Rupert Resources Reports Exceptional Recoveries From Metallurgical Testwork at Ikkari and Provides Exploration Outlook for 2024/25

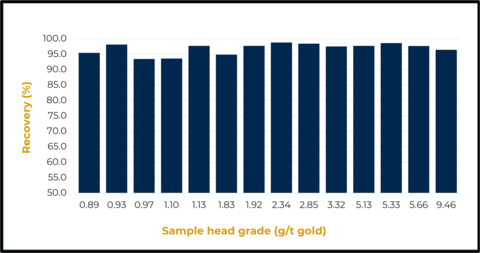

Figure 1: Gold leach recoveries for Ikkari PFS variability samples at range of grades. Gold leach recoveries reported as a percentage of the back-calculated head grade for Ikkari variability samples. Recovery percentages are shown for P80 100µm grind size, 1g/l NaCN concentration after 48hrs leach time. Gravity concentration was not performed prior to leach testing for the variability samples.

Highlights

Ikkari Metallurgy

- Ikkari Pre-Feasibility Study (“PFS”) metallurgical test work is complete demonstrating exceptional gold recoveries from a simple gravity and leach circuit.

-

Bulk sample demonstrated

96.4% Au recovery from a head grade of 1.99g/t including a significant gravity recoverable gold component. -

Variability samples returned recoveries between

93.4% and98.8% highlighting the consistent high recoveries across a range of head grades.

Ikkari Drilling

- #124054 intersected 192m at 3.6g/t Au from 39m downhole (30m vertical), including 12.45m at 9.8g/t Au from 123.25m (Figures 5 and 6). It is the fourth-best intercept achieved to date at Ikkari with 691 gram x meters (see Table 1 for details). This metallurgical hole demonstrates once again the potential for Ikkari to deliver exceptional grades and continuity.

- #124057 intersected 35m at 6.3g/t Au from 124m downhole (95m vertical) including 6m at 13.5g/t Au from 149m. This geotechnical drillhole was principally designed to intersect the southern wall of the open pit in an area underrepresented in geotechnical data.

- #124044 intersected 39m at 1.2g/t from 47m and 19.4m at 1.4g/t from 99m in a geotechnical hole informing the western sector of the planned open pit design.

Regional Exploration

- #124065 intersected 2m at 13.2g/t Au from 59m downhole including 1m at 25.2g/t Au from the Heinä South northern high-grade zone whilst #124070 intersected 18m at 0.9g/t Au and 14m at 1.3g/t Au in the southern breccia zone. Further extensions to both the high grade and the broader southern breccia zone are a key focus this coming winter with the aim of adding to the project resource inventory.

- Seven (7) priority targets ranging from follow-up drilling on targets that have yielded promising intercepts to completely untested targets, have been highlighted for drill testing in the winter 2024/2025 drill season

James Withall, CEO of Rupert Resources commented “As we work towards completion of the PFS, the best-in-class metallurgical results reported today show the potential to further increase the future revenues from Ikkari whilst at the same time simplifying the process plant design. We have also published further drilling results which confirm the exceptional grade and continuity in the upper levels of the Ikkari orebody and indicate satellite orebody potential 1km to the northwest at Heinä South. After a summer of field mapping and sampling, drilling has now recommenced on our regional exploration targets and the team have a number of high priority programs as we head into the autumn and winter season.”

Ikkari Drilling

A project drilling program was initiated at Ikkari during spring 2024 serving multiple purposes: increasing confidence in the ~4Moz Indicated Mineral Resource Estimate (see press release 28th November 2023); providing additional material for metallurgical test work feeding into future, more advanced engineering studies and providing further geotechnical data for the optimisation of mine planning. The final results of this program are presented here including hole #124054 which achieved one of the best intercepts at Ikkari to date and hole #124057, principally a geotechnical hole targeting the southern pit wall. Project engineering and permitting continues with a prefeasibility study now targeted for delivery in the second half of calendar 2024.

Table 1. Top 10 intercepts from Ikkari

Hole ID |

From (m) |

To (m) |

Length (m) |

Grade (g/t Au) |

Gram x Meters |

Release Date |

121026 |

58.00 |

258.00 |

200.00 |

4.2 |

840 |

April 20, 2021 |

121160 |

153.00 |

258.00 |

105.00 |

7.9 |

824 |

February 1, 2022 |

124043 |

45.00 |

165.00 |

120.00 |

6.2 |

748 |

May, 16, 2024 |

124054 |

39.00 |

231.00 |

192.00 |

3.6 |

691 |

*New |

121010 |

254.00 |

412.00 |

158.00 |

3.8 |

593 |

March 17, 2021 |

121019 |

202.00 |

294.00 |

92.00 |

6.3 |

579 |

April 6, 2021 |

120075 |

11.80 |

169.00 |

157.20 |

3.7 |

574 |

October 21, 2020 |

121169 |

185.00 |

300.00 |

115.00 |

4.9 |

567 |

March 16, 2022 |

121171 |

32.00 |

193.00 |

161.00 |

3.4 |

541 |

March 16, 2022 |

120086 |

186.00 |

310.00 |

124.00 |

4.2 |

521 |

November 12, 2020 |

Top 10 intercepts from Ikkari are ranked by gram-meters (average grade [Au g/t] x length [m]). Intercepts are calculated with a 0.4g/t Au cut-off with a maximum 5m continuous internal dilution accepted. See relevant press releases for further information.

Ikkari Metallurgy

Rupert Resources commissioned a comprehensive metallurgical testing program at Grinding Solutions Limited (“GSL”) of

Test work on the composite bulk sample, designed to be representative of the Ikkari deposit, gives an overall recovery of

Sample preparation is now underway at GSL on a bulk sample which alongside further variability samples will inform the final engineering design during the Definitive Feasibility Study (“DFS”). The focus of this ongoing work will be to further optimise the process flowsheet with a focus on cost reduction.

Regional Exploration – 2024/25 Campaign

Following on from the success of the exploration campaign during the winter 2023/24, the discovery of significant widths and tenors of mineralisation at Heinä South, and the structural reinterpretation of the wider Area 1, the 2024/25 exploration drill program is now underway.

Figure 3 shows the intersections greater 5 (five) gram x metres within the Area 1 project encompassing Ikkari, Heinä South, Heinä Central amongst the 9 gold discoveries made in the region. The aim of the upcoming season is to systematically explore extensions to the prospective structures outlined in the updated structural interpretation with specific focus on the following prospects.

Letters correspond to the annotated boxes in Figure 3

(A) |

Heinä South – At the western extent of the Heinä South trend drilling, primarily during winter 2023-24, intersected gold mineralisation over significant widths hosted by a breccia zone at the southern margin including hole #124027, 29m at 1.9g/t Au (see press release May 1, 2024). To date mineralisation has been traced over a strike length >250m and to a depth > 200m. Additionally numerous high-grade intersections were also encountered to the north of this trend such as hole #124019, 25m at 16.5g.t Au (see press release March 3, 2024) and #124061: 24.40m at 10.5g/t Au (see press release May 1, 2024). Follow up testing of the continuity of these high-grade intercepts along with testing near surface extensions to the southern mineralisation trend will be a priority in winter 2024/25. |

(B) |

Koppelo – A large scale base of till (“BoT”) anomaly defines the Koppelo target. Initial drill testing focused on the very eastern extent of this anomaly and successfully intersected gold mineralisation within a strongly albitised and silicified quartzite highlighted by hole #122258, 8m at 1.7g/t Au and hole #122161, 3.1m at 5.3g/t Au (see press release March 21, 2022). The upcoming drill season will aim to test the remainder of previously untested >1km anomalous BoT trend. |

(C) |

Naattuakangas – Interpreted from magnetics as a continuation of the structural and lithological setting present at Ikkari, scout drilling has confirmed the presence of intercalated sediment within strongly altered and deformed ultramafic lithologies, a key control to the mineralisation at Ikkari. Drilling in the upcoming season will aim to follow up mineralisation near the collar of hole #123091, 1.10m at 13.6g/t and (see press release November 28, 2023) and further test the >1.5km strike extent of the target. |

(D) |

Rajala – 15km NE of Ikkari along the same structural trend the Rajala target area is largely untested, limited drilling during 2019, reinterpreted this summer identified the same lithologies and breccias present in Area 1. It’s position, along the Ikkari structural trend and adjacent to the nose of the Kittila thrust nappe where the structure swings north, was highlighted during internal targeting sessions to be a priority area for follow-up exploration. |

(E) |

Kuusivaara – Untested, >400m BoT anomaly with limited coverage to date along strike of the Koppelo prospect. |

(F) |

Heinä West – Significant IP anomaly in a previous untested structural setting. |

(G) |

Kaunislehto – BoT anomaly with sporadic very high grades of up to 2g/t. Previous testing of these anomalies was limited by the onset of the spring melt leading to sub-optimal drill locations. Drilling in the coming season will directly target these BoT anomalies located between Island North and Koppelo. |

Additionally, target generation through high resolution magnetic surveys over newly granted exploration reservations, and BoT drilling focused on prospective lithological-structural settings will continue with aim to generate new prospects for drill testing in future seasons.

The eastern portions of the Rupert Lapland Project are considered highly prospective for magmatic hosted Ni-Cu-PGE deposits. The operating Kevitsa mine (Boliden) is located 10km to the northeast of the Rupert land package and the Sakatti (Anglo American) deposit is located less than 8km to the southeast. Figure 4 highlights the portions of the Rupert Lapland Project that share a similar geological setting to these deposits and are considered the most prospective for this style of mineralisation. Rupert Resources is continuing to reinterpret airborne electro-magnetic acquired previously over these licences in the context of the high-resolution drone magnetic data acquired in winter 2023-24 to generate drill targets during the coming winter. Limited BoTcoverage to date (Figure 4) has already highlighted areas of Ni and Cu anomalism that will be followed-up during the upcoming campaign.

Geological interpretation of Ikkari

Ikkari was discovered using systematic regional exploration that initially focused on geochemical sampling of the bedrock/till interface through glacial till deposits of 5m to 40m thickness. No outcrop is present, and topography is dominated by low-lying swamp areas.

The Ikkari deposit occurs within rocks that have been regionally mapped as 2.05-2.15 billion years (“Ga”) old Savukoski group greenschist-metamorphosed mafic-ultramafic volcanic rocks, part of the Central Lapland Greenstone Belt (“CLGB”). Gold mineralisation is largely confined to the structurally modified unconformity at a significant domain boundary. Younger sedimentary lithologies are complexly interleaved, with intensely altered ultramafic rocks, and the mineralized zone is bounded to the north by a steeply N-dipping cataclastic zone. Within the mineralised zone lithologies, alteration and structure appear to be sub-vertical in contrast to wider Area 1 where lithologies generally dipping at a moderated angle to the north.

The main mineralized zone is strongly altered and characterised by intense veining and foliation that pervasively overprints original textures. An early phase of finely laminated grey ankerite/dolomite veins is overprinted by stockwork-like irregular siderite ± quartz ± chlorite ± sulphide veins. These vein arrays are often deformed with shear-related boudinage and in situ brecciation. Magnetite and/or haematite are common, in association with pyrite. Hydrothermal alteration commonly comprises quartz-dolomite-chlorite-magnetite (±haematite). Gold is hosted by disseminated and vein-related pyrite. Multi-phase breccias are well developed within the mineralised zone, with early silicified cataclastic phases overprinted by late, carbonate- iron-oxide- rich, hydrothermal breccias which display a subvertical control. All breccias frequently host disseminated pyrite, and are often associated with higher gold grades, particularly where magnetite or haematite is prevalent. In the sedimentary lithologies, albite alteration is intense and pervasive, with pyrite-magnetite (± gold) hosted in veinlets in brittle fracture zones.

Geological interpretation of Heinä South

The Heinä South target was reappraised based on results from a new higher resolution geophysical survey flown in later 2023 which identified a south-west extension which had been untested in previous years due to a lack of base of till anomalism. Gold mineralisation in the west of Heinä South is associated with multi-phase sulphide mineralisation consisting of pyrite+-pyrrhotite+-chalcopyrite, principally occurring as the matrix to an earlier brecciated (iron)-carbonate phase. The earlier veins occur primarily within altered carbonaceous sediments folded between more homogenous gabbroic units. Gold mineralisation in the east of Heinä South is hosted within quartz-pyrite and massive pyrite veins and as lenses, as part of a stockwork of quartz-carbonate veins. Zones of massive pyrite contain the highest grades (>10g/t Au) with disseminated sulphide zone containing anomalous (<0.5g/t) gold. Early quartz-carbonate veins are overprinted by extensional veins that include coarse-grained pyrite and form sub-parallel trends, broadly related to lithological contacts between sediments and mafic-intermediate intrusives, although mineralisation also occurs within both lithologies. Further drilling is required to allow a resource to be published for the occurrence.

Figures & tables

Figures and tables featured in the Appendix at end of release include:

- Figure 5. Plan map showing the location of new drilling at Ikkari.

- Figure 6. Cross section showing the results of hole 124054 in relation to the mineral resource block model and the geological interpretation at Ikkari.

- Figure 7. Plan map showing the location of the new drilling at Heinä South

- Figure 8: Section showing the reported intercept at Heinä South in the context of previously reported intercepts

- Table 1. Collar locations of the new drill holes, Ikkari

- Table 2. New intercepts from infill drill holes, Ikkari

- Table 3. Collar location of the new drill holes, Heinä South

- Table 4. New intercepts from drill hole, Heinä South

- Table 5. Uncut mineralised intercept of 3.6g/t Au over 192m in drill hole 124054

Review by Qualified Person, Quality Control and Reports

Craig Hartshorne, a Chartered Geologist and a Fellow of the Geological Society of

The majority of samples are prepared by ALS Finland in either Sodankylä or Outokumpu. Fire assays are subsequently completed at ALS Romania whilst multielement analysis is completed in ALS Ireland or

Base of till samples are prepared in ALS Sodankylä by dry-sieving method prep-41 and assayed for gold by fire assay with ICP-AES finish. Multi-elements are assayed in ALS laboratories in either of

About Rupert Resources

Rupert Resources is a gold exploration and development company listed on the TSX Exchange under the symbol “RUP.” The Company is focused on making and advancing discoveries of scale and quality with high margin and low environmental impact potential. The Company’s principal focus is Ikkari1, a new high quality gold discovery in

Neither the TSX Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward Looking Statements

This press release contains statements which, other than statements of historical fact constitute “forward-looking statements” within the meaning of applicable securities laws, including statements with respect to: results of exploration activities and mineral resources. The words “may”, “would”, “could”, “will”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions, as they relate to the Company, are intended to identify such forward-looking statements. Investors are cautioned that forward-looking statements are based on the opinions, assumptions and estimates of management considered reasonable at the date the statements are made, and are inherently subject to a variety of risks and uncertainties and other known and unknown factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include the general risks of the mining industry, as well as those risk factors discussed or referred to in the Company's annual Management's Discussion and Analysis for the year ended February 29, 2024 available here. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company does not intend, and does not assume any obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

1 November 2023 Updated Mineral Resource Estimate for the Ikkari Project.

The Mineral Resource Estimate for the Ikkari project has been prepared in accordance with NI 43-101 and following the requirements of Form 43-101F1. The methodology used to determine the Mineral Resource Estimate is consistent with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Estimation of Mineral Resource and Mineral Reserves Best Practices Guidelines (November 2019) and was classified following CIM Definition Standards for Mineral Resources & Mineral Reserves (May 2014). Readers are cautioned that Mineral Resources are not Mineral Reserves, and do not demonstrate economic viability. There is no certainty that all, or any part, of this Mineral Resource will be converted into Mineral Reserve. Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. Numbers may be affected by rounding.

The QP for the Ikkari Mineral Resource estimate is Mr. Brian Thomas, P.Geo., an independent QP, as defined under NI43-101 and an employee of WSP Canada Inc. based in

The effective date of the 2023 Mineral Resource Estimate for Ikkari is 24th October 2023. The Mineral Resource Estimate at Ikkari is interpolated using Ordinary Kriging (OK) and is reported both within a Whittle optimized open pit shell and as a potential underground operation outside that. Underground mineral resources are constrained within the estimation domains to meet the RPEEE criteria for UG mining. The Mineral Resource Estimate at Ikkari is reported using a cutoff grade of 0.4g/t Au for mineralisation potentially mineable by open pit methods and 0.9g/t Au for mineralisation potentially extractable by underground methods. The open pit and underground cut off-grades are calculated using a gold price at

APPENDIX

Table 3. Collar locations of new drill holes from Ikkari

Hole ID |

Prospect |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

EOH (m) |

124039 |

Ikkari |

453602.0 |

7497083.4 |

230.127 |

157.0 |

-51.1 |

782.2 |

124044 |

Ikkari |

453834.0 |

7496867.3 |

223.76 |

215.2 |

-49.8 |

349.8 |

124054 |

Ikkari |

454052.3 |

7496757.8 |

223.922 |

332.9 |

-49.9 |

242.5 |

124057 |

Ikkari |

453995.4 |

7496911.7 |

222.813 |

175.0 |

-50.4 |

476.2 |

Table 4. New Intercepts from Ikkari

Hole ID |

|

From (m) |

To (m) |

Interval (m) |

Grade Au (g/t) |

124039 |

|

224.00 |

225.00 |

1.00 |

1.7 |

|

|

303.00 |

306.00 |

3.00 |

0.7 |

|

|

321.00 |

33.00 |

9.00 |

1.1 |

|

Including |

325.00 |

326.00 |

1.00 |

5.2 |

|

|

339.00 |

344.00 |

5.00 |

0.7 |

|

|

352.00 |

355.00 |

3.00 |

0.5 |

|

|

427.00 |

437.00 |

10.00 |

1.3 |

|

Including |

427.00 |

428.00 |

1.00 |

5.8 |

|

|

455.00 |

461.00 |

6.00 |

0.9 |

|

|

473.00 |

479.00 |

6.00 |

0.6 |

|

Including |

473.00 |

474.00 |

1.00 |

1.8 |

|

|

650.00 |

651.00 |

1.00 |

1.8 |

|

|

675.00 |

677.00 |

2.00 |

0.7 |

|

|

679.70 |

680.50 |

0.80 |

2.0 |

|

|

698.00 |

699.00 |

1.00 |

0.7 |

|

|

702.00 |

705.00 |

3.00 |

1.9 |

|

Including |

704.00 |

705.00 |

1.00 |

4.9 |

|

|

717.00 |

723.00 |

6.00 |

0.6 |

|

|

746.00 |

747.00 |

1.00 |

1.0 |

124044 |

|

47.00 |

86.00 |

39.00 |

1.2 |

|

Including |

61.00 |

62.00 |

1.00 |

5.0 |

|

Including |

73.00 |

74.00 |

1.00 |

4.5 |

|

Including |

85.00 |

86.00 |

1.00 |

3.4 |

|

|

99.00 |

118.40 |

19.40 |

1.4 |

|

Including |

111.00 |

112.00 |

1.00 |

3.6 |

|

|

158.00 |

159.40 |

1.40 |

0.9 |

|

|

166.00 |

190.00 |

24.00 |

0.6 |

|

|

213.00 |

216.00 |

3.00 |

0.8 |

Table 4 continued.

Hole ID |

|

From (m) |

To (m) |

Interval (m) |

Grade Au (g/t) |

124054 |

|

19.00 |

30.00 |

11.00 |

0.6 |

|

Including |

20.00 |

21.00 |

1.00 |

1.3 |

|

and |

28.00 |

29.00 |

1.00 |

1.6 |

|

|

39.00 |

231.00 |

192.00 |

3.6 |

|

Including |

60.00 |

60.50 |

0.50 |

10.4 |

|

and |

80.60 |

85.70 |

5.10 |

10.9 |

|

and |

93.00 |

100.85 |

7.85 |

11.8 |

|

and |

103.00 |

106.00 |

3.00 |

5.9 |

|

and |

123.25 |

135.70 |

12.45 |

9.8 |

|

also includes |

125.00 |

126.00 |

1.00 |

36.1 |

|

and |

165.00 |

167.00 |

2.00 |

7.1 |

|

and |

168.00 |

169.00 |

1.00 |

16.1 |

|

and |

174.00 |

175.00 |

1.00 |

15.1 |

|

and |

179.00 |

185.00 |

6.00 |

7.8 |

|

also includes |

179.00 |

180.00 |

1.00 |

18.7 |

|

and |

189.00 |

190.00 |

1.00 |

13.6 |

|

and |

202.00 |

203.00 |

1.00 |

10.2 |

|

and |

219.00 |

220.00 |

1.00 |

8.3 |

|

|

236.00 |

242.50 (EOH) |

6.50 |

0.5 |

124057 |

|

66.00 |

73.00 |

7.00 |

0.9 |

|

Including |

67.00 |

68.00 |

1.00 |

3.0 |

|

|

84.00 |

94.00 |

10.00 |

1.0 |

|

Including |

84.00 |

86.00 |

2.00 |

2.6 |

|

and |

91.00 |

92.00 |

1.00 |

2.4 |

|

|

107.00 |

113.00 |

6.00 |

0.6 |

|

|

124.00 |

159.00 |

35.00 |

6.3 |

|

Including |

138.00 |

139.00 |

1.00 |

24.6 |

|

and |

142.00 |

144.00 |

2.00 |

15.8 |

|

and |

149.00 |

155.00 |

6.00 |

13.5 |

|

also includes |

153.00 |

154.00 |

1.00 |

43.4 |

|

|

260.00 |

261.00 |

1.00 |

1.1 |

|

|

335.00 |

336.00 |

1.00 |

1.0 |

|

|

341.00 |

343.00 |

2.00 |

4.8 |

|

Including |

342.00 |

343.00 |

1.00 |

7.6 |

No upper cut-off grade has been applied. 0.4g/t Au lower cut-off applied, a maximum of 5m internal dilution has been allowed when calculating intercepts unless otherwise stated. All intervals over the cut-off grade and greater than 1gram-meter are presented here Italic intervals indicate intercepts included within the wider intercept. Unless specified, true widths cannot be accurately determined from the information available. Bold intervals referred to in text or figures of release. Refer to https://rupertresources.com/news/ for details of previously released drilling intercepts. EOH– End of Hole. NSI – No significant intercept

Table 3. Collar locations of new drill holes, Heinä South

Hole ID |

Prospect |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

EOH (m) |

124058 |

Heinä S |

452337.3 |

7497181.9 |

226.8 |

335.3 |

-45.2 |

131.30 |

124065 |

Heinä S |

452367.3 |

7497277.2 |

227.5 |

280.5 |

-49.0 |

266.00 |

124068 |

Heinä S |

452372.9 |

7497304.5 |

226.9 |

284.8 |

-48.1 |

149.10 |

124070 |

Heinä S |

452453.9 |

7497202.7 |

226.9 |

282.2 |

-44.7 |

302.80 |

Table 4. New Intercepts from Heinä South

Hole ID |

|

From (m) |

To (m) |

Interval (m) |

Grade Au (g/t) |

124058 |

|

92.00 |

117.00 |

25.00 |

1.11 |

|

Including |

100.00 |

101.00 |

1.00 |

5.21 |

|

and |

114.00 |

115.00 |

1.00 |

7.8 |

|

|

125.00 |

126.00 |

1.00 |

1.0 |

124065 |

|

59.00 |

61.00 |

2.00 |

13.2 |

|

Including |

59.00 |

60.00 |

1.00 |

25.2 |

|

|

98.00 |

99.00 |

1.00 |

0.4 |

|

|

104.00 |

109.00 |

5.00 |

1.1 |

|

Including |

108.00 |

109.00 |

1.00 |

3.5 |

|

|

132.00 |

133.00 |

1.00 |

0.8 |

|

|

262.00 |

263.00 |

1.00 |

0.8 |

124068 |

|

|

|

|

NSI |

124070 |

|

36.00 |

37.00 |

1.00 |

0.5 |

|

|

44.00 |

52.30 |

8.30 |

1.0 |

|

Including |

46.00 |

47.00 |

1.00 |

5.2 |

|

|

79.00 |

83.00 |

4.00 |

0.9 |

|

|

93.00 |

94.00 |

1.00 |

0.4 |

|

|

95.00 |

96.00 |

1.00 |

0.4 |

|

|

121.00 |

122.00 |

1.00 |

0.5 |

|

|

127.00 |

128.00 |

1.00 |

0.6 |

|

|

141.00 |

145.00 |

7.00 |

0.4 |

|

|

156.00 |

174.00 |

18.00 |

0.9 |

|

Including |

173.00 |

174.00 |

1.00 |

4.1 |

|

|

180.00 |

194.00 |

14.00 |

1.3 |

|

Including |

185.00 |

187.00 |

2.00 |

2.9 |

|

|

199.00 |

202.00 |

3.00 |

0.4 |

|

|

208.50 |

209.30 |

0.80 |

0.5 |

|

|

220.00 |

221.00 |

1.00 |

0.5 |

|

|

229.00 |

230.00 |

1.00 |

0.5 |

|

|

231.00 |

232.00 |

1.00 |

0.5 |

|

|

265.00 |

267.00 |

2.00 |

0.7 |

1Assays include results from Screen Fire Assay, all other results from standard 50g fire assay.

No upper cut-off grade has been applied. 0.4g/t Au lower cut-off applied, a maximum of 5m internal dilution has been allowed when calculating intercepts unless otherwise stated. All intervals over the cut-off grade are presented here. Italic intervals indicate intercepts included within the wider intercept. Unless specified, true widths cannot be accurately determined from the information available. Bold intervals referred to in text or figures of release. Refer to https://rupertresources.com/news/ for details of previously released drilling intercepts. EOH– End of Hole. NSI – No significant intercept

Table 5. Uncut mineralised intercept of 3.6g/t Au over 192m in drill hole 124054

From (m) |

To (m) |

Int (m) |

Au (g/t) |

39.00 |

40.00 |

1.00 |

1.5 |

40.00 |

41.00 |

1.00 |

0.9 |

41.00 |

42.00 |

1.00 |

0.6 |

42.00 |

43.25 |

1.25 |

3.7 |

43.25 |

44.00 |

0.75 |

0.5 |

44.00 |

44.50 |

0.50 |

0.2 |

44.50 |

45.00 |

0.50 |

0.3 |

45.00 |

46.00 |

1.00 |

6.3 |

46.00 |

47.00 |

1.00 |

3.8 |

47.00 |

48.15 |

1.15 |

3.0 |

48.15 |

48.80 |

0.65 |

1.1 |

48.80 |

50.00 |

1.20 |

0.9 |

50.00 |

51.00 |

1.00 |

1.9 |

51.00 |

52.00 |

1.00 |

2.5 |

52.00 |

53.00 |

1.00 |

5.3 |

53.00 |

54.00 |

1.00 |

1.3 |

54.00 |

55.00 |

1.00 |

2.1 |

55.00 |

56.00 |

1.00 |

4.1 |

56.00 |

57.00 |

1.00 |

6.3 |

57.00 |

58.00 |

1.00 |

6.7 |

58.00 |

59.00 |

1.00 |

4.6 |

59.00 |

60.00 |

1.00 |

3.9 |

60.00 |

60.50 |

0.50 |

10.4 |

60.50 |

60.70 |

0.20 |

0.0 |

60.70 |

61.10 |

0.40 |

0.3 |

61.10 |

62.00 |

0.90 |

1.4 |

62.00 |

63.00 |

1.00 |

1.8 |

63.00 |

64.00 |

1.00 |

1.9 |

64.00 |

65.20 |

1.20 |

1.5 |

65.20 |

66.00 |

0.80 |

0.2 |

66.00 |

67.00 |

1.00 |

1.4 |

67.00 |

67.55 |

0.55 |

0.4 |

67.55 |

68.00 |

0.45 |

0.3 |

68.00 |

69.00 |

1.00 |

0.3 |

69.00 |

70.00 |

1.00 |

0.1 |

70.00 |

71.00 |

1.00 |

0.3 |

71.00 |

72.00 |

1.00 |

0.1 |

72.00 |

72.40 |

0.40 |

1.1 |

72.40 |

73.00 |

0.60 |

1.3 |

73.00 |

74.00 |

1.00 |

3.0 |

74.00 |

74.30 |

0.30 |

1.2 |

74.30 |

75.00 |

0.70 |

1.4 |

75.00 |

76.00 |

1.00 |

2.2 |

76.00 |

77.00 |

1.00 |

3.6 |

77.00 |

78.00 |

1.00 |

1.0 |

78.00 |

79.00 |

1.00 |

0.2 |

79.00 |

80.00 |

1.00 |

1.7 |

80.00 |

80.60 |

0.60 |

3.7 |

80.60 |

81.00 |

0.40 |

10.4 |

81.00 |

82.00 |

1.00 |

7.7 |

82.00 |

82.85 |

0.85 |

3.2 |

From (m) |

To (m) |

Int (m) |

Au (g/t) |

82.85 |

83.55 |

0.70 |

8.2 |

83.55 |

84.40 |

0.85 |

19.8 |

84.40 |

85.00 |

0.60 |

5.5 |

85.00 |

85.70 |

0.70 |

21.6 |

85.70 |

86.70 |

1.00 |

0.8 |

86.70 |

87.00 |

0.30 |

0.6 |

87.00 |

88.00 |

1.00 |

3.7 |

88.00 |

88.40 |

0.40 |

1.7 |

88.40 |

89.00 |

0.60 |

6.9 |

89.00 |

90.00 |

1.00 |

0.1 |

90.00 |

90.30 |

0.30 |

0.9 |

90.30 |

90.85 |

0.55 |

3.7 |

90.85 |

92.00 |

1.15 |

5.1 |

92.00 |

93.00 |

1.00 |

5.7 |

93.00 |

94.00 |

1.00 |

7.3 |

94.00 |

95.00 |

1.00 |

10.0 |

95.00 |

96.00 |

1.00 |

6.7 |

96.00 |

97.00 |

1.00 |

16.1 |

97.00 |

98.00 |

1.00 |

8.8 |

98.00 |

99.00 |

1.00 |

15.7 |

99.00 |

99.75 |

0.75 |

20.5 |

99.75 |

100.85 |

1.10 |

11.9 |

100.85 |

102.00 |

1.15 |

5.0 |

102.00 |

103.00 |

1.00 |

1.2 |

103.00 |

104.00 |

1.00 |

8.0 |

104.00 |

104.30 |

0.30 |

9.0 |

104.30 |

104.75 |

0.45 |

2.8 |

104.75 |

105.60 |

0.85 |

2.9 |

105.60 |

106.00 |

0.40 |

8.1 |

106.00 |

107.00 |

1.00 |

1.1 |

107.00 |

107.40 |

0.40 |

0.5 |

107.40 |

108.00 |

0.60 |

3.9 |

108.00 |

109.00 |

1.00 |

5.4 |

109.00 |

110.00 |

1.00 |

6.2 |

110.00 |

110.35 |

0.35 |

0.3 |

110.35 |

111.15 |

0.80 |

1.9 |

111.15 |

112.00 |

0.85 |

5.3 |

112.00 |

113.00 |

1.00 |

1.6 |

113.00 |

113.60 |

0.60 |

2.0 |

113.60 |

114.00 |

0.40 |

1.7 |

114.00 |

115.00 |

1.00 |

3.2 |

115.00 |

116.00 |

1.00 |

0.6 |

116.00 |

117.00 |

1.00 |

2.2 |

117.00 |

117.30 |

0.30 |

0.7 |

117.30 |

117.85 |

0.55 |

1.7 |

117.85 |

118.55 |

0.70 |

1.7 |

118.55 |

119.40 |

0.85 |

0.4 |

119.40 |

120.00 |

0.60 |

0.1 |

120.00 |

121.00 |

1.00 |

0.3 |

121.00 |

122.00 |

1.00 |

0.2 |

122.00 |

123.25 |

1.25 |

0.7 |

From (m) |

To (m) |

Int (m) |

Au (g/t) |

123.25 |

124.00 |

0.75 |

8.4 |

124.00 |

125.00 |

1.00 |

7.2 |

125.00 |

126.00 |

1.00 |

36.1 |

126.00 |

127.00 |

1.00 |

6.6 |

127.00 |

128.00 |

1.00 |

7.0 |

128.00 |

129.00 |

1.00 |

7.9 |

129.00 |

130.00 |

1.00 |

6.1 |

130.00 |

131.00 |

1.00 |

3.8 |

131.00 |

132.00 |

1.00 |

3.6 |

132.00 |

133.00 |

1.00 |

14.9 |

133.00 |

133.35 |

0.35 |

4.1 |

133.35 |

134.00 |

0.65 |

9.5 |

134.00 |

135.00 |

1.00 |

8.0 |

135.00 |

135.70 |

0.70 |

9.7 |

135.70 |

136.00 |

0.30 |

1.1 |

136.00 |

137.00 |

1.00 |

0.5 |

137.00 |

138.00 |

1.00 |

0.2 |

138.00 |

139.00 |

1.00 |

0.0 |

139.00 |

140.00 |

1.00 |

0.1 |

140.00 |

141.00 |

1.00 |

0.1 |

141.00 |

142.00 |

1.00 |

0.5 |

142.00 |

143.00 |

1.00 |

0.2 |

143.00 |

144.00 |

1.00 |

0.7 |

144.00 |

145.00 |

1.00 |

0.1 |

145.00 |

146.00 |

1.00 |

0.4 |

146.00 |

147.00 |

1.00 |

0.5 |

147.00 |

147.80 |

0.80 |

0.9 |

147.80 |

149.00 |

1.20 |

6.8 |

149.00 |

150.00 |

1.00 |

0.8 |

150.00 |

151.00 |

1.00 |

0.3 |

151.00 |

152.00 |

1.00 |

2.2 |

152.00 |

153.00 |

1.00 |

1.2 |

153.00 |

153.80 |

0.80 |

3.6 |

153.80 |

154.36 |

0.56 |

0.8 |

154.36 |

155.00 |

0.64 |

0.0 |

155.00 |

156.00 |

1.00 |

0.3 |

156.00 |

157.00 |

1.00 |

1.1 |

157.00 |

158.00 |

1.00 |

0.4 |

158.00 |

159.00 |

1.00 |

0.4 |

159.00 |

160.00 |

1.00 |

1.5 |

160.00 |

161.00 |

1.00 |

1.6 |

161.00 |

162.00 |

1.00 |

0.5 |

162.00 |

163.00 |

1.00 |

3.7 |

163.00 |

164.00 |

1.00 |

2.9 |

164.00 |

165.00 |

1.00 |

1.9 |

165.00 |

166.00 |

1.00 |

5.4 |

166.00 |

167.00 |

1.00 |

8.7 |

167.00 |

168.00 |

1.00 |

1.6 |

168.00 |

169.00 |

1.00 |

16.1 |

169.00 |

170.00 |

1.00 |

4.9 |

170.00 |

171.00 |

1.00 |

3.2 |

171.00 |

172.00 |

1.00 |

1.9 |

172.00 |

173.00 |

1.00 |

2.7 |

173.00 |

174.00 |

1.00 |

2.7 |

From (m) |

To (m) |

Int (m) |

Au (g/t) |

174.00 |

175.00 |

1.00 |

15.1 |

175.00 |

176.00 |

1.00 |

3.0 |

176.00 |

177.00 |

1.00 |

1.3 |

177.00 |

178.00 |

1.00 |

4.4 |

178.00 |

179.00 |

1.00 |

5.0 |

179.00 |

180.00 |

1.00 |

18.7 |

180.00 |

181.00 |

1.00 |

8.4 |

181.00 |

182.00 |

1.00 |

2.7 |

182.00 |

183.00 |

1.00 |

3.3 |

183.00 |

184.00 |

1.00 |

7.4 |

184.00 |

185.00 |

1.00 |

6.3 |

185.00 |

186.00 |

1.00 |

0.2 |

186.00 |

187.00 |

1.00 |

0.8 |

187.00 |

188.00 |

1.00 |

0.6 |

188.00 |

189.00 |

1.00 |

0.1 |

189.00 |

190.00 |

1.00 |

13.6 |

190.00 |

191.00 |

1.00 |

1.4 |

191.00 |

192.00 |

1.00 |

2.5 |

192.00 |

193.00 |

1.00 |

0.7 |

193.00 |

194.00 |

1.00 |

0.1 |

194.00 |

195.00 |

1.00 |

0.4 |

195.00 |

196.00 |

1.00 |

0.9 |

196.00 |

197.00 |

1.00 |

0.9 |

197.00 |

198.00 |

1.00 |

5.0 |

198.00 |

199.00 |

1.00 |

0.4 |

199.00 |

200.00 |

1.00 |

0.1 |

200.00 |

201.00 |

1.00 |

0.4 |

201.00 |

202.00 |

1.00 |

0.2 |

202.00 |

203.00 |

1.00 |

10.2 |

203.00 |

204.00 |

1.00 |

0.2 |

204.00 |

205.00 |

1.00 |

0.2 |

205.00 |

206.00 |

1.00 |

0.0 |

206.00 |

207.00 |

1.00 |

0.1 |

207.00 |

208.00 |

1.00 |

0.7 |

208.00 |

209.00 |

1.00 |

0.7 |

209.00 |

210.00 |

1.00 |

0.4 |

210.00 |

211.00 |

1.00 |

1.3 |

211.00 |

212.00 |

1.00 |

3.7 |

212.00 |

213.00 |

1.00 |

1.3 |

213.00 |

214.00 |

1.00 |

0.1 |

214.00 |

215.00 |

1.00 |

0.2 |

215.00 |

216.00 |

1.00 |

1.4 |

216.00 |

217.00 |

1.00 |

2.6 |

217.00 |

218.00 |

1.00 |

2.3 |

218.00 |

219.00 |

1.00 |

1.8 |

219.00 |

220.00 |

1.00 |

8.3 |

220.00 |

221.00 |

1.00 |

1.3 |

221.00 |

222.00 |

1.00 |

0.0 |

222.00 |

223.00 |

1.00 |

0.8 |

223.00 |

224.00 |

1.00 |

1.6 |

224.00 |

225.00 |

1.00 |

4.6 |

225.00 |

226.00 |

1.00 |

0.4 |

226.00 |

227.00 |

1.00 |

5.9 |

227.00 |

228.00 |

1.00 |

0.3 |

From (m) |

To (m) |

Int (m) |

Au (g/t) |

228.00 |

229.00 |

1.00 |

5.4 |

229.00 |

230.00 |

1.00 |

3.1 |

230.00 |

231.00 |

1.00 |

0.5 |

View source version on businesswire.com: https://www.businesswire.com/news/home/20240903103249/en/

James Withall

Chief Executive Officer

jwithall@rupertresources.com

Thomas Credland

Head of Corporate Development

tcredland@rupertresources.com

Rupert Resources Ltd

82 Richmond Street East, Suite 203,

Tel: +1 416-304-9004 Web: http://rupertresources.com/

Source: Rupert Resources Ltd.