Pega’s AI Innovation Drives Strong ACV Growth and Record Cash Flow in Q4 2024

-

Operating cash flow grows to

$346 million $338 million -

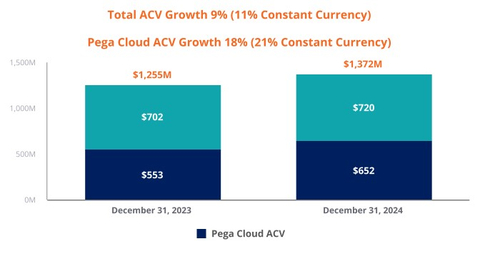

Annual Contract Value (ACV) grows

9% year over year (11% in constant currency) -

Pega Cloud ACV grows

18% year over year (21% in constant currency) -

2025 guidance of

12% ACV growth,$455 million $440 million

Total ACV Growth and Pega Cloud ACV Growth (Graphic: Business Wire)

“2024 was a transformative year for Pega, the industry, and our clients,” said Alan Trefler, Pega founder and CEO. “Our team’s impressive performance drove the introduction of the most innovative solutions in our history. The reaction from our clients and partners has been remarkable, leading to deeper engagement and new opportunities.

“We met or exceeded our financial objectives for 2024 including becoming a Rule of 40 company,” said Ken Stillwell, Pega COO and CFO. “We’re committed to accelerating growth and free cash flow in 2025 and beyond.”

Financial and performance metrics (1)

Reconciliation of ACV and Constant Currency ACV |

||||||||

(in millions, except percentages) |

December 31, 2023 |

|

December 31, 2024 |

|

1-Year Change |

|||

ACV |

$ |

1,255 |

|

$ |

1,372 |

|

9 |

% |

Impact of changes in foreign exchange rates |

|

— |

|

|

23 |

|

|

|

Constant currency ACV |

$ |

1,255 |

|

$ |

1,395 |

|

11 |

% |

Note: Constant currency ACV is calculated by applying the December 31, 2023 foreign exchange rates to all periods shown. |

||||||||

_____________________________ |

| 1 Refer to the schedules at the end of this release for additional information, including a reconciliation of GAAP and non-GAAP measures. |

(Dollars in thousands, except per share amounts) |

Three Months Ended December 31, |

|

|

|

Year Ended December 31, |

|

|

||||||||||

|

2024 |

|

|

2023 |

|

Change |

|

|

2024 |

|

|

2023 |

|

Change |

|||

Total revenue |

$ |

490,830 |

|

$ |

474,233 |

|

3 |

% |

|

$ |

1,497,180 |

|

$ |

1,432,616 |

|

5 |

% |

Net income - GAAP |

$ |

119,090 |

|

$ |

142,665 |

|

(17 |

)% |

|

$ |

99,189 |

|

$ |

67,808 |

|

46 |

% |

Net income - non-GAAP |

$ |

147,953 |

|

$ |

152,141 |

|

(3 |

)% |

|

$ |

270,542 |

|

$ |

210,159 |

|

29 |

% |

Diluted earnings per share - GAAP |

$ |

1.25 |

|

$ |

1.61 |

|

(22 |

)% |

|

$ |

1.11 |

|

$ |

0.73 |

|

52 |

% |

Diluted earnings per share - non-GAAP |

$ |

1.61 |

|

$ |

1.77 |

|

(9 |

)% |

|

$ |

3.03 |

|

$ |

2.48 |

|

22 |

% |

(Dollars in thousands) |

Three Months Ended December 31, |

|

Change |

|

Year Ended December 31, |

|

Change |

||||||||||||||||||||||||

2024 |

|

2023 |

|

|

2024 |

|

2023 |

|

|||||||||||||||||||||||

Pega Cloud |

$ |

149,638 |

30 |

% |

|

$ |

120,346 |

25 |

% |

|

$ |

29,292 |

|

24 |

% |

|

$ |

558,734 |

37 |

% |

|

$ |

461,328 |

32 |

% |

|

$ |

97,406 |

|

21 |

% |

Maintenance |

|

81,257 |

17 |

% |

|

|

86,646 |

18 |

% |

|

|

(5,389 |

) |

(6 |

)% |

|

|

323,304 |

22 |

% |

|

|

331,856 |

24 |

% |

|

|

(8,552 |

) |

(3 |

)% |

Subscription services |

|

230,895 |

47 |

% |

|

|

206,992 |

43 |

% |

|

|

23,903 |

|

12 |

% |

|

|

882,038 |

59 |

% |

|

|

793,184 |

56 |

% |

|

|

88,854 |

|

11 |

% |

Subscription license |

|

204,697 |

42 |

% |

|

|

207,559 |

44 |

% |

|

|

(2,862 |

) |

(1 |

)% |

|

|

398,102 |

27 |

% |

|

|

407,625 |

28 |

% |

|

|

(9,523 |

) |

(2 |

)% |

Subscription |

|

435,592 |

89 |

% |

|

|

414,551 |

87 |

% |

|

|

21,041 |

|

5 |

% |

|

|

1,280,140 |

86 |

% |

|

|

1,200,809 |

84 |

% |

|

|

79,331 |

|

7 |

% |

Consulting |

|

52,822 |

11 |

% |

|

|

54,310 |

12 |

% |

|

|

(1,488 |

) |

(3 |

)% |

|

|

213,273 |

14 |

% |

|

|

221,706 |

15 |

% |

|

|

(8,433 |

) |

(4 |

)% |

Perpetual license |

|

2,416 |

— |

% |

|

|

5,372 |

1 |

% |

|

|

(2,956 |

) |

(55 |

)% |

|

|

3,767 |

— |

% |

|

|

10,101 |

1 |

% |

|

|

(6,334 |

) |

(63 |

)% |

Total revenue |

$ |

490,830 |

100 |

% |

|

$ |

474,233 |

100 |

% |

|

$ |

16,597 |

|

3 |

% |

|

$ |

1,497,180 |

100 |

% |

|

$ |

1,432,616 |

100 |

% |

|

$ |

64,564 |

|

5 |

% |

2025 Guidance (1)

As of February 12, 2025, we are providing the following guidance:

|

2025 |

Annual contract value growth |

|

|

2025 |

||

|

GAAP |

|

Non-GAAP (1) |

Revenue |

|

|

|

Diluted earnings per share |

|

|

|

|

2025 |

Cash provided by operating activities |

|

Free cash flow |

|

(1) A reconciliation of our GAAP and Non-GAAP guidance is contained in the financial schedules at the end of this release. |

Quarterly conference call

A conference call and audio-only webcast will be conducted at 8:00 a.m. EST on Thursday, February 13, 2025.

Members of the public and investors are invited to join the call and participate in the question and answer session by dialing 1 (800) 715-9871 (domestic) or 1 (646) 307-1963 (international) and using Conference ID 3830305, or via https://events.q4inc.com/attendee/343473625 by logging onto www.pega.com at least five minutes prior to the event's broadcast and clicking on the webcast icon in the Investors section.

Discussion of non-GAAP financial measures

Our non-GAAP financial measures should only be read in conjunction with our consolidated financial statements prepared in accordance with GAAP. We believe that these measures help investors understand our core operating results and prospects, which is consistent with how management measures and forecasts our performance without the effect of often one-time charges and other items outside our normal operations. Management uses these measures to assess the performance of the company's operations and establish operational goals and incentives. They are not a substitute for financial measures prepared under

Forward-looking statements

Certain statements in this press release may be "forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995.

Words such as expects, anticipates, intends, plans, believes, will, could, should, estimates, may, targets, strategies, intends to, projects, forecasts, guidance, likely, and usually or variations of such words and other similar expressions identify forward-looking statements. These statements represent our views only as of the date the statement was made and are based on current expectations and assumptions.

Forward-looking statements deal with future events and are subject to risks and uncertainties that are difficult to predict, including, but not limited to:

- our future financial performance and business plans;

- the adequacy of our liquidity and capital resources;

- the successful execution of investments in artificial intelligence;

- the continued payment of our quarterly dividends;

- the timing of revenue recognition;

- variation in demand for our products and services, including among clients in the public sector;

- reliance on key personnel;

- reliance on third-party service providers, including hosting providers;

- compliance with our debt obligations and covenants;

- foreign currency exchange rates;

- potential legal and financial liabilities, as well as damage to our reputation, due to cyber-attacks;

- security breaches and security flaws;

- our ability to protect our intellectual property rights, costs associated with defending such rights, intellectual property rights claims, and other related claims by third parties against us, including related costs, damages, and other relief that may be granted against us;

- our ongoing litigation with Appian Corp.;

- our client retention rate; and

- management of our growth.

These risks and others that may cause actual results to differ materially from those expressed in such forward-looking statements are described further in Part I of our Annual Report on Form 10-K for the year ended December 31, 2024, and other filings we make with the

Investors are cautioned not to place undue reliance on such forward-looking statements, and there are no assurances that the results included in such statements will be achieved. Although subsequent events may cause our view to change, except as required by applicable law, we do not undertake and expressly disclaim any obligation to publicly update or revise these forward-looking statements, whether as the result of new information, future events, or otherwise.

Any forward-looking statements in this press release represent our views as of February 12, 2025.

About Pegasystems

Pega is The Enterprise Transformation Company that helps organizations Build for Change® with enterprise AI decisioning and workflow automation. Many of the world’s most influential businesses rely on our platform to solve their most pressing challenges, from personalizing engagement to automating service to streamlining operations. Since 1983, we’ve built our scalable and flexible architecture to help enterprises meet today’s customer demands while continuously transforming for tomorrow. For more information on Pega (NASDAQ: PEGA), visit www.pega.com.

All trademarks are the property of their respective owners.

PEGASYSTEMS INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share amounts) |

|||||||||||||||

|

Three Months Ended December 31, |

|

Year Ended December 31, |

||||||||||||

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

Revenue |

|

|

|

|

|

|

|

||||||||

Subscription services |

$ |

230,895 |

|

|

$ |

206,992 |

|

|

$ |

882,038 |

|

|

$ |

793,184 |

|

Subscription license |

|

204,697 |

|

|

|

207,559 |

|

|

|

398,102 |

|

|

|

407,625 |

|

Consulting |

|

52,822 |

|

|

|

54,310 |

|

|

|

213,273 |

|

|

|

221,706 |

|

Perpetual license |

|

2,416 |

|

|

|

5,372 |

|

|

|

3,767 |

|

|

|

10,101 |

|

Total revenue |

|

490,830 |

|

|

|

474,233 |

|

|

|

1,497,180 |

|

|

|

1,432,616 |

|

Cost of revenue |

|

|

|

|

|

|

|

||||||||

Subscription services |

|

40,988 |

|

|

|

34,697 |

|

|

|

149,918 |

|

|

|

144,250 |

|

Subscription license |

|

384 |

|

|

|

635 |

|

|

|

1,888 |

|

|

|

2,606 |

|

Consulting |

|

60,978 |

|

|

|

55,298 |

|

|

|

238,842 |

|

|

|

231,560 |

|

Perpetual license |

|

5 |

|

|

|

16 |

|

|

|

17 |

|

|

|

67 |

|

Total cost of revenue |

|

102,355 |

|

|

|

90,646 |

|

|

|

390,665 |

|

|

|

378,483 |

|

Gross profit |

|

388,475 |

|

|

|

383,587 |

|

|

|

1,106,515 |

|

|

|

1,054,133 |

|

Operating expenses |

|

|

|

|

|

|

|

||||||||

Selling and marketing |

|

139,655 |

|

|

|

133,924 |

|

|

|

534,780 |

|

|

|

559,177 |

|

Research and development |

|

76,379 |

|

|

|

71,250 |

|

|

|

298,074 |

|

|

|

295,512 |

|

General and administrative |

|

28,207 |

|

|

|

22,850 |

|

|

|

112,848 |

|

|

|

96,743 |

|

Litigation settlement, net of recoveries |

|

— |

|

|

|

— |

|

|

|

32,403 |

|

|

|

— |

|

Restructuring |

|

1,245 |

|

|

|

297 |

|

|

|

4,528 |

|

|

|

21,747 |

|

Total operating expenses |

|

245,486 |

|

|

|

228,321 |

|

|

|

982,633 |

|

|

|

973,179 |

|

Income from operations |

|

142,989 |

|

|

|

155,266 |

|

|

|

123,882 |

|

|

|

80,954 |

|

Foreign currency transaction gain (loss) |

|

6,318 |

|

|

|

(1,271 |

) |

|

|

(912 |

) |

|

|

(5,242 |

) |

Interest income |

|

6,944 |

|

|

|

3,428 |

|

|

|

25,779 |

|

|

|

9,259 |

|

Interest expense |

|

(1,788 |

) |

|

|

(1,647 |

) |

|

|

(6,835 |

) |

|

|

(6,876 |

) |

Gain (loss) on capped call transactions |

|

4 |

|

|

|

(899 |

) |

|

|

(663 |

) |

|

|

(1,348 |

) |

Other (loss) income, net |

|

(299 |

) |

|

|

25 |

|

|

|

1,385 |

|

|

|

18,693 |

|

Income before provision for income taxes |

|

154,168 |

|

|

|

154,902 |

|

|

|

142,636 |

|

|

|

95,440 |

|

Provision for income taxes |

|

35,078 |

|

|

|

12,237 |

|

|

|

43,447 |

|

|

|

27,632 |

|

Net income |

$ |

119,090 |

|

|

$ |

142,665 |

|

|

$ |

99,189 |

|

|

$ |

67,808 |

|

Earnings per share |

|

|

|

|

|

|

|

||||||||

Basic |

$ |

1.38 |

|

|

$ |

1.71 |

|

|

$ |

1.16 |

|

|

$ |

0.82 |

|

Diluted |

$ |

1.25 |

|

|

$ |

1.61 |

|

|

$ |

1.11 |

|

|

$ |

0.73 |

|

Weighted-average number of common shares outstanding |

|

|

|

|

|

|

|

||||||||

Basic |

|

86,000 |

|

|

|

83,654 |

|

|

|

85,265 |

|

|

|

83,162 |

|

Diluted |

|

95,636 |

|

|

|

89,447 |

|

|

|

89,634 |

|

|

|

84,914 |

|

PEGASYSTEMS INC. UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) |

|||||

|

December 31, 2024 |

|

December 31, 2023 |

||

Assets |

|

|

|

||

Current assets: |

|

|

|

||

Cash and cash equivalents |

$ |

337,103 |

|

$ |

229,902 |

Marketable securities |

|

402,870 |

|

|

193,436 |

Total cash, cash equivalents, and marketable securities |

|

739,973 |

|

|

423,338 |

Accounts receivable, net |

|

305,468 |

|

|

300,173 |

Unbilled receivables, net |

|

173,085 |

|

|

237,379 |

Other current assets |

|

115,178 |

|

|

68,137 |

Total current assets |

|

1,333,704 |

|

|

1,029,027 |

Long-term unbilled receivables, net |

|

61,407 |

|

|

85,402 |

Goodwill |

|

81,113 |

|

|

81,611 |

Other long-term assets |

|

292,049 |

|

|

314,696 |

Total assets |

$ |

1,768,273 |

|

$ |

1,510,736 |

Liabilities and stockholders’ equity |

|

|

|

||

Current liabilities: |

|

|

|

||

Accounts payable |

$ |

6,226 |

|

$ |

11,290 |

Accrued expenses |

|

31,544 |

|

|

39,941 |

Accrued compensation and related expenses |

|

138,042 |

|

|

126,640 |

Deferred revenue |

|

423,910 |

|

|

377,845 |

Convertible senior notes, net |

|

467,470 |

|

|

— |

Other current liabilities |

|

18,866 |

|

|

21,343 |

Total current liabilities |

|

1,086,058 |

|

|

577,059 |

Long-term convertible senior notes, net |

|

— |

|

|

499,368 |

Long-term operating lease liabilities |

|

67,647 |

|

|

66,901 |

Other long-term liabilities |

|

29,088 |

|

|

13,570 |

Total liabilities |

|

1,182,793 |

|

|

1,156,898 |

Total stockholders’ equity |

|

585,480 |

|

|

353,838 |

Total liabilities and stockholders’ equity |

$ |

1,768,273 |

|

$ |

1,510,736 |

PEGASYSTEMS INC. UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) |

|||||||

|

Year Ended December 31, |

||||||

|

|

2024 |

|

|

|

2023 |

|

Net income |

$ |

99,189 |

|

|

$ |

67,808 |

|

Adjustments to reconcile net income to cash provided by operating activities |

|

|

|

||||

Non-cash items |

|

227,582 |

|

|

|

227,983 |

|

Change in operating assets and liabilities, net |

|

19,155 |

|

|

|

(78,006 |

) |

Cash provided by operating activities |

|

345,926 |

|

|

|

217,785 |

|

Cash (used in) investing activities |

|

(202,576 |

) |

|

|

(50,750 |

) |

Cash (used in) financing activities |

|

(30,214 |

) |

|

|

(81,963 |

) |

Effect of exchange rate changes on cash, cash equivalents, and restricted cash |

|

(4,434 |

) |

|

|

2,701 |

|

Net increase in cash, cash equivalents, and restricted cash |

|

108,702 |

|

|

|

87,773 |

|

Cash, cash equivalents, and restricted cash, beginning of period |

|

232,827 |

|

|

|

145,054 |

|

Cash, cash equivalents, and restricted cash, end of period |

$ |

341,529 |

|

|

$ |

232,827 |

|

PEGASYSTEMS INC. RECONCILIATION OF SELECTED GAAP AND NON-GAAP MEASURES (in thousands, except percentages and per share amounts) |

|||||||||||||||||||||

|

Three Months Ended December 31, |

|

Year Ended December 31, |

||||||||||||||||||

|

2024 |

|

|

|

2023 |

|

|

Change |

|

|

2024 |

|

|

|

2023 |

|

|

Change |

|||

Net income - GAAP |

$ |

119,090 |

|

|

$ |

142,665 |

|

|

(17 |

)% |

|

$ |

99,189 |

|

|

$ |

67,808 |

|

|

46 |

% |

Stock-based compensation (1) |

|

34,500 |

|

|

|

33,269 |

|

|

|

|

|

142,718 |

|

|

|

143,352 |

|

|

|

||

Restructuring |

|

1,245 |

|

|

|

297 |

|

|

|

|

|

4,528 |

|

|

|

21,747 |

|

|

|

||

Legal fees |

|

4,499 |

|

|

|

2,817 |

|

|

|

|

|

18,713 |

|

|

|

13,883 |

|

|

|

||

Litigation settlement, net of recoveries |

|

— |

|

|

|

— |

|

|

|

|

|

32,403 |

|

|

|

— |

|

|

|

||

Amortization of intangible assets |

|

700 |

|

|

|

963 |

|

|

|

|

|

3,153 |

|

|

|

3,940 |

|

|

|

||

Interest on convertible senior notes |

|

594 |

|

|

|

615 |

|

|

|

|

|

2,451 |

|

|

|

2,603 |

|

|

|

||

Capped call transactions |

|

(4 |

) |

|

|

899 |

|

|

|

|

|

663 |

|

|

|

1,348 |

|

|

|

||

Repurchases of convertible senior notes |

|

(459 |

) |

|

|

— |

|

|

|

|

|

(459 |

) |

|

|

(7,855 |

) |

|

|

||

Foreign currency transaction (gain) loss |

|

(6,318 |

) |

|

|

1,271 |

|

|

|

|

|

912 |

|

|

|

5,242 |

|

|

|

||

Other |

|

759 |

|

|

|

19 |

|

|

|

|

|

(869 |

) |

|

|

(10,266 |

) |

|

|

||

Income taxes (2) |

|

(6,653 |

) |

|

|

(30,674 |

) |

|

|

|

|

(32,860 |

) |

|

|

(31,643 |

) |

|

|

||

Net income - non-GAAP |

$ |

147,953 |

|

|

$ |

152,141 |

|

|

(3 |

)% |

|

$ |

270,542 |

|

|

$ |

210,159 |

|

|

29 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Diluted earnings per share - GAAP |

$ |

1.25 |

|

|

$ |

1.61 |

|

|

(22 |

)% |

|

$ |

1.11 |

|

|

$ |

0.73 |

|

|

52 |

% |

non-GAAP adjustments |

|

0.36 |

|

|

|

0.16 |

|

|

|

|

|

1.92 |

|

|

|

1.75 |

|

|

|

||

Diluted earnings per share - non-GAAP |

$ |

1.61 |

|

|

$ |

1.77 |

|

|

(9 |

)% |

|

$ |

3.03 |

|

|

$ |

2.48 |

|

|

22 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Diluted weighted-average number of common shares outstanding - GAAP |

|

95,636 |

|

|

|

89,447 |

|

|

7 |

% |

|

|

89,634 |

|

|

|

84,914 |

|

|

6 |

% |

Capped call transactions |

|

(3,553 |

) |

|

|

(3,719 |

) |

|

|

|

|

(214 |

) |

|

|

(235 |

) |

|

|

||

Diluted weighted-average number of common shares outstanding - non-GAAP |

|

92,083 |

|

|

|

85,728 |

|

|

7 |

% |

|

|

89,420 |

|

|

|

84,679 |

|

|

6 |

% |

Our non-GAAP financial measures reflect the following adjustments:

- Stock-based compensation: We have excluded stock-based compensation from our non-GAAP operating expenses and profitability measures. Although stock-based compensation is a key incentive offered to our employees, and we believe such compensation contributed to our revenues recognized during the periods presented and is expected to contribute to our future revenues, we continue to evaluate our business performance, excluding stock-based compensation.

- Restructuring: We have excluded restructuring from our non-GAAP financial measures. Restructuring fluctuates in amount and frequency and is significantly affected by the timing and size of our restructuring activities. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as these amounts are not representative of our core business operations and ongoing operational performance.

- Legal fees: Legal and related fees arising from proceedings outside the ordinary course of business. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operational performance.

- Litigation settlement, net of recoveries: Cost to settle litigation, net of insurance recoveries, arising from proceedings outside the ordinary course of business. See "Note 20. Commitments And Contingencies" in our Annual Report on Form 10-K for the year ended December 31, 2024 for additional information. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operational performance.

- Amortization of intangible assets: We have excluded the amortization of intangible assets from our non-GAAP operating expenses and profitability measures. Amortization of intangible assets fluctuates in amount and frequency and is significantly affected by the timing and size of acquisitions. Investors should note that intangible assets contributed to our revenues recognized during the periods presented and are expected to contribute to future revenues. Amortization of intangible assets is likely to recur in future periods. We believe excluding these amounts provides a useful comparison of our operational performance in different periods.

- Interest on convertible senior notes: In February 2020, we issued convertible senior notes, due March 1, 2025, in a private placement. We believe that excluding the amortization of issuance costs provides a useful comparison of our operational performance in different periods.

-

Capped call transactions: We have excluded gains and losses related to our capped call transactions held at fair value under

U.S. GAAP. The capped call transactions are expected to reduce common stock dilution and/or offset any potential cash payments we must make, other than for principal and interest, upon conversion of the convertible senior notes. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operational performance. - Repurchases of convertible senior notes: We have excluded gains from the repurchases of Convertible Senior Notes. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operational performance.

- Foreign currency transaction (gain) loss: We have excluded foreign currency transaction gains and losses from our non-GAAP profitability measures. Foreign currency transaction gains and losses fluctuate in amount and frequency and are significantly affected by foreign exchange market rates. Foreign currency transaction gains and losses are likely to recur in future periods. We believe excluding these amounts provides a useful comparison of our operational performance in different periods.

- Other: We have excluded gains and losses from our venture investments and expenses incurred due to the cancellation of in-person sales and marketing events. We believe excluding these amounts from our non-GAAP financial measures is useful to investors as the types of events giving rise to them are not representative of our core business operations and ongoing operational performance.

-

Diluted weighted-average number of common shares outstanding:

-

Capped call transactions: In periods of GAAP income, the shares that would be issued if the Company’s Convertible Senior Notes were fully converted to common shares are included in the diluted weighted-average shares outstanding. The capped call transactions are expected to reduce common stock dilution and/or offset any potential cash payments the Company must make, other than for principal and interest, upon conversion of the convertible senior notes, with such reduction and/or offset subject to a cap of

$196.44

-

Capped call transactions: In periods of GAAP income, the shares that would be issued if the Company’s Convertible Senior Notes were fully converted to common shares are included in the diluted weighted-average shares outstanding. The capped call transactions are expected to reduce common stock dilution and/or offset any potential cash payments the Company must make, other than for principal and interest, upon conversion of the convertible senior notes, with such reduction and/or offset subject to a cap of

(1) Stock-based compensation: |

|||||||||||||||

|

Three Months Ended December 31, |

|

Year Ended December 31, |

||||||||||||

(Dollars in thousands) |

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

Cost of revenue |

$ |

6,795 |

|

|

$ |

6,497 |

|

|

$ |

27,353 |

|

|

$ |

28,994 |

|

Selling and marketing |

|

13,463 |

|

|

|

14,265 |

|

|

|

55,084 |

|

|

|

57,675 |

|

Research and development |

|

7,059 |

|

|

|

6,753 |

|

|

|

29,838 |

|

|

|

31,039 |

|

General and administrative |

|

7,183 |

|

|

|

5,754 |

|

|

|

30,443 |

|

|

|

25,644 |

|

|

$ |

34,500 |

|

|

$ |

33,269 |

|

|

$ |

142,718 |

|

|

$ |

143,352 |

|

Income tax benefit |

$ |

(422 |

) |

|

$ |

(618 |

) |

|

$ |

(1,799 |

) |

|

$ |

(2,187 |

) |

(2) Effective income tax rates: |

|||||

|

Year Ended December 31, |

||||

|

2024 |

|

|

2023 |

|

GAAP |

30 |

% |

|

29 |

% |

non-GAAP |

22 |

% |

|

22 |

% |

Our GAAP effective income tax rate is subject to significant fluctuations due to several factors, including our stock-based compensation plans, research and development tax credits, and the valuation allowance on our deferred tax assets in the

PEGASYSTEMS INC. RECONCILIATION OF FREE CASH FLOW (1) AND OTHER METRICS (in thousands, except percentages) |

||||||||||

|

Year Ended December 31, |

|

Change |

|||||||

|

2024 |

|

|

|

2023 |

|

|

|||

Cash provided by operating activities |

$ |

345,926 |

|

|

$ |

217,785 |

|

|

59 |

% |

Investment in property and equipment |

|

(7,712 |

) |

|

|

(16,781 |

) |

|

|

|

Free cash flow (1) |

$ |

338,214 |

|

|

$ |

201,004 |

|

|

68 |

% |

|

|

|

|

|

|

|||||

Supplemental information (2) |

|

|

|

|

|

|||||

Litigation settlement, net of recoveries |

$ |

32,403 |

|

|

$ |

— |

|

|

|

|

Legal fees |

|

16,197 |

|

|

|

14,645 |

|

|

|

|

Restructuring |

|

5,252 |

|

|

|

29,401 |

|

|

|

|

Interest on convertible senior notes |

|

3,810 |

|

|

|

4,134 |

|

|

|

|

Other |

|

— |

|

|

|

601 |

|

|

|

|

Income taxes |

|

82,317 |

|

|

|

11,664 |

|

|

|

|

|

$ |

139,979 |

|

|

$ |

60,445 |

|

|

|

|

(1) |

Our non-GAAP free cash flow is defined as cash provided by operating activities less investment in property and equipment. Investment in property and equipment fluctuates in amount and frequency and is significantly affected by the timing and size of investments in our facilities. We provide information on free cash flow to enable investors to assess our ability to generate cash without incurring additional external financings. This information is not a substitute for financial measures prepared under |

|

(2) |

The supplemental information discloses items that affect our cash flows and are considered by management not to be representative of our core business operations and ongoing operational performance. |

- Litigation settlement, net of recoveries: Cost to settle litigation, net of insurance recoveries, arising from proceedings outside the ordinary course of business. See "Note 20. Commitments And Contingencies" in our Annual Report on Form 10-K for the year ended December 31, 2024 for additional information.

- Legal fees: Legal and related fees arising from proceedings outside the ordinary course of business.

- Restructuring: Restructuring fluctuates in amount and frequency and is significantly affected by the timing and size of our restructuring activities.

-

Interest on convertible senior notes: In February 2020, we issued convertible senior notes, due March 1, 2025, in a private placement. The convertible senior notes accrue interest at an annual rate of

0.75% , payable semi-annually in arrears on March 1 and September 1. - Other: Fees related to canceled in-person sales and marketing events.

- Income taxes: Direct income taxes paid net of refunds received.

PEGASYSTEMS INC. |

ANNUAL CONTRACT VALUE |

(in thousands, except percentages) |

Annual contract value (“ACV”) - Annual Contract Value (“ACV”) represents the annualized value of our active contracts as of the measurement date. The contract's total value is divided by its duration in years to calculate ACV. ACV is a performance measure that we believe provides useful information to our management and investors.

|

December 31, 2024 |

|

December 31, 2023 |

|

Change |

|

Constant Currency Change |

|||||||

Pega Cloud |

$ |

652,443 |

|

$ |

552,998 |

|

$ |

99,445 |

|

18 |

% |

|

21 |

% |

Maintenance |

|

291,807 |

|

|

324,091 |

|

|

(32,284 |

) |

(10 |

)% |

|

(8 |

)% |

Subscription services |

|

944,250 |

|

|

877,089 |

|

|

67,161 |

|

8 |

% |

|

10 |

% |

Subscription license |

|

427,268 |

|

|

377,794 |

|

|

49,474 |

|

13 |

% |

|

14 |

% |

|

$ |

1,371,518 |

|

$ |

1,254,883 |

|

$ |

116,635 |

|

9 |

% |

|

11 |

% |

PEGASYSTEMS INC. |

BACKLOG |

(in thousands, except percentages) |

Remaining performance obligations (“Backlog”) - Expected future revenue from existing non-cancellable contracts:

As of December 31, 2024:

|

Subscription services |

|

Subscription license |

|

Perpetual license |

|

Consulting |

|

Total |

||||||||||||||||

Pega Cloud |

|

Maintenance |

|

|

|

|

|||||||||||||||||||

1 year or less |

$ |

525,133 |

|

|

$ |

230,866 |

|

|

$ |

88,880 |

|

|

$ |

317 |

|

|

$ |

50,519 |

|

|

$ |

895,715 |

|

56 |

% |

1-2 years |

|

328,234 |

|

|

|

65,461 |

|

|

|

10,874 |

|

|

|

— |

|

|

|

3,297 |

|

|

|

407,866 |

|

25 |

% |

2-3 years |

|

159,536 |

|

|

|

24,598 |

|

|

|

733 |

|

|

|

— |

|

|

|

125 |

|

|

|

184,992 |

|

11 |

% |

Greater than 3 years |

|

114,256 |

|

|

|

19,935 |

|

|

|

678 |

|

|

|

— |

|

|

|

50 |

|

|

|

134,919 |

|

8 |

% |

|

$ |

1,127,159 |

|

|

$ |

340,860 |

|

|

$ |

101,165 |

|

|

$ |

317 |

|

|

$ |

53,991 |

|

|

$ |

1,623,492 |

|

100 |

% |

% of Total |

|

70 |

% |

|

|

21 |

% |

|

|

6 |

% |

|

|

— |

% |

|

|

3 |

% |

|

|

100 |

% |

|

|

Change since December 31, 2023 |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

$ |

166,895 |

|

|

$ |

(33,694 |

) |

|

$ |

20,068 |

|

|

$ |

(2,410 |

) |

|

$ |

9,265 |

|

|

$ |

160,124 |

|

|

|

|

|

17 |

% |

|

|

(9 |

)% |

|

|

25 |

% |

|

|

(88 |

)% |

|

|

21 |

% |

|

|

11 |

% |

|

|

As of December 31, 2023:

|

Subscription services |

|

Subscription license |

|

Perpetual license |

|

Consulting |

|

Total |

||||||||||||||||

Pega Cloud |

|

Maintenance |

|

|

|

|

|||||||||||||||||||

1 year or less |

$ |

446,160 |

|

|

$ |

245,271 |

|

|

$ |

62,070 |

|

|

$ |

2,284 |

|

|

$ |

39,810 |

|

|

$ |

795,595 |

|

54 |

% |

1-2 years |

|

279,474 |

|

|

|

67,720 |

|

|

|

9,138 |

|

|

|

443 |

|

|

|

2,020 |

|

|

|

358,795 |

|

25 |

% |

2-3 years |

|

144,453 |

|

|

|

37,142 |

|

|

|

9,789 |

|

|

|

— |

|

|

|

2,896 |

|

|

|

194,280 |

|

13 |

% |

Greater than 3 years |

|

90,177 |

|

|

|

24,421 |

|

|

|

100 |

|

|

|

— |

|

|

|

— |

|

|

|

114,698 |

|

8 |

% |

|

$ |

960,264 |

|

|

$ |

374,554 |

|

|

$ |

81,097 |

|

|

$ |

2,727 |

|

|

$ |

44,726 |

|

|

$ |

1,463,368 |

|

100 |

% |

% of Total |

|

66 |

% |

|

|

25 |

% |

|

|

6 |

% |

|

|

— |

% |

|

|

3 |

% |

|

|

100 |

% |

|

|

PEGASYSTEMS INC. RECONCILIATION OF GAAP BACKLOG AND CONSTANT CURRENCY BACKLOG (in millions, except percentages) |

||||||||

|

December 31, 2023 |

|

December 31, 2024 |

|

1 Year Growth Rate |

|||

Backlog - GAAP |

$ |

1,463 |

|

$ |

1,623 |

|

11 |

% |

Impact of changes in foreign exchange rates |

|

— |

|

|

39 |

|

|

|

Constant currency backlog |

$ |

1,463 |

|

$ |

1,662 |

|

14 |

% |

Note: Constant currency Backlog is calculated by applying the December 31, 2023 foreign exchange rates to all periods shown. |

||||||||

PEGASYSTEMS INC. RECONCILIATION OF FORWARD-LOOKING GUIDANCE (in millions, except percentages and per share amounts) |

|||

|

|

2025 |

|

Annual contract value growth |

|

12 |

% |

|

|

||

Revenue (GAAP and Non-GAAP) |

$ |

1,600 |

|

|

|

||

Net Income - GAAP |

$ |

149 |

|

Stock-based compensation |

|

147 |

|

Legal fees |

|

25 |

|

Incomes taxes |

|

(32 |

) |

Net Income - Non-GAAP |

$ |

289 |

|

|

|

||

Diluted earnings per share - GAAP |

$ |

1.60 |

|

Non-GAAP adjustments |

|

1.50 |

|

Diluted earnings per share - non-GAAP |

$ |

3.10 |

|

|

|

||

Diluted weighted-average number of common shares outstanding (GAAP and Non-GAAP) |

|

93.1 |

|

|

|

2025 |

|

|

|

||

Cash provided by operating activities |

$ |

455 |

|

Investment in property and equipment |

|

(15 |

) |

Free cash flow |

$ |

440 |

|

|

|

||

Supplemental information |

|

||

Legal fees |

$ |

25 |

|

Income taxes (1) |

|

50 |

|

|

$ |

75 |

|

(1) Evolving |

|||

View source version on businesswire.com: https://www.businesswire.com/news/home/20250212298048/en/

Press contact:

Lisa Pintchman

VP, Corporate Communications

lisapintchman.rogers@pega.com

617-866-6022

Twitter: @pega

Investor contact:

Peter Welburn

VP, Corporate Development & Investor Relations

PegaInvestorRelations@pega.com

617-498-8968

Source: Pegasystems Inc.