Pitney Bowes BOXpoll™: Both Vaccinated and Unvaccinated Americans Plan for a Summer of Increased Spending

Pitney Bowes Inc. (NYSE: PBI), a global technology company that provides commerce solutions in the areas of ecommerce, shipping, mailing and financial services, today released results from its latest BOXpoll™, revealing that as household incomes steady, the retail industry is set for an optimistic few months, with US consumers – both those vaccinated and not – set to increase spending this summer across key product categories.

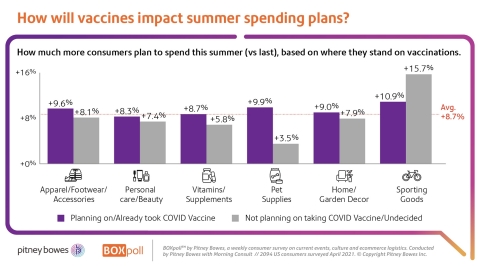

How will vaccines impact summer spending plans? (Graphic: Business Wire)

For the first time in seven months, the percentage of Americans earning less money than before the pandemic fell below

“As we come upon Memorial Day, Americans are eagerly anticipating a more normal summer. Spending on vacations, dining out and other services are widely expected to increase following deep declines in 2020. But, Pitney Bowes BOXpoll respondents also tell us they also plan to spend more on products this summer versus last. This is encouraging and hopeful news for retailers, both because product sales typically experience a decline from spring to summer, and because y-o-y product sales were surprisingly strong last summer too,” said Gregg Zegras, EVP and President, Global Ecommerce, Pitney Bowes.

According to US Department of Commerce statistics, US retail sales, excluding autos, gas, food and beverage services and grocery stores, saw its highest year-over-year increase in Q3 2020 of any quarter over the past decade. Twenty-twenty was also the only year in the decade when the same categories of retail product sales increased from Q2 to Q3. The increase was over

Gen Z leads the charge

Leading this trend are the younger generations, whose plans for summer spending are significantly greater when compared with Gen Xers and Baby Boomers, with Gen Z and Millennials spending approximately

BOXpoll™ revealed spending trends for this summer across other demographics as well, including the following:

-

Urban dwellers will spend significantly more (

17% ) than consumers in suburban and rural areas (5% and8% , respectively) -

Parents plan to spend about three times more than those without children year over year (

15% vs.5% ) -

Mid-income earners plan a higher increase in spending (

12% ) compared with lower- and higher-income earners (5% and11% respectively) -

Shoppers in the Northeast (

13% ) and West (10% ) planned higher spending increases this summer than those in the Midwest (6% ) and South (8% ).

Vaccinated, or not, Americans are spending

What’s more, BOXpoll™ found little difference in the spending plans of consumers who have been, or plan to be vaccinated (

Methodology

BOXpoll™ by Pitney Bowes is a weekly consumer survey on current events, culture and ecommerce logistics. Morning Consult conducts weekly polls on behalf of Pitney Bowes among a national sample of more than 2,000 online shoppers. The results included in this press release are extracted from surveys conducted over the past month. The interviews were conducted online, and the data were weighted to approximate a target sample of adults based on age, educational attainment, gender, race, and region. Results from the full survey have a margin of error of +/- 2 percentage points. Visit pitneybowes.com/boxpoll for the latest BOXpoll findings.

About Pitney Bowes

Pitney Bowes (NYSE:PBI) is a global technology company providing commerce solutions that power billions of transactions. Clients around the world, including 90 percent of the Fortune 500, rely on the accuracy and precision delivered by Pitney Bowes solutions, analytics, and APIs in the areas of ecommerce fulfillment, shipping and returns; cross-border ecommerce; office mailing and shipping; presort services; and financing. For 100 years Pitney Bowes has been innovating and delivering technologies that remove the complexity of getting commerce transactions precisely right. For additional information visit Pitney Bowes at www.pitneybowes.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210526005402/en/