NMG Issues Positive Results of its Preliminary Economic Assessment for the Uatnan Mining Project – One of the World’s Largest Graphite Projects in Development with Indicative NPV in Excess of C$2 Billion

+ Preliminary economic assessment of the

+

+ Results indicate an after-tax IRR of

+

+ NMG has extended its vision of responsible mining to the

+ Shareholders and analysts are invited to attend an Investor Briefing today at

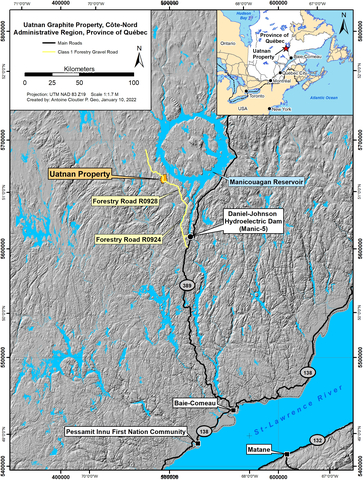

Location of the

The PEA, conducted by engineering firms

Arne H Frandsen, Chair of NMG, declared: “NMG’s vision is to become North America’s most important producer of battery grade graphite.

PEA Results: Uncovering the Potential of the

NMG and its consultants revisited all components of Mason Graphite’s original mining project to align the development of the Lac Guéret graphite deposit with today’s market opportunity and potential customers’ requirements. The most recent technical report from

The PEA optimizes the Mineral Resources and aims to expand the original mining project tenfold by targeting the production of approximately 500,000 tonnes of graphite concentrate per annum, entirely destined for the anode material manufacturing market. The concentrator has been relocated to be near the deposit with electrical needs that could be sourced from the Manic-5 hydroelectric power station, located 70 km away.

In line with NMG’s responsible mining approach, plans include progressive site closure with backfilling of the pit with waste rock as much as possible. Additional characterization of waste rock and tailings will be included in the next engineering phase to select proper tailings and waste rock management technologies. Existing baseline studies will be updated based on the study area to identify any environmental issues, evaluate potential impacts and develop alternatives for the

Commercial parameters were set using current projections of pricing prepared by a third-party expert for flake concentrate. Design of the

The following lists the economic highlights and operational parameters developed in the PEA. Graphite is expressed in graphitic carbon (“Cg”):

Table 1: Operational Parameters of the |

|

OPERATIONAL PARAMETERS |

|

LOM |

24 years |

Nominal annual processing rate |

3.4 M tonnes |

Stripping ratio (LOM) |

1.3:1 |

Average grade (LOM) |

|

Average graphite recovery |

|

Average annual graphite concentrate production (LOM) |

500,000 tonnes |

Finished product purity |

|

Cautionary Note: The PEA is preliminary in nature and includes Inferred Mineral Resources, considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral resources that are not mineral reserves have not demonstrated economic viability. Additional trenching and/or drilling will be required to convert inferred mineral resources to indicated or measured mineral resources. There is no certainty that the resources development, production, and economic forecasts on which this PEA is based will be realized.

Table 2: Economic Highlights of the |

|

ECONOMIC HIGHLIGHTS |

|

Pre-tax NPV ( |

|

After-tax NPV (8 % discount rate) |

|

Pre-tax IRR |

|

After-tax IRR |

|

Pre-tax payback |

2.8 years |

After-tax payback |

3.2 years |

Initial CAPEX |

|

Sustaining CAPEX |

|

LOM OPEX |

|

Annual OPEX |

|

OPEX per tonne of graphite concentrate |

|

Concentrate selling price |

|

All costs are in Canadian dollars with the exception of the graphite sale price which is provided in US dollars.

Capital expenditure (“CAPEX”) and operational expenditure (“OPEX”) were established from test work results, supplier quotations and consultant in-house databases. Estimates currently being at the market's peak as influenced by inflationary trends, NMG,

Considering the significant modifications to Mason Graphite’s original project, NMG initiated a name change with the collaboration of the Innu First Nation of Pessamit. The deposit is located on the Nitassinan, the Innu of Pessamit’s ancestral territory, in a sector referred to as Ka uatshinakanishkat meaning “where there is Tamarack”. Hence, the name Uatnan meaning Tamarack, a conifer prominent in the area, was chosen to identify the property and project. The graphite deposit identified on the property is still referred to as the Lac Guéret deposit.

Initial modelling indicates that the

The Property

The Uatnan property presently consists of 74 map-designated claims totalling 3,999.52 hectares (“ha”), wholly owned (

Exploration work on the Uatnan property targeted graphite mineralization and consists to date of airborne geophysics, prospecting, ground geophysics, trenching/channel sampling and core drilling. Bulk surface samples and core samples were also collected for metallurgical and geomechanical tests. Exploration work uncovered significant crystalline flake graphite mineralization, ultimately leading to the identification of Mineral Resources and Mineral Reserves (see Mason Graphite’s press release dated

On

Mineral Resources

Current Mineral Resources (Table 3) have been estimated for the Uatnan property based on 25,956 assay intervals collected from 43,343.1 m of core drilling and 4 surface trenches providing 207 channel samples totalling 721.7 m. Proper quality control measures, including the insertion of duplicate, blank and standard samples, were used throughout the exploration programs and returned within acceptable limits. Although parameters to determine reasonable prospects for eventual economic extraction (RPEE) were updated (Table 4), there are no significant changes between the current Mineral Resources and the Mineral Resources last published on

Table 3: Current Pit-Constrained Mineral Resource Estimate |

|||

IN-PIT CONSTRAINED MINERAL

|

Tonnes (Mt) |

Grade (% Cg) |

Cg (Mt) |

Measured |

15.65 |

15.2 |

2.38 |

Measured Cg > |

3.35 |

30.6 |

1.02 |

Total Measured |

19.02 |

17.9 |

3.40 |

Indicated |

40.29 |

14.6 |

5.89 |

Indicated Cg > |

6.33 |

31.6 |

2.00 |

Total Indicated |

46.62 |

16.9 |

7.89 |

Indicated + Measured |

55.94 |

14.8 |

8.27 |

Indicated + Measured Cg > |

9.70 |

31.2 |

3.03 |

Total Measured + Indicated |

65.64 |

17.2 |

11.30 |

Inferred |

15.35 |

14.9 |

2.28 |

Inferred Cg > |

2.47 |

31.8 |

0.79 |

Total Inferred |

17.82 |

17.2 |

3.07 |

Notes :

-

The Mineral Resources provided in this table were estimated byM. Rachidi P.Geo ., and C. Duplessis, Eng., (QPs) ofGoldMinds Geoservices Inc. , using currentCanadian Institute of Mining , Metallurgy and Petroleum (CIM) Standards on Mineral Resources and Reserves, Definitions and Guidelines. - Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, market or other relevant issues. The quantity and grade of reported Inferred Mineral Resources are uncertain in nature and there has not been sufficient work to define these Inferred Mineral Resources as indicated or Measured Mineral Resources. There is no certainty that any part of a Mineral Resource will ever be converted into Mineral Reserves.

-

The Mineral Resources presented here were estimated with a block size of 3mE x 3mN x 3mZ. The blocks were interpolated from equal-length composites (3 m) calculated from the mineralized intervals. - The Mineral Resource estimate was completed using the inverse distance to the square methodology utilizing three runs. For run 1, the number of composites was limited to ten with a maximum of two composites from the same drillhole. For runs two and three the number of composites was limited to ten with a maximum of one composite from the same drillhole.

- The Measured Mineral Resources classified using a minimum of four drillholes. Indicated resources classified using a minimum of two drillholes. The Inferred Mineral Resources were classified by a minimum of one drillholes.

- Tonnage estimates are based on a fixed density of 2.9 t/m3.

-

A pit shell to constrain the Mineral Resources was developed using the parameters presented in Table 4 . The effective date of the current Mineral Resources is

January 10, 2023 . -

Mineral Resources are stated at a cut-off grade of

5.75% C(g).

Table 4: Parameters used to develop the pit shell to constrain the Mineral Resources |

|

PARAMETERS |

Value |

Mining cost |

|

Processing cost |

|

Tailings management cost |

|

G&A cost |

|

Mill recovery |

|

Concentrate grade |

|

Concentrate price |

|

Production rate |

3.4 Mtpa |

Overall pit slope |

|

Mining

The mining method selected for the

To minimize the environmental footprint of the

Table 5: Subset of Mineral Resources within the Pit Design for the PEA |

|||

DESCRIPTION |

Tonnes

|

Cg Grade

|

In-Situ Graphite

|

Measured resources |

18.7 |

17.9 |

3.3 |

Indicated resources |

43.5 |

17.1 |

7.4 |

Total M&I resources |

62.2 |

17.3 |

10.8 |

Inferred resources |

14.2 |

18.0 |

2.6 |

Overburden & waste rock |

102.6 |

|

|

The mine would be operated by an owner fleet, seven days per week, 24 hours per day and be comprised of a four‑crew system working on a two-week in, two-week out rotation. NMG intends to deploy a zero-emission operating strategy with a battery-powered fleet of haul trucks and electric equipment as the technology becomes available. In the meantime, the PEA used a base case with a diesel-operated fleet.

Processing & Recovery

The process flow sheet was developed using the same metallurgical basis used for Mason Graphite’s updated Feasibility Study issued on

The flowsheet consists of a mineral sizer to reduce the size of the run of mine (“ROM”) mineral before it is fed to a SAG mill for primary grinding. The ground mineral then undergoes rougher flotation, after which the reground and scavenged concentrate is combined with the rougher concentrate for further processing. The concentrate then undergoes two additional stages of regrinding, first in a ball mill ahead of the first cleaning step, then a second regrind in a tower mill ahead of secondary cleaning. The resulting concentrate undergoes a final deliming stage to remove low-grade minus 20-micron particles to maximize the final concentrate grade. The concentrator tailings are filtered and delivered to the tailings storage facility. The concentrate is filtered and dried before being trucked 285 km to

Economic Evaluation

The CAPEX, summarized below, covers the development of the mine, processing facilities, and infrastructure required for the

Table 6: Summary of Uatnan Mining Project CAPEX Costs |

|

SECTOR |

LOM CAPEX ($M) |

Mining |

61 |

Site infrastructure |

55 |

Offsite infrastructure |

184 |

Water treatment and tailings |

118 |

Ore crushing and process plant |

548 |

Indirect |

319 |

Contingency |

279 |

TOTAL CAPEX |

1,564 |

Initial CAPEX |

1,417 |

Sustaining CAPEX |

147 |

Table 7: Summary of Main Uatnan Mining Project OPEX Costs |

||

SECTOR |

LOM OPEX Cost ($M) |

C$/t Conc. |

Mining and tailings |

917 |

76 |

Processing |

1,620 |

134 |

Water management |

134 |

11 |

G&A |

565 |

47 |

TOTAL |

3,236 |

268 |

Next Steps and Quality Assurance

The PEA shows that the

On the basis of these positive results, NMG intends to launch an updated feasibility study in compliance with the option and joint venture agreement signed with

NMG is committed to extending its approach of open and proactive engagement with Indigenous Peoples and local stakeholders to the

Shareholders and analysts are invited to attend a webcast Investor Briefing this morning,

There is no certainty that the economic forecasts on which this PEA is based will be realized. The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA will be realized. Mineral Resources that are not Mineral Reserves have not demonstrated economic viability. Additional trenching and/or drilling will be required to convert Inferred Mineral Resources to Indicated or Measured Mineral Resources. There is no certainty that the resources development, production, and economic forecasts on which this PEA is based will be realized. There are a number of risks and uncertainties identifiable to any new project and usually cover the mineralization, mineral processing, financial, environmental and permitting aspects. NMG’s Phase-3 is no different, and an evaluation of the possible risks was undertaken as part of the PEA.

Scientific and technical information presented in this press release was reviewed and approved by

The PEA for the

About

About

Subscribe to our news feed: https://bit.ly/3UDrY3X

Cautionary Note

All statements, other than statements of historical fact, contained in this press release including, but not limited to those describing the impact of the foregoing on the

Forward-looking statements are subject to known or unknown risks and uncertainties that may cause actual results to differ materially from those anticipated or implied in the forward-looking statements. Risk factors that could cause actual results or events to differ materially from current expectations include, among others, those risks which are discussed under the “Next Steps and Quality Assurance” paragraph, delays in the scheduled delivery times of the equipment, the ability of the Company to successfully implement its strategic initiatives and whether such strategic initiatives will yield the expected benefits, the availability of financing or financing on favorable terms for the Company, the dependence on commodity prices, the impact of inflation on costs, the risks of obtaining the necessary permits, the operating performance of the Company’s assets and businesses, competitive factors in the graphite mining and production industry, changes in laws and regulations affecting the Company’s businesses, political and social acceptability risk, environmental regulation risk, currency and exchange rate risk, technological developments, the impacts of the global COVID-19 pandemic and the governments’ responses thereto, and general economic conditions, as well as earnings, capital expenditure, cash flow and capital structure risks and general business risks. A further description of risks and uncertainties can be found in NMG’s Annual Information Form dated

Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are provided for the purpose of providing information about management’s expectations and plans relating to the future. The Company disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.

The market and industry data contained in this press release is based upon information from independent industry publications, market research, analyst reports and surveys and other publicly available sources. Although the Company believes these sources to be generally reliable, market and industry data is subject to interpretation and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data-gathering process and other limitations and uncertainties inherent in any survey. The Company has not independently verified any of the data from third-party sources referred to in this press release and accordingly, the accuracy and completeness of such data is not guaranteed.

Disclosures regarding Mineral Resource estimates included in this press release were prepared in accordance with Canadian NI 43-101. The disclosures included in this press release use the terms “Feasibility Study,” “Mineral Resource,” “Inferred Mineral Resource,” “Indicated Mineral Resource,” “Measured Mineral Resource,” in connection with the presentation of resources, as each of these terms is defined in accordance with the CIM Definition Standards on Mineral Resources and Reserves adopted by the

NI 43-101 is a rule developed by the Canadian Securities Administrators that establish the Canadian standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. These standards differ from the requirements of the

Neither the

Further information regarding the Company is available in the SEDAR database (www.sedar.com), and for

View source version on businesswire.com: https://www.businesswire.com/news/home/20230110005458/en/

MEDIA

VP Communications & ESG Strategy

+1-450-757-8905 #140

jpaquet@nmg.com

INVESTORS

Director, Investor Relations

+1-450-757-8905 #993

mjasmin@nmg.com

Source: