Novo Resources Corp. - September Quarterly Update

Rhea-AI Summary

Novo Resources reported significant Q3 2024 exploration results from drilling programs in Western Australia and Victoria. At Nunyerry North, drilling extended high-grade Main Lode to 500m strike with notable intercepts including 13m at 2.68 g/t Au. At the Egina Gold Project, partner De Grey Mining completed 34,180m of AC drilling and 9,129m of RC drilling, satisfying its A$7M minimum expenditure commitment. The Belltopper Gold Project delivered multiple new gold intercepts, including 6.0m @ 4.37 g/t Au. The company maintains a strong financial position with A$6.7M cash and A$44.6M in investments as of September 2024.

Positive

- High-grade gold intercepts at Nunyerry North, including 13m at 2.68 g/t Au

- De Grey Mining completed A$7M minimum expenditure commitment at Egina

- Strong financial position with A$6.7M cash and A$44.6M in investments

- Multiple significant gold intercepts at Belltopper Project

Negative

- None.

News Market Reaction

On the day this news was published, NSRPF declined 4.57%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, British Columbia, Oct. 23, 2024 (GLOBE NEWSWIRE) --

HIGHLIGHTS

- Significant Q3 2024 exploration results received from drilling programs at Novo Resource’s priority targets across the Pilbara (Western Australia) and Belltopper Project (Victoria).

- Drilling at Nunyerry North completed in July with 34 RC holes for 3,942 m. The program tested multiple new targets along strike of known mineralisation and down plunge of existing intercepts extending the high-grade Main Lode to 500 m strike/plunge and intersected high-grade gold along the Estrid Fault.

- Standout intercepts from drilling at Nunyerry North include4:

- 13 m at 2.68 g/t Au from 66 m, including 3 m at 10.41 g/t Au from 66 m

- 11 m at 2.20 g/t Au from 84 m, including 1 m at 18.06 g/t Au from 86 m

- 17 m at 1.85 g/t Au from 25 m, including 7 m at 3.55 g/t Au from 25 m

- 9 m at 2.52 g/t Au from 87 m, including 2 m at 8.89 g/t Au from 92 m

- At the Egina Gold Project, De Grey Mining (ASX: DEG) continued an aggressive exploration program at the Becher Project, with drilling at four main prospects, being the Heckmair, Irvine, Lowe and Whillans Prospects. Egina is located near De Grey’s 12.7 Moz Hemi Gold Project1.

- In addition to Novo’s approx. 60,000 m AC and RC drilling completed in 2023, De Grey has completed 34,180 m of AC drilling and 9,129 m of RC drilling to date across the four main prospects, testing prospective intrusions and regional structures, as well as a drone magnetic survey.

- De Grey satisfied its initial A

$7 million minimum expenditure commitment over a 15-month period on exploration at the Egina Gold Project. - Novo completed a review of the antimony (Sb) – gold (Au) potential across its Pilbara landholding. Two prospects in the early stages of exploration rank highly for antimony potential, including the historic Sherlock Crossing (Clarke) antimony mine and the Southeast Wyloo antimony-gold stream sediment anomaly.

- Detailed re-logging and additional sampling from 11 historical diamond holes in priority target areas at the Belltopper Gold Project in Victoria, delivered multiple new significant gold intercepts across a range of known and emerging targets2.

- The Belltopper re-logging program confirmed controls on higher-grade mineralisation and refined the position of several target reefs and key structural features such as modelled high-grade shoots and high priority target anticline corridors2.

- 6.0 m @ 4.37 g/t Au from 169 m (including 5.0 m @ 5.18 g/t Au from 169 m) in DDHMA1 on the Never Despair Reef.

- 2.0 m @ 7.19 g/t Au from 52 m (including 1.15 m @ 12.01 g/t Au from 52 m) and 2.0 m @ 3.87 g/t Au from 43 m (including 1.0 m @ 6.92 g/t Au from 43 m) in MD04 on the emerging Butchers Gully Fault target, a layer parallel structure to the high-grade Leven Star Reef.

- 3.1 m @ 3.29 g/t Au from 36 m (including 1.3 m @ 7.26 g/t Au from 37.3 m) in MD06A, also on the Butchers Gully Fault.

- 2.1 m @ 3.82 g/t Au from 78.9 m (including 0.6 m @ 9.74 g/t Au from 79.3 m) in MD07 on NW Fault 9, an important, west-dipping, sub-parallel trending structure to the high-priority Missing Link Reef target.

- 13 m @ 0.64 g/t Au from 90 m (including 1 m @ 1.92 g/t Au from 94 m) in DDHMA2 on the West Panama Reef.

- An exploration target was defined at Belltopper (the Exploration Target)3 through geological modelling of priority target reefs following completion of 2024 drilling and the release of assay results.

- The Exploration Target excludes numerous emerging prospective zones and conceptual targets based on progressive geological and geochemical understanding.

- Novo is in a strong financial position to continue its exploration focus on Western Australia and Victoria, with no debt and a cash balance of A

$6.7 million (C$6.3 million ) and investments of approximately A$44.6 million (C$41.6 million ) as of 30 September 2024.

Commenting on the September quarter, Novo Executive Co-Chairman and Acting CEO Mike Spreadborough said, “Novo continues to actively explore and drill across our highly prospective exploration portfolio in Western Australia and Victoria. The September quarter was another productive quarter with our geological teams delivering excellent results in the Pilbara and at our Belltopper Project. Key standout achievements from the quarter were the definition of the Belltopper Exploration Target which highlights the exciting growth opportunity we have at this Project and subsequent to quarter end, our joint venture partner De Grey Mining completing its initial A

“Importantly, De Grey will continue with its investment to earn a

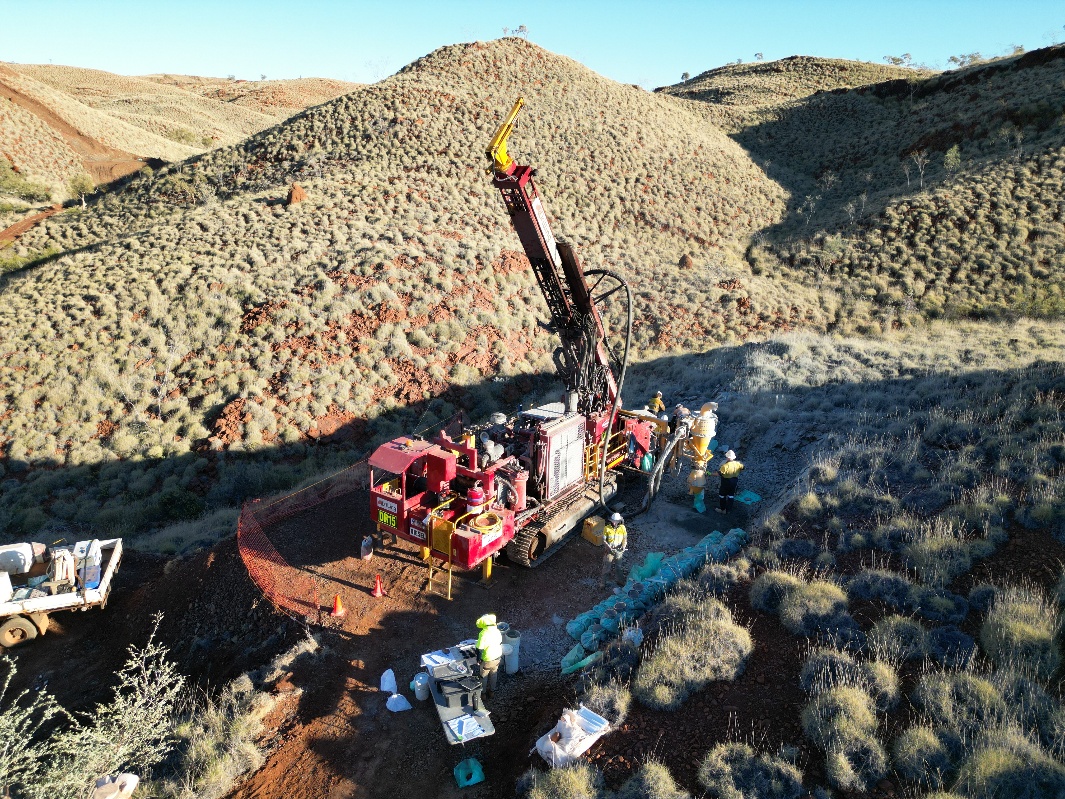

Drilling at Nunyerry North

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/9da9e36c-01b4-4b85-afef-981dcee5aeda

SUSTAINABILITY

There were no significant safety, environment, or community incidents during Q3 2024.

Discussions with the representatives of the Traditional Owners are on-going as Novo reviews and updates the relevant access agreements. Updated Determination Wide agreements were executed with the Nyamal and Kariyarra Peoples during the quarter. Novo remains in close contact with the Traditional Owners to ensure appropriate heritage protection for planned exploration activities across the Pilbara

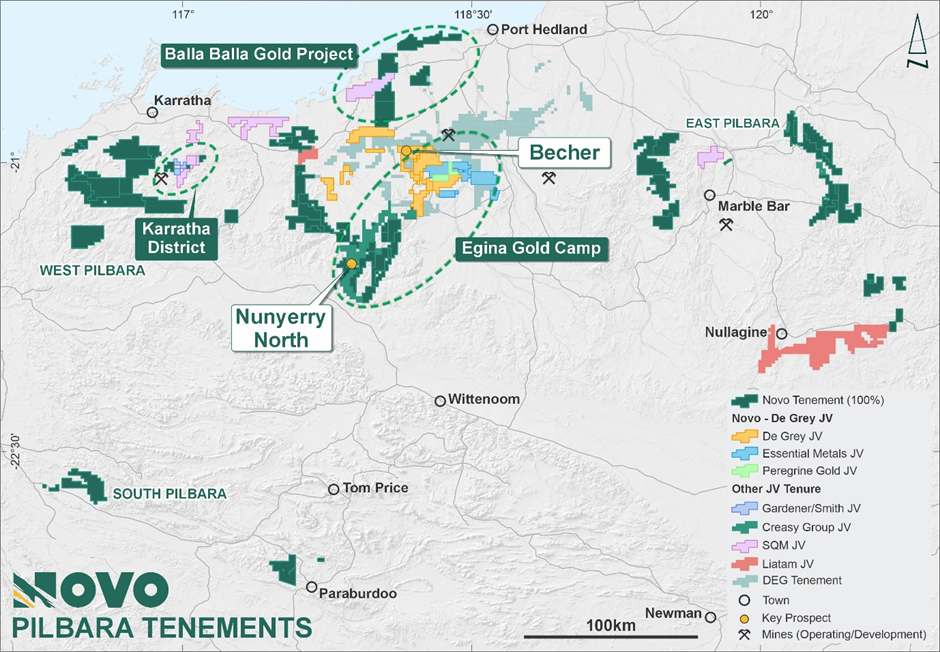

WESTERN AUSTRALIAN GOLD PORTFOLIO

Egina Gold Camp

The Egina Gold Camp (EGC) is an 80 km long contiguous tenement package, which hosts Novo’s current high priority Pilbara targets (Figure 1) at Nunyerry North and Becher. The tenure is focussed on a series of structurally complex, gold-fertile corridors and is hosted by rocks of the Mallina Basin in the north and mafic / ultramafic sequences further south. This belt is the primary focus for Novo’s 2024 Pilbara exploration programs.

Figure 1: Novo Pilbara tenure showing main projects and significant prospect.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/c67b0085-0b41-402d-8428-5c15889cde67

Nunyerry North

The Nunyerry North prospect lies within Exploration License E47/2973 in the southern EGC, located 150 km from Port Hedland. The tenement is subject to a joint venture agreement, with Novo holding a

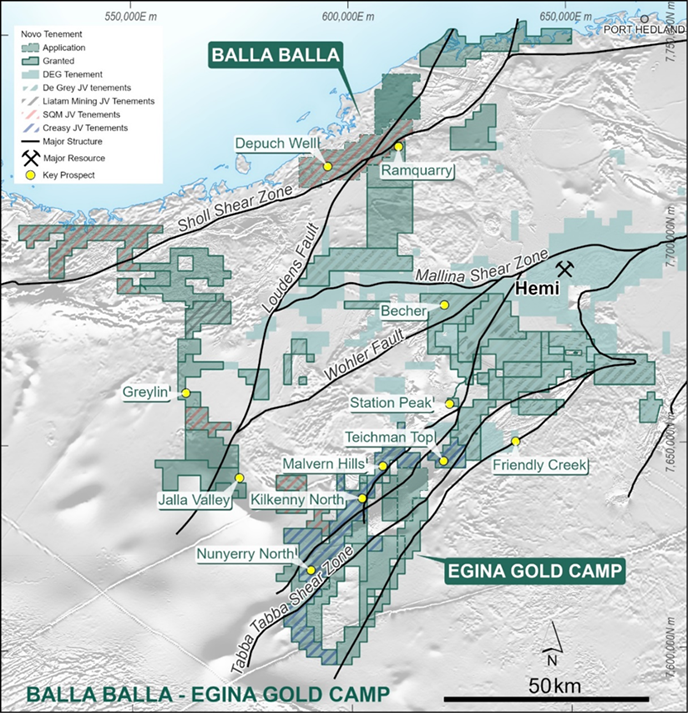

In addition to the Nunyerry North and Egina JV, several other priority gold targets are also being progressed along the main structural corridors within the EGC (Figure 2). These prospects form part of Novo’s regional reconnaissance program along the Tabba Tabba Shear Corridor in 2024.

Nunyerry North (

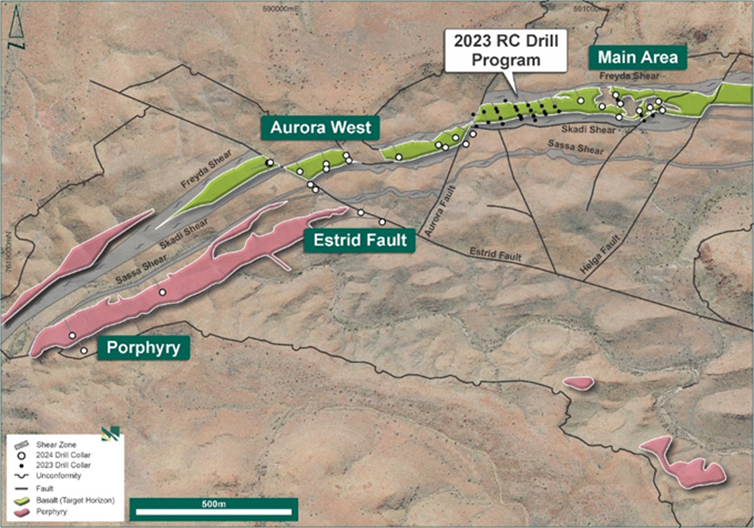

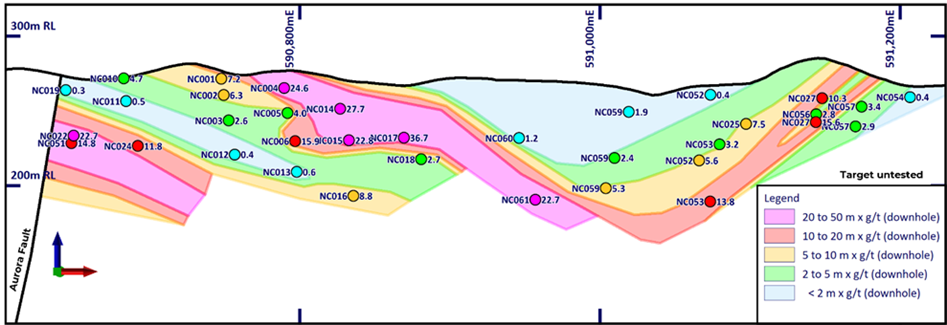

Novo completed a maiden RC drilling program of 30 holes for 2,424 m at Nunyerry North in Q4 2023. Phase 2 RC drilling continued to completion on 21 July at Nunyerry North4 with final drill metrics of 34 holes for 3,942 m testing four main targets (Figure 3). Angled drill holes ranged from 66 m to 192 m in depth (average 116 m) and were drilled on 40 m to 80 m spaced sections. All holes were drilled oriented perpendicular to the interpreted mineralised trend, with the intersected widths representative of the true width of the mineralisation unless noted otherwise.

Figure 2: Novo Tenure in the Central Pilbara showing the Egina Gold Camp and Balla Balla Gold Project Au prospects, location of Nunyerry North, and JV interests.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4810cb57-3197-4e51-877a-403d7f4a06ff

Drilling at the Main Lode target area successfully extended known gold mineralisation by 250 m to ~ 500 m strike (see long section in Figure 4) and produced several significant intercepts (see results below). High-grade gold results were returned from drilling along the Estrid Fault and also require follow up.

Best results from the latest drilling include4:

- 13 m at 2.68 g/t Au from 66 m, including 3 m at 10.41 g/t Au from 66 m (NC046)

- 11 m at 2.20 g/t Au from 84 m, including 1 m at 18.06 g/t Au from 86 m (NC046)

- 17 m at 1.85 g/t Au from 25 m, including 7 m at 3.55 g/t Au from 25 m (NC063)

- 9 m at 2.52 g/t Au from 87 m, including 2 m at 8.89 g/t Au from 92 m (NC061)

- 2 m at 7.38 g/t Au from 42 m (NC051)

The mineralisation presented in the body of this release is not necessarily representative of mineralisation throughout the Nunyerry North Project. Intercepts are expressed as down-hole intersections and should not be presumed always to represent true widths, which may vary from hole to hole.

Assays from the Porphyry target included a best intercept of 7 m at 0.1 g/t Au, coinciding with elevated XRF assays on RC powder of up to

Figure 3: Nunyerry project area with interpreted geology, highlighting strike extent of favourable stratigraphy and additional structural targets.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3194eebe-2ec0-4367-b7bf-d654fe823428

Figure 4: Nunyerry North long section (looking NNW) showing m x g/t Au (downhole width)

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/6027c880-223c-4bfe-82e0-6d1bba20191f

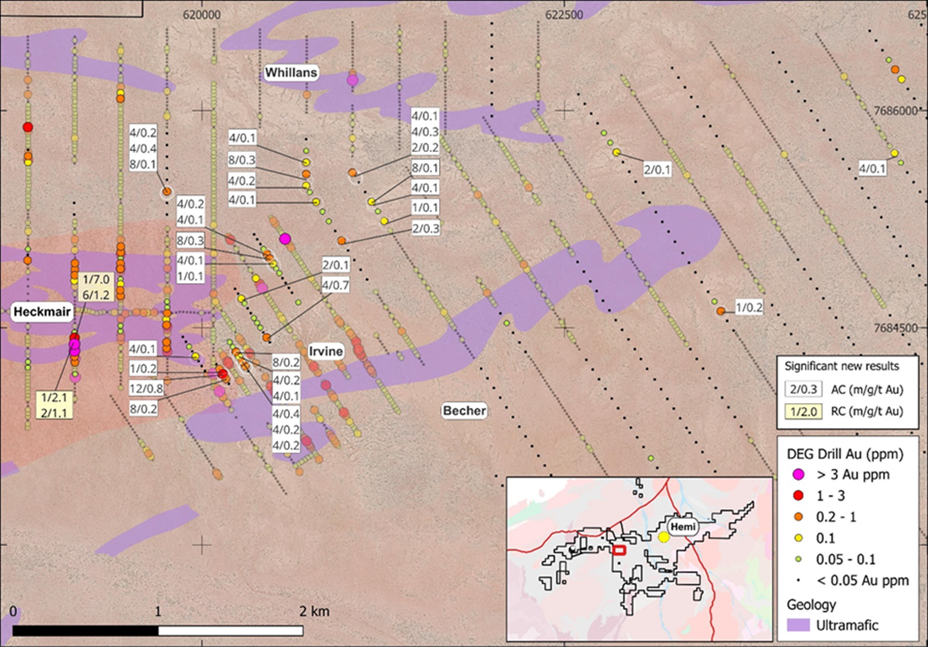

Egina Earn-in/JV (De Grey earning a

At the Egina Gold Project, JV partner De Grey continued AC drilling at the Becher Project, with drilling at Heckmair, Irvine, Lowe and Whillans Prospects. In addition to Novo’s approx. 60,000 m AC and RC drilling completed in 2023, De Grey has now completed 34,180 m of AC drilling and 9,129 m of RC drilling to date across the four main prospects, testing prospective intrusions and regional structures5.

A drone magnetic survey was completed across parts of the northern JV tenure during the quarter, which was flown to enable more detailed structural and geological interpretation of bedrock.

Results were received from the AC program and are summarised in Figure 5 below.

Figure 5: Egina JV drill results showing anomalous gold intercepts.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/82be04d2-1d22-45d6-985e-375ae9d5c697

Whillans Prospect

- Multiple thin anomalous gold intercepts were returned at the Whillans prospect from drillholes MSRC0074, and MSRC0076, associated with minor quartz veining and weak sericite alteration of metasedimentary arkosic sandstone and siltstone.

Heckmair Prospect

- Multiple thin intercepts were returned at the southern edge of the Heckmair sanukitoid intrusion from drillholes MSRC0012, MSRC0013, MSRC0068, MSRC0069, including 6 m @ 1.2g/t Au in MSRC0068. All intercepts were associated with minor quartz veining and weak sericite alteration and hosted within a dioritic intrusion.

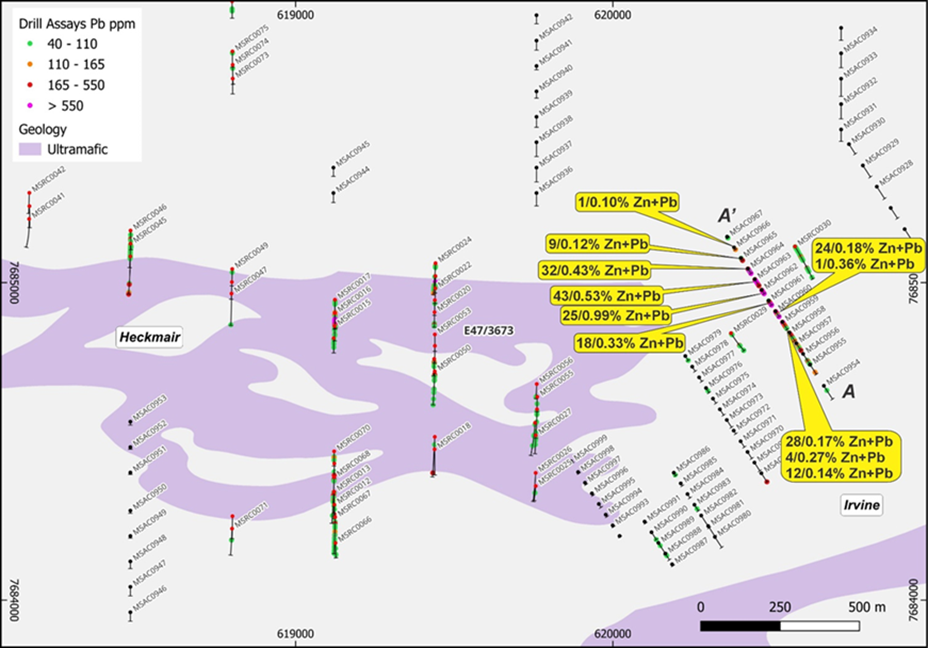

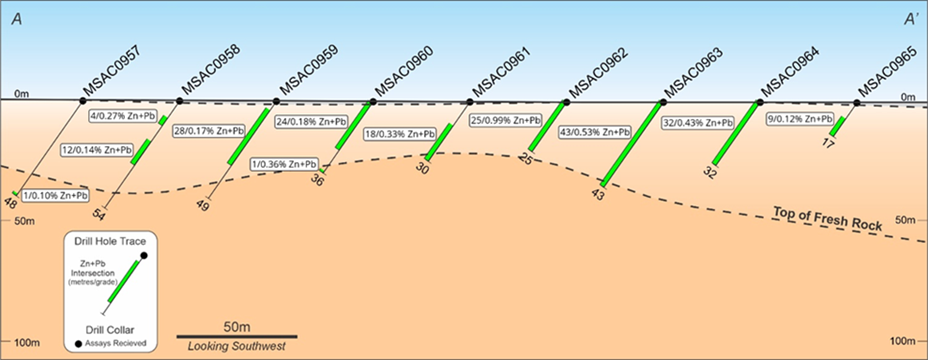

Irvine and Heckmair East Prospects

- Aircore drilling at Irvine, extending to the eastern side of the Heckmair Intrusion identified broad zones of Zn-Pb-Ag and gold anomalism within the weathered horizon. These are adjacent to the previously reported intercepts of base metal mineralisation within the Heckmair Fault that bisects the Heckmair intrusion (Figure 6 and Figure 7).

In the Mallina basin, base metal anomalies can signal enhanced gold prospectivity. Better gold intercepts included 12 m @ 0.8 g/t Au (including 4 m @ 2.1 g/t Au) in MSAC0989. Gold mineralisation is hosted in quartz veining within metasediments, immediately adjacent to an intrusion. Anomalous base metal intercepts include 25 m @

The mineralisation presented in the body of this release is not necessarily representative of mineralisation throughout the Egina district.

Figure 6: Plan showing anomalous base metal results in AC drilling at Heckmair East.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/99286317-138f-454a-89d3-ecb23efa9c6b

Figure 7: Section showing anomalous base metal (Zn+Pb) results in AC drilling at Heckmair East

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b73f349e-0db6-4c91-a648-609d10a0650b

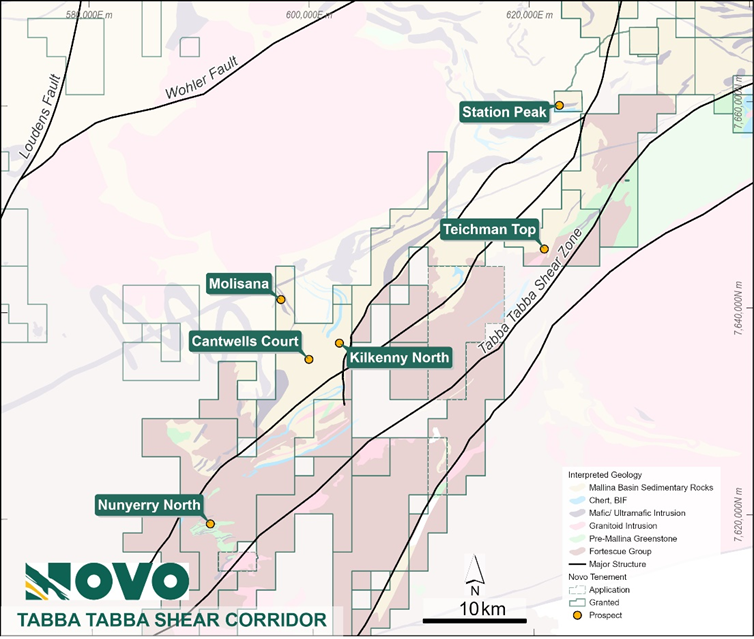

Tabba Tabba Shear Corridor

Further southwest along the Egina Gold Camp, exploration work by Novo has commenced on multiple high priority targets along the ~ 60 km long fertile Tabba Tabba Corridor (Figure 8)4. The latter is underexplored, as access is difficult and significant parts of the corridor are covered with shallow alluvium and colluvium or overlain by Fortescue Group basalt.

Several conceptual targets were identified from recent re-interpretation, with most having received little to no historical exploration. Conceptual targets focus on structural intersections of faults and shears within the Tabba Tabba Shear Corridor, particularly where folded stratigraphy and / or minor intrusions are noted.

The Kilkenny prospect was explored by Kilkenny Gold NL (Kilkenny) in the late 1990s and comprised several short costeans and 18 shallow percussion holes for a total of 530 m drilled, following up a coherent gold in soil anomaly. Despite the very small program, Kilkenny returned best costean samples of 8 m at 4.2 g/t Au, 8 m at 2.1 g/t Au, and drilling results of 5 m at 5.0 g/t Au from 9 m (ACN05) and 5m at 1.7 g/t Au from 14 m, including 2 m at 3.5 from 14 m (ACN13). Novo has not conducted data verification (as that term is defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects (NI 43-101)) of this data.

At Teichman Top, several historic workings are present, and modern exploration includes results of 25.5 g/t Au and 32.3 g/t Au from rock samples. Novo has not conducted data verification (as that term is defined in NI 43-101) of this data. This prospect is located within the Yandeyarra Reserve and has not been accessible in recent years due to the requirement to complete access agreements.

Drilling and surface sample results may not be representative of mineralisation in the district.

Novo recently completed a mapping and surface sampling campaign over these prospective parts of the Tabba Tabba Corridor to delineate targets for potential future drill testing. The initial program comprised six mapping areas and approximately 1,200 surface soil samples, with opportunistic rock and stream sediment samples where appropriate. Results are pending.

Figure 8: Geological context and main prospects of the Tabba Tabba Corridor

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/d4b3c51d-a892-4e7d-af9c-81af8ef18368

Balla Balla Gold Project

Balla Balla is an emerging exploration project centred on the Sholl Shear and associated potentially fertile structural corridors undercover (Figure 2). The Project is considered prospective for intrusion-hosted gold mineralisation, in addition to structurally controlled gold. Geophysical interpretation and research of historical data completed in 2023 advanced the Company’s understanding of prospectivity in the project area and further delineated priority targets. The Company is awaiting tenement grant prior to commencing on-ground exploration programs, including AC drilling.

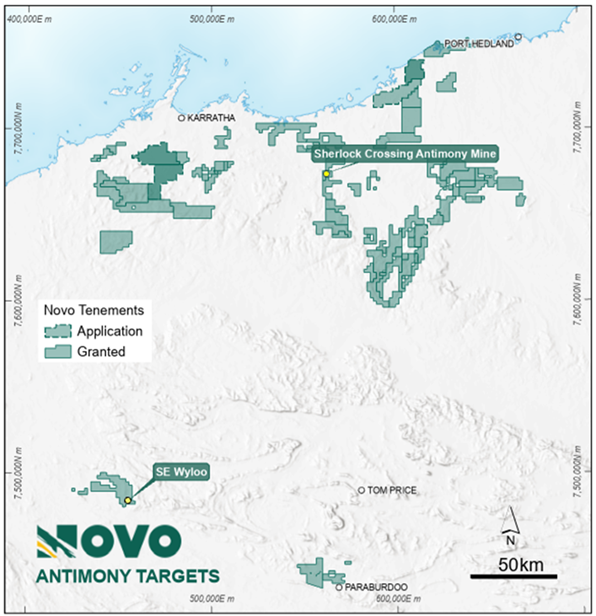

Antimony (Sb) Review

A review of antimony prospectivity6 was completed across Novo’s Pilbara landholding, with two prospects in the early stages of exploration ranking highly for antimony potential (Figure 9).

The Sherlock Crossing (Clarke) antimony mine was discovered in 1906 and operated during 1907 to 1916. According to historic records, the mine initially produced 16 tonnes of concentrate grading

Novo conducted reconnaissance work, collected rock chip samples and undertook soil sampling at Sherlock Crossing in 2022 with peak results of 1.71 g/t Au and 592 ppm Sb. Follow up mapping and sampling was conducted during the quarter to further test the high-grade historical record, with assays awaited.

Southeast Wyloo includes two, 2km-strike high-order Sb (± Au) stream sediment anomalies, where reconnaissance rock chip sampling completed by Novo in mid-2023 yielded peak results of 387 g/t Ag,

Both projects will require detailed follow-up exploration work.

Figure 9: Location map of the Sherlock Crossing antimony mine and SE Wyloo targets.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/fb3d0f4d-8a74-4e04-a07c-7b00197d939c

Forward Programs – Pilbara

At the Egina JV De Grey is currently awaiting final assay results from Becher including AC re-splits. Work will continue compiling and analysing results from recently completed work programs in addition to generating additional targets and developing follow-up programs.

Given the normal period of high temperatures and cyclone risks it is expected that all exploration drill programs will remain suspended until approximately March 2025.

Follow up sampling and mapping is planned on the antimony targets at Sherlock Crossing/Clarke and Southeast Wyloo. Regional reconnaissance work will continue in the East Pilbara at Miralga, prior to the onset of more challenging conditions throughout summer.

BELLTOPPER GOLD PROJECT, VICTORIA

The Belltopper Gold Project (Belltopper) is located 120 km northwest of Melbourne and approximately 50 km south of Agnico Eagle’s (TSX: AEM) Fosterville Gold Mine (Figure 10) in the Bendigo Zone, an area with historical gold production of more than 60 million ounces7. The tenure at Belltopper is

During the quarter, a relogging and infill sampling program was conducted across 11 previously under sampled, historic drill holes with all results received during the period. In addition, an Exploration Target was defined through geological modelling of priority target reefs following completion of all 2024 drilling and receipt of all assay results (including the relogging program).

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/124aca70-e1dd-42e9-abd9-ca62401fd389

Figure 10: Belltopper Gold Project location map with regional gold occurrences and major structures8.

Historical Core - Relogging and Sampling Program

The relogging and infill sampling program delivered multiple new significant gold intercepts across a range of known and emerging targets (Figure 11), including the following:

- 6.0 m @ 4.37 g/t Au from 169 m (including 5.0 m @ 5.18 g/t Au from 169 m) in DDHMA1 on the Never Despair Reef.

- 2.0 m @ 7.19 g/t Au from 52 m (including 1.15 m @ 12.01 g/t Au from 52 m) and 2.0 m @ 3.87 g/t Au from 43 m (including 1.0 m @ 6.92 g/t Au from 43 m) in MD04 on the emerging Butchers Gully Fault target, a layer parallel structure to the high-grade Leven Star Reef.

- 3.1 m @ 3.29 g/t Au from 36 m (including 1.3 m @ 7.26 g/t Au from 37.3 m) in MD06A, also on the Butchers Gully Fault.

- 2.1 m @ 3.82 g/t Au from 78.9 m (including 0.6 m @ 9.74 g/t Au from 79.3 m) in MD07 on NW Fault 9, an important, west-dipping, sub-parallel trending structure to the high-priority Missing Link Reef target.

- 13 m @ 0.64 g/t Au from 90 m (including 1 m @ 1.92 g/t Au from 94 m) in DDHMA2 on the West Panama Reef.

The re-logging program confirmed controls on higher-grade mineralisation and refined the position of several target reefs and key structural features such as modelled high-grade shoots and high priority target anticline corridors.

The mineralisation presented in the body of this release is not necessarily representative of mineralisation throughout the Belltopper Gold Project. Intercepts are expressed as down-hole intersections and should not be presumed to represent true widths, which vary from hole to hole and between reefs.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/78592611-f783-4efe-97e0-18296e2d4e10

Figure 11: Location of re-logged and infill sampled historic drill-holes with significant new assays highlighted. Callouts represent new assays > 5-gram x meters.

Belltopper Exploration Target3

Through the integration of all results from the current 2024 exploration program, Novo developed an updated 3D model of priority target reefs at Belltopper (Figure 12), which was utilised in the definition of an Exploration Target. A characteristic feature at Belltopper is the dense network of apparent high-grade gold ± antimony reefs that cluster in the northwest quadrant of the project adjacent to the regional Taradale Fault.

The Exploration Target (Table 1) has been generated for the Project area based on seven individual reefs (Figure 12) considered to show high prospectivity based on geological, drilling and/or historical data. This Target delineates between 1.5 million tonnes to 2.1 million tonnes grading between 6.6 and 8.4 g/t Au for between 320,000 and 570,000 oz Au.

Table 1: Exploration Target for the Belltopper Project, Victoria. Figures may not compute due to rounding.

| Metric | Low case (approximation) | High case (approximation) |

| Tonnage range | 1.5 Mt | 2.1 Mt |

| Grade range | 6.6 g/t Au | 8.4 g/t Au |

| Contained Au range | 320 koz Au | 570 koz Au |

Clarification statement: An Exploration Target as defined in the JORC Code (2012) is a statement or estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. Accordingly, these figures are not Mineral Resource or Ore Reserve estimates as defined in the JORC Code (2012). The potential quantities and grades referred to above are conceptual in nature and there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. These figures are based on the interpreted continuity of mineralisation and projection into unexplored ground often around historical workings. The Exploration Target has been prepared in accordance with the JORC Code (2012).

The mineralisation presented in the body of this announcement is not necessarily representative of mineralisation throughout the Belltopper Gold Project. Intercepts are expressed as down-hole intersections and should not be presumed to represent true widths, which vary from hole to hole and between reefs. In addition, all references in this announcement to tonnage, grade, contained Au and associated ranges are expressed as approximations.

Figure 12 depicts significant intercepts returned across all phases of drilling at Belltopper. Callouts are provided for all >50 mg/t Au intercepts, and select intercepts from important target reefs, as well as the gold-bearing Missing Link Granite, a porphyritic felsic intrusion with IRGS (Intrusion Related Gold System) characteristics that outcrops centrally to the network of high-grade reefs at Belltopper. Figure 12 highlights the exceptional prospectivity and diverse nature of mineralisation present at Belltopper.

In addition to the Exploration Target work at Belltopper, Novo identified numerous emerging prospective zones and conceptual targets based on progressive geological and geochemical understanding.

Several modelled and projected structural intersections between identified gold-bearing west-dipping structures and mapped anticline corridors provide both shallow and deeper conceptual targets to test for Fosterville-style, anticline-related mineralisation at Belltopper. With deeper conceptual targets also facilitating testing of hitherto-untested underlying stratigraphy and key mineralised structures at depth. Figure 13 and Figure 14 highlight evolving shallow and deeper targets associated with key anticline corridors at Belltopper.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/b302e732-163b-487b-898b-cd28758aaa1d

Figure 12:. Location map for Exploration Target reefs labelled #1 through #7. Callouts highlight key significant intercepts on the project.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/39ab2e0f-bbed-42a9-ba46-60a4dc606207

Figure 13: Geology cross section 5880600mN, looking north (Refer Figure 12 for cross section location). Depicts key reefs and emerging gold reefs, in addition to structural features including the regional Taradale Fault and important anticline-syncline hinge zones. Conceptual targets for intrusion hosted mineralisation associated with projected intersections of key gold reefs with the Missing Link Granite, in addition to various emerging conceptual targets across anticline hinge zones are highlighted.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/cb284b05-d431-468e-b256-22b3dd89e2a6

Figure 14: Geology cross section 5880300mN, looking north (Refer Figure 12 for cross section location). Depicts key reefs and emerging gold reefs, in addition to structural features including the regional Taradale Fault and important anticline-syncline hinge zones. Conceptual targets for key identified gold-bearing west-dipping faults across several mapped target anticline corridors (e.g. Fosterville-style targets) highlighted on this section.

Forward Programs - Victoria

In Q4 2024, Novo will continue to develop exploration programs to build on recent success with emerging reef discoveries, as well as drilling programs designed to test the higher-priority conceptual shallow and deeper targets that are continuously evolving on the project, with a strong focus on exploring for world class, Fosterville-style, anticline related targets, still considered the highest priority targets at Belltopper.

BATTERY METALS JOINT VENTURES

Harding Battery Metals Joint Venture (HBMJV)

In December 2023, Novo entered into a tenement sale agreement, joint venture agreement, and coordination agreement with SQM Australia Pty Ltd (SQM), a wholly owned subsidiary of Sociedad Química y Minera de Chile S.A., in relation to five of Novo’s prospective lithium and nickel exploration tenements (Priority Tenements) in the West Pilbara (Figure 15). SQM paid Novo A

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/4628b561-c612-4aa1-8ee7-bb0bb4763bad

Figure 15: Location of Priority Tenement adjacent to Azure Minerals’ (ASX: AZS)

Andover Lithium – Nickel Project.

Quartz Hill Joint Venture

The Quartz Hill Joint Venture is an

The Quartz Hill Joint Venture comprises five granted Exploration Licences and eighteen Prospecting Licences, covering approximately 702 sq km. Field based exploration to date confirms the area is highly prospective for LCT-style (lithium-caesium-tantalum) pegmatite hosted lithium mineralisation.

CORPORATE

Investment in San Cristobal Mining Inc.

Novo’s board of directors has resolved to seek interest from parties to acquire Novo’s interest in San Cristobal Mining Inc.

Project Generation

Novo continues to focus its efforts on a dedicated and disciplined project generation and consolidation program to identify value accretive opportunities across targeted precious and base metals assets that complement the Company’s current portfolio.

Comet Well and Purdy’s North

Novo’s board of directors has resolved to seek interest from parties to acquire or be part of a joint venture in relation to, the Comet Well and Purdy’s North project.

As part of this decision, a sale process for Mechanical Ore Sorting is underway.

Relinquishment of Tenure

The Company’s exploration programs across key Pilbara areas continue to be successful in identifying priority targets for exploration follow-up drilling along with identifying tenure that provides little further exploration value or follow-up.

As a result, tenure of no value to Novo’s strategy, continues to be relinquished to reduce land tenure holding costs. The Company currently has an estimated ~5,500 sq km of tenure and has reduced annual holding costs by relinquishing tenure of limited value.

Financial Update

As of 30 September 2024, Novo had a cash balance of A

In addition, Novo has an investment portfolio of shares held in ASX-listed and unlisted companies that is valued at approximately A

(1) ASX-listed companies, valued at approximately A

(2) Unlisted companies, valued at approximately A

| Ticker | Number of shares held | Novo’s interest | Value A$’000 | Value C$’000 | ||||

| (1) ASX-listed shares* | ||||||||

| Kalamazoo Resources Limited | ASX: KZR | 10,000,000 | 5.35 | % | $ | 780 | $ | 728 |

| GBM Resources Limited | ASX: GBZ | 11,363,637 | 1.00 | % | $ | 102 | $ | 95 |

| Kali Metals Limited (commenced trading January 8, 2024) | ASX: KM1 | 566,947 | 0.39 | % | $ | 74 | $ | 69 |

| (2) Unlisted shares** | ||||||||

| Elementum 3D Inc. (E3D) | Unlisted (US$) | 2,076,560 | 9.01 | % | $ | 20,484 | $ | 19,117 |

| San Cristobal Mining Inc. (SCM) | Unlisted (US$) | 2,000,000 | 3.98 | % | $ | 23,142 | $ | 21,598 |

*ASX-listed shares were converted to C$ using an exchange rate of C$ to A$ of 1: 1.0715

**The valuation of the unlisted shares held in E3D is in line with management’s valuation as of 30 September 2024, converted using an exchange rate as of 30 September 2024 from US$ to C$ of 1: 1.3499 and C$ to A$ of 1: 1.0715. The valuation of the unlisted shares held in SCM is in line with management’s valuation as at 30 September 2024 based on a private placement that commenced in March 2024, and closed in April 2024, converted using an exchange rate as at 31 March 2024 from US$ to C$ of 1 : 1.3687 and C$ to A$ of 1 : 1.0952.

Shares held in Elementum 3D and San Cristobal Mining are initially recognised at fair value (and remeasured with reference to share prices at which funds are raised from third-party investors) or were based on independent valuations performed. For further information on Novo’s investment portfolio, please refer to Novo’s website.

Cost Base

During the quarter, the company reviewed its corporate and exploration cost base given the planned exploration activities for the remainder of the year and H1 2025. This review resulted in a reduction in employees and activities.

CONTACT

| Investors: Mike Spreadborough +61 8 6400 6100 info@novoresources.com | North American Queries: Leo Karabelas +1 416 543 3120 leo@novoresources.com | Media: Cameron Gilenko +61 466 984 953 cgilenko@citadelmagnus.com |

Authorised for release by Board of Directors.

QP STATEMENT

Ms De Luca (MAIG), is the qualified person, as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects, responsible for, and having reviewed and approved, the technical information contained in this news release. Ms De Luca is Novo’s General Manager Exploration.

Dr Christopher Doyle (MAIG) and Dr Simon Dominy (FAusIMM CPGeo; FAIG RPGeo), are the qualified persons, as defined under National Instrument 43-101 Standards of Disclosure for Mineral Projects, responsible for, and having reviewed and approved, the technical information contained in this news release in relation to Belltopper. Dr Doyle is Novo’s Exploration Manager - Victoria and Dr Dominy is a Technical Advisor to Novo.

JORC COMPLIANCE STATEMENTS

The information in this news release that relates to Exploration Results from Novo’s Western Australian Gold Portfolio is extracted from the following announcements:

(a) Nunyerry North High-Grade Gold Zone Extended and Egina Gold Camp Exploration Targets Advanced dated 29 August 2024 (and released to ASX on 30 August 2024).

(b) De Grey Reaches $A7m Minimum Spend at Egina Gold Project and Continues Investment released to ASX on 10 October 2024; and

(c) Evaluation of Pilbara Antimony-Gold Potential Generates Positive Results dated 11 September 2024 (and released to ASX on 12 September 2024), each of which is available to view at www.asx.com.au.

The Company confirms that it is not aware of any new information or data that materially affects the information in the original market announcements and that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcements.

The information in this news release that relates to the previously reported exploration target at Belltopper is extracted from Novo’s ASX announcement titled Belltopper Mineralisation Modelling Defines Prospectivity released to ASX on 25 September 2024, which is available to view at www.asx.com.au. The Company confirms that it is not aware of any new information that materially affects the information included in the original market announcement and that all material assumptions and technical parameters underpinning the estimates in the original market announcement continue to apply and have not materially changed.

The information in this news release that relates to Exploration Results at Belltopper is extracted from Novo's announcement titled Significant Results from Diamond Drilling at Belltopper, Victoria dated 4 June 2024 (and released to ASX on 5 June 2024), and Significant Results From Historical Drill Hole Infill Assay Program at Belltopper dated 21 August 2024 (and released to ASX on 22 August 2024) which are available to view at www.asx.com.au. The Company confirms that it is not aware of any new information or data that materially affects the information in the original market announcements and that the form and context in which the Competent Person’s findings are presented have not been materially modified from the original market announcements.

DISCLAIMER

This Business Review constitutes a voluntary disclosure by the Company and is not a Quarterly Activities Report for the purposes of ASX Listing Rules 5.3 and 5.5 for which Novo has an exemption, as a foreign entity with its primary listing on an overseas exchange with a particular obligation imposed by the home exchange that is comparable to the ASX Listing Rule obligation.

FORWARD-LOOKING INFORMATION

Some statements in this news release contain forward-looking statements, including, without limitation, planned exploration and the expected timing of receipt of assay results. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the statements. Such factors include, without limitation, customary risks of the resource industry and the risk factors identified in Novo’s annual information form for the year ended December 31, 2023, which is available under Novo’s profile on SEDAR+ at www.sedarplus.ca and in the Company’s prospectus dated 2 August 2023 which is available at www.asx.com.au. Forward-looking statements speak only as of the date those statements are made. Except as required by applicable law, Novo assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the forward-looking statements. If Novo updates any forward-looking statement(s), no inference should be drawn that the Company will make additional updates with respect to those or other forward-looking statements.

ABOUT NOVO

Novo is an Australian based gold explorer listed on the ASX and the TSX focused on discovering standalone gold projects with > 1 Moz development potential. Novo is an innovative gold explorer with a significant land package covering approximately 5,500 square kilometres in the Pilbara region of Western Australia, along with the 22 square kilometre Belltopper project in the Bendigo Tectonic Zone of Victoria, Australia.

Novo’s key project area is the Egina Gold Camp, where De Grey Mining (ASX: DEG) is farming-in to form a JV at the Becher Project and surrounding tenements through exploration expenditure of A

Novo has also formed lithium joint ventures with both Liatam and SQM in the Pilbara which provides shareholder exposure to battery metals.

Novo has a significant investment portfolio and a disciplined program in place to identify value accretive opportunities that will build further value for shareholders.

Please refer to Novo’s website for further information including the latest Corporate Presentation.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/dce7a483-d98e-46b1-8822-6eba6e02fd52

An Exploration Target as defined in the JORC Code (2012) is a statement or estimate of the exploration potential of a mineral deposit in a defined geological setting where the statement or estimate, quoted as a range of tonnes and a range of grade (or quality), relates to mineralisation for which there has been insufficient exploration to estimate a Mineral Resource. Accordingly, these figures are not Mineral Resource or Ore Reserve estimates as defined in the JORC Code (2012). The potential quantities and grades referred to above are conceptual in nature and there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. These figures are based on the interpreted continuity of mineralisation and projection into unexplored ground often around historical workings. The Exploration Target has been prepared in accordance with the JORC Code (2012). The Tonnage range for the exploration target is 1.5Mt to 2.1Mt and the Grade range is 6.6g/t Au to 8.4g/t Au.

1 Refer to De Grey’s ASX Announcement, Hemi Gold Project Resource Update, dated 21 November 2023. No assurance can be given that a similar (or any) commercially viable mineral deposit will be determined at Novo’s Becher Project

2 Refer to announcement dated 21 August 2024 – Significant results from historical drill hole infill assay program at Belltopper.

3 Refer to announcement dated 25 September 2024 – Belltopper mineralisation modelling defines prospectivity.

4 Refer to announcement dated 29 August 2024 – Nunyerry North High-Grade Gold Zone extended and Egina Gold Camp exploration targets advanced.

5 Refer to announcement dated 10 October 2024 – De Grey reaches A

6 Refer to announcement dated 11 September 2024 – Evaluation of Pilbara Antimony-Gold potential generates positive results.

7 No assurance can be given that a similar (or any) commercially mineable deposit will be determined at Belltopper.

8 See the following for source documents in relation to the historical gold production figures for Bendigo, Fosterville, Costerfield, Castlemaine and Ballarat. Wilson, C. J. L., Moore, D. H., Vollgger, S. A., & Madeley, H. E. (2020). Structural evolution of the orogenic gold deposits in central Victoria, Australia: The role of regional stress change and the tectonic regime. Ore Geology Reviews, 120, 103390. Phillips, G. N., & Hughes, M. J. (1996). The geology and gold deposits of the Victorian gold province. Ore Geology Reviews, 11(5), 255-302. Costerfield Operation, Victoria, Australia, NI 43-101 Technical Report, March 2024; Agnico Eagle Mines Detailed Mineral Reserve and Mineral Resources Statement (as of December 31, 2023). Agnico Eagle Mines Limited. Fosterville Gold Mine. Retrieved August 21, 2024, from Agnico Eagle Website. For Comet and Sunday Creek exploration results, refer: Great Pacific Gold (TSXV:GPAC) Company TSXV release dated 11 January 2024, and Southern Cross Gold (ASX:SXG) Company ASX release dated 5 March 2024, respectively. Production figures for Bendigo, Castlemaine and Ballarat include combined alluvial and hard rock production. Gold endowment for Fosterville include historic production + reserves + resources as at 31/12/2023. Gold endowment for Costerfield equals historic production + resource (including reserves) as at 28/03/2024. Novo has not conducted data verification (as that term is defined in National Instrument 43-101 Standards of Disclosure for Mineral Projects and JORC 2012) in respect of the data set out in Figure 1 and therefore is not to be regarded as reporting, adopting or endorsing those results/figures. No assurance can be given that Novo will achieve similar results at Belltopper.