PowerBand Releases 2020 Annual Financial Results

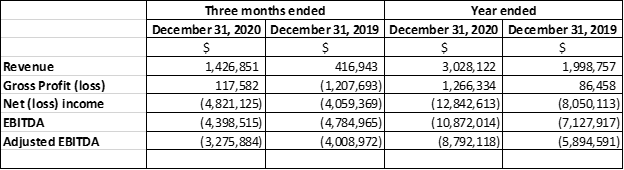

PowerBand Solutions (PWWBF) reported Q4 2020 revenues of $1,426,635, a 242% increase compared to Q4 2019. Adjusted EBITDA rose by $733,088, or 18%. For the fiscal year 2020, revenues grew by 51% to $3,043,442, but the net loss expanded to $12,842,613 from $8,050,113 in 2019. Cash on hand improved significantly to $1,403,213. Subsequent to year-end, PowerBand secured $7,173,640 from financing activities, which were primarily allocated to debt repayments.

- 242% revenue growth in Q4 2020 compared to Q4 2019.

- 51% increase in annual revenues for 2020.

- Substantial cash increase to $1,403,213 by Dec 31, 2020.

- Secured $7,173,640 from financing post year-end.

- Net loss widened to $12,842,613 in 2020 from $8,050,113 in 2019.

Insights

Analyzing...

Reports Q4 2020 revenues of

VANCOUVER, BC / ACCESSWIRE / April 29, 2021 / PowerBand Solutions (TSXV:PBX) (OTCQB:PWWBF) ("PowerBand" "PBX" or the "Company"), a comprehensive e-commerce solution transforming the online experience to sell, trade, lease, and finance vehicles, is announcing that it has filed its Consolidated Financial Statements and Management's Discussion and Analysis report for the years ended December 31, 2020 and 2019. These documents may be viewed under the Company's profile at www.sedar.com.

The Company has reported an increase in revenue of

The revenues for the fiscal year 2020 increased by

Cash on hand at December 31, 2020 was

Subsequent to the year end, the Company received

Kelly Jennings, CEO and Founder of PowerBand Solutions states "The year 2020 was a transformational year for PowerBand. We have incurred high costs in 2020 to complete the various initiatives for the launch of DRIVRZ. By the end of April 2021, we expect our top line revenues to exceed the total revenues for the year 2020."

About PowerBand Solutions, Inc.

PowerBand Solutions Inc., listed on the TSX Venture Exchange and the OTCQB markets, is a fintech provider disrupting the automotive industry. PowerBand's integrated, cloud-based transaction platform facilitates transactions amongst consumers, dealers, funders, and manufacturers (OEMs). It enables them to buy, sell, trade, finance, and lease new and used, electric and non-electric vehicles, on any phone, tablet or PC connected to the internet. PowerBand's transaction platform - being trademarked under DRIVRZ™ - is being made available across North American and global markets.

For further information, please contact:

Kelly Jennings

Chief Executive Officer

E: info@powerbandexchange.com

P: 1-866-768-7653

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Non-IFRS Measures:

This news release contains non-IFRS financial measures; the Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company's performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance with IFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments thereto provided herein have an actual effect on the Company's operating results.

SOURCE: PowerBand Solutions Inc.

View source version on accesswire.com:

https://www.accesswire.com/643418/PowerBand-Releases-2020-Annual-Financial-Results