Pan American Energy Corp Announces Filing of Inaugural NI 43-101 Technical Report For The Horizon Lithium Project

- One of the largest identified lithium deposits in the U.S.

- High-grade mineral resources with an average grade of 678 ppm lithium

- Rapid advancement in a short timeframe with the MRE based on 20 diamond drill holes completed in 2023

- Significant expansion potential through step-out drilling

- Ideal location near essential infrastructure and the town of Tonopah

- None.

The maiden Mineral Resource Estimate included in the Technical Report Is One of The Largest Identified Lithium Deposits in the United States, Totaling Over 1.3 million tonnes of Indicated and 8.8 million tonnes of Inferred Lithium Carbonate Equivalent Resources

CALGARY, Alberta, Jan. 05, 2024 (GLOBE NEWSWIRE) -- Pan American Energy Corp. (CSE:PNRG) (OTCQB: PAANF) (FRA: SS60) (“Pan American” or the “Company”) is pleased to announce that, further to its news release dated November 20, 2023 announcing the maiden mineral resource estimate (the “MRE”) for the Horizon Lithium Project (the “Project”), it has filed a technical report pursuant to National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“43-101”) entitled “NI 43-101 Technical Report for the Horizon Lithium Project” with an effective date of December 21, 2023 (the “Technical Report”). The Company has filed the Technical Report on the Company’s SEDAR+ profile at www.sedarplus.ca and the Technical Report is also available on the Company’s website. The Technical Report was prepared by Tabetha Stirrett, P. Geo., and Erik Hemstad, PE, each of RESPEC, LLC (“RESPEC”), and each of whom is a “Qualified Person” for purposes 43-101 and independent of the Company.

Key Highlights of the Technical Report

- One of the largest identified lithium deposits in the U.S. with an estimated Indicated Mineral Resource of 1,325 Lithium Carbonate Equivalent (“LCE”) Kilo tonnes (“KTonnes”) and Inferred Mineral Resource of 8,879 LCE KTonnes, with an average grade of 678 ppm lithium (“Li”) (see table below for additional details regarding the calculation of the MRE and the average Li grades for the Inferred Mineral Resources and Indicated Mineral Resources).

- High-Grade Mineral Resources. Estimates were calculated based on a conservative 300 ppm Li cut-off within an optimized pit.

- Rapid advancement in a short timeframe. The MRE is based on 20 diamond drill holes completed in 2023, within one year of the Company acquiring rights to the Project pursuant to the property option agreement entered into with the owner of the Project, Horizon Lithium LLC. One hole was abandoned due to hole conditions and was not used in the MRE.

- Significant expansion potential through step-out drilling to extend the deposit to the Northwest, South, East and West and at greater depths. The Company is actively evaluating geophysical exploration techniques and Phase 3 drill planning, as recommended by the authors of the Technical Report.

- Project engineering. The authors of the Technical Report recommend that a Preliminary Economic Assessment ("PEA") be completed for the Project, pending results from geochemical testing of samples gathered during the recommended drilling and planned metallurgical testwork. The Company has begun the work necessary to complete the necessary metallurgical testwork, and the Company is targeting the completion of a PEA in Q4-2024.

- Access and infrastructure. The Project benefits from an ideal location near essential infrastructure and the town of Tonopah with limited impediments (i.e. no highway intersects impacting pit design).

Jason Latkowcer, Chief Executive Officer of Pan American, states, "We are proud to publish the inaugural technical report for the Project. The initial mineral resource estimation highlights the identification of a promising high-grade, large-tonnage lithium deposit in North America. The deposit is open in numerous directions and at depth. We expect upcoming geophysical exploration techniques to further refine Phase 3 drill targeting and are in active conversations with partners to support metallurgical testing as we advance towards a PEA at the Project.”

Readers are encouraged to review the Company’s related November 20, 2023 news release with respect to the MRE and the Technical Report, each of which is filed on the Company’s SEDAR+ profile at www.sedarplus.ca. There are no material differences as between the MRE disclosed in the Technical Report and that disclosed in the Company’s November 20, 2023 news release.

MRE Preparation

The MRE was estimated and reported with an effective date of November 15, 2023. The estimated mineral resources at the Project were classified by geological and quantitative confidence in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Reserves and 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into a mineral reserve, and there are currently no mineral reserves estimated at the Project.

The mineral resources were estimated by inverse distance to the second power. Two estimation passes were performed independently for each of the three mineral domains. Estimated grades and partial percentages of the domains were used to calculate weight-averaged lithium grades for each block. Grades and percentages outside modeled domains were included in calculations to produce fully block-diluted grades.

The mineral resources were tabulated to reflect potential open pit mining extraction as the primary scenario. A pit optimization was produced to meet the requirement of reasonable prospects for eventual economic extraction and reports production as LCE. The in-pit mineral resources are reported at a cutoff grade of 300 parts per million Li. For additional information regarding the calculation of the MRE, please refer to the Technical Report.

| Table 1. Mineral Resource Estimate for the Horizon Lithium Project | |||||

| Classification | Cut-off (ppm Li) | Total KTonnes | Average Grade (ppm Li) | Li KTonnes | LCE KTonnes |

| Indicated | 300 | 372,845 | 669 | 249 | 1,325 |

| Inferred | 300 | 2,453,963 | 680 | 1,668 | 8,879 |

Notes:

- The mineral resource estimate is in metric tonnes.

- Mineral resources comprised all model blocks at a 300 ppm Li cut-off within an optimized pit.

- Mineral resources within the optimized pit are block-diluted tabulations.

- To describe the resource in terms of industry-standard LCE, a conversion factor of 5.323 was used to convert elemental lithium to LCE.

- 20 drillholes were used in the mineral resource estimate.

- An inferred mineral resource has a lower confidence level than measured and indicated mineral resources and must not be converted to mineral reserves. It is reasonably expected that most of the inferred mineral resources could be upgraded to indicated mineral resources with continued delineation drilling.

- Mineral resources potentially amenable to open pit mining methods and leach processing are reported using a Li carbonate price of US

$20,000 /tonne, a throughput of 30,000 tonnes/day, assumed metallurgical recoveries of 66 percent, mining costs of US$2.20 /tonne mined, processing costs of US$14.12 /tonne processed, and general and administrative costs of US$0.42 /tonne processed. The results from pit optimization are used solely to test for “reasonable prospects for economic extraction” and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Property. The results are used as a guide to assist in preparing the mineral resource estimate and selecting an appropriate resource reporting cutoff grade. - The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues.

- The effective date of the mineral resource estimate is November 15, 2023.

- All figures are rounded to reflect the relative accuracy of the estimate, and sums may vary because of rounding.

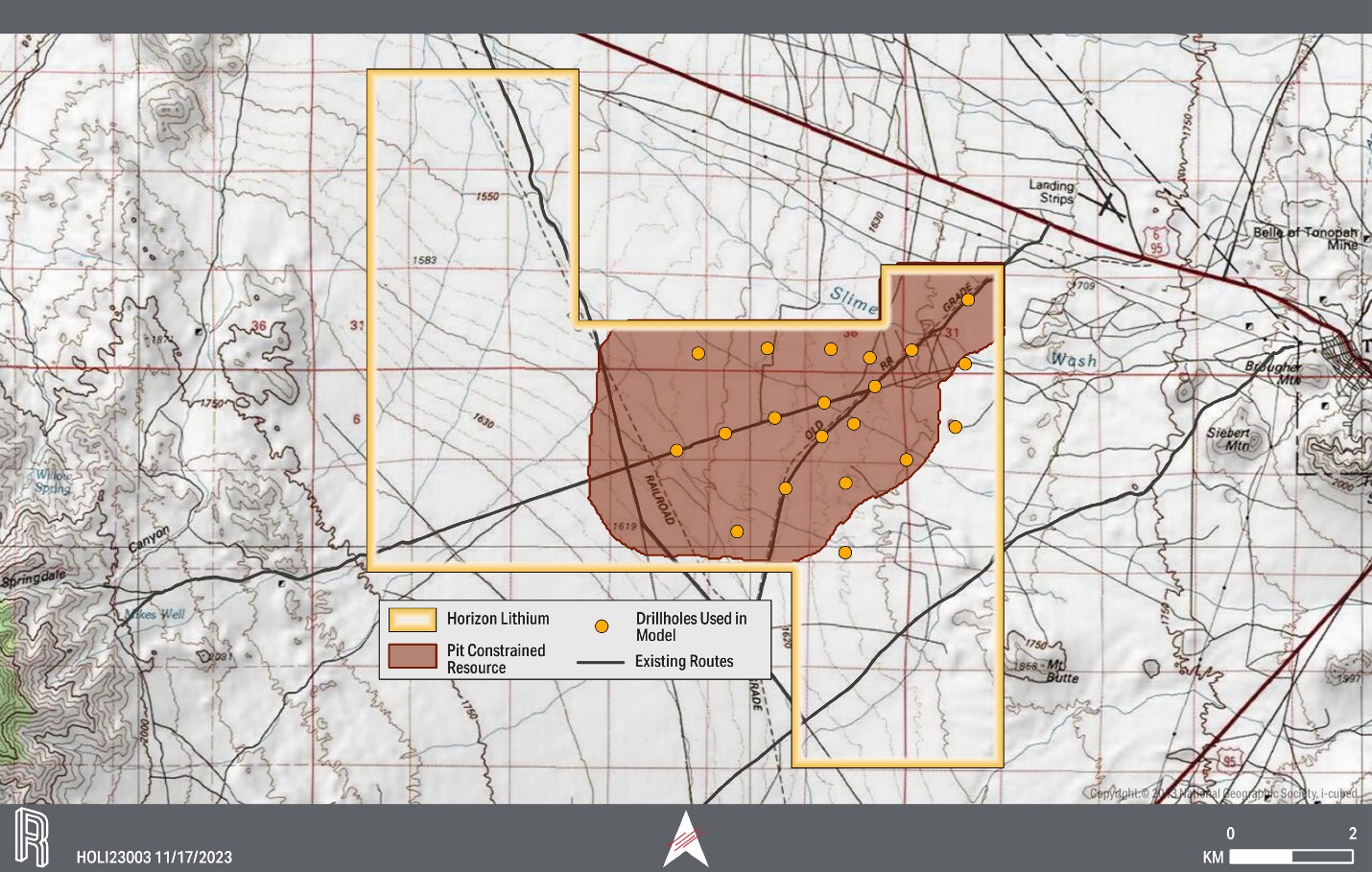

Figure 1 — The Project boundary, 20 exploratory drillholes used in the MRE, and the Mineral resource body showing unexplored areas to the west, northwest, east and south.

Technical Report Recommendations

The authors of the Technical Report have recommended that the Company conduct two phases of additional work on the Project, including exploration and metallurgical testing, while concurrently developing a PEA. The authors recommend a phased approach to the further exploration of the Project, including:

- Phase 1:

- Geophysical Survey – Conducting a seismic survey of the Project to define the thickness of overburden sediments and gain a better understanding of underlying structural features;

- Exploration and Infill Drilling – Completing drillholes in the western and southern portions of the Project to laterally expand the stratigraphic understanding and potentially grow the mineral resource; completing infill drilling with the aim of upgrading the mineral resource classification and extending the mineral resource to greater depth; and

- Metallurgical Testing – Developing a processing strategy, which is paramount to Project advancement and overall de-risking of the Project. The authors recommend that the Company continue pursuing partnerships with select academic and institutional and research groups to develop the process for the recovery of claystone-hosted Li.

- Phase 2 – PEA – To define the economic viability of the Project, the authors recommend the Company complete a thorough scoping study of the potential profitability and risks associated with the Project.

The Company is actively evaluating geophysical exploration techniques and engaged in Phase 3 drill planning. The Company has also begun the work necessary to complete the necessary metallurgical testwork, and the Company is targeting the completion of the PEA in Q4-2024.

Qualified Persons

The scientific and technical contents of this news release have been reviewed and approved by Tabetha Stirrett, P.Geo, who is a consulting geologist at RESPEC, an independent consultant to the Company, and a “Qualified Person” as defined by NI 43-101.

For additional information regarding the scientific and technical information contained in this press release, including data verification, collection and compilation information and QA/QC procedures undertaken please refer to the Technical Report.

About Pan American

Pan American Energy Corp. (CSE: PNRG) (OTCQB: PAANF) (FSE: SS60) is an exploration stage company engaged principally in the acquisition, exploration and development of mineral properties containing battery metals in North America.

The Company executed an option agreement in Canada with Magabra Resources, providing for the right to acquire up to a

For more information, please contact the Company at info@panam-energy.com or visit our website at https://panam-energy.com.

Follow us on Facebook, Twitter and LinkedIn.

On Behalf of the Board of Directors

Jason Latkowcer

CEO & Director

Contact:

Phone: (587) 885-5970

Email: info@panam-energy.com

Cautionary Note Regarding Forward-Looking Statements

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words “could”, “intend”, “expect”, “believe”, “will”, “projected”, “estimated” and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company’s current beliefs or assumptions as to the outcome and timing of such future events. In particular, this press release contains forward-looking information relating to, among other things, the MRE, including the economic assumptions used to formulate the mineral resource estimate; the potential of the Project, including the exploration and expansion prospects of the Project; planned and proposed exploration activities that the Company may undertake on the Project and the anticipated outcomes of such exploration activities, including that geophysical exploration techniques will allow the Company to further refine Phase 3 drill targeting; and the Company’s plans to complete a PEA, including the target date for the completion of a PEA.

Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information, including, in respect of the forward-looking information included in this press release, the assumptions set out in the Technical Report, including the economic, geological and operational assumptions discussed above under the heading “MRE Preparation”; that the MRE is accurate in estimating the mineral resources present at the Project; that the Company will be able to successfully undertake further exploration activities on the Project and that such exploration activities will yield the anticipated results; and that the Company will be able to successfully complete the preparation and publication of a PEA on the timeline estimated, or at all.

Although forward-looking information is based on the reasonable assumptions of the Company’s management, there can be no assurance that any forward-looking information will prove to be accurate. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among other things, risks related to the estimation of mineral resources, including that mineral resource estimates are estimates only and are subject to a number of assumptions which may prove untrue; that the Company will be unsuccessful in converting inferred mineral resources into measured or indicated mineral resources, or mineral resources into mineral reserves; that the Company will be unsuccessful in completing, or will determine not to complete, the planned or recommended exploration activities discussed above in this press release or in the Technical Report, on the timeline anticipated or at all; that planned or recommended exploration activities may not yield the desired results; that the completion of the recommended exploration activities will not permit the Company to complete a PEA, on the timeline currently anticipated or at all; risks inherent in the exploration and development of mineral deposits, including risks relating to receiving requisite permits and approvals, changes in project parameters or delays as plans continue to be redefined; that mineral exploration is inherently uncertain and that the results of mineral exploration may not be indicative of the actual geology or mineralization of a project; that mineral exploration may be unsuccessful, result in cost overruns or fail to achieve the results anticipated by the Company; that mineral exploration activities are often unsuccessful; that commodity prices and general economic conditions are subject to fluctuation and the other risks set out in the Company’s annual information form filed on the Company’s profile at www.sedarplus.ca. The forward-looking information contained in this release is made as of the date hereof, and the Company not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

The CSE has neither approved nor disapproved the information contained herein.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/70790afa-45b8-4886-b0ed-821235615f50