Orogen Royalties Sells the Celts Gold Project to Eminent Gold

Rhea-AI Summary

Orogen Royalties (TSXV:OGN)(OTCQX:OGNRF) has signed an agreement to sell its Celts gold project in Nevada to Eminent Gold. The deal includes a total payment of US$400,000 in cash and/or shares, plus a 3% NSR royalty, of which 1% can be purchased for US$1.5 million. Under a previous alliance agreement with Altius Minerals, the proceeds will be split evenly, with each party receiving US$200,000 and a 1.5% NSR royalty.

The 560-hectare Celts project, located 13km northeast of the Goldfield district, features an 800-meter diameter zone of advanced argillic alteration. The project shows geological similarities to the Silicon deposit, where Orogen holds a 1% NSR royalty. While there's no gold at surface in the steam cap, peripheral gold samples up to 33 grams per tonne have been found in quartz veins.

Positive

- Immediate cash/share payment of US$75,000 with additional US$325,000 within six months

- Retention of 3% NSR royalty on the Celts project

- Strategic partnership maintaining exposure to potential discovery upside with no operational costs

Negative

- Divestment of 100% ownership interest in the Celts project

- Required to split proceeds 50/50 with Altius Minerals

News Market Reaction – OGNRF

On the day this news was published, OGNRF declined 1.60%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESSWIRE / December 12, 2024 / (TSXV:OGN)(OTCQX:OGNRF) Orogen Royalties Inc. ("Orogen" or the "Company") is pleased to announce that the Company has signed a purchase and sale agreement (the "Agreement") with a wholly-owned U.S. subsidiary of Eminent Gold ("Eminent") (TSX.V: EMNT) whereby Eminent has acquired the Celts gold project ("Celts" or the "Project"), located in Nevada, USA.

To acquire a

Pursuant to the terms of a generative alliance (the "Alliance") agreement between Altius Minerals Corporation (TSX:ALS) ("Altius") and Orogen previously announced September 12, 20221, proceeds from the sale of the Project will be split evenly between the Alliance participants whereby each party will receive US

"Celts is one of four projects generated and the second sold to date under the Alliance with Altius, a collaboration of technical expertise to identify targets with geological similarities to the Expanded Silicon project in the Walker Lane Trend, Nevada," commented Orogen's CEO and President, Paddy Nicol. "Celts is representative of Orogen's business model of organic royalty generation, creating exposure to new discoveries with significant leverage to value potential. We are excited to partner with the Eminent team and look forward to their exploration efforts."

Figure 1: Location of the Celts project

About the Celts Gold Project

The 560-hectare Celts project is located in southeastern Nevada, thirteen kilometres northeast of the historic high-sulphidation Goldfield district and one-hundred kilometres northwest of the Silicon discovery (Figure 1). Celts contains a cell of advanced argillic alteration that is recognized to be steam heated alteration within a low-sulphidation system. The steam cap remains undrilled.

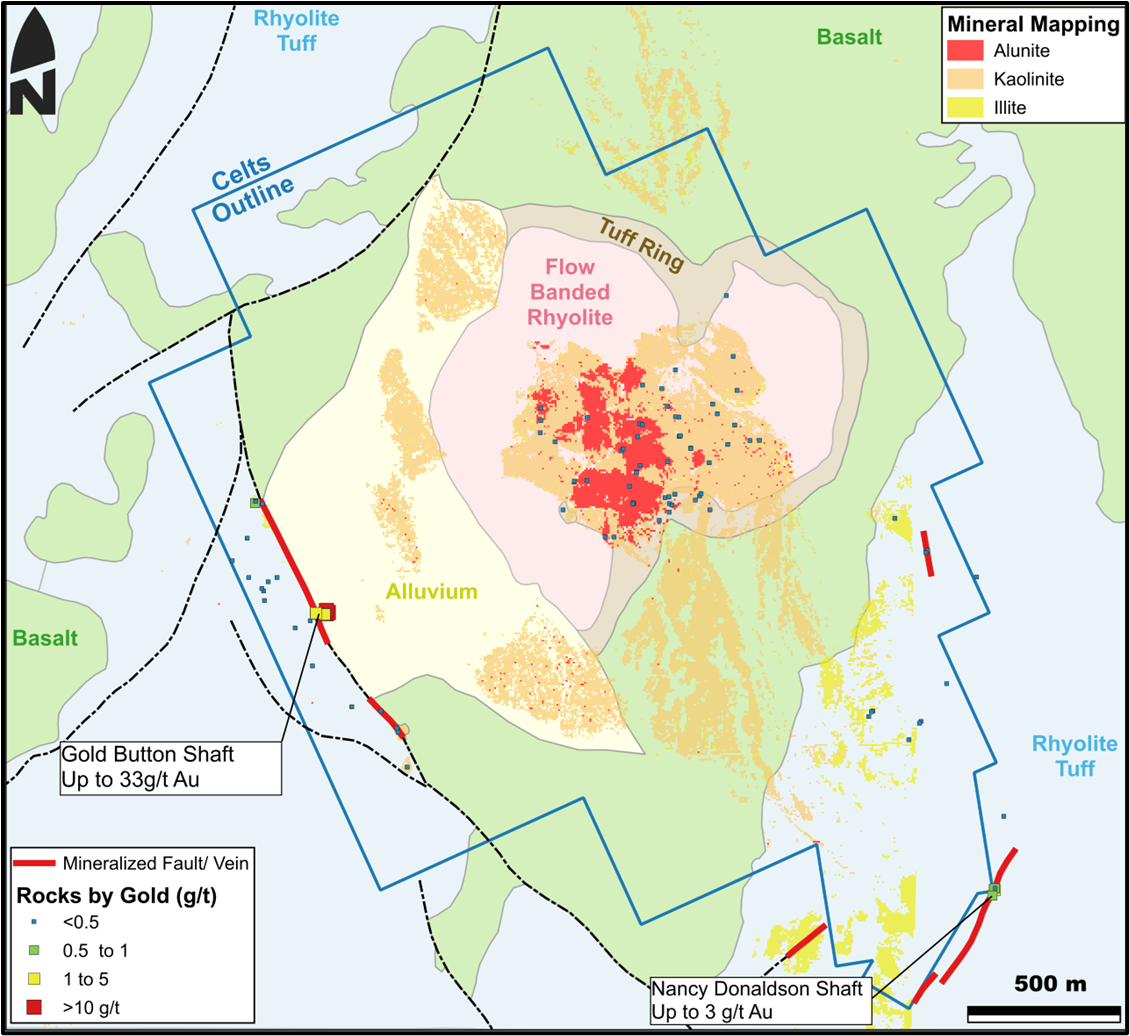

The alteration cell at Celts is centered on a Tertiary rhyolite dome with an eight-hundred metre diameter zone of alteration composed of alunite and kaolinite interspersed with regions of fine-grained silica flooding (Figure 2). Celts could be one of the few epithermal systems in Nevada associated with slab window magmatism, like the Silicon (3.4Moz of indicated and 800Koz inferred gold resources) and Merlin (9.05Moz gold resource inferred) deposits, where Orogen holds a

Similar to the Silicon deposit, there is no gold at surface in the steam cap, but peripheral gold, including grab samples up to 33 grams per tonne, occurs in quartz veins associated with illite and adularia at lower elevations one to two kilometres from the dome (Figure 2). Taken together, the central steam cap and peripheral gold-bearing mineralized structures define a four-square kilometre mineral system.

The property is on road-accessible BLM land with a clear and unencumbered pathway to drill testing.

Transaction Details

Orogen, Altius and Eminent have signed an Agreement whereby Eminent has acquired a

The issuance of Eminent shares is subject to regulatory approval of the TSX Venture Exchange.

Figure 2: Simplified Geology, Alteration and Gold Geochemistry at Celts

Qualified Person Statement

All technical data, as disclosed in this press release, has been verified by Laurence Pryer, Ph.D., P.Geo. VP Exploration for the Company. Dr. Pryer is a qualified person as defined under the terms of National Instrument 43-101.

About Orogen Royalties Inc.

Orogen Royalties Inc. is focused on organic royalty creation and royalty acquisitions on precious and base metal discoveries in western North America. The Company's royalty portfolio includes the Ermitaño gold and silver mine in Sonora, Mexico (

On Behalf of the Board

OROGEN ROYALTIES INC.

Paddy Nicol

President & CEO

To find out more about Orogen, please contact Paddy Nicol, President & CEO at 604-248-8648, and Marco LoCascio, Vice President, Corporate Development at 604-248-8648. Visit our website at www.orogenroyalties.com.

Orogen Royalties Inc.

1015 - 789 West Pender Street

Vancouver, BC

Canada V6C 1H2

info@orogenroyalties.com

Forward Looking Information

This news release includes certain statements that may be deemed "forward looking statements". All statements in this presentation, other than statements of historical facts, that address events or developments that Orogen Royalties Inc. (the "Company") expect to occur, are forward looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur.

Although the Company believe the expectations expressed in such forward looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward looking statements. Factors that could cause the actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, and continued availability of capital and financing, and general economic, market or business conditions. Furthermore, the extent to which COVID-19 may impact the Company's business will depend on future developments such as the geographic spread of the disease, the duration of the outbreak, travel restrictions, physical distancing, business closures or business disruptions, and the effectiveness of actions taken in Canada and other countries to contain and treat the disease. Although it is not possible to reliably estimate the length or severity of these developments and their financial impact as of the date of approval of these condensed interim consolidated financial statements, continuation of the prevailing conditions could have a significant adverse impact on the Company's financial position and results of operations for future periods.

Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward looking statements. Forward looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by securities laws, the Company undertakes no obligation to update these forward looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

SOURCE: Orogen Royalties Inc

View the original press release on accesswire.com