Prime Mining Announces Grant Of Incentive Securities

VANCOUVER, British Columbia, Jan. 24, 2024 (GLOBE NEWSWIRE) -- Prime Mining Corp. (“Prime” or the “Company”) (TSX: PRYM) (OTCQX: PRMNF) (Frankfurt: 04V3) announces that it has granted a total of 991,626 incentive stock options (the “Options”), 455,846 restricted share units (the “RSUs”) and 661,202 deferred share units (the “DSUs”) in accordance with the long-term incentive plan (the “Plan”) adopted by the Company.

The Options were granted to Management of the Company and are exercisable at the price of

The RSUs were granted to the Management of the Company with each RSU equivalent to one Common Share or, at the Corporation's option, a cash payment equal to the Fair Market Value (as defined in the Plan) of such Common Share (with the additional option of receiving any combination of cash and Common Shares). The RSUs will vest over a three year period, with one-third vesting on the first year anniversary of the grant, one-third on the second year anniversary, and one-third on the third year anniversary. Settlement will occur at the end of the third year.

The DSUs were granted to the Board of Directors and will vest after twelve months, or upon the adoption of a revised long-term incentive plan which permits earlier vesting. Settlement will occur when a director resigns from or ceases to be a member of the Board, or in connection with a change of control, and is payable in either cash or commons shares at the discretion of the board of directors on the settlement date.

About the Los Reyes Gold and Silver Project

Los Reyes is a rapidly evolving high-grade, low sulphidation epithermal gold-silver project located in Sinaloa State, Mexico. Since acquiring Los Reyes in 2019, Prime has spent approximately CAD

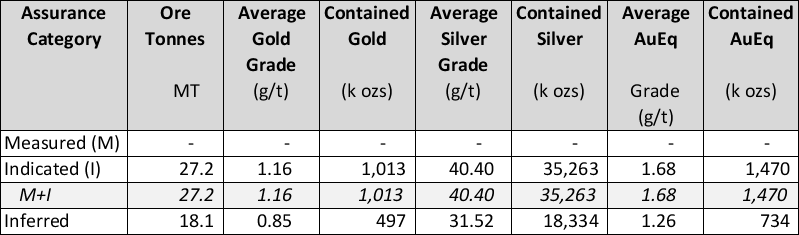

May 2, 2023 Resource Statement

Drilling is ongoing and suggests that the three known main deposit areas (Guadalupe, Central and Z-T) are larger than previously reported. Potential also exists for new discoveries where mineralized trends have been identified outside of the currently defined resource areas.

Historic operating results indicate that an estimated 1 million ounces of gold and 60 million ounces of silver were recovered from five separate operations at Los Reyes between 1770 and 1990. Prior to Prime’s acquisition, recent operators of Los Reyes had spent approximately US

Qualified Person

Scott Smith, P.Geo., Executive Vice President of Exploration, is a qualified person for the purposes of National Instrument 43-101 and has reviewed and approved the technical content in this news release.

About Prime Mining

Prime is managed by an ideal mix of successful mining executives, strong capital markets personnel and experienced local operators all focused on unlocking the full potential of the Los Reyes Project. The Company has a well-planned capital structure with a strong management team and insider ownership. Prime is targeting a material resource expansion at Los Reyes through a combination of new generative area discoveries and growth, while also building on technical de-risking activities to support eventual project development.

ON BEHALF OF THE BOARD OF DIRECTORS

Daniel Kunz

Chief Executive Officer

For further information, please contact:

Daniel Kunz

Chief Executive Officer and Director

Telephone: +1 (208) 926-6379 office

email: daniel@primeminingcorp.ca

Scott Hicks

Executive Vice President and Director

Telephone: +1 (604) 428-6128 office

email: scott.hicks@primeminingcorp.ca

Prime Mining Corp.

710 – 1030 West Georgia St.

Vancouver, BC V6E 2Y3 Canada

+1(604) 428-6128

info@primeminingcorp.ca

Cautionary Notes to U.S. Investors Concerning Resource Estimates

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of the U.S. securities laws. In particular, and without limiting the generality of the foregoing, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “inferred mineral resources,” “indicated mineral resources,” “measured mineral resources” and “mineral resources” used or referenced in this presentation are Canadian mineral disclosure terms as defined in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) under the guidelines set out in the 2014 Canadian Institute of Mining, Metallurgy and Petroleum Standards for Mineral Resources and Mineral Reserves, Definitions and Guidelines, May 2014 (the “CIM Standards”). The CIM Standards differ from the mineral property disclosure requirements of the U.S. Securities and Exchange Commission (the “SEC”) in Regulation S-K Subpart 1300 (the “SEC Modernization Rules”) under the U.S. Securities Act of 1933, as amended (the “Securities Act”). As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multijurisdictional disclosure system, the Company is not required to provide disclosure on its mineral properties under the SEC Modernization Rules and will continue to provide disclosure under NI 43-101 and the CIM Standards. Accordingly, the Company’s disclosure of mineralization and other technical information may differ significantly from the information that would be disclosed had the Company prepared the information under the standards adopted under the SEC Modernization Rules.

Forward Looking Information

This news release contains certain “forward-looking information” and “forward-looking statements” within the meaning of Canadian securities legislation as may be amended from time to time, including, without limitation, statements regarding the perceived merit of the Company’s properties, including additional exploration potential of Los Reyes, potential quantity and/or grade of minerals, the potential size of the mineralized zone, metallurgical recoveries, and the Company’s exploration and development plans in Mexico. Forward-looking statements are statements that are not historical facts which address events, results, outcomes, or developments that the Company expects to occur. Forward-looking statements are based on the beliefs, estimates and opinions of the Company’s management on the date the statements are made, and they involve several risks and uncertainties. Certain material assumptions regarding such forward-looking statements were made, including without limitation, assumptions regarding the price of gold, silver and copper; the accuracy of mineral resource estimations; that there will be no material adverse change affecting the Company or its properties; that all required approvals will be obtained, including concession renewals and permitting; that political and legal developments will be consistent with current expectations; that currency and exchange rates will be consistent with current levels; and that there will be no significant disruptions affecting the Company or its properties. Consequently, there can be no assurances that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements involve significant known and unknown risks and uncertainties, which could cause actual results to differ materially from those anticipated. These risks include, but are not limited to: risks related to uncertainties inherent in the preparation of mineral resource estimates, including but not limited to changes to the cost assumptions, variations in quantity of mineralized material, grade or recovery rates, changes to geotechnical or hydrogeological considerations, failure of plant, equipment or processes, changes to availability of power or the power rates, ability to maintain social license, changes to interest or tax rates, changes in project parameters, delays and costs inherent to consulting and accommodating rights of local communities, environmental risks, title risks, including concession renewal, commodity price and exchange rate fluctuations, risks relating to COVID-19, delays in or failure to receive access agreements or amended permits, risks inherent in the estimation of mineral resources; and risks associated with executing the Company’s objectives and strategies, including costs and expenses, as well as those risk factors discussed in the Company's most recently filed management's discussion and analysis, as well as its annual information form dated August 21, 2023, available on www.sedarplus.ca. Except as required by the securities disclosure laws and regulations applicable to the Company, the Company undertakes no obligation to update these forward-looking statements if management’s beliefs, estimates or opinions, or other factors, should change.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/a733d00b-9b58-4297-a63c-246d1da2a1fb