Paychex Small Business Jobs Index Shows Little Change in March and Levels Consistent with Last Several Quarters

Hourly earnings growth for workers remained flat at

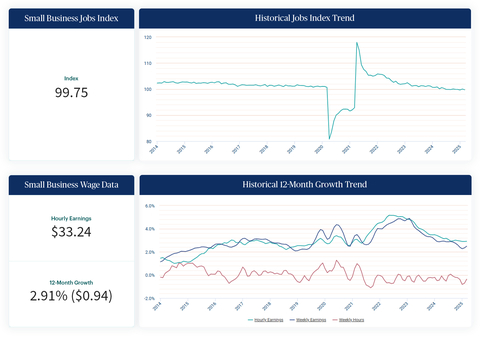

The Paychex Small Business Employment Watch showed job growth continued at levels seen over the last several quarters at 99.75 in March.

“According to our most recent data, the small business labor market is fundamentally healthy and showing no current signs of a recession,” said John Gibson, Paychex president and CEO. “Job growth within

“It’s an interesting time as small businesses are expressing both optimism and uncertainty, while continuing to face consistent challenges such as the impacts of inflation and difficulty finding qualified employees,” Gibson added. “We continue to build and deploy innovative solutions to address the issues facing small- and mid-sized businesses, including Paychex Recruiting Copilot, Paychex Flex® Perks, and Paychex Funding Solutions.”

Jobs Index and Wage Data Highlights

- The national Small Business Jobs Index dipped 0.29 percentage points to 99.75 in March, slightly below the pace set at the end of the past two quarters.

-

Hourly earnings growth (

2.91% ) remained below three percent for the fifth consecutive month in March, while one-month annualized hourly earnings growth (3.51% ) outpaced annual growth (2.91% ) for the fourth-straight month. - The Midwest remained the top region for the 10th consecutive month, despite slowing 0.58 percentage points in March to 99.96.

-

Texas (100.85) continued to lead states for small business job growth in March. -

Consistently among the top metros in recent months,

Minneapolis (102.52) gained 1.87 percentage points to move into first place in March. - The Manufacturing (99.30) industry has gained 1.05 percentage points during the first quarter of 2025, best among sectors.

-

Paced by Manufacturing,

Tampa topped metros in March for hourly earnings growth (4.20% ) and weekly earnings growth (4.00% ).

More Information

For more information about the Paychex Small Business Employment Watch, visit the website and sign up to receive monthly Employment Watch alerts.

*Information regarding the professions included in the industry data can be found at the Bureau of Labor Statistics website.

About the Paychex Small Business Employment Watch

The Paychex Small Business Employment Watch is released each month by Paychex, Inc. Focused exclusively on businesses with fewer than 50 workers, the monthly report offers analysis of national employment and wage trends and examines regional, state, metro, and industry sector activity. Drawing from the payroll data of approximately 350,000 Paychex clients, this powerful industry benchmark delivers real-time insights into the small business trends driving the

About Paychex

Paychex, Inc. (Nasdaq: PAYX) is an industry-leading HCM company delivering a full suite of technology and advisory services in human resources, employee benefit solutions, insurance, and payroll. The company serves more than 745,000 customers in the

View source version on businesswire.com: https://www.businesswire.com/news/home/20250401954801/en/

Media Contacts

Tracy Volkmann

Paychex, Inc.

Manager, Public Relations

(585) 387-6705

tvolkmann@paychex.com

@Paychex

Emily Walsh

Highwire Public Relations

Account Executive

(914) 815-8846

paychex@highwirepr.com

Source: Paychex, Inc.