U.S. Small Business Job Growth Shows Positive Gains, While Wage Inflation Decelerates

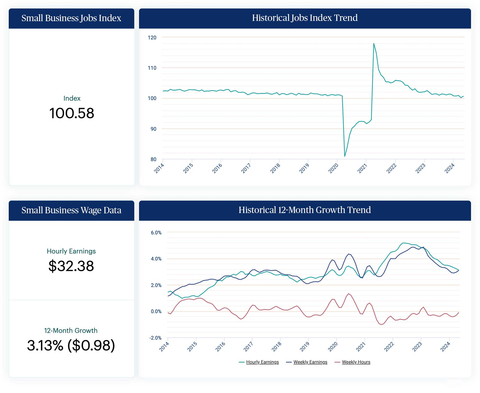

According to the May report from the Paychex Small Business Employment Watch, the Small Business Jobs Index rose by 0.46 points to 100.58, marking the largest increase since January 2022. However, hourly earnings growth decelerated to 3.13%, the lowest since June 2021. Weekly earnings growth saw a positive uptick to above 3% for the first time since January 2024, driven by stabilized weekly working hours. The Midwest led regional growth with a 0.61-point increase, while the South maintained the highest employment growth rate at 101.05. The Leisure and Hospitality sector saw a notable 0.77-point rise. Despite these gains, challenges such as inflation, access to capital, and labor shortages persist.

- Small Business Jobs Index rose by 0.46 points to 100.58 in May, the highest increase since January 2022.

- Weekly earnings growth exceeded 3% for the first time since January 2024, driven by stabilized weekly hours.

- Midwest led regional growth with a 0.61-point increase.

- The South maintained the highest employment growth rate at 101.05.

- Leisure and Hospitality sector saw a 0.77-point rise, the largest increase since February 2023.

- Hourly earnings growth decelerated to 3.13%, the lowest since June 2021.

- National jobs index down by 0.09 points over the past three months.

- Concerns remain over inflation, access to capital, and labor shortages.

Insights

The Small Business Jobs Index showing its largest one-month increase since January 2022 indicates a positive turn in the employment market for small businesses. This growth can potentially boost investor confidence, as it suggests that small businesses are starting to recover from previous downturns. However, the fact that the index is still down over the past three months reflects ongoing volatility. Investors in small-cap stocks should watch this trend closely.

The deceleration in hourly earnings growth to 3.13% is a noteworthy development. While this may ease inflationary pressures, it also suggests that wage growth is not keeping pace with cost of living increases, which could impact consumer spending power. For retail investors, particularly those invested in consumer goods companies, this slowdown in wage growth might indicate a potential decrease in discretionary spending, which could affect sales and profit margins.

A closer look at the regional data reveals that the Midwest experienced the most significant employment growth, with a 0.61 percentage point increase. This outperformance could indicate a regional economic resurgence, possibly driven by manufacturing or other industrial sectors. For investors, this suggests potential investment opportunities in region-specific small-cap stocks or businesses with a strong presence in the Midwest.

The Leisure and Hospitality sector showing the largest gain since February 2023 is another key insight. This sector has been hit hard by the pandemic and its recovery could signal increased consumer confidence and spending. Investors in hospitality-related stocks may find this trend encouraging, as it points to a rebound in a previously struggling sector.

Weekly earnings growth increases as weekly hours worked stabilize

The Paychex Small Business Jobs Index rose 0.46 percentage points to 100.58 in May, the largest one-month increase since January 2022. (Graphic: Business Wire)

“It appears we are seeing a stabilization in job growth and continued downward pressure on hourly wages,” said John Gibson, Paychex president and CEO. “Yet, challenges still remain for small business owners given concerns over inflation, access to capital, and a shortage of labor and skills.”

“Small business owners in most sectors scheduled workers for more hours in May, which resulted in increased weekly earnings,” Gibson added. “Following a long-term trend of decreasing hours worked for small business employees, there are early signs of a turning point, moving towards stabilization.”

Jobs Index and Wage Data Highlights:

- The national jobs index increased 0.46 percentage points to 100.58 in May, the largest one-month gain in more than two years. Despite the 0.46 percentage point increase in May, the national jobs index was down 0.09 percentage points during the past three months.

- At 100.58, the national jobs index showed modest employment gains, though at a slower pace than last year (0.78 percentage points).

- All regions improved their rate of employment growth in May, led by the Midwest with a one-month increase of 0.61 percentage points to an index level of 100.94. With an index of 101.05, the South has been the fastest-paced region for small business employment growth for 19 of the past 21 months.

- Following eight-straight decreases, the Leisure and Hospitality sector increased 0.77 percentage points to a 100.26 jobs index in May, marking the largest one-month gain since February 2023.

-

Hourly earnings growth for workers slowed to

3.13% in May, the lowest level since June 2021 (2.90% ), and resumed the downward trend of the past two years. -

One-month annualized hourly earnings growth was

2.11% , more than one percent below the year-over-year rate and the lowest level since November 2020 (1.74% ).

The complete Small Business Employment Watch results for May 2024, including interactive charts detailing the data at a national, regional, state, metro, and industry sector level are available at www.paychex.com/watch. Learn more and sign up to receive monthly Employment Watch alerts.

About the Paychex Small Business Employment Watch

The Paychex Small Business Employment Watch is released each month by Paychex, Inc. Focused exclusively on businesses with fewer than 50 workers, the monthly report offers analysis of national employment and wage trends and examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful industry benchmark delivers real-time insights into the small business trends driving the

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is an industry-leading HCM company delivering a full suite of technology and advisory services in human resources, employee benefit solutions, insurance, and payroll. The company serves approximately 740,000 customers in the

View source version on businesswire.com: https://www.businesswire.com/news/home/20240604606746/en/

Media

Tracy Volkmann

Paychex, Inc.

Manager, Public Relations

(585) 387-6705

tvolkman@paychex.com

@Paychex

Colleen Bennis

Matter Communications

Account Director

(585) 666-9510

cbennis@matternow.com

Source: Paychex