Welcome to our dedicated page for Orion Group Hldgs news (Ticker: ORN), a resource for investors and traders seeking the latest updates and insights on Orion Group Hldgs stock.

Orion Group Holdings, Inc. (NYSE: ORN) is a specialty construction company with marine and concrete segments serving infrastructure, industrial, and building markets in the continental United States, Alaska, Hawaii, Canada, and the Caribbean Basin. The ORN news feed on this page brings together company-issued updates and market disclosures that highlight how Orion executes its marine construction, dredging, and concrete construction activities.

News items for Orion commonly include announcements of new contract awards across its marine and concrete segments, such as maintenance dredging for the U.S. Army Corps of Engineers, shoreline protection projects, marine transportation facility work, crane trestle installations, and large concrete projects including data centers, manufacturing facilities, healthcare projects, energy-related facilities, and cold storage. These updates provide insight into the company’s contracted backlog and the mix of projects it is pursuing.

Investors and followers of ORN can also expect earnings releases and related communications, where Orion reports contract revenues, gross profit, backlog levels, and non-GAAP measures such as EBITDA and Adjusted EBITDA. The company uses these releases and associated conference calls to discuss operational performance in its marine and concrete segments, backlog trends, and financial guidance.

Additional news coverage includes information about capital structure developments, such as the establishment of a senior credit facility with UMB Bank, as well as governance and leadership updates like board appointments. Orion also reports on its participation in investor and industry conferences, where management presents its strategy, project pipeline, and market opportunities.

By reviewing the ORN news stream, readers can follow Orion Group Holdings’ reported contract wins, segment activity, financial updates, and corporate developments over time.

Orion Group Holdings (NYSE: ORN) announced that Francis Okoniewski, Vice President of Investor Relations, will present at the Sidoti Virtual Micro-Cap Conference on December 9, 2021, at 10:45 AM ET. The event will also feature virtual one-on-one meetings with investors on December 8 and 9, 2021. Registration is free and open to all interested parties. Orion specializes in construction services for infrastructure and industrial sectors, operating in the U.S., Alaska, Canada, and the Caribbean.

Orion Group Holdings (NYSE: ORN) announced four new contract awards in its Concrete segment, totaling approximately $28 million. The contracts include a $3.8 million data center expansion, a $4.3 million project for two cast-in-place retirement residential buildings, and a $5.6 million cold storage facility, all expected to start in Q1 2022 and complete by Q4 2022. Additionally, a $5.1 million contract for tilt-wall warehouses and a $9.2 million mixed-use building in Houston will begin in Q1 2022 and finish by Q1 2023. These projects reinforce Orion's leadership in Texas concrete construction.

Orion Group Holdings (NYSE: ORN) announced three new contract awards in its Marine segment, totaling approximately $16 million. The contracts include $7.1 million for dredging in Freeport Harbor Channel by the U.S. Army Corps of Engineers, $4.1 million for a pipeline removal project by a local port, and $5.2 million for a bulkhead wall installation in Florida. Work on these projects is expected to start in early 2022 and conclude by mid-2022. Orion's President expressed satisfaction with these awards, emphasizing a disciplined bidding approach to boost 2022 backlog.

Orion Group Holdings reported a net loss of $10.2 million ($0.33 per share) for Q3 2021, a stark contrast to net income of $11.8 million in Q3 2020. The operating loss reached $8.7 million, down from an operating income of $13.1 million year-over-year. Contract revenues fell by 26.1% to $139.9 million, primarily due to timing issues in marine projects. However, backlog increased by 45% to $572.8 million. The company reported a book-to-bill ratio of 2.28x but noted challenges from COVID-19, weather impacts, and rising unabsorbed costs.

Orion Group Holdings (NYSE: ORN) will release its financial results for Q3 2021 on October 27, 2021, after market close. The management will host a conference call on October 28, 2021, at 10:00 a.m. ET to discuss these results. Investors can join the call by dialing 201-493-6739 or through the company’s website. Orion specializes in construction services across various sectors, including marine and concrete services, throughout the U.S., Alaska, Canada, and the Caribbean Basin.

Orion Group Holdings, Inc. (NYSE: ORN) announced the resignation of Robert L. Tabb as Executive Vice President and Chief Financial Officer, effective October 29, 2021. Tabb, who joined the company in 2018 and served as CFO since March 2019, is leaving for a non-competitive opportunity. The senior management team will oversee his responsibilities during the search for a new CFO. CEO Mark Stauffer praised Tabb's contributions, highlighting his role in building a strong team and positioning Orion for future success.

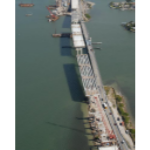

Orion Group Holdings (NYSE: ORN) announced two significant contract awards in its Marine segment, totaling nearly $200 million. The first is a $125 million contract from the Florida Department of Transportation for the replacement of the Indian River Bridge, expected to start in Q4 2021 and finish in Q4 2024. The second is a $67 million contract for the Berth 6 Expansion Project at the Port of Port Arthur, Texas, set to commence in Q4 2021 and complete in Q3 2024. These projects enhance Orion's backlog and reinforce its role in U.S. infrastructure development.

Orion Group Holdings (NYSE: ORN) has secured three contracts totaling approximately $22 million for dredging services from the US Army Corps of Engineers (USACE). These contracts involve maintenance work on Gulf coast waterways, with potential increases valued at up to $19 million. Two contracts from the Galveston District total $18.3 million for the Gulf Intracoastal Waterway and Sabine Neches Waterway. A third contract worth $3.5 million is from the Jacksonville District for Tampa Harbor. Work is expected to begin in Q4 2021.

Orion Group Holdings, Inc. (NYSE: ORN) has secured six contract awards totaling approximately

Orion Group Holdings (NYSE: ORN) announced contract awards totaling approximately $35 million. The Marine segment secured four contracts, notably in the Gulf Coast and Alaska, with three contracts in Texas and Louisiana valued at $27.5 million for marine infrastructure development. The projects commence in Q4 2021 and are expected to complete by Q3 2022. Additionally, a $7.8 million contract from the US Department of Transportation involves bridge replacement in Alaska's Denali National Park and will begin in Q1 2022, concluding in late 2023.