are parallel to sub-parallel (see Plan map). Winter conditions, snow and freezing temperatures, will allow for better positioning of the drills testing the 253 Zone over the next couple of months.

Near-surface gold mineralization, first intersected in MH-21-152 (3.0 m @1.82 g/t Au) is believed to be in the same structure as recent hole MH-21-251 which cut 3.65 m at 2.47 g/t Au in the southern part of the 75 Zone. Reconnaissance drilling in early December, to the east of the

QP

This news release has been reviewed and approved by

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

About

Sokoman now controls, independently and through the Benton alliance, over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of

Neither the

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially.

| DDH # | Length m | Az. | Dip | Target | From (m) | To (m) | Length m* | Au (g/t) | G x M | Visible Gold | |

| MH-21-346 | 146 |

285 |

-64 |

Eastern Trend |

|

122.20 |

131.80 |

9.60 |

7.33 |

70.39 |

Y |

|

|

|

|

incl |

122.60 |

127.17 |

4.55 |

12.98 |

59.09 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-345 | 167 |

284 |

-55 |

Eastern Trend |

|

117.65 |

122.40 |

4.75 |

20.75 |

98.55 |

Y |

|

|

|

|

|

119.50 |

121.75 |

2.25 |

39.57 |

89.03 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-344 | 268 |

282 |

-65 |

Recon |

|

244.00 |

249.25 |

5.25 |

1.93 |

10.14 |

N |

|

|

|

|

incl |

248.75 |

249.25 |

0.50 |

9.74 |

4.87 |

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-343 | 180 |

285 |

-50 |

Eastern Trend |

|

115.95 |

120.20 |

4.25 |

2.22 |

9.46 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-342 | 137 |

280.5 |

-71 |

Eastern Trend |

|

67.80 |

73.35 |

5.55 |

56.58 |

314.03 |

Y |

|

|

|

|

incl |

68.10 |

71.20 |

3.10 |

100.00 |

310.00 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-341** | 110 |

282.4 |

-58.5 |

Eastern Trend |

|

62.10 |

62.80 |

0.70 |

14.10 |

9.87 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-318 | 102 |

285 |

-53 |

Eastern Trend |

|

68.75 |

71.75 |

3.00 |

7.62 |

22.85 |

Y |

|

|

|

|

incl |

68.95 |

70.90 |

1.95 |

11.48 |

22.39 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-317 | 113 |

289.4 |

-45 |

Eastern Trend |

|

66.20 |

68.50 |

2.30 |

30.29 |

69.66 |

Y |

|

|

|

|

incl |

66.20 |

67.05 |

0.85 |

81.15 |

68.98 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-315 | 114 |

286 |

-56 |

Eastern Trend |

|

51.05 |

53.15 |

2.10 |

2.95 |

6.20 |

N |

|

|

|

|

and |

62.85 |

66.30 |

3.45 |

1.36 |

4.70 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-313 | 109 |

283 |

-45 |

Eastern Trend |

|

48.55 |

51.35 |

2.80 |

1.80 |

5.04 |

N |

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-309 | 142 |

286 |

-40 |

75 Zone |

|

33.57 |

35.75 |

2.18 |

5.11 |

11.15 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-302 | 199 |

283 |

-39 |

Eastern Trend |

|

91.76 |

93.71 |

1.95 |

8.42 |

16.43 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-298 | 142 |

285 |

-40 |

Eastern Trend |

|

17.50 |

25.90 |

8.40 |

3.35 |

28.16 |

Y |

|

|

|

|

incl |

17.50 |

19.80 |

2.30 |

9.75 |

22.44 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-294 | 73 |

281 |

-78 |

Eastern Trend |

|

27.40 |

30.00 |

2.60 |

8.59 |

22.34 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-276 | 115 |

284 |

-45 |

Eastern Trend |

|

42.00 |

44.20 |

2.20 |

75.82 |

166.81 |

Y |

|

|

|

|

incl |

43.00 |

43.80 |

0.80 |

208.12 |

166.51 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-263 | 229 |

284 |

-54 |

Eastern Trend |

|

184.30 |

189.10 |

4.80 |

12.85 |

60.59 |

Y |

|

|

|

|

incl |

184.80 |

185.76 |

0.96 |

62.13 |

59.64 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-259 | 244 |

284 |

-50 |

Eastern Trend |

|

178.70 |

181.92 |

3.22 |

16.70 |

53.76 |

Y |

|

|

|

|

incl |

180.67 |

181.20 |

0.53 |

64.88 |

34.38 |

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

| MH-21-251 | 226 |

285 |

-40 |

75 Zone |

|

66.00 |

69.65 |

3.65 |

2.47 |

9.01 |

Y |

|

|

|

|

and |

190.95 |

192.35 |

1.4 |

4.99 |

6.99 |

Y |

|

|

|

|

|

|

|

|

|

|

|

Y |

|

| MH-21-244 | 109 |

286 |

-49 |

75 Zone |

|

62.60 |

66.70 |

4.10 |

2.08 |

8.55 |

N |

| * Core lengths - believed to be 80 |

|||||||||||

| ** shoulder sampling pending | |||||||||||

View source version on businesswire.com: https://www.businesswire.com/news/home/20220120005402/en/

709-765-1726

tim@sokomanmineralscorp.com

416-868-1079 x 251

cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

Source:

FAQ

What are the latest assay results from Sokoman Minerals Corp. regarding the Moosehead Project?

What future drilling plans does Sokoman Minerals have for the Moosehead Project?

What is the significance of the 75 Zone in the Moosehead Project?

What impacts are expected from the recent drilling activities at the Moosehead Project?