Introducing PayPal Everywhere

Rhea-AI Summary

PayPal (NASDAQ: PYPL) has launched 'PayPal Everywhere', a new initiative to enhance customer experience both in-store and online. The program offers rich rewards, including 5% cash back on selected monthly spending categories up to $1,000, and stackable cash back offers from top brands. Key features include:

1. Auto-reload option for balance management

2. Integration with Apple Wallet for Apple Pay

3. Tap-to-pay functionality for in-store purchases

4. Enhanced security for online transactions

This move aims to transform PayPal into a comprehensive solution for all types of customers, emphasizing simplicity, rewards, and security across all shopping channels.

Positive

- Introduction of 5% cash back on selected monthly spending categories up to $1,000

- Stackable cash back offers from top brands like Sephora, Domino's, DoorDash, and Instacart

- Integration with Apple Wallet for Apple Pay, expanding payment options

- Auto-reload feature for personalized balance management

- Tap-to-pay functionality for in-store purchases with PayPal Debit Card

Negative

- None.

News Market Reaction

On the day this news was published, PYPL declined 0.80%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

New rich rewards and in-store access transform PayPal into a single solution for every type of customer everywhere they shop

PayPal has been the go-to solution for online purchases, with the majority of

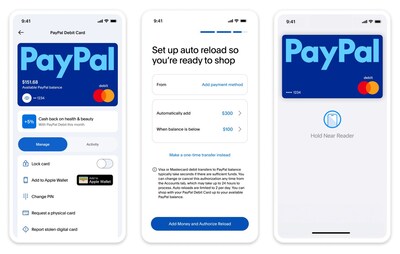

Every customer has unique needs and individual spending patterns. PayPal's new auto-reload option empowers them to shop confidently by setting a PayPal balance threshold that automatically tops up if it dips below their chosen amount. Knowing how much is in their balance and customizing it for their shopping needs removes the guesswork and makes PayPal simpler for millions of Americans.

"We know that consumers are looking for smart, simple and safe ways to make their everyday purchases while also getting more value out of every transaction. That's why millions of customers can now enjoy the trust and convenience they love about PayPal everywhere - both in-store and online, with access to rich rewards that put more money back in their pockets," said Alex Chriss, President and CEO, PayPal. "It's a pivotal moment for PayPal and our customers and a significant first step as we bring the power of PayPal to everywhere they shop."

In addition, customers can add their PayPal Debit Card to Apple Wallet in just a few steps and use it with Apple Pay, enabling even more ways to pay.

"We're excited to work with PayPal to bring Apple Pay to PayPal cardholders and help deliver a seamless shopping experience to even more users," said Eddy Cue, Senior Vice President of Services at Apple. "Whether in-store, online or in-apps, PayPal cardholders will be able to enjoy the convenience and security that Apple Pay brings to their everyday lives."

Why Customers Will Love Using PayPal Everywhere They Shop:

- Simple Sign-up: Streamlined sign up for a PayPal Balance Account, Digital Debit Card, and Account and Routing Numbers for PayPal Direct Deposit. A physical debit card can be requested at no cost.

- Auto-reload: Customers will now have a personalized way to manage their spending, with the ability to automatically reload funds to keep their PayPal balance at a certain threshold.

- Tap-to-Pay: Add the PayPal Debit Card to their mobile wallet with just a few clicks to earn cash back when they tap-to-pay with PayPal Debit in stores.

5% Cash Back In-Store and Online: Flexibility to choose a5% PayPal Debit monthly cash back category from grocery, gas, restaurant, clothing, and health & beauty.- Stackable Cash Back Rewards: Earn

5% cash back with PayPal Debit and even more by stacking additional offers in their monthly category at the brands customers love like Sephora, Domino's, DoorDash, Instacart, PetSmart, and many more when they check out with PayPal online. - Secure Transactions: As always expected, when they check out online with PayPal, all transactions are encrypted, and customers' full financial information is not shared.

To learn more about shopping everywhere with PayPal, visit paypal.com.

About PayPal

PayPal has been revolutionizing commerce globally for more than 25 years. Creating innovative experiences that make moving money, selling, and shopping simple, personalized, and secure, PayPal empowers consumers and businesses in approximately 200 markets to join and thrive in the global economy. For more information, visit https://www.paypal.com, https://about.pypl.com/ and https://investor.pypl.com/.

Press Contact

Amy Bonitatibus

Abonitatibus@paypal.com

Gideon Anstey

Gbanstey@paypal.com

Investor Relations Contact

Steven Winoker

swinoker@paypal.com

- PayPal consumer penetration % calculation is based on number of unique PayPal consumers divided by total adult population (aged 18+), Source: UN World Population Prospects Report 2022 (2022 and 2023 adult population estimated using 2015-2021 CAGR).

- The PayPal Debit Mastercard is issued by The Bancorp Bank, N.A. pursuant to a license by Mastercard International Incorporated and may be used everywhere Mastercard is accepted. Mastercard and the circles design are registered trademarks of Mastercard International Incorporated. The Bancorp is issuer of the Card only and not responsible for the associated accounts or other products, services, or offers from PayPal.

5% Cash back earned as points you can redeem for cash and other options on up to$1,000

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/introducing-paypal-everywhere-302238872.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/introducing-paypal-everywhere-302238872.html

SOURCE PayPal Holdings, Inc.