AmeriTrust Announces Third Quarter 2024 Financial Results

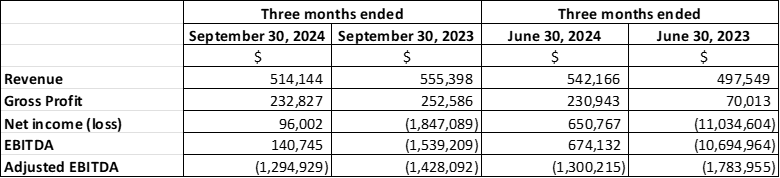

AmeriTrust Financial Technologies has released its Q3 2024 financial results. The company reported revenue of $514,144 for Q3 2024, showing a slight decrease from $542,166 in Q2 2024 and $555,398 in Q3 2023. Revenue primarily came from servicing the existing lease portfolio. The company's cash position stood at $1,679,738 as of September 30, 2024, down from $2,220,567 at the end of Q2. The company implemented cost management initiatives to maintain minimal operating expenses while preparing for planned growth.

AmeriTrust Financial Technologies ha pubblicato i risultati finanziari del terzo trimestre del 2024. L'azienda ha registrato un fatturato di $514,144 per il terzo trimestre del 2024, mostrando una leggera diminuzione rispetto a $542,166 nel secondo trimestre del 2024 e $555,398 nel terzo trimestre del 2023. Il fatturato proviene principalmente dalla gestione del portafoglio di leasing esistente. La posizione di liquidità dell'azienda ammontava a $1,679,738 al 30 settembre 2024, in calo rispetto a $2,220,567 alla fine del secondo trimestre. L'azienda ha implementato iniziative di gestione dei costi per mantenere le spese operative al minimo, mentre si prepara per una crescita pianificata.

AmeriTrust Financial Technologies ha publicado sus resultados financieros del tercer trimestre de 2024. La compañía reportó ingresos de $514,144 para el tercer trimestre de 2024, mostrando una leve disminución desde $542,166 en el segundo trimestre de 2024 y $555,398 en el tercer trimestre de 2023. Los ingresos provinieron principalmente de la gestión del portafolio de arrendamientos existente. La posición de efectivo de la compañía se situaba en $1,679,738 al 30 de septiembre de 2024, disminuyendo desde $2,220,567 al final del segundo trimestre. La compañía implementó iniciativas de gestión de costos para mantener los gastos operativos al mínimo mientras se prepara para un crecimiento planificado.

AmeriTrust Financial Technologies는 2024년 3분기 재무 결과를 발표했습니다. 회사는 2024년 3분기에 $514,144의 매출을 기록했으며, 이는 2024년 2분기의 $542,166와 2023년 3분기의 $555,398에 비해 약간 감소한 수치입니다. 매출은 주로 기존 리스 포트폴리오의 관리에서 발생했습니다. 2024년 9월 30일 현재 회사의 현금 잔고는 $1,679,738로, 2분기 말의 $2,220,567에서 감소했습니다. 회사는 계획된 성장에 대비하여 최소한의 운영 비용을 유지하기 위한 비용 관리 이니셔티브를 시행했습니다.

AmeriTrust Financial Technologies a publié ses résultats financiers pour le troisième trimestre 2024. L'entreprise a déclaré un chiffre d'affaires de $514,144 pour le troisième trimestre 2024, montrant une légère diminution par rapport à $542,166 au deuxième trimestre 2024 et $555,398 au troisième trimestre 2023. Les revenus proviennent principalement de la gestion du portefeuille de baux existant. La position de liquidités de l'entreprise était de $1,679,738 au 30 septembre 2024, en baisse par rapport à $2,220,567 à la fin du deuxième trimestre. L'entreprise a mis en œuvre des initiatives de gestion des coûts pour maintenir des dépenses opérationnelles minimales tout en se préparant à une croissance planifiée.

AmeriTrust Financial Technologies hat seine Finanzergebnisse für das dritte Quartal 2024 veröffentlicht. Das Unternehmen meldete für das dritte Quartal 2024 einen Umsatz von $514,144, was einen leichten Rückgang von $542,166 im zweiten Quartal 2024 und $555,398 im dritten Quartal 2023 bedeutet. Der Umsatz kam hauptsächlich aus der Verwaltung des bestehenden Leasingportfolios. Die Liquiditätsposition des Unternehmens belief sich zum 30. September 2024 auf $1,679,738, ein Rückgang gegenüber $2,220,567 zum Ende des zweiten Quartals. Das Unternehmen hat Kostenmanagementinitiativen umgesetzt, um die Betriebsausgaben auf einem minimalen Niveau zu halten, während es sich auf geplantes Wachstum vorbereitet.

- Implementation of successful cost management initiatives reducing operating expenses

- Maintained stable revenue stream from existing lease portfolio servicing

- Sequential quarterly revenue decline from $542,166 to $514,144 (5.2% decrease)

- Cash position decreased by $540,829 from Q2 to Q3 2024

- Continued Adjusted EBITDA losses

TORONTO, ON / ACCESSWIRE / November 22, 2024 / AmeriTrust Financial Technologies Inc. (TSXV:AMT)(OTC PINK:PWWBF)(Frankfurt:1ZVA) ("AmeriTrust", "AMT"or the"Company"), a fintech platform targeting automotive finance and specializing in used vehicle lease originations for the automotive industry, is announcing that it has filed its Interim Consolidated Financial Statements and Management's Discussion and Analysis report for the three and nine-month periods ended September 30, 2024. These documents may be viewed under the Company's profile at www.sedarplus.ca.

Revenue for the third quarter of 2024 was relatively consistent at

Cash on hand as at September 30, 2024 was

About AmeriTrust Financial Technologies Inc.

AmeriTrust Financial Technologies Inc., listed on the TSX Venture Exchange and the OTC Pink, and Frankfurt markets, is a finance solution and fintech provider disrupting the automotive industry. AmeriTrust's integrated, cloud-based transaction platform facilitates transactions amongst consumers, dealers, and funders. AmeriTrust's platform is being made available across the United States of America.

For further information, please visit the AmeriTrust website or contact:

Shibu Abraham

Chief Financial Officer and Director

E: info@ameritrust.com

P: 1-800-600-6872

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Non-IFRS Measures:

This news release contains non-IFRS financial measures; the Company believes that these measures provide investors with useful supplemental information about the financial performance of its business, enable comparison of financial results between periods where certain items may vary independent of business performance, and allow for greater transparency with respect to key metrics used by management in operating its business. Although management believes these financial measures are important in evaluating the Company's performance, they are not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with IFRS. These non-IFRS financial measures do not have any standardized meaning and may not be comparable with similar measures used by other companies. For certain non-IFRS financial measures, there are no directly comparable amounts under IFRS. These non-IFRS financial measures should not be viewed as alternatives to measures of financial performance determined in accordance with IFRS. Moreover, presentation of certain of these measures is provided for year-over-year comparison purposes, and investors should be cautioned that the effect of the adjustments there to provided herein have an actual effect on the Company's operating results.

FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements relating to the Company and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact, included in this release, including, without limitation, statements regarding future plans and objectives of the Company, are forward looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements.

The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. As a result, we cannot guarantee that any forward-looking statement will materialize, and the reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as at the date of this news release, and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by Canadian securities law.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any of the securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States unless registered under the U.S. Securities Act and applicable state securities laws, unless an exemption from such registration is available.

SOURCE: AmeriTrust Financial Technologies Inc.

View the original press release on accesswire.com