Q2 Metals Announces Final Analytical Results from the 2024 Drill Campaign at the Cisco Lithium Property, James Bay, Quebec, Canada, and Proceeds of $1.9 Million from Warrant Exercises

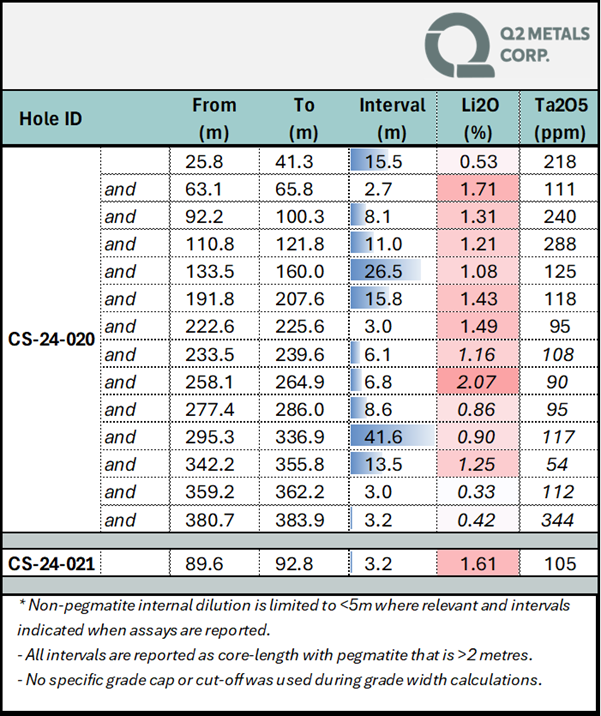

Q2 Metals (QUEXF) has announced final analytical results from its 2024 drill campaign at the Cisco Lithium Property in Quebec, Canada. Drill hole CS-24-020 showed significant lithium concentrations across multiple intervals, including 26.5m at 1.08% Li2O, 15.8m at 1.43% Li2O, 41.6m at 0.90% Li2O, and 13.5m at 1.25% Li2O.

The company also reported receiving $1.9 million from the exercise of 6,250,000 share purchase warrants at $0.305 per share before their December 15, 2024 expiry. The Cisco Property, acquired in February 2024, spans 39,389 hectares and has shown promising results throughout the year's exploration campaign. The company plans to resume work at Cisco in late January 2025.

Q2 Metals (QUEXF) ha annunciato i risultati analitici finali della sua campagna di perforazione 2024 presso il Cisco Lithium Property in Quebec, Canada. Il foro di perforazione CS-24-020 ha mostrato concentrazioni significative di litio in diversi intervalli, tra cui 26,5 m a 1,08% Li2O, 15,8 m a 1,43% Li2O, 41,6 m a 0,90% Li2O e 13,5 m a 1,25% Li2O.

L'azienda ha anche riportato di aver ricevuto 1,9 milioni di dollari dall'esercizio di 6.250.000 warrants per l'acquisto di azioni a $0,305 per azione prima della scadenza del 15 dicembre 2024. Il Cisco Property, acquisito a febbraio 2024, si estende su 39.389 ettari e ha mostrato risultati promettenti durante la campagna di esplorazione dell'anno. L'azienda prevede di riprendere i lavori a Cisco alla fine di gennaio 2025.

Q2 Metals (QUEXF) ha anunciado los resultados analíticos finales de su campaña de perforación 2024 en la Propiedad de Litio Cisco en Quebec, Canadá. El pozo de perforación CS-24-020 mostró concentraciones significativas de litio en múltiples intervalos, incluyendo 26,5 m a 1,08% Li2O, 15,8 m a 1,43% Li2O, 41,6 m a 0,90% Li2O, y 13,5 m a 1,25% Li2O.

La compañía también informó haber recibido $1.9 millones del ejercicio de 6.250.000 opciones de compra de acciones a $0.305 por acción antes de su vencimiento el 15 de diciembre de 2024. La Propiedad Cisco, adquirida en febrero de 2024, abarca 39.389 hectáreas y ha mostrado resultados prometedores durante la campaña de exploración del año. La empresa planea reanudar el trabajo en Cisco a finales de enero de 2025.

Q2 Metals (QUEXF)는 캐나다 퀘벡의 Cisco 리튬 자산에서 2024년 탐사 캠페인의 최종 분석 결과를 발표했습니다. 시추공 CS-24-020은 여러 구간에서 리튬 농도가 상당한 수준임을 보여주었으며, 26.5m에서 1.08% Li2O, 15.8m에서 1.43% Li2O, 41.6m에서 0.90% Li2O, 그리고 13.5m에서 1.25% Li2O의 농도가 포함되어 있습니다.

회사는 또한 $1.9 백만을 6,250,000개의 주식 매입 워런트를 주당 $0.305에 행사하여 확보했다고 보고했습니다. 2024년 2월에 인수한 Cisco 자산은 39,389헥타르를 차지하며, 올해 탐사 캠페인 동안 유망한 결과를 보여주었습니다. 회사는 2025년 1월 말에 Cisco에서 작업을 재개할 계획입니다.

Q2 Metals (QUEXF) a annoncé les résultats analytiques finaux de sa campagne de forage 2024 à la propriété lithium Cisco au Québec, Canada. Le trou de forage CS-24-020 a montré des concentrations significatives de lithium à plusieurs intervalles, y compris 26,5 m à 1,08% Li2O, 15,8 m à 1,43% Li2O, 41,6 m à 0,90% Li2O et 13,5 m à 1,25% Li2O.

L'entreprise a également signalé avoir reçu 1,9 million de dollars de l'exercice de 6.250.000 bons de souscription d'actions à 0,305 $ par action avant leur expiration le 15 décembre 2024. La propriété Cisco, acquise en février 2024, s'étend sur 39.389 hectares et a montré des résultats prometteurs tout au long de la campagne d'exploration de l'année. L'entreprise prévoit de reprendre les travaux à Cisco à la fin janvier 2025.

Q2 Metals (QUEXF) hat die finalen analytischen Ergebnisse seiner Bohrkampagne 2024 auf dem Cisco Lithium Property in Quebec, Kanada, bekannt gegeben. Der Bohrer CS-24-020 zeigte signifikante Lithiumkonzentrationen über mehrere Intervalle, darunter 26,5 m bei 1,08% Li2O, 15,8 m bei 1,43% Li2O, 41,6 m bei 0,90% Li2O und 13,5 m bei 1,25% Li2O.

Das Unternehmen berichtete zudem, dass es 1,9 Millionen Dollar aus der Ausübung von 6.250.000 Aktienkaufwarrants zu je $0,305 pro Aktie vor deren Ablauf am 15. Dezember 2024 erhalten hat. Die Cisco-Immobilie, die im Februar 2024 erworben wurde, erstreckt sich über 39.389 Hektar und zeigte im Verlauf der Erkundungskampagne des Jahres vielversprechende Ergebnisse. Das Unternehmen plant, die Arbeiten auf Cisco Ende Januar 2025 wieder aufzunehmen.

- Strong lithium concentrations in multiple drill intervals, with up to 1.43% Li2O

- Received $1.9 million from warrant exercises, strengthening balance sheet

- Mineralization system remains open in both directions

- 850m drill-defined strike length with potential 1,050m southern extension

- True width of mineralized intervals not yet determined

- Additional drilling required to define resource extent

Highlights:

Strong analytical results for drill hole CS-24-020 include several wide intervals containing:

26.5 m at

1.08% Li2O,15.8 m at

1.43% Li2O,41.6 m at

0.90% Li2O, and13.5 m at

1.25% Li2O.

Proceeds of

$1.9 million received on exercise of warrants expiring December 15, 2024.

VANCOUVER, BC / ACCESSWIRE / December 17, 2024 / Q2 Metals Corp. (TSXV:QTWO)(OTCQB:QUEXF)(FSE:458) ("Q2" or the "Company") is pleased to report that it has received core assay results on drill hole CS-24-020, as well as one small interval that was remaining on drill hole CS-24-021 from the 2024 drill campaign at the Cisco Lithium Property (the "Property" or the "Cisco Property") located within the greater Nemaska traditional territory of the Eeyou Istchee James Bay region of Quebec, Canada. All core assay results from the 2024 drill campaign at the Cisco Property have now been received and reported on.

The Company also announces that all share purchase warrants originally issued in a December 2022 private placement financing were exercised in advance of their December 15, 2024 expiry date. Total proceeds of

"2024 has been a transformative year for Q2. Since its acquisition in February 2024, we have been focused on the Cisco Property, which has far surpassed our lofty expectations," said Neil McCallum, Q2 Metals Vice President of Exploration. "With the final drill results now reported on from our 2024 exploration campaign, we are eager to resume work on Cisco in late January and expand on the exceptional results we've received so far."

"We are pleased that the cash proceeds from the exercise of expiring warrants, as well as the exercise of other in-the-money warrants, will further add to Q2's strong balance sheet, providing us with a solid financial foundation from which we will continue to build shareholder value through the drill bit with our 2025 winter exploration program," said Alicia Milne, President and Chief Executive Officer of Q2 Metals. "Plans for the winter campaign at Cisco are being finalized and will be detailed early in the new year."

Results for CS-24-020

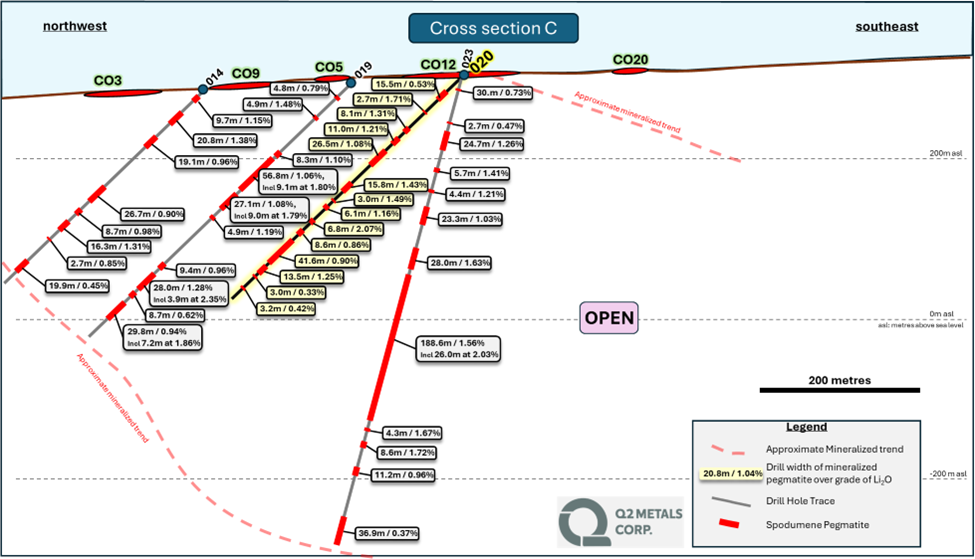

The analytical results reported herein represent 405 m of drilling over one (1) hole (CS-24-020), as well as the uppermost interval of drill hole CS-24-021, during the 2024 drill campaign. Complete highlighted intervals from hole CS-24-020, are summarized in Table 1 and represented in Figure 1, with two cross sections in Figures 2 and 3.

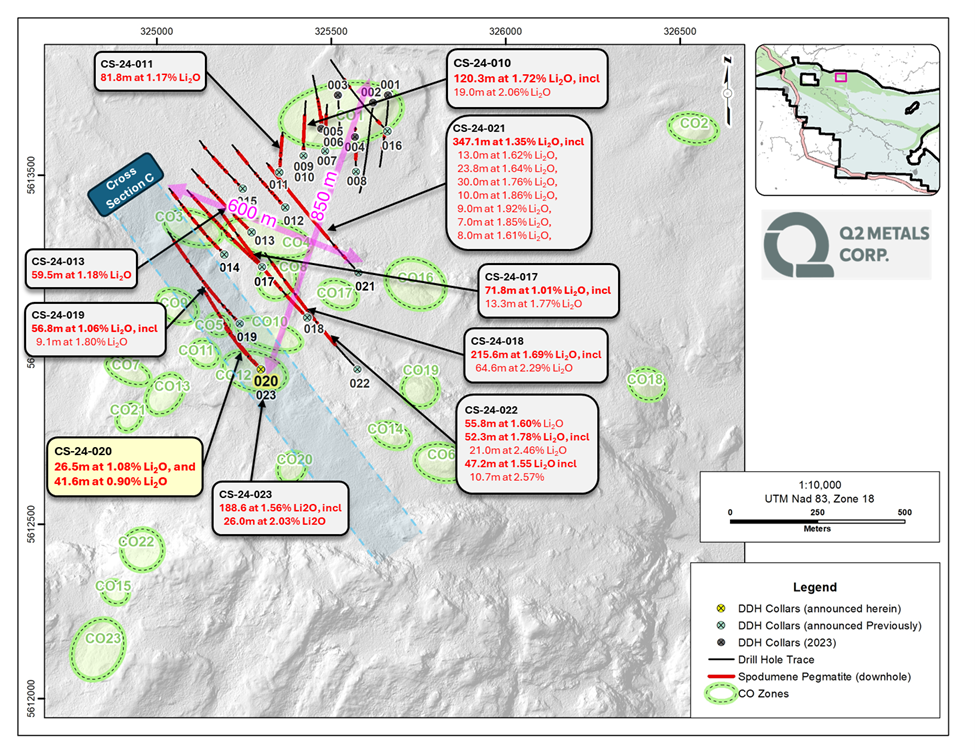

Figure 1. Map of Recent Drill Holes with Analytical Results at Cisco Property

Drill hole CS-24-020 was drilled on the same pad as hole CS-24-023 and approximately 150 m to the southeast of hole CS-24-019. The results reveal several separate mineralized intervals including the widest intervals: 26.5 m at

Figure 2. Cross Section C (looking northeast)

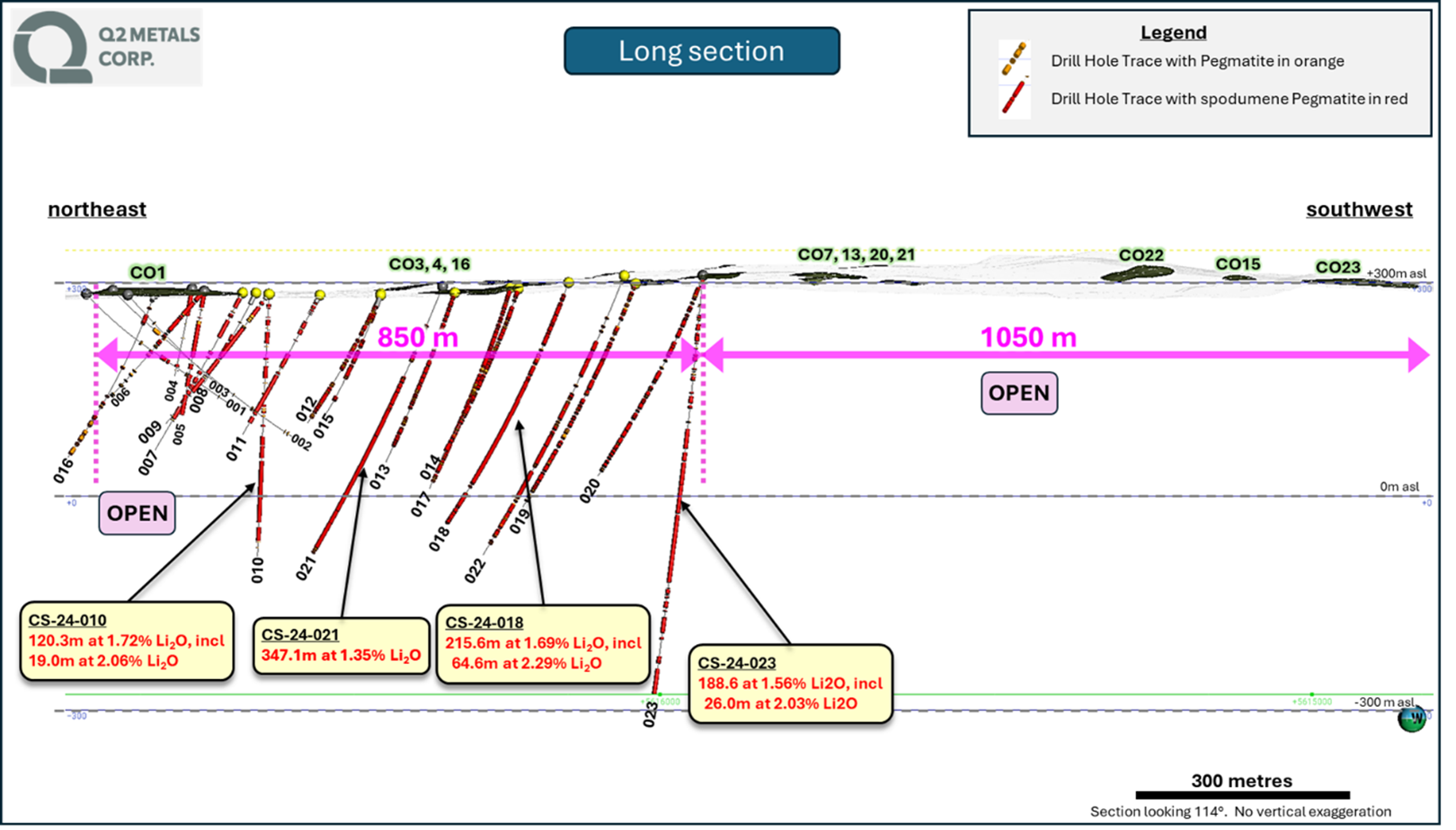

All drill holes from the 2024 drill campaign are detailed in Figure 3 from northeast to southwest and represent a drill-defined strike length of approximately 850 m. The surface outcrops and drilling suggest that the mineralization may continue to the south for another 1,050 m.

As previously reported, drill hole CS-24-023, drilled from the same drill pad as CS-24-020, confirms the continuity of the mineralized system to the southeast and the mineralized system remains open in both directions.

Figure 3. Long Section containing all holes drilled to-date (looking southwest)

Table 1. Summary of Analytical Results of Spring Drill Holes at Cisco Property

All intervals of greater than 2 m of core-length are included in the table. Internal dilution of non-pegmatite material was limited to intervals of less than 5 m. No specific grade cap or lower cut-offs were used during grade and width calculations. All intervals are reported as core widths and mineralized intervals in all the holes drilled thus far are not representative of the true width as the modelled pegmatite zones are being refined with every additional hole. Complete drill hole collar, lithology and assay information is available at: www.q2metals.com/property/cisco-lithium-property/

Sampling, Analytical Methods and QA/QC Protocols

Drill core was saw-cut with half-core sent for geochemical analysis and half-core remaining in the box for reference. The same side of the core was sampled to maintain representativeness. All drill core samples were shipped to SGS Canada's preparation facility in Val D'Or, Quebec, for standard sample preparation (code PRP92) which includes drying at 105°C, crushing to

Upcoming Events

AME Roundup Core Shack

Q2 is pleased to have been selected as a participant in the core shack at the upcoming AME annual Roundup conference being held in Vancouver, BC from January 20 - 23, 2025.

Vice President of Exploration Neil McCallum as well as senior project geologists will be on hand with core from the 2024 drill season at Cisco. Mr. McCallum will also be presenting at the Critical and Base Metals Speaker Session on Tuesday January 21, 2025.

For more information on AME Roundup, please click here.

PDAC Booth and Core Shack

The Company will be attending and exhibiting on site at the 2025 Prospectors & Developers Association of Canada event ("PDAC 2025") in Toronto, ON. Q2 is exhibiting in the Investors Exchange from March 2 - 5, 2025 at booth number 2726.

Additionally, Q2 Metals is pleased to announce that the Company has been selected to exhibit core from the Cisco Lithium Property at PDAC 2025. More details to be provided as the event approaches.

For more information on PDAC 2025, please click here.

Qualified Person

Neil McCallum, B.Sc., P.Geol, is a registered permit holder with the Ordre des Géologues du Québec and Qualified Person as defined by NI 43-101 ("QP") and has reviewed and approved the technical information in this news release. Mr. McCallum is a director and VP Exploration for Q2.

About Q2 Metals Corp

Q2 Metals is a Canadian mineral exploration company focused on unlocking its portfolio of lithium projects in the Eeyou Istchee James Bay region of Quebec, Canada, that includes both its 100-per-cent-owned Mia Lithium Property and the Cisco Lithium Property.

The Cisco Property is comprised of 767 claims, totaling 39,389 hectares ("ha"). The Cisco Property transects the Billy Diamond Highway, and the main mineralized zone is located only 6.5 kilometres ("km") away from the highway. The Cisco Property is approximately 150 km north of Matagami, a small town that contains the closest rail link to much of James Bay; and is within the greater Nemaska traditional territory of the Eeyou Istchee Territory, James Bay, Quebec.

The Cisco Property is situated along the Frotet Evans Greenstone Belt, comprised of a volcanic package dominated by mafic to felsic metavolcanic rocks, of the southern James Bay Lithium District, the same belt that hosts the Sirmac and Moblan lithium deposits, located 130 km and 180 km away, respectively.

The Cisco Lithium Property has district-scale potential with an already identified mineralized zone and discovery drill results that include:

120.3 metres at

1.72% Li2O (hole CS-24-010);215.6 metres at

1.69% Li2O (hole CS-24-018);347.1 metres at

1.35% Li2O (hole CS-24-021); and188.6 metres at

1.56% Li2O (hole CS-24-023)

Since May 2024, the Company has drilled a total of 6,359.7 m over 17 holes. All drill holes intercepted pegmatite with visual indications of spodumene mineralization identified.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Alicia Milne | Jason McBride |

Telephone: 1 (800) 482-7560

E-mail: info@Q2metals.com

Follow the Company: Twitter, LinkedIn, Facebook, and Instagram

Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian legislation. Forward-looking statements are typically identified by words such as: "believes", "expects", "anticipates", "intends", "estimates", "plans", "may", "should", "would", "will", "potential", "scheduled" or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. Accordingly, all statements in this news release that are not purely historical are forward-looking statements and include statements regarding beliefs, plans, expectations and orientations regarding the future including, without limitation, any statements or plans regard the geological prospects of the Company's properties and the future exploration endeavors of the Company. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in such forward-looking statements. The forward-looking statements in this news release speak only as of the date of this news release or as of the date specified in such statement. Forward looking statements in this news release include, but are not limited to, drilling results on the Cisco Property and inferences made therefrom, the potential scale of the Cisco Property, the focus of the Company's current and future exploration and drill programs, the scale, scope and location of future exploration and drilling activities, the Company's expectations in connection with the projects and exploration programs being met, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, variations in ore grade or recovery rates, changes in project parameters as plans continue to be refined, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same. Readers are cautioned that mineral exploration and development of mines is an inherently risky business and accordingly, the actual events may differ materially from those projected in the forward-looking statements. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for its recently completed fiscal period, which is available under Company's SEDAR profile at www.sedarplus.ca.

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Q2 Metals Corp.

View the original press release on accesswire.com