Group Ten Metals Signs Binding Letter of Intent on the Black Lake-Drayton Gold Project in Ontario, Canada

Rhea-AI Summary

Group Ten Metals Inc. has signed a binding Letter of Intent (LOI) with Heritage Mining Ltd. to potentially transfer up to a 90% interest in the Black Lake-Drayton gold project in Ontario. Heritage must issue 7.2 million shares, pay CAD $320,000 in cash, and complete CAD $5 million in exploration work to earn this stake. Group Ten will retain a 10% interest and could benefit from discovery payments. The transaction is subject to regulatory approvals and is expected to close around October 23, 2021.

Positive

- Group Ten retains a 10% carried interest in the project post-transaction.

- Potential discovery payments of up to CAD $10 million could enhance shareholder value.

- Heritage’s veteran team is expected to unlock the gold project's potential.

Negative

- The transaction is subject to regulatory approvals, which may delay completion.

- There is no guarantee that the transaction will be finalized on the expected terms.

News Market Reaction 1 Alert

On the day this news was published, PGEZF declined NaN%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESSWIRE / August 23, 2021 / Group Ten Metals Inc. (TSX.V:PGE | OTCQB:PGEZF; FSE:5D32) (the "Company" or "Group Ten") is pleased to announce that it has entered into a binding Letter of Intent (the "LOI") with Heritage Mining Ltd. ("Heritage") whereby, subject to the earn-in requirements specified therein, Heritage can acquire up to a

Terms of the Agreement per the LOI

Under the terms of the binding LOI, Heritage may acquire a

- Heritage is required to pay a CAD

$20,000 cash payment to Group Ten within three (3) business days of executing the LOI, and the LOI is exclusive and binding on the parties for a period of 60 days to allow for completion of the definitive agreement (the "Agreement"). - Heritage shall issue 2,800,000 shares to Group Ten within three (3) business days of execution of the Agreement.

- Heritage may earn a

51% interest (the "First Option") in the Property by completing the following on or before the third anniversary of the "Agreement:- Issuing an additional 3.3 million shares to Group Ten;

- Completing cash payments totaling CAD

$300,000 ; and - Completing exploration work totaling CAD

$2.5 million .

- Upon completion of the First Option, Heritage may earn an additional

39% ownership interest in the Property (the "Second Option") for a cumulative90% interest by completion of the following on or before the fourth anniversary of the Agreement:- Issuing an additional 1.1 million shares to Group Ten; and

- Completing additional exploration work totaling CAD

$2.5 million .

In addition, the LOI provides the following:

- Upon completion of the Second Option, Group Ten will retain a

10% free carried interest in the Project, with Heritage being responsible for all Property costs until completion by Heritage of a positive feasibility study supported by a technical report prepared in accordance with NI 43-101 on the Property (the "FS"). - A discovery payment of

$1.00 per ounce of gold or gold equivalent shall be made on mineral resource estimates as filed from time-to-time on the Property and shall, in Heritage's discretion, be paid in cash or shares (or a combination thereof), capped at a maximum of$10 million . - The LOI provides for the formation of a Joint Venture ("JV") based on the then legal and beneficial ownership levels in the Property following completion of the FS. A JV may also be formed in the event Heritage does not complete the requirements of the Second Option, in which case Heritage will be required to maintain minimum exploration and development expenditures of CAD

$500,000 per annum until the completion of the FS in order to maintain status as operator of the JV. - Group Ten is required to complete CAD

$300,000 of exploration work on the Property within the first year of the Agreement, provided any shortfall by Group Ten shall reduce Heritage's obligation on a dollar-for-dollar basis.

Group Ten President & CEO, Michael Rowley stated, "We are pleased to announce the first of what we expect will ultimately become a series of deals whereby Group Ten looks to realize value for our non-core assets, which are high-quality brownfields projects that are

The proposed transaction is subject to a number of conditions, including the negotiation and execution of the Agreement, and board and regulatory approval. There is no assurance that the conditions will be satisfied or that any the proposed transaction will be completed on the terms contemplated, or at all. It is anticipated that the proposed transaction will close on or around October 23, 2021.

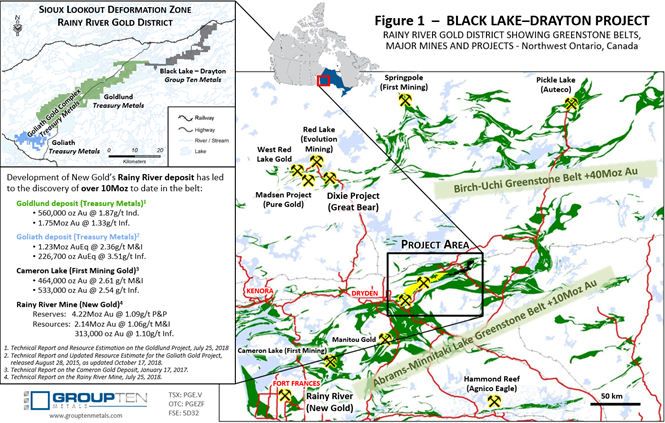

Black Lake - Drayton Gold Project Overview

The

About Heritage Mining

Heritage Mining Ltd. is a private, well-capitalized company focused on acquiring Tier-1, advanced stage precious and base metal exploration projects and/or the junior/micro-producer project stage. Heritage's board and management Team have a proven track record of shareholder value creation with over 100 years of combined experience in the mining and exploration sector.

Heritage Mining's CEO, Peter Schloo stated, "It is rare that a project of this size and quality becomes available, and we appreciate Group Ten's faith in our ability to add significant shareholder value in a timely manner. We are very excited about the Black Lake-Drayton gold project and look forward to developing the property in a systematic manner. This is a pivotal point in Heritage Mining's path, and we look forward to the future. We anticipate a go public listing shortly after the agreement is finalized, pending market conditions."

About Group Ten Metals Inc.

Group Ten Metals Inc. is a TSX-V-listed Canadian mineral exploration company focused on the development of high-quality platinum, palladium, nickel, copper, cobalt, and gold exploration assets in top North American mining jurisdictions. The Company's core asset is the Stillwater West PGE-Ni-Cu-Co + Au project adjacent to Sibanye-Stillwater's high-grade PGE mines in Montana, USA. Group Ten also holds the high-grade Black Lake-Drayton Gold project adjacent to Treasury Metals' development-stage Goliath Gold Complex in northwest Ontario, and the Kluane PGE-Ni-Cu-Co project on trend with Nickel Creek Platinum‘s Wellgreen deposit in Canada‘s Yukon Territory.

FOR FURTHER INFORMATION, PLEASE CONTACT:

Michael Rowley,

President, CEO & Director

Email: info@grouptenmetals.com

Phone: (604) 357 4790

Web: http://grouptenmetals.com

Toll Free: (888) 432 0075

Forward-Looking Statements

Forward Looking Statements: This news release includes certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical facts including, without limitation, statements regarding the execution of a definitive agreement, the completion of the proposed transaction and the receipt of any cash or share payments therefrom, future exploration and development expenditures, the sale of non-core assets, potential mineralization, the realization of mineral resource estimates, the timing and success of exploration activities generally or the completion of a feasibility study, the timing and results of future resource estimates, future driling activities, and future plans and objectives of the Company are forward-looking statements that involve various risks and uncertainties. Although Group Ten believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals (including board and stock exchange approvals), the failure to negotiate and execute the Agreement on the terms currently contemplated or at all, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same, and other exploration or other risks detailed herein and from time to time in the filings made by the companies with securities regulators. Readers are cautioned that mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral exploration and development of mines is an inherently risky business. Accordingly, the actual events may differ materially from those projected in the forward-looking statements. For more information on Group Ten and the risks and challenges of their businesses, investors should review their annual filings that are available at www.sedar.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Group Ten Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/660869/Group-Ten-Metals-Signs-Binding-Letter-of-Intent-on-the-Black-Lake-Drayton-Gold-Project-in-Ontario-Canada