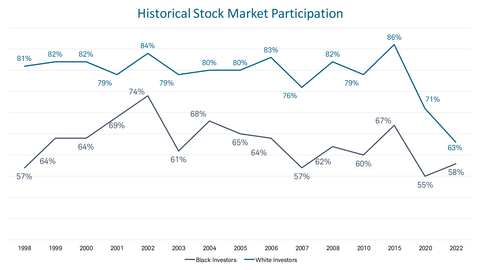

Longstanding Disparity Between Black and White Investors Narrows, But New Risks Emerge

Black investing participation remains stagnant, with only 58% of Black Americans owning stocks in 2022, down from 74% in 2002. In contrast, 63% of white Americans hold stocks, down from 86% in 2015. Notably, 68% of Black investors under 40 are investing, compared to 57% of white investors. Younger Black investors are gravitating towards cryptocurrency, with 25% owning it, and 38% of those under 40. The study highlights a significant education gap, with many Black investors trusting less credible sources. Despite improvements, Black Americans save significantly less than their white counterparts, at $657 vs. $857 monthly.

- Black Americans increased investment contributions by 40%, averaging $657 per month in 2022, up from $393 in 2020.

- Younger Black Americans are showing increased stock market participation, with 68% under 40 investing.

- The gap in discussing the stock market with family has closed significantly, nearly equalizing Black and white investor family discussions.

- Investment participation among Black Americans remains low at 58%, significantly down from previous highs.

- Many Black investors express distrust in financial institutions and the stock market, with 36% citing lack of trust as the reason for not investing.

- Black investors are more likely to invest in high-risk assets like cryptocurrency, indicating a preference for risky investments without full understanding.

Black investing remains stagnant at 1998 level while white stock market participation at historic low

Higher risk investments are growing in popularity, especially among younger Black investors

Ariel-Schwab Black Investor Survey Historical Stock Market Participation (Graphic: Business Wire)

For 24 years, Ariel Investments and

While the investment gap between Black and white Americans narrowed in 2022, there was a significant drop-off among white investors (down 8 percentage points from

For Many Black Americans, Higher Risk Assets are First Foray into Investing

The popularity of new, higher risk investment options, especially among younger and first time Black investors, is striking.

-

One-quarter of Black Americans (

25% ) currently own cryptocurrency, and among Black investors under 40, that figure jumps to38% .-

This is compared to only

15% of white investors who own cryptocurrency, and29% of white investors under 40.

-

This is compared to only

-

Black investors are more than twice as likely to say cryptocurrency was their first investment (

11% of Black investors compared to4% of white investors).-

Younger Black Americans are even more likely to first experience investing through this high-risk asset class. Nearly a quarter (

23% ) of Black investors under 40 first invested in the stock market through cryptocurrency.

-

Younger Black Americans are even more likely to first experience investing through this high-risk asset class. Nearly a quarter (

-

Black investors are also twice as likely to rank cryptocurrency as the best investment choice overall (

8% of Black investors vs.4% of white investors).

Cryptocurrency |

||||||

|

Black Americans by Age |

White Americans by Age |

||||

|

<40 |

40-59 |

60+ |

<40 |

40-59 |

60+ |

Current

|

|

|

|

|

|

|

View

|

|

|

|

|

|

|

There is clear evidence of an education gap between Black and white Americans. Despite headline-making news about volatility in cryptocurrency values, platform hacks, and a lack of government regulation, Black investors are less likely than white investors to think that cryptocurrency is a risky investment (

More Education is Needed—Especially Among Younger Investors

Nearly half of all Black and white investors (

Risky Investing Behaviors |

||||||

|

Black Americans |

White Americans |

||||

Invested in something they didn’t fully understand |

|

|

||||

Of those who invested in something they didn’t fully understand, did so because it seemed like a “sure deal” |

|

|

||||

Invested based on something seen on social media |

|

|

||||

Trust social media as investing information source |

|

|

||||

|

Black Americans by Age |

White Americans by Age |

||||

<40 |

40-59 |

60+ |

<40 |

40-59 |

60+ |

|

Invested in something they didn’t fully understand |

|

|

|

|

|

|

Invested based on something seen on social media |

|

|

|

|

|

|

“The confluence of low stock market participation, appetite for risky investment options, and alarming lack of knowledge about fundamental investing principles is a red flag about the critical need for greater investor education,” said

When asked about anticipated investment returns, more than one-in-four Black investors (

Trust and Fear are Barriers to Investing, Respect is On the Move

Black Americans are less trusting of the stock market (

Since 2020, Black Americans who either stopped investing or have never invested were more likely to cite lack of trust in the stock market (

Black investors are also more fearful of losing money than white investors—

While trust remains low, feelings of respect have also improved. As in 2020, Black Americans were less likely than white Americans to feel respected by financial institutions, however, that gap has decreased substantially. Black Americans feel more respected in 2022 (

When it comes to growing and protecting their assets, Black Americans are less trusting of people (

“The survey shows a penchant for ‘get rich quick’ tactics, and if we don’t educate the next generation about the value of long-term investing, their financial prospects will be limited and it will be difficult for our industry to gain their trust,” said

Workplace Retirement Plans Not the Only Gateway to Investing

Over the last several decades, the

Additionally, investors are entering the stock market through a variety of investment vehicles. In 2020,

Gateways to Investing |

||

|

Black Americans |

White Americans |

401(k) or another workplace plan |

|

|

Individual stocks/bonds |

|

|

Mutual Funds |

|

|

Cryptocurrency |

|

|

Fractional Shares |

|

|

Signs of Improvement

Black Americans are saving and investing more in 2022, with an impressive

Historically, the survey has shown that Black Americans are less likely than white Americans to have discussed the stock market growing up. Today, however, the gap has closed as Black and white investors are almost equally as likely to discuss the stock market with their families (

Detailed survey results can be found here.

About the Survey

The online survey was conducted in

About Ariel Investments

About

At Charles Schwab we believe in the power of investing to help individuals create a better tomorrow. We have a history of challenging the status quo in our industry, innovating in ways that benefit investors and the advisors and employers who serve them, and championing our clients’ goals with passion and integrity.

More information is available at www.aboutschwab.com. Follow us on Twitter, Facebook, YouTube and LinkedIn.

#0422-2UHK

View source version on businesswire.com: https://www.businesswire.com/news/home/20220405005467/en/

stephanie.corns@schwab.com

Ariel Investments:

csciarrino@arielinvestments.com

Source:

FAQ

What percentage of Black Americans own stocks according to the 2022 Ariel-Schwab survey?

How has cryptocurrency investment changed among Black investors in 2022?

What is the average monthly investment contribution for Black Americans in 2022?

How does trust in financial institutions differ between Black and white investors?