Sokoman Acquires District-Scale Property in NW Newfoundland: Fleur de Lys Project Targets Dalradian-Style Orogenic Gold

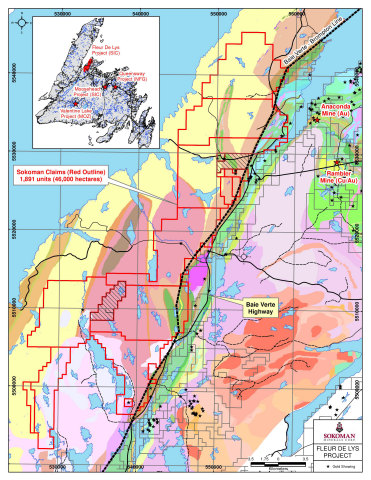

Sokoman Minerals Corp. (TSX-V: SIC) (OTCQB: SICNF) (the “Company” or “Sokoman”) is pleased to announce that it has acquired, through staking and option agreements, a total of 1,891 claims (47,275 hectares), the Fleur de Lys Project, on the Baie Verte Peninsula of northwestern Newfoundland.

Fleur de Lys Project (Graphic: Business Wire)

Fleur de Lys Project Highlights:

- Geological equivalent to the Dalradian belt in the Northern UK Caledonides (host to 6 million oz* Curraghinalt Deposit)

-

2019/20 Sokoman tills returned up to 122 gold grains with more than

35% pristine - Unexplained gold anomalies in government collected lake sediments and tills

-

98% of property is100% owned with no royalties or required payments -

Historic exploration:

- limited - virtually none since late 1990s

- only 1 drill hole for gold

- gold in bedrock values from 3.3 to 25.5 g/t gold** - not drilled

- Adjacent to all of Newfoundland’s current gold production

- Recent Federal/Provincial mapping and airborne geophysics, incorporated in a recently released digital geoscience atlas of the Baie Verte Peninsula

- Excellent infrastructure including ready access via hundreds of kilometres of paved secondary highways and forest-access roads

- Mining-friendly jurisdiction – in top-ten of Fraser Institutes (2020) global mining jurisdictions

Tim Froude, President & CEO of Sokoman, says: “The staking of the Fleur de Lys project is the result of two years of research and recce exploration. This exciting project will not distract us from our flagship Moosehead Project but will become a great addition to our portfolio. We are excited and proud to have seized the opportunity to acquire, largely for staking costs only, a district-scale project in one of the hottest gold exploration jurisdictions in the world. Historic exploration has been minimal with only 1 recorded drill hole testing for gold on the 475 sq. km property. An analogous geological setting, at multiple levels, to a multi-million-ounce gold deposit in the UK (Curraghinalt); anomalous gold in government lake-sediment and till geochemical surveys; gold in till samples taken by Sokoman with many pristine gold grains indicating closeness to source; and rock samples with significant gold values - all of this is found on our new Fleur de Lys property.”

The Fleur de Lys Project is highly prospective for Dalradian-style (e.g., Curraghinalt) orogenic vein-hosted gold deposits and as such, represents a readily accessible yet underexplored, district-scale, gold target in the Newfoundland Appalachians. The property is underlain primarily by Late Precambrian-Early Cambrian metasedimentary rocks of the Fleur de Lys Supergroup, locally cut by a regional suite of Silurian intrusions. The Fleur de Lys metamorphic terrane lies immediately west of the Baie Verte – Brompton Line (BVBL), a major Appalachian-Caledonian crustal-scale structure, marked by ultramafic remnants of ophiolite complexes. The structure and adjoining continental margin/volcanic arc rocks extend NW from Newfoundland into the Caledonian orogen in Northern Ireland and Scotland (UK). Similar metamorphosed and deformed continental margin sediments, equivalent to parts of the Fleur de Lys Supergroup, occur in the same tectonic position relative to the BVBL in northern UK, and contain structurally controlled, vein-hosted orogenic gold deposits. The largest of these are Curraghinalt in Northern Ireland and Cononish in Scotland. The Curraghinalt Gold Project (Dalradian Gold/Orion Mine Finance) is a high-grade, 6-million-ounce deposit*, the largest gold deposit in the Appalachian-Caledonian orogen.

Currently, all of Newfoundland’s gold production comes from the Baie Verte Peninsula; the largest of these is Anaconda Mining Inc.’s Point Rousse operation, which lies less than 8 kilometres from the property boundary. There are more than 100 gold prospects and showings on the Baie Verte Peninsula, many of which are orogenic-style, related to major splays and related second-order structures linked to the BVBL. Similar second- and third order structures, farther west and likewise linked to the BVBL, represent potential targets within Sokoman’s Fleur de Lys property.

The property has seen little modern exploration, with some areas remaining completely unexplored. Historic work by Noranda, other smaller companies, and individual prospectors documented polymetallic (Cu, Pb, Mo) quartz veins with high silver values, gold (including visible gold), pyrite and arsenic-rich alteration, in structurally controlled quartz veinlets, veins and vein-breccias, that cut psammitic, pelitic and graphitic Fleur de Lys metasediments, just west of the Baie Verte - Brompton Line. Historical grab sample grades of 3.3 g/t Au to 25.5 g/t Au are reported from several separate locations (Jacobs, 1991; Basha, 1999). (Note: historical assays have not been verified by the Company and should not be relied upon.)

Reconnaissance till sampling by Sokoman in 2019/20 over the “then” Crown Land in the Fleur de Lys belt has defined multiple gold targets, defined by 129 C-horizon till samples sent to Overburden Drilling Management (ODM) in Ottawa for gold grain analysis. Results gave 38 samples with >20 grains, 14 >40 grains with a maximum of 122 grains. Many samples with high gold grain counts have a high percentage (30

Sokoman is pleased to have Sean O’Brien, P. Geo., of Far Eastern Geo-Consult, joining the Company as a Technical Advisor on the Project. Sean is a highly respected mapper and researcher, a former Senior Geologist with the Geological Survey of Newfoundland and Labrador with 40 years’ experience in the Appalachian-Caledonian orogen. Part of his most recent work, via his consultancy, includes research and project generation related to orogenic, and hydrothermal, intrusion-related gold on the metamorphosed margins of the Northern Appalachian-Caledonian belt.

Sokoman is using the services of Overburden Drilling Management (ODM) to propose and oversee a Phase 1 till program over the entire property. ODM are specialists in till / overburden sampling for gold and were involved in planning of Sokoman’s early reconnaissance program over the Fleur de Lys Supergroup.

Till Sampling QA/QC

The till samples were collected by Sokoman personnel using field collection techniques provided by ODM. All samples were hand dug to the desired depth (C- Horizon Till) with a 10-12 kg sieved sample (8 mesh) placed in a clear plastic sample bag and sealed. Samples were shipped in plastic pails by bonded courier to the ODM lab in Ottawa, Ontario.

The till samples are processed using procedures designed to progressively concentrate the heavy minerals, expose the gold grains and prepare a split of the heavy mineral concentrate (“HMC”) suitable for geochemical analysis if requested.

The sample is wet screened at 2 mm with a preliminary concentrate extracted from the -2 mm fraction by tabling. Geological observations on the character of the sample are made during both the screening and tabling operations. The table concentrate is purposely large (typically 300-400 g) and of low grade (10

Quality Control and Quality Assurance Measures

In addition to using field duplicates to monitor the quality of the indicator mineral data obtained from specific projects, ODM performs blind tests to ensure that the recovery rates for all targeted minerals are consistently in the 80 to

QP

This news release has been reviewed and approved by Timothy Froude, P. Geo., a “Qualified Person” under National Instrument 43-101 and the President / CEO of Sokoman Minerals Corp.

Covid-19 Protocols

To ensure a working environment that protects the health and safety of the staff and contractors, Sokoman is operating under Federally and Provincially mandated and recommended guidelines during the current Level 5 (full lockdown) COVID-19 alert Level.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company with projects in Newfoundland & Labrador, Canada. The Company's primary focus is its portfolio of gold projects (Moosehead, Crippleback Lake and East Alder) in central Newfoundland on the structural corridor hosting Marathon Gold's advanced stage Valentine Lake gold project. The

The Company also retains an interest in an early-stage antimony/gold project in Newfoundland optioned to White Metal Resources Inc. In Labrador, the Company has a

Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward- looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

*Mineral Resource Statement, Curraghinalt Gold Project, Northern Ireland, SRK Consulting (Canada) Inc., May 10th, 2018

**Historical References:

Basha, M, 1999: First and second year assessment report on prospecting and geochemical and geophysical exploration for licences 5920m, 5925m, 5153m-5154m and 5156m-5157m on claims in the Baie Verte area, on the Baie Verte Peninsula, Newfoundland. Government of Newfoundland and Labrador, Geofile 12H/16/1463.

Jacobs, W, 1991: First year assessment report on geological and geochemical exploration for licence 3999 on claim blocks 6992-6993 in the Wild Cove Pond area on the Baie Verte Peninsula, Newfoundland. Report for Long Range Resources Ltd. Government of Newfoundland and Labrador, Geofile 12H/10/1251.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210304005295/en/