O3 Mining to Drill 250,000 Metres at Marban and Alpha in 2021-2022

Rhea-AI Summary

O3 Mining (OIIIF) has announced a significant 250,000-metre drilling program for 2021-2022 at its Malartic and Alpha properties in Val-d'Or, Québec. Following successful drilling of 86,000 metres in 2019-2020, O3 aims to convert, expand, and discover gold resources, supported by CDN $35 million financing that boosted cash reserves to CDN $145.9 million. The exploration budget is set at CDN $49.3 million, with drilling expected to continue year-round using six rigs. The initiative seeks to enhance the corporation's prospective developments ahead of the planned Pre-Feasibility Study.

Positive

- Planned drilling program of 250,000 metres for resource expansion.

- Total cash and investments increased to CDN $145.9 million after financing.

- Exploration budget of CDN $49.3 million allocated for 2021-2022.

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, OIIIF gained 2.26%, reflecting a moderate positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

TSXV: OIII | OTCQX: OIIIF - O3 Mining

TORONTO, March 2, 2021 /PRNewswire/ - O3 Mining Inc. (TSX.V: OIII) (OTCQX: OIIIF) ("O3 Mining" or the "Corporation") is pleased to announce its plan to execute a 250,000-metre drilling program during 2021 and 2022 at its Malartic and Alpha properties in Val-d'Or, Québec, Canada as it seeks to convert, expand and discover new gold resources.

O3 Mining drilled 86,000 metres during 2019 and 2020 on its Malartic and Alpha properties to build on its mineral inventory in Québec of 3.9 million ounces of gold (total measured and indicated resource of 2.4 million ounces gold contained within 62.0 Mt @ 1.22 g/t Au and 1.5 million ounces gold contained within 20.2 Mt @ 2.27 g/t Au in the Inferred category).

The exploration success to date, as well as a recently completed CDN

The exploration budget for 2021-2022 is CDN

O3 Mining Strategy

Convert: At the Marban project on the Malartic property, the Corporation is undertaking infill drilling to convert Inferred mineral resources to the Measured and Indicated categories as it moves towards completing a Pre-Feasibility Study, planned for 2022. Marban has a Preliminary Economic Assessment ("PEA") announced on September 8, 2020 which outlined open-pit production of 115,000 ounces a year for 15 years.

Expand: O3 Mining will continue with step-out drilling and testing new areas within 5 kilometres of the proposed plant site at Malartic with the aim of identifying new mineral resources that can be brought within the mine plan, a strategy the Corporation successfully executed in 2020 (see Press Releases November 24, 2020 and November 3, 2020). The Marban PEA was based on a measured and indicated resource of 1.9 million ounces gold contained within 54.2 Mt @ 1.10 g/t Au and a total of 0.6 million ounces gold contained within 13.2 Mt @ 1.44 g/t Au in the Inferred category.

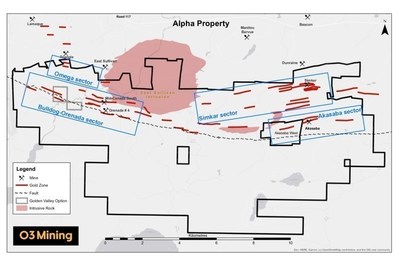

O3 Mining also aims to continue to expand the mineral resource footprint in the Orenada-Bulldog and Akasaba sectors at Alpha where it has an option on the nearby Aurbel mill. Alpha hosts 1.2 million ounces of gold (total Measured and Indicated resource of 500,000 ounces gold contained within 7.7 Mt @ 2.00 g/t Au and 700,000 ounces gold contained within 5.9 Mt @ 3.80 g/t Au in the Inferred category).

Discover: O3 Mining aims to continue to discover new mineralized zones at the Simkar and Omega sectors at Alpha and to test targets generated by its exploration team and verified using artificial intelligence ("AI") by Mira Geoscience Ltd. incorporating drilling and mapping databases, geochemical samples, Induced Polarization (IP), Electromagnetic (EM), magnetic and gravity datasets (see Press Release August 6, 2020).

"We see the market looking for large, economic gold deposits in mining-friendly jurisdictions and that is exactly what O3 Mining is in the process of delivering. We have secured the financial resources to increase the planned scope of our 2021 and 2022 exploration programs to convert, expand and discover and keep building ounces around our two potential production sites in Val-d'Or. 2021 will be an exciting year for O3 Mining as this exploration program further advances the production potential of Malartic and Alpha," said President and CEO Jose Vizquerra.

Highlights

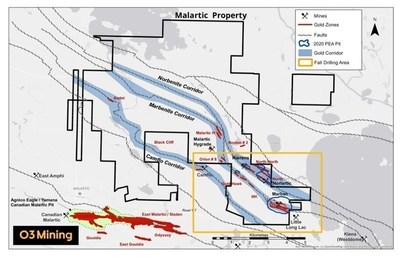

Drilling at the Malartic property will test extensions of the ore deposits included in the September 2020 PEA (See press release September 8, 2020) to grow the mineral resource base, specifically focused on the Norlartic–Kierens, North-North, North Shear, Marban, and the Gold Hawk deposits. Other drilling targets include Orion #8, Golden Bridge, MK, Malartic H, Marban NE, and Camflo deep, including extensions of historical mineralized zones within three kilometres of the PEA pit shells, which offer additional potential to increase resources within the Marban mining project area.

Drilling at Alpha will aim to expand the known deposits at Bulldog, Orenada, Simkar, and Akasaba, and the Corporation will proceed to a resource estimate when it feels there are enough resources to generate an economic production scenario. Drilling will follow-up on significant drill intercepts to prove-up the continuity of grades and widths to turn these into new deposits as well as make new discoveries within the Bulldog-Orenada, Akasaba, Simkar, and Omega sectors.

BMO 30th Global Metals & Mining Conference

Jose Vizquerra, President and CEO, will present at the BMO Global Metals & Mining Conference on Wednesday, March 3rd at 4:00 p.m. (EST) as part of the Osisko Group Panel alongside Osisko Development, Osisko Mining, and Osisko Metals, and will be available for one-on-one meetings throughout the conference. Meeting requests can be made through the conference website.

BMO Global Metals & Mining Conference is one of the sector's premier events. This five-day invitation-only conference brings together mining industry leaders and institutional investors from around the globe. The event is considered a barometer of industry sentiment for the year to come.

Figure 2: Malartic Property Map

Qualified Person

The scientific and technical content of this news release has been reviewed, prepared, and approved by Mr. Louis Gariepy. (OIQ #107538), VP Exploration, who is a "qualified person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101").

About O3 Mining Inc.

O3 Mining Inc., an Osisko Group company, is a gold explorer and mine developer ready to produce from its highly prospective gold camps in Québec, Canada. O3 Mining benefits from the support, previous mine-building success, and expertise of the Osisko team as it grows towards being a gold producer with several multi-million ounce deposits in Québec.

O3 Mining is well-capitalized and owns a

O3 Mining trades on the TSX Venture Exchange (TSX.V: OIII) and OTC Markets (OTCQX: OIIIF). The company is focused on delivering superior returns to its shareholders and long-term benefits to its stakeholders. Further information can be found on our website at https://o3mining.com/

Cautionary Note Regarding Forward-Looking Information

This news release contains "forward-looking information" within the meaning of the applicable Canadian securities legislation that is based on expectations, estimates, projections, and interpretations as at the date of this news release. The information in this news release about the transaction; and any other information herein that is not a historical fact may be "forward-looking information". Any statement that involves discussions with respect to predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "interpreted", "management's view", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking information and are intended to identify forward-looking information. This forward-looking information is based on reasonable assumptions and estimates of management of the Corporation, at the time it was made, involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the companies to be materially different from any future results, performance or achievements expressed or implied by such forward-looking information. Such factors include, among others, risks relating to the restart of operations; further steps that might be taken to mitigate the spread of COVID-19; the impact of COVID-19 related disruptions in relation to the Corporation's business operations including upon its employees, suppliers, facilities and other stakeholders; uncertainties and risk that have arisen and may arise in relation to travel, and other financial market and social impacts from COVID-19 and responses to COVID 19. Although the forward-looking information contained in this news release is based upon what management believes, or believed at the time, to be reasonable assumptions, the parties cannot assure shareholders and prospective purchasers of securities that actual results will be consistent with such forward-looking information, as there may be other factors that cause results not to be as anticipated, estimated or intended, and neither the Corporation nor any other person assumes responsibility for the accuracy and completeness of any such forward-looking information. The Corporation does not undertake, and assumes no obligation, to update or revise any such forward-looking statements or forward-looking information contained herein to reflect new events or circumstances, except as may be required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

![]() View original content to download multimedia:http://www.prnewswire.com/news-releases/o3-mining-to-drill-250-000-metres-at-marban-and-alpha-in-2021-2022--301238254.html

View original content to download multimedia:http://www.prnewswire.com/news-releases/o3-mining-to-drill-250-000-metres-at-marban-and-alpha-in-2021-2022--301238254.html

SOURCE O3 Mining Inc.