Nasdaq Announces Mid-Month Open Short Interest Positions in Nasdaq Stocks as of Settlement Date November 15, 2024

Rhea-AI Summary

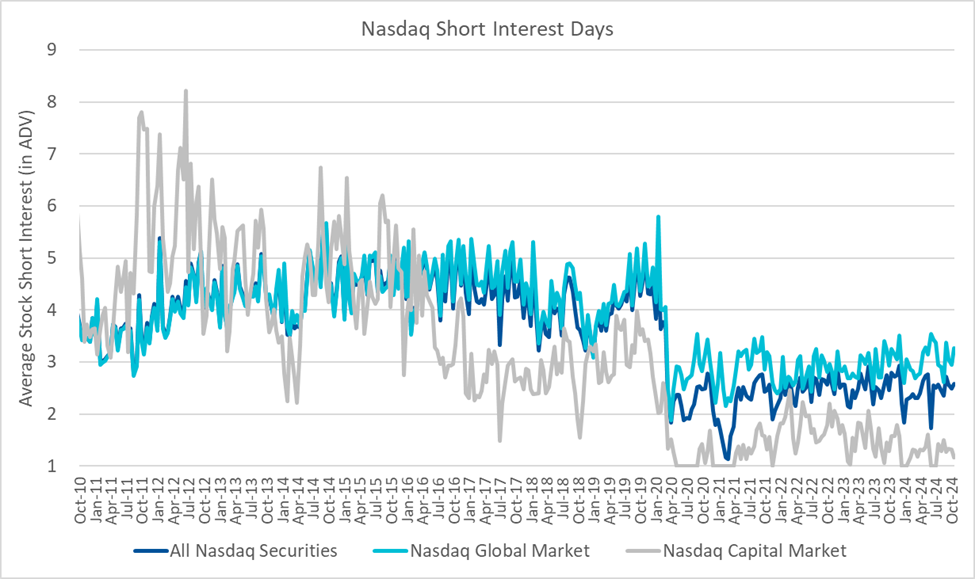

Nasdaq reported short interest positions for the settlement date of November 15, 2024. In Nasdaq Global Market securities, short interest totaled 11.97 billion shares across 3,070 securities, down from 12.17 billion shares in 3,083 issues on October 31. The mid-November short interest represents 2.25 days compared to 3.02 days previously.

For Nasdaq Capital Market securities, short interest was 2.04 billion shares in 1,668 securities, decreasing from 2.13 billion shares in 1,664 securities. Overall, total short interest across all 4,738 Nasdaq securities was 14.02 billion shares, down from 14.30 billion shares, with average daily volume dropping to 1.83 days from 2.36 days.

Positive

- None.

Negative

- None.

News Market Reaction 1 Alert

On the day this news was published, NDAQ gained 0.48%, reflecting a mild positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

NEW YORK, Nov. 26, 2024 (GLOBE NEWSWIRE) -- At the end of the settlement date of November 15, 2024, short interest in 3,070 Nasdaq Global MarketSM securities totaled 11,973,515,318 shares compared with 12,172,949,545 shares in 3,083 Global Market issues reported for the prior settlement date of October 31, 2024. The mid-November short interest represents 2.25 days compared with 3.02 days for the prior reporting period.

Short interest in 1,668 securities on The Nasdaq Capital MarketSM totaled 2,044,997,906 shares at the end of the settlement date of November 15, 2024, compared with 2,128,624,815 shares in 1,664 securities for the previous reporting period. This represents a 1.00 day average daily volume; the previous reporting period’s figure was 1.05

In summary, short interest in all 4,738 Nasdaq® securities totaled 14,018,513,224 shares at the November 15, 2024 settlement date, compared with 4,747 issues and 14,301,574,360 shares at the end of the previous reporting period. This is 1.83 days average daily volume, compared with an average of 2.36 days for the prior reporting period.

The open short interest positions reported for each Nasdaq security reflect the total number of shares sold short by all broker/dealers regardless of their exchange affiliations. A short sale is generally understood to mean the sale of a security that the seller does not own or any sale that is consummated by the delivery of a security borrowed by or for the account of the seller.

For more information on Nasdaq Short interest positions, including publication dates, visit http://www.nasdaq.com/quotes/short-interest.aspx or http://www.nasdaqtrader.com/asp/short_interest.asp.

About Nasdaq:

Nasdaq (Nasdaq: NDAQ) is a leading global technology company serving corporate clients, investment managers, banks, brokers, and exchange operators as they navigate and interact with the global capital markets and the broader financial system. We aspire to deliver world-leading platforms that improve the liquidity, transparency, and integrity of the global economy. Our diverse offering of data, analytics, software, exchange capabilities, and client-centric services enables clients to optimize and execute their business vision with confidence. To learn more about the company, technology solutions, and career opportunities, visit us on LinkedIn, on X @Nasdaq, or at www.nasdaq.com.

Media Contact:

Jennifer Lawson

jennifer.lawson@nasdaq.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/f227accd-cd52-4299-9a83-e3bcaa7a247c

NDAQO