Ryder To Acquire Impact Fulfillment Services; Will Add Contract Packaging and Manufacturing Capabilities

(Graphic: Business Wire)

The transaction is expected to add approximately

“The acquisition of IFS supports our strategy to accelerate growth in our supply chain business, providing Ryder with new capabilities that are complementary to our existing suite of services,” says Steve Sensing, president of supply chain solutions for Ryder. “Initially, the co-packaging and co-manufacturing services will roll into our CPG vertical; however, we see considerable opportunity to leverage these new capabilities across other industry verticals.”

IFS has built a blue-chip customer base with its proven model for co-packing and co-manufacturing in both food and non-food products, including a specialty in blending and filling dry powder and viscous products.

“Ryder already serves the top 10 U.S. food and beverage companies, and this acquisition will expand and strengthen our relationships with those customers while also attracting new customers in additional verticals, especially in retail, health, and beauty,” says Darin Cooprider, senior vice president of CPG for Ryder. “And IFS’ customer base will benefit from access to Ryder’s capabilities as a fully integrated port-to-door logistics provider.”

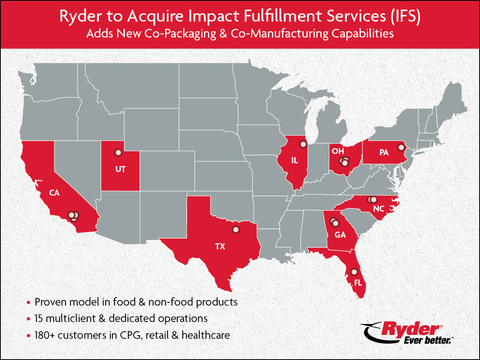

Ryder will integrate the IFS facilities and operations into its supply chain solutions business, including nine multiclient and six dedicated customer operations, totaling just under four million square feet. To ensure a seamless experience for customers, Ryder plans to retain IFS’ workforce of approximately 1,000 full-time employees. President of IFS Rob LeBaron will join Ryder as vice president of contract manufacturing and packaging.

“As we considered the next step in our growth strategy, it became clear that joining Ryder would open doors in just about every industry vertical while allowing our marquee customer base to leverage Ryder’s comprehensive suite of services,” says LeBaron.

Founded 25 years ago, IFS specializes in contract manufacturing, contract packaging and assembly, display engineering, product launches, multichannel programs, and club store programs.

“IFS was built on trust, saying what we do and then doing what we say,” says IFS Founder Todd Porterfeld, who plans to retire. “It’s the people who come to work every day determined to deliver on the promises we make that have led to our success. Thinking about the future, I want to ensure our employees are in a place where they can continue to grow, and our customers are in the best possible hands. I believe Ryder is that place.”

Blank Rome LLP is acting as Ryder’s legal counsel for the transaction. Wofford Advisors LLC and Paul Hastings LLP are representing IFS.

About Ryder System, Inc.

Ryder System, Inc. (NYSE: R) is a leading logistics and transportation company. It provides supply chain, dedicated transportation, and fleet management solutions, including warehousing and distribution, e-commerce fulfillment, last-mile delivery, managed transportation, professional drivers, freight brokerage, full-service leasing, maintenance, commercial truck rental, and used vehicle sales to some of the world’s most-recognized brands. Ryder provides services throughout

Note Regarding Forward-Looking Statements: Certain statements and information included in this news release are “forward-looking statements” within the meaning of the Federal Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current plans and expectations and are subject to risks, uncertainties and assumptions. Accordingly, these forward-looking statements, including our expectations regarding the benefits and timing of the transaction, should be evaluated with consideration given to the many risks and uncertainties that could cause actual results and events to differ materially from those in the forward-looking statements including those risks set forth in our periodic filings with the Securities and Exchange Commission. New risks emerge from time to time. It is not possible for management to predict all such risk factors or to assess the impact of such risks on our business. Accordingly, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

ryder-scs

View source version on businesswire.com: https://www.businesswire.com/news/home/20231023244648/en/

Anne

amhendricks@ryder.com

Amy Federman

afederman@ryder.com

Source: Ryder System, Inc.