New Found Reports Positive Phase 1 Metallurgical Test Results Demonstrating 90% to 96% Gold Extraction at Queensway

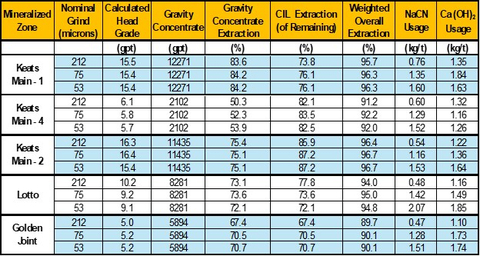

Table 1. Weighted Average Gravity Leach Test Results. (Graphic: Business Wire)

Highlights:

- Phase I metallurgical testing commenced in 2023 and focused on three mineralized zones – Keats Main, Golden Joint, and Lotto. A total of 116 Variability Composites were generated from approximately 1,000 metres of drill core with a combined weight of 3,400 kilograms, from which three Master Composites were assembled.

-

Weighted average gold extraction on all 116 Variability Composite samples, broken out by the five cross sections shown in Figures 1-6, range from

90% to96% . Gold extractions were achieved using both gravity separation and conventional carbon-in-leach (CIL) on the gravity tails. - Gold extraction across the three zones tested in Phase I demonstrates similar metallurgical characteristics and achieved similar extractions from both gravity and CIL.

-

The Company is currently undertaking a Phase II metallurgical testing program focused on Iceberg and Iceberg East with composites having been selected for shipment to Base Metallurgical Laboratory Ltd. in

Kamloops, BC , and testing is set to begin in Q2 2024. - Metallurgical test work at Queensway has been designed and supervised by Gary Simmons (MMSA QP Number: 01013QP) as an independent consultant. Mr. Simmons is an internationally recognized metallurgist who previously served as Director of Metallurgy and Technology of Newmont Mining Corporation, where he managed the corporate metallurgical laboratory R&D staff and a number of Process Engineers responsible for global Newmont process development and design engineering.

Mr. Simmons commented, “The Phase I geo-metallurgical characterization and test work program results confirm the high-grade nature of the project and our high gold extraction expectations for Keats Main, Lotto and Golden Joint vein systems. The program further demonstrates that conventional gravity separation and CIL are well-suited recovery methods for gold mineralization at Queensway. Additional flowsheet development work is ongoing to determine if marginal improvements in gold extraction can be achieved.”

Ron

Additional Details

Phase I scope of work consisted of chemical and mineralogical analyses, environmental characterization, establishment of comminution parameters, gold extraction methods, reagent consumption, cyanide detoxification, and solid-liquid separation properties for process and tailings streams.

Results, summarized in Table 1, which include all 116 variability composites, indicate that mineralized zones are generally high-grade and contain significant free-milling gold, which is amenable to both gravity and CIL leach extraction. Free gold grains greater than 150 microns in size were observed predominantly in the quartz veins located throughout the zones. Weighted average gold extraction for all targeted mineralized zones ranged from

Comminution test work indicated that the tested material had an average SMC Axb index of approximately 62 and an average Bond Work Index (BWI) of approximately 17.5 kWh/t, which would be considered a medium hard ore for SAG milling and medium hard ore for ball milling.

Laboratory test work was carried out by Base Metallurgical Laboratory Ltd. in

At-The-Market Quarterly Update

The Company is pleased to provide a quarterly update with respect to the Company’s at-the-market equity offering program (the “ATM”) implemented on August 26, 2022, pursuant to an equity distribution agreement (the “Equity Distribution Agreement”) with BMO Nesbitt Burns Inc., Paradigm Capital Inc. (together, the “Canadian Agents”) and BMO Capital Markets Corp. (the “

From the commencement of the ATM to March 31, 2024, the Company issued an aggregate of 6,614,143 common shares in the capital of the Company (the “ATM Shares”), through the facilities of the TSX Venture Exchange and NYSE American, at an average price per ATM Share of

This press release shall not constitute an offer to sell or a solicitation of an offer to buy, nor will there be any sale of these securities in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Receipt of Audit Opinion with Going Concern Qualification

Pursuant to the disclosure requirements of the NYSE American Company Guidelines Sections 401(h) and 610(b), New Found is reporting that its audited financial statements for the fiscal year ended December 31, 2023, included in New Found’s Annual Report on Form 40-F filed with the Securities and Exchange Commission on March 21, 2024, contain an audit opinion from its independent registered public accounting firm that includes an explanatory paragraph related to New Found’s ability to continue as a going concern. This announcement does not represent any change or amendment to the Company's financial statements or to its Annual Report on Form 40-F for the fiscal year ended December 31, 2023.

Qualified Person

The scientific and technical information disclosed in this press release was reviewed and approved by Greg Matheson, P. Geo., Chief Operating Officer, and a Qualified Person as defined under National Instrument 43-101. Mr.

About New Found Gold Corp.

New Found holds a

Please see the Company’s website at www.newfoundgold.ca and the Company’s SEDAR+ profile at www.sedarplus.ca.

Acknowledgements

New Found acknowledges the financial support of the Junior Exploration Assistance Program, Department of Natural Resources, Government of

Contact

To contact the Company, please visit the Company’s website, www.newfoundgold.ca and make your request through our investor inquiry form. Our management has a pledge to be in touch with any investor inquiries within 24 hours.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement Cautions

This press release contains certain “forward-looking statements” within the meaning of Canadian securities legislation, relating to exploration, drilling and mineralization on the Company’s Queensway gold project in

View source version on businesswire.com: https://www.businesswire.com/news/home/20240403658266/en/

New Found Gold Corp.

Per: “Collin Kettell”

Collin Kettell, Chief Executive Officer

Email: ckettell@newfoundgold.ca

Phone: +1 (845) 535-1486

Source: New Found Gold Corp.