Q2 Metals Announces Closing of the Acquisition of Additional Claims at the Cisco Lithium Property, James Bay, Quebec, Canada

Q2 Metals Corp. (QUEXF) has finalized the acquisition of 545 additional mineral claims at the Cisco Lithium Property in James Bay, Quebec. This expansion more than triples the company's claim position, resulting in 767 contiguous claims covering 39,389 hectares. The expanded property includes over 30 km of strike length on the Frotet-Evans Greenstone Belt.

To acquire these claims, Q2 must pay $2,400,000 over 42 months and complete $1,200,000 in exploration expenditures. The claims are subject to varying royalties: a 3% GMR (2% repurchasable for $3,000,000) and a combined 2% NSR (1% repurchasable for $500,000) plus 1% GMR.

The Cisco Property has shown promising drill results, including intersections of 120.3m at 1.72% Li2O and 347.1m at 1.35% Li2O. The company has completed 6,359.7m of drilling over 17 holes, all intercepting pegmatite with visual spodumene mineralization.

Q2 Metals Corp. (QUEXF) ha completato l'acquisizione di 545 ulteriori diritti minerari presso il Cisco Lithium Property a James Bay, Quebec. Questa espansione fa più che triplicare la posizione delle concessioni della società, portando il totale a 767 concessioni contigue che coprono 39.389 ettari. La proprietà ampliata include oltre 30 km di lunghezza nel Frotet-Evans Greenstone Belt.

Per acquisire queste concessioni, Q2 deve pagare 2.400.000 dollari nel corso di 42 mesi e completare 1.200.000 dollari in spese di esplorazione. Le concessioni sono soggette a diverse royalty: un 3% GMR (2% riacquistabile per 3.000.000 dollari) e una combinata 2% NSR (1% riacquistabile per 500.000 dollari) più un 1% GMR.

La proprietà Cisco ha mostrato risultati promettenti nei sondaggi, tra cui intersezioni di 120,3 m a 1,72% Li2O e 347,1 m a 1,35% Li2O. La società ha completato 6.359,7 m di perforazioni su 17 fori, tutti intercettando pegmatite con mineralizzazione visibile di spodumene.

Q2 Metals Corp. (QUEXF) ha finalizado la adquisición de 545 derechos minerales adicionales en la propiedad de litio Cisco en James Bay, Quebec. Esta expansión triplica más que la posición de derechos de la compañía, resultando en 767 reclamos contiguos que cubren 39,389 hectáreas. La propiedad ampliada incluye más de 30 km de longitud en el Frotet-Evans Greenstone Belt.

Para adquirir estos derechos, Q2 debe pagar $2,400,000 durante 42 meses y completar $1,200,000 en gastos de exploración. Los derechos están sujetos a regalías variables: un 3% GMR (2% recomprable por $3,000,000) y un combinado 2% NSR (1% recomprable por $500,000) más un 1% GMR.

La propiedad Cisco ha mostrado resultados de perforación prometedores, incluyendo intersecciones de 120.3m a 1.72% Li2O y 347.1m a 1.35% Li2O. La compañía ha completado 6,359.7m de perforaciones en 17 agujeros, todos interceptando pegmatita con mineralización de spodumene visible.

Q2 Metals Corp. (QUEXF)는 퀘벡 주 제임스 베이에 있는 시스코 리튬 소유지에서 추가로 545개의 광물 청구권을 인수 완료했습니다. 이번 확장은 회사의 청구권 위치를 세 배 이상 증가시켜, 총 767개의 인접한 청구권이 39,389 헥타르를 덮도록 합니다. 확장된 소유지는 Frotet-Evans 그린스톤 벨트에서 30km가 넘는 노두 길이를 포함합니다.

이 청구권을 인수하기 위해 Q2는 42개월 동안 2,400,000 달러를 지불하고 1,200,000 달러의 탐사 비용을 완료해야 합니다. 청구권은 다양한 로열티에 따라 달라지며: 3% GMR (2%는 3,000,000 달러에 재구매 가능)와 결합된 2% NSR (1%는 500,000 달러에 재구매 가능) 및 1% GMR이 있습니다.

시스코 소유지는 120.3m에서 1.72% Li2O 및 347.1m에서 1.35% Li2O를 포함한 유망한 시추 결과를 보여주었습니다. 회사는 17개의 구멍에서 6,359.7m의 시추를 완료했으며, 모두 시각적으로 스포듐니가 있는 페그마타이트를 관통했습니다.

Q2 Metals Corp. (QUEXF) a finalisé l'acquisition de 545 droits miniers supplémentaires à la propriété de lithium Cisco à James Bay, Québec. Cette expansion multiplie par plus de trois la position des droits de la société, aboutissant à 767 droits contigus couvrant 39,389 hectares. La propriété agrandie comprend plus de 30 km de longueur de gîte dans la ceinture de roches vertes Frotet-Evans.

Pour acquérir ces droits, Q2 doit payer 2.400.000 $ sur 42 mois et réaliser 1.200.000 $ en dépenses d'exploration. Les droits sont soumis à des redevances variées : 3 % GMR (2 % rachetable pour 3.000.000 $) et un NSR combiné de 2 % (1 % rachetable pour 500.000 $) plus 1 % GMR.

La propriété Cisco a montré des résultats de forage prometteurs, comprenant des intersections de 120,3 m à 1,72 % Li2O et 347,1 m à 1,35 % Li2O. L'entreprise a complété 6.359,7 m de forage sur 17 trous, tous interceptant du pegmatite avec une minéralisation de spodumène visible.

Q2 Metals Corp. (QUEXF) hat die Akquisition von 545 zusätzlichen Mineralansprüchen im Cisco Lithium Property in James Bay, Quebec, abgeschlossen. Diese Erweiterung vervielfacht die Anspruchsposition des Unternehmens mehr als dreimal und führt zu 767 zusammenhängenden Ansprüchen, die 39.389 Hektar abdecken. Die erweiterte Fläche umfasst über 30 km Erzganglänge im Frotet-Evans Greenstone Belt.

Um diese Ansprüche zu erwerben, muss Q2 2.400.000 Dollar über 42 Monate zahlen und 1.200.000 Dollar an Explorationsausgaben tätigen. Die Ansprüche unterliegen unterschiedlichen Lizenzgebühren: 3% GMR (2% rückkaufbar für 3.000.000 Dollar) und eine kombinierte 2% NSR (1% rückkaufbar für 500.000 Dollar) sowie 1% GMR.

Das Cisco Property hat vielversprechende Bohrergebnisse gezeigt, darunter Schnittstellen von 120,3 m bei 1,72% Li2O und 347,1 m bei 1,35% Li2O. Das Unternehmen hat 6.359,7 m Bohrungen über 17 Löcher abgeschlossen, die alle Pegmatit mit sichtbarer Spodumenmineralisierung durchschnitten.

- Significant property expansion tripling the claim position to 767 claims (39,389 ha)

- Strong drill results showing high-grade lithium intersections up to 1.72% Li2O

- Strategic location near existing lithium deposits (Sirmac and Moblan)

- All 17 drill holes intercepted pegmatite with visual spodumene mineralization

- Substantial financial commitment required ($2,400,000 over 42 months)

- Additional exploration expenditure requirement of $1,200,000

- High royalty obligations (3% GMR and 2% NSR + 1% GMR) with costly buyback options

VANCOUVER, BC / ACCESSWIRE / December 18, 2024 / Q2 Metals Corp. (TSXV:QTWO)(OTCQB:QUEXF)(FSE:458) ("Q2" or the "Company") is pleased to report that the previously announced option agreement made between 9219-8845 QC Inc. (" CMH "), Anna-Rosa Giglio (together with CMH, the " Vendors ") and the Company, as amended and restated December 17, 2024 (the "Agreement"), has closed.

Under the terms of the Agreement, Q2 has acquired the exclusive right and option to acquire a

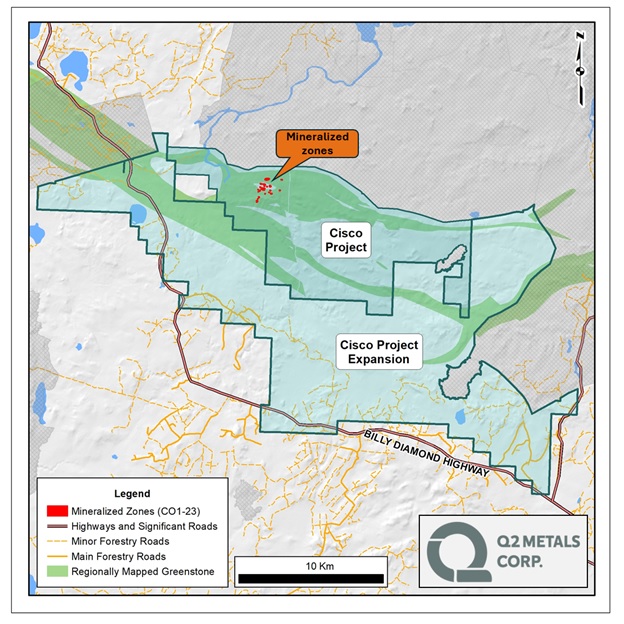

The Cisco Property is now comprised of a total of 767 contiguous mineral claims over 39,389 ha, including more than 30 km of strike length on the Frotet-Evans Greenstone Belt, which hosts the Sirmac and Moblan lithium deposits, located 130 km and 180 km away, respectively. The Additional Cisco Claims are primarily south of the original Cisco Property claims, adding several kilometres of prospective greenstone rocks and providing extensive strategic sites for future development and mining infrastructure scenarios.

To acquire the Additional Cisco Claims, the Company must pay to CMH an aggregate of

For further details on the terms of the Agreement and the royalties on the Additional Cisco Claims, please see the Company's press release dated November 26, 2024.

Upcoming Events:

AME Roundup Core Shack

Q2 is pleased to have been selected as a participant in the core shack at the upcoming AME annual Roundup conference being held in Vancouver, BC from January 20 - 23, 2025.

Vice President of Exploration Neil McCallum as well as senior project geologists will be on hand with core from the 2024 drill season at Cisco. Mr. McCallum will also be presenting at the Critical and Base Metals Speaker Session on Tuesday January 21, 2025.

For more information on AME Roundup, please click here.

PDAC Booth and Core Shack

The Company will be attending and exhibiting on site at the 2025 Prospectors & Developers Association of Canada event ("PDAC 2025") in Toronto, ON. Q2 is exhibiting in the Investors Exchange from March 2 - 5, 2025 at booth number 2726.

Additionally, Q2 Metals is pleased to announce that the Company has been selected to exhibit core from the Cisco Lithium Property at PDAC 2025. More details to be provided as the event approaches.

For more information on PDAC 2025, please click here.

Qualified Person

Neil McCallum, B.Sc., P.Geol, is a registered permit holder with the Ordre des Géologues du Québec and Qualified Person as defined by NI 43-101 ("QP") and has reviewed and approved the technical information in this news release. Mr. McCallum is a director and VP Exploration for Q2.

About Q2 Metals Corp

Q2 Metals is a Canadian mineral exploration company focused on unlocking its portfolio of lithium projects in the Eeyou Istchee James Bay region of Quebec, Canada, that includes both its 100-per-cent-owned Mia Lithium Property and the Cisco Lithium Property.

The Cisco Property is comprised of 767 claims, totaling 39,389 hectares ("ha"). The Cisco Property transects the Billy Diamond Highway, and the main mineralized zone is located only 6.5 kilometres ("km") away from the highway. The Cisco Property is approximately 150 km north of Matagami, a small town that contains the closest rail link to much of James Bay; and is within the greater Nemaska traditional territory of the Eeyou Istchee Territory, James Bay, Quebec.

The Cisco Property is situated along the Frotet Evans Greenstone Belt, comprised of a volcanic package dominated by mafic to felsic metavolcanic rocks, of the southern James Bay Lithium District, the same belt that hosts the Sirmac and Moblan lithium deposits, located 130 km and 180 km away, respectively.

The Cisco Lithium Property has district-scale potential with an already identified mineralized zone and discovery drill results that include:

|

Since May 2024, the Company has drilled a total of 6,359.7 m over 17 holes. All drill holes intercepted pegmatite with visual indications of spodumene mineralization identified.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Alicia Milne - President & CEO

Alicia@Q2metals.com

Jason McBride - Corporate Communications

Jason@Q2metals.com

Telephone: 1 (800) 482-7560

E-mail: info@Q2metals.com

Follow the Company: Twitter, LinkedIn, Facebook, and Instagram

Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian legislation. Forward-looking statements are typically identified by words such as: "believes", "expects", "anticipates", "intends", "estimates", "plans", "may", "should", "would", "will", "potential", "scheduled" or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. Accordingly, all statements in this news release that are not purely historical are forward-looking statements and include statements regarding beliefs, plans, expectations and orientations regarding the future including, without limitation, any statements or plans regard the geological prospects of the Company's properties and the future exploration endeavors of the Company. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in such forward-looking statements. The forward-looking statements in this news release speak only as of the date of this news release or as of the date specified in such statement. Forward looking statements in this news release include, but are not limited to, the prospectivity of the greenstone rocks in the area, the possibility of future development and mining infrastructure scenarios, the potential for development, the potential scale of the Cisco Property, the focus of the Company's current and future exploration and drill programs, the scale, scope and location of future exploration and drilling activities, the Company's expectations in connection with the projects and exploration programs being met, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, variations in ore grade or recovery rates, changes in project parameters as plans continue to be refined, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same. Readers are cautioned that mineral exploration and development of mines is an inherently risky business and accordingly, the actual events may differ materially from those projected in the forward-looking statements. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for its recently completed fiscal period, which is available under Company's SEDAR profile at www.sedarplus.ca.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Q2 Metals Corp.

View the original press release on accesswire.com

FAQ

What are the key terms of Q2 Metals' (QUEXF) Cisco Property acquisition?

What are the recent drilling results at Q2 Metals' (QUEXF) Cisco Property?

How many claims does Q2 Metals (QUEXF) now control at the Cisco Property?