NioCorp Plans to Produce Made-in-USA Scandium Master Alloy to Supply Lightweight Parts to Vehicles

- NioCorp plans to develop aluminum-scandium vehicle parts that are stronger, lighter, higher-performing, and fully recyclable. EV/Hybrid sales forecasts predict tens of millions of units globally by 2030. NioCorp aims to become one of the largest producers of Al-Sc MA in the world. The growth in EV and hybrid vehicle sales and demand from the defense sector are expected to drive demand for scandium.

- None.

NioCorp Now Working With Automakers To Develop Aluminum-Scandium Vehicle Parts That Are Stronger, Lighter, Higher-Performing, and Fully Recyclable

Prototype Aluminum-Scandium Alloy Parts Have Dual Uses in Commercial and Military Applications

EV/Hybrid Sales Forecasts Predict Tens of Millions of Units Globally By 20301, Underscoring the Importance of Bringing New Sources of Non-Chinese and Non-Russian Scandium Supply Online, NioCorp Says

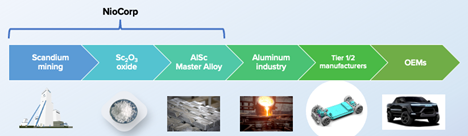

CENTENNIAL, CO / ACCESSWIRE / September 28, 2023 / NioCorp Developments Ltd. ("NioCorp" or the "Company") (NASDAQ:NB)(TSX:NB) plans to make aluminum-scandium master alloy product ("Al-Sc MA") from mining and upgrade facilities to be located in the U.S., subject to, among other matters, receipt of project financing and consummation of mining operations at the Elk Creek Project, which could enable commercial and defense manufacturers to replace select existing aluminum parts in vehicles. Aluminum alloys containing scandium offer high-strength, corrosion-resistant, weldable alternatives to existing aluminum options and deliver significant property improvements and light-weighting opportunities, particularly in transportation applications. Military and strategic applications are expected to be significant as well.

Scandium is one of several strategic metal products that NioCorp plans to make from its Elk Creek Critical Minerals Project (the "Project") in Nebraska, USA, contingent on, among other matters, obtaining sufficient project financing. Once in commercial operation, the scandium component from this mine could potentially position NioCorp as one of the largest producers of Al-Sc MA in the world. Still, more scandium production would need to come online in both North America and Europe, if more than a small handful of manufacturers are to benefit from these high-performance aluminum alloy variants.

"Our planned scandium oxide and master alloy production could be large enough to enable manufacturers to supply aluminum-scandium alloy parts to electric and/or conventional vehicles. As recent forecasts from Morningstar1 and others predict, EV and hybrid sales are expected to grow into the tens of millions per year over the next decade and longer," according to NioCorp's CEO and Executive Chairman Mark Smith. "This is one of the reasons the U.S. Government designated scandium as a critical mineral for the U.S. economy and national security and underscores the importance of getting multiple new, reliable sources of scandium supply for North America online as rapidly as possible." As an example, Mr. Smith pointed to a recent Morningstar forecast estimating that EV and hybrid vehicle sales, combined, could hit approximately 60 million units by 2030.

"Beyond the growth forecast for electric and hybrid vehicle sales, we anticipate additional demand coming from the defense sector, given scandium's ability to lightweight, strengthen, and improve corrosion resistance to land, air, space, and sea-based systems," Mr. Smith added.

NIOCORP'S PHASED COMMERCIAL DEVELOPMENT OF AL-SC MASTER ALLOY PRODUCTION

At the recent HC Wainwright Global Investor Conference in New York City, Mr. Smith discussed these trends, as well as the Company's recently launched phased approach to commercial-scale production in the U.S. of Al-Sc MA. A video replay of Mr. Smith's presentation can be seen here: https://youtu.be/MwWQTQv0jpo.

The traditional method of introducing scandium into Al-Sc alloys is via a master alloy containing

"Our pilot-scale demonstration plant has produced scandium metal and is expected to produce test aluminum-scandium master alloy ingots, with a goal of producing 1-kilogram ingots at pilot scale," said Mr. Smith. "Our next step is to produce master alloy at the Commercial Demonstration level, scaling from 10 kg ingots to 100 kg ingots. Finally, once we secure sufficient financing to move to construction and eventual commercial operation, among other matters, we intend to move to full-scale production of master alloy."

Qualified Persons:

Scott Honan, M.Sc., SME-RM, COO of NioCorp Developments Ltd., a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information and verified the data contained in this news release.

# # #

FOR MORE INFORMATION:

Jim Sims, Corporate Communications Officer, NioCorp Developments Ltd., (720) 334-7066, jim.sims@niocorp.com

ABOUT NIOCORP

NioCorp is developing a critical minerals project in Southeast Nebraska that will produce niobium, scandium, and titanium. The Company also is evaluating the potential to produce several rare earths from the Project. Niobium is used to produce specialty alloys as well as High Strength, Low Alloy ("HSLA") steel, which is a lighter, stronger steel used in automotive, structural, and pipeline applications. Scandium is a specialty metal that can be combined with aluminum to make alloys with increased strength and improved corrosion resistance. Scandium is also a critical component of advanced solid oxide fuel cells. Titanium is used in various lightweight alloys and is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications, armor, and medical implants. Magnetic rare earths, such as neodymium, praseodymium, terbium, and dysprosium are critical to the making of Neodymium-Iron-Boron ("NdFeB") magnets, which are used across a wide variety of defense and civilian applications.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements may include, but are not limited to, statements about NioCorp's expectation and ability to mine ore from the Elk Creek Project, NioCorp launching a phased approach to eventual commercial production of Al-Sc master alloy, the results of the Nanoscale technology at pilot scale and its impact on potential future production levels and efficiency, NioCorp's plans to produce scandium oxide and Al-Sc master alloy and the anticipated production levels of same, market demand for scandium and scandium alloys, the US' ability to emerge as a leading scandium producer, NioCorp's ability to obtain sufficient project financing to launch construction of the Elk Creek Project and move it to commercial production, and NioCorp's expectation and ability to produce niobium, scandium, and titanium at the Elk Creek Project. Forward-looking statements are typically identified by words such as "plan," "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of NioCorp and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. Such expectations and assumptions are inherently subject to uncertainties and contingencies regarding future events and, as such, are subject to change. Forward-looking statements involve a number of risks, uncertainties or other factors that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made by NioCorp with the SEC and with the applicable Canadian securities regulatory authorities and the following: the success of the Nanoscale technology at pilot scale and its impact on NioCorp's potential production of Al-Sc master alloy; NioCorp's ability to recognize the anticipated benefits of the business combination with GX Acquisition Corp. II (the "Business Combination") and the standby equity purchase agreement (the "Yorkville Equity Facility Financing Agreement" and, together with the Business Combination, the "Transactions") with YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, LP, including NioCorp's ability to access the full amount of the expected net proceeds under the Yorkville Equity Facility Financing Agreement over the next three years; unexpected costs related to the Transactions; the outcome of any legal proceedings that may be instituted against NioCorp following closing of the Transactions; NioCorp's ability to receive a final commitment of financing from the Export-Import Bank of the United States on the anticipated timeline, on acceptable terms, or at all; NioCorp's ability to continue to meet the listing standards of The Nasdaq Stock Market LLC; NioCorp's ability to operate as a going concern; risks relating to NioCorp's common shares, including price volatility, lack of dividend payments and dilution or the perception of the likelihood any of the foregoing; NioCorp's requirement of significant additional capital; the extent to which NioCorp's level of indebtedness and/or the terms contained in agreements governing NioCorp's indebtedness or the Yorkville Equity Facility Financing Agreement may impair NioCorp's ability to obtain additional financing; covenants contained in agreements with NioCorp's secured creditors that may affect its assets; NioCorp's limited operating history; NioCorp's history of losses; the restatement of NioCorp's consolidated financial statements as of and for the fiscal years ended June 30, 2022 and 2021 and the interim periods ended September 30, 2021, December 31, 2021, March 31, 2022, September 30, 2022, and December 31, 2022 and the impact of such restatement on NioCorp's future financial statements and other financial measures; the material weakness in NioCorp's internal control over financial reporting, NioCorp's efforts to remediate such material weakness and the timing of remediation; the possibility that NioCorp may qualify as a passive foreign investment company under the U.S. Internal Revenue Code of 1986, as amended (the "Code"); the potential that the Transactions could result in NioCorp becoming subject to materially adverse U.S. federal income tax consequences as a result of the application of Section 7874 and related sections of the Code; cost increases for NioCorp's exploration and, if warranted, development projects; a disruption in, or failure of, NioCorp's information technology systems, including those related to cybersecurity; equipment and supply shortages; current and future offtake agreements, joint ventures, and partnerships; NioCorp's ability to attract qualified management; the effects of global health crises on NioCorp's business plans, financial condition and liquidity; estimates of mineral resources and reserves; mineral exploration and production activities; feasibility study results; the results of metallurgical testing; changes in demand for and price of commodities (such as fuel and electricity) and currencies; competition in the mining industry; changes or disruptions in the securities markets; legislative, political or economic developments, including changes in federal and/or state laws that may significantly affect the mining industry; the impacts of climate change, as well as actions taken or required by governments related to strengthening resilience in the face of potential impacts from climate change; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the timing and reliability of sampling and assay data; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of NioCorp's projects; risks of accidents, equipment breakdowns, and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining, or development activities; the management of the water balance at the Elk Creek Project site; land reclamation requirements related to the Elk Creek Project; the speculative nature of mineral exploration and development, including the risks of diminishing quantities of grades of reserves and resources; claims on the title to NioCorp's properties; potential future litigation; and NioCorp's lack of insurance covering all of NioCorp's operations.

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of NioCorp prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning the matters addressed herein and attributable to NioCorp or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Except to the extent required by applicable law or regulation, NioCorp undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events.

---

1Morningstar Forecast, Sept 2023.

SOURCE: NioCorp Developments Ltd.

View source version on accesswire.com:

https://www.accesswire.com/788211/niocorp-plans-to-produce-made-in-usa-scandium-master-alloy-to-supply-lightweight-parts-to-vehicles