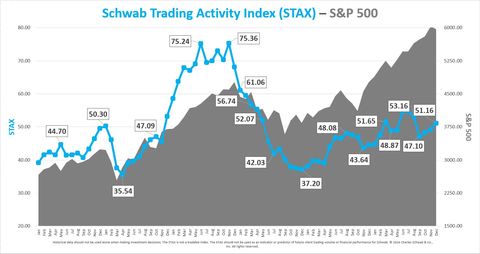

Schwab Trading Activity Index™: December Score Edges Higher for Third Consecutive Month

Charles Schwab's Trading Activity Index (STAX) increased to 51.16 in December 2024, up from 49.22 in November, indicating a 'moderate low' reading compared to historic averages. Schwab clients increased equity exposure, particularly in Health Care and Energy sectors, while net selling Information Technology and Communication Services.

Despite market turbulence and the absence of a significant 'Santa Claus Rally', investor sentiment remained bullish. The S&P 500 finished about 1% lower in December but achieved a 24% gain for 2024, marking back-to-back annual returns above 20% for the first time since 1998.

Top stocks bought by clients included NVIDIA (NVDA), Tesla (TSLA), Palantir (PLTR), Amazon (AMZN), and MicroStrategy (MSTR). Throughout 2024, STAX ranged from 44.73 in January to 54.81 in July, with investors focusing on AI, semiconductors, cloud computing, and electric vehicle technologies.

L'Indice di Attività di Trading di Charles Schwab (STAX) è aumentato a 51,16 a dicembre 2024, rispetto al 49,22 di novembre, indicando un'interpretazione 'moderatamente bassa' rispetto alle medie storiche. I clienti di Schwab hanno aumentato l'esposizione azionaria, in particolare nei settori della Salute e dell'Energia, mentre hanno venduto netto nel settore della Tecnologia dell'Informazione e dei Servizi di Comunicazione.

Nonostante le turbolenze del mercato e l'assenza di un significativo 'Santa Claus Rally', il sentiment degli investitori è rimasto ottimista. L'S&P 500 ha chiuso circa l'1% in ribasso a dicembre, ma ha registrato un guadagno del 24% per il 2024, segnando ritorni annuali consecutivi superiori al 20% per la prima volta dal 1998.

Le principali azioni acquistate dai clienti includevano NVIDIA (NVDA), Tesla (TSLA), Palantir (PLTR), Amazon (AMZN) e MicroStrategy (MSTR). Nel corso del 2024, lo STAX è variato da 44,73 a gennaio a 54,81 a luglio, con gli investitori concentrati su IA, semiconduttori, informatica cloud e tecnologie dei veicoli elettrici.

El Índice de Actividad de Trading de Charles Schwab (STAX) aumentó a 51.16 en diciembre de 2024, subiendo desde 49.22 en noviembre, lo que indica una lectura 'moderadamente baja' en comparación con los promedios históricos. Los clientes de Schwab aumentaron la exposición a acciones, especialmente en los sectores de Salud y Energía, mientras que realizaron ventas netas en Tecnología de la Información y Servicios de Comunicación.

A pesar de la turbulencia del mercado y la ausencia de un significativo 'Rally de Santa Claus', el sentimiento de los inversores se mantuvo optimista. El S&P 500 terminó aproximadamente un 1% más bajo en diciembre pero logró una ganancia del 24% para 2024, marcando retornos anuales consecutivos superiores al 20% por primera vez desde 1998.

Las principales acciones compradas por los clientes incluyeron NVIDIA (NVDA), Tesla (TSLA), Palantir (PLTR), Amazon (AMZN) y MicroStrategy (MSTR). A lo largo de 2024, el STAX osciló entre 44.73 en enero y 54.81 en julio, con los inversores enfocados en IA, semiconductores, computación en la nube y tecnologías de vehículos eléctricos.

찰스 슈왑의 거래 활동 지수(STAX)가 2024년 12월에 51.16으로 증가했으며, 11월의 49.22에서 상승하였습니다. 이는 역사적 평균에 비추어 '보통 낮음'의 수치를 나타냅니다. 슈왑 고객은 주식에 대한 노출을 늘렸으며, 특히 헬스케어와 에너지 부문에서 두드러졌습니다. 반면 정보 기술 및 커뮤니케이션 서비스 부문에서는 순매도를 보였습니다.

시장 불안과 유의미한 '산타랠리' 부재에도 불구하고 투자자 심리는 낙관적이었습니다. S&P 500은 12월에 약 1% 하락했지만, 2024년도에 24% 상승을 기록하며 1998년 이후 처음으로 20% 이상의 연간 수익률을 두 해 연속 달성했습니다.

고객들이 가장 많이 구매한 주식은 NVIDIA (NVDA), Tesla (TSLA), Palantir (PLTR), Amazon (AMZN) 및 MicroStrategy (MSTR)였습니다. 2024년 동안 STAX는 1월 44.73에서 7월 54.81 사이에서 변동하였으며, 투자자들은 AI, 반도체, 클라우드 컴퓨팅 및 전기차 기술에 집중하였습니다.

L'Indice d'Activité de Trading de Charles Schwab (STAX) a augmenté à 51,16 en décembre 2024, passant de 49,22 en novembre, indiquant une lecture 'modérément basse' par rapport aux moyennes historiques. Les clients de Schwab ont accru leur exposition aux actions, en particulier dans les secteurs de la Santé et de l'Énergie, tout en vendant net dans les services de Technologie de l'Information et de Communication.

Malgré la turbulence du marché et l'absence d'un 'Rallye de Noël' significatif, le sentiment des investisseurs est resté optimiste. Le S&P 500 a terminé environ 1% plus bas en décembre, mais a enregistré un gain de 24% pour 2024, marquant ainsi deux années consécutives de rendements annuels supérieurs à 20% pour la première fois depuis 1998.

Les actions les plus achetées par les clients comprenaient NVIDIA (NVDA), Tesla (TSLA), Palantir (PLTR), Amazon (AMZN) et MicroStrategy (MSTR). Tout au long de 2024, le STAX a varié de 44,73 en janvier à 54,81 en juillet, les investisseurs se concentrant sur l'IA, les semi-conducteurs, l'informatique en nuage et les technologies de véhicules électriques.

Der Handelsaktivitätsindex von Charles Schwab (STAX) stieg im Dezember 2024 auf 51,16, von 49,22 im November, was eine 'mäßig niedrige' Lesart im Vergleich zu historischen Durchschnittswerten anzeigt. Schwab-Kunden erhöhten ihre Aktienengagements, insbesondere in den Bereichen Gesundheit und Energie, während sie netto im Bereich der Informationstechnologie und Kommunikationsdienste verkauften.

Trotz der Marktturbulenzen und dem Fehlen eines signifikanten 'Santa Claus Rally' blieb die Stimmung der Investoren optimistisch. Der S&P 500 schloss im Dezember etwa 1% niedriger, erzielte jedoch einen Gewinn von 24% für 2024 und verzeichnete damit erstmals seit 1998 zwei aufeinanderfolgende Jahresrenditen von über 20%.

Zu den von den Kunden am häufigsten gekauften Aktien gehörten NVIDIA (NVDA), Tesla (TSLA), Palantir (PLTR), Amazon (AMZN) und MicroStrategy (MSTR). Im Jahr 2024 schwankte der STAX zwischen 44,73 im Januar und 54,81 im Juli, wobei die Investoren den Fokus auf KI, Halbleiter, Cloud-Computing und Elektrofahrzeugtechnologien legten.

- STAX index showed increased investor activity for third consecutive month

- S&P 500 achieved 24% annual gain in 2024

- Back-to-back annual returns above 20% for first time since 1998

- S&P 500 declined 1% in December

- Market experienced significant volatility with VIX spiking above 27

- 10-year Treasury yield increased 10% indicating higher rate expectations

Insights

The latest Schwab Trading Activity Index (STAX) data reveals compelling shifts in retail investor behavior and sector rotation trends. The increase to 51.16 in December, while modest, signals growing retail investor confidence despite market volatility. The sector rotation pattern is particularly noteworthy - investors are tactically reducing exposure to 2023's outperformers (Tech and Communication Services) while building positions in lagging sectors (Healthcare and Energy), suggesting a strategic rebalancing approach rather than momentum chasing.

The divergence between retail trading patterns and institutional positioning is significant. Despite the S&P 500's

The buying patterns in AI-related stocks (NVDA, PLTR) coupled with selling in traditional tech leaders (AAPL, MSFT) suggests retail investors are making targeted bets on next-generation technology while reducing exposure to mature tech companies - a nuanced strategy that differs from previous retail trading cycles.

The STAX data provides important insights into retail investor positioning heading into 2025. The moderate-low reading relative to historical averages, combined with increased equity exposure despite market turbulence, indicates a calculated risk-taking approach among retail investors. The sector rotation into Healthcare and Energy, traditionally defensive sectors, while trimming high-performing tech positions, suggests sophisticated portfolio management techniques are being employed by retail investors.

The market's reaction to the FOMC's hawkish 2025 outlook, with the VIX spiking above 27 and the 10-year Treasury yield rising to 4.619%, demonstrates heightened sensitivity to monetary policy shifts. The

The strengthening U.S. Dollar Index (up

More Schwab clients net bought equities than net sold, adding exposure in the Health Care and Energy sectors while net selling Information Technology and Communication Services

Schwab Trading Activity Index vs. S&P 500 (Graphic: Charles Schwab)

The reading for the four-week period ending December 27, 2024, ranks “moderate low” compared to historic averages.

“Schwab clients increased their exposure to equities in December, even as major indices experienced atypical swings and turbulence,” said Joe Mazzola, Head Trading & Derivatives Strategist at Charles Schwab. “We didn’t see a significant ‘Santa Claus Rally’ this year, but investor sentiment appeared bullish, particularly at the start and end of the month. Many clients appeared to close out the year by rebalancing their portfolios, adding exposure to underperforming sectors such as Health Care and Energy and trimming positions in outperformers like Information Technology and Communication Services.”

The

While the Federal Open Market Committee (FOMC) statement on December 18 did not suggest a major pivot, the Committee’s 2025 outlook postulated that markets may have fewer interest rate cuts to look forward to than had been previously expected. This set off a tantrum that played out in the markets through the remainder of the period, with major indices selling off hard and the VIX spiking above 27. The

Once the dust settled after the FOMC meeting, the VIX established a new, somewhat higher baseline, hovering just below 18 in the final days of the period and the year. The 10-year Treasury yield closed at

Popular names bought by Schwab clients during the period included:

- NVIDIA Corp. (NVDA)

- Tesla Inc. (TSLA)

- Palantir Technologies Inc. (PLTR)

- Amazon.com Inc. (AMZN)

- MicroStrategy Inc. (MSTR)

Names net sold by Schwab clients during the period included:

- Apple Inc. (AAPL)

- AT&T Inc. (T)

- Broadcom Inc. (AVGO)

- Microsoft Corp. (MSFT)

- Walt Disney Co. (DIS)

2024 In Review

In 2024, the STAX stayed in a relatively tight range – from 44.73 in January to 54.81 in July. Clients seemed content to maintain their levels of equity market exposure as major indices repeatedly hit all-time highs throughout the year, perhaps waiting on a clear trend to develop so they might trade on that momentum. On the buy side, technologies including Artificial Intelligence, semiconductors, cloud computing and electric vehicles consistently grabbed investors’ attention this year, while on the sell side, the Consumer Discretionary, Telecommunications, Industrial and Energy sectors were most popular. In a year with dramatic shifts in Fed policy, clients demonstrated sensitivity not necessarily by rotating out of growth and into value stocks but rather by awaiting better opportunities in the growth and technology names they favored.

The five most popular names net bought by Schwab clients throughout the year were:

- NVIDIA Corp. (NVDA)

- Advanced Micro Devices Inc. (AMD)

- Amazon.com Inc. (AMZN)

- Microsoft Corp. (MSFT)

- Palantir Technologies Inc. (PLTR)

The five most popular names net sold throughout the year by clients included:

- Walt Disney Co. (DIS)

- Bank of America Corp. (BAC)

- Apple Inc. (AAPL)

- Tesla Inc. (TSLA)

- PayPal Holdings Inc. (PYPL)

About the STAX

The STAX value is calculated based on a complex proprietary formula. Each month, Schwab pulls a sample from its client base of millions of funded accounts, which includes accounts that completed a trade in the past month. The holdings and positions of this statistically significant sample are evaluated to calculate individual scores, and the median of those scores represents the monthly STAX.

For more information on the Schwab Trading Activity Index, please visit www.schwab.com/investment-research/stax. Additionally, Schwab clients can chart the STAX using the symbol $STAX in either the thinkorswim® or thinkorswim Mobile platforms.

Investing involves risk, including loss of principal. Past performance is no guarantee of future results. Content intended for educational/informational purposes only. Not investment advice, or a recommendation of any security, strategy, or account type.

Historical data should not be used alone when making investment decisions. Please consult other sources of information and consider your individual financial position and goals before making an independent investment decision.

The STAX is not a tradable index. The STAX should not be used as an indicator or predictor of future client trading volume or financial performance for Schwab.

About Charles Schwab

At Charles Schwab, we believe in the power of investing to help individuals create a better tomorrow. We have a history of challenging the status quo in our industry, innovating in ways that benefit investors and the advisors and employers who serve them, and championing our clients’ goals with passion and integrity.

More information is available at aboutschwab.com. Follow us on X, Facebook, YouTube, and LinkedIn.

0125-ELME

View source version on businesswire.com: https://www.businesswire.com/news/home/20250106221369/en/

At the Company

Margaret Farrell

Director, Corporate Communications

(203) 434-2240

margaret.farrell@schwab.com

Source: The Charles Schwab Corporation