Sokoman Announces High-Grade Results Demonstrating Continuity of Eastern Trend Mineralization at The Moosehead Project, Central Newfoundland

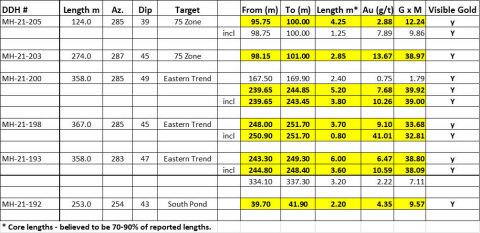

Sokoman Minerals Corp. announced significant progress in its ongoing Phase 6 drilling at the 100% owned Moosehead Property in Newfoundland. Multiple holes have intersected high-grade gold mineralization, confirming the presence of visible gold across various zones. The drilling has extended the interpreted high-grade shoots within a 700 m strike area, with plans to continue explorations using two rigs. Notable results include previous holes returning grades of 13.67 g/t Au and 6.93 g/t Au. The Moosehead Gold Project's total drilling has reached 22,326 m in Phase 6, with more assessments planned.

- Intersections of high-grade gold with visible gold mineralization reported.

- Drilling confirms continuity of high-grade gold in various zones, including grades of 13.67 g/t Au and 6.93 g/t Au.

- Potential to link and expand gold mineralization zones, indicating strong exploration potential.

- None.

Sokoman Minerals Corp. (TSXV: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that ongoing Phase 6 drilling at the

(Graphic: Business Wire)

Tim Froude, President and CEO of Sokoman, says: “Drilling continues to confirm high-grade gold at Moosehead and provide insights into the complex geological controls on the high-grade mineralization. Our methodical approach is paying off as we continue to intersect and extend the interpreted high-grade shoots that lie within the larger envelope of gold mineralization. With high-grade gold existing in all known zones within an area at least 700 m in strike, up to 200 m in width, and at least 250 m vertical: the potential to link these zones as well as expand the footprint of the Moosehead system is high. Drilling will continue with two rigs and arrival of the barge rig on the property is expected to be two – three weeks. The barge is ready and will be mobilized immediately on receipt of the Water Resources permit, which is the only permit outstanding. We will be posting all Phase 6 drill hole summaries on our website as soon as compilation and updating of sections and plans are complete.”

75 Zone

While waiting on assays for South Pond the drill was relocated to the 75 Zone to assess the southern extension of the Eastern Trend. Borehole MH-19-75 was originally drilled in the fall of 2019 and returned a 5.80 m intersection (core length) grading 6.93 g/t Au starting at 87.50 m downhole, including two visible gold-bearing veins that assayed 30.42 g/t Au over 0.30 m (from 88.95 m), and 32.99 g/t Au over 0.80 m (from 92.50 m). The initial follow-up program around MH-19-75 was based on 25 m step outs which the Company has determined to be less than ideal for evaluating these complex shear systems. MH-21-203 returned 13.67 g/t Au over 2.85 m from 98.15 m downhole – a 10 m step out to the south from MH-19-75. MH-21-205 – a 15 m step out from MH-19-75 (and up-dip from MH-21-203) intersected four veins with visible gold, returning 2.88 g/t Au over 4.25 m including 7.89 g/t Au over 1.25 m. Given these results the drill will continue at the 75 Zone.

South Pond

At South Pond, ongoing drilling has defined a steeply-plunging, high-grade core within the moderately to steeply east-northeast dipping mineralized zone. Modeling of the area suggests that South Pond is possibly a splay off the Eastern Trend structure to the east, with many similar characteristics to the original Footwall Splay at North Pond. This interpretation bodes well for continued exploration between South Pond and Western Trend (approximately 250 m corridor) not only for gold mineralization on the main structures but for repeating splays as well.

Eastern Trend

Drill holes MH-21-193, 198 and 200 all focused on the Lower Eastern Trend between vertical depths of 150 to 200 m and were follow-up to previous drilled holes MH-19-62 (7.20 m @ 22.35 g/t Au and MH-19-81 (6.40 m @ 17.34 g/t Au). The results have confirmed continuity of gold mineralization in the Lower Eastern Trend and drilling will continue in this area for the foreseeable future.

Previous drilling in the Eastern Trend intersected gold mineralization on structures both above and below the main mineralized envelope. Ongoing close-spaced drilling of the Lower Eastern Trend indicates that there is more regularity and predictability to these intersections. The upcoming barge-based program will be key to assessing the up-plunge potential and whether these structures prove to be additional high-grade splays and or parallel structures.

About the Moosehead Gold Project

The

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101 and President and CEO of Sokoman Minerals Corp.

COVID-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under federally and provincially mandated and recommended guidelines during the current COVID-19 alert level.

Analytical Techniques / QA/QC

All core samples submitted for assay were saw cut by Sokoman personnel with one-half submitted for assay and one-half retained for reference. Samples were delivered in sealed bags directly to the lab by Sokoman personnel. Samples, including duplicates, blanks and standards, were submitted to Eastern Analytical Ltd. in Springdale, Newfoundland for gold analysis. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples with possible visible gold were submitted for total pulp metallics and gravimetric finish. All other samples were analyzed by standard fire assay methods. Total pulp metallic analysis includes: the whole sample is crushed to -10 mesh; then pulverized to

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in the province of Newfoundland & Labrador, Canada. The Company's primary focus is its portfolio of gold projects Moosehead, Crippleback Lake and East Alder (optioned to Canterra Minerals Corporation) along the Central Newfoundland Gold Belt, and the district scale Fleur de Lys project in northwestern Newfoundland, that is targeting Dalradian-type orogenic gold mineralization similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company also recently entered into a strategic alliance with Benton Resources Inc. through three, large-scale joint-venture properties including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Sokoman now controls independently and through the Benton alliance over 150,000 hectares (>6,000 claims – 1500 sq. km), making it one of the largest landholders in Newfoundland, in Canada’s newest and rapidly emerging gold districts. The Company also retains an interest in an early-stage antimony/gold project (Startrek) in Newfoundland, optioned to White Metal Resources Inc., and in Labrador, the Company has a

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The Company would like to thank the Government of Newfoundland and Labrador for financial support of the Moosehead Project through the Junior Exploration Assistance Program.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210729005309/en/