NioCorp Demonstrates the Ability to Potentially Double Projected Titanium Recovery Rates for the Elk Creek Project

Demonstration Plant Shows New Recovery Process May Double NioCorp's Titanium Production per Tonne of Ore as well as Produce a Higher Purity Product that May Command Higher Market Prices

CENTENNIAL, CO / ACCESSWIRE / May 26, 2023 / NioCorp Developments Ltd. ("NioCorp" or the "Company") (NASDAQ:NB)(TSX:NB) is pleased to announce that it has successfully demonstrated an ability to potentially double the recovery of titanium from each tonne of ore the Company expects to mine at its Nebraska-based Elk Creek Critical Minerals Project (the "Project"), once project financing is obtained and the commercial plant is constructed. The new process is expected to produce a purer form of titanium that may command a higher price than is assumed in NioCorp's June 2022 feasibility study for the Project (the "Feasibility Study").

NioCorp's demonstration plant in Trois Rivieres, Quebec, has shown that the Company's new and improved recovery process can likely achieve an

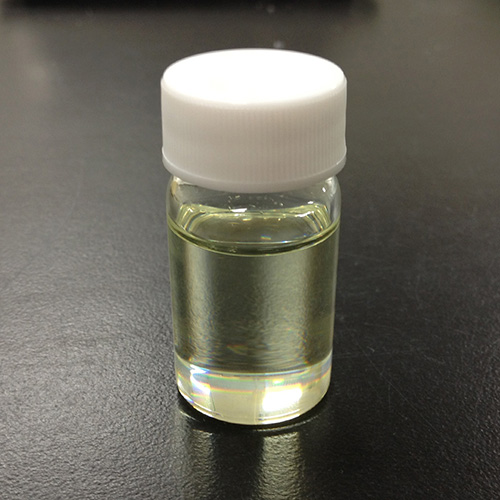

NioCorp's current Feasibility Study shows the Project producing approximately 431,793 tonnes of titanium dioxide. The titanium produced by NioCorp's new process is in the form of titanium tetrachloride ("TiCl4"), known in commercial markets as "tickle." This is a purer form of titanium than the synthetic rutile, and generally commands a higher market price. TiCl4 is an input for the production of high-purity titanium oxides and compounds, which are used primarily in the manufacture of white pigments, and titanium metal and aerospace-grade titanium alloys.

Final determination of planned titanium production can be made only after work related to a mineral reserve update, additional engineering, updated project capital and operating cost estimates, and other required information is produced for publication in a new feasibility study.

Growing Demand for Titanium Metal and Alloys in the U.S. and the West

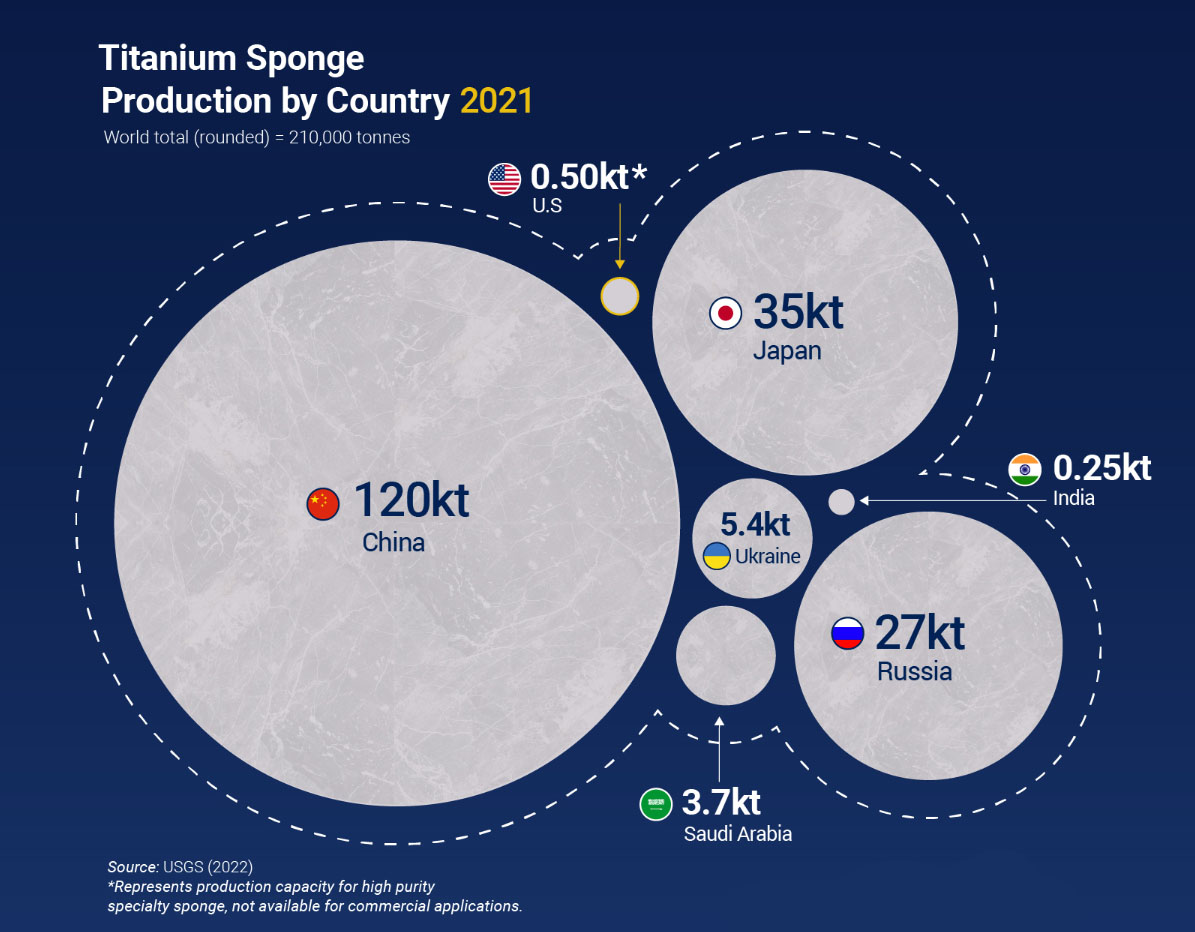

Demand and pricing for titanium metal and associated alloys has increased in recent years, and the U.S. is more than

More Streamlined Production Process Demonstrated

NioCorp's new process has been demonstrated to be more efficient than the previous design, is expected to require fewer processing steps, and may allow the elimination of entire processes in NioCorp's planned processing plant in Nebraska, such as acid regeneration.

"In demonstrating our ability to potentially make higher-purity titanium in multiple forms, and in potentially higher volumes, we open up a range of new and exciting possibilities for the business, including potentially emerging as a key supplier of titanium to several industries of importance to U.S. national defense and commercial markets," said Mark A. Smith, CEO and Executive Chairman of NioCorp. "The increasing value of potential titanium production in the Elk Creek Project is a direct result of our new processing design and the careful testing of that system at the demonstration plant level. This is one of the reasons why we have focused so intently on getting this process right and demonstrating its technical feasibility."

"A lot of work has gone into testing and validating this new processing approach, and while we are seeing the results that we expected, it is very gratifying to have those results validated at the demonstration plant level," said Scott Honan, Chief Operating Officer of NioCorp. "For the U.S. and many Western nations, supply chain risk for titanium has become an increasing concern for both industry and defense markets. We look forward to NioCorp helping to contribute to a more reliable and domestic titanium supply chain from our potential production in Nebraska."

Qualified Persons:

Eric Larochelle, B.Eng., Co-Owner, L3 Process Development, a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information, and verified the data, contained in this news release.

Scott Honan, M.Sc., SME-RM, COO of NioCorp Developments Ltd., a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical information contained in the news release.

# # #

FOR MORE INFORMATION:

Jim Sims, Corporate Communications Officer, NioCorp Developments Ltd., (720) 334-7066, jim.sims@niocorp.com

@NioCorp $NB $NB.TO #niobium #scandium #titanium #rareearths #neodymium #praseodymium #dysprosium #terbium

ABOUT NIOCORP

NioCorp is developing a critical minerals project in Southeast Nebraska that will produce niobium, scandium, and titanium. The Company also is evaluating the potential to produce several rare earths from the Project. Niobium is used to produce specialty alloys as well as High Strength, Low Alloy ("HSLA") steel, which is a lighter, stronger steel used in automotive, structural, and pipeline applications. Scandium is a specialty metal that can be combined with Aluminum to make alloys with increased strength and improved corrosion resistance. Scandium is also a critical component of advanced solid oxide fuel cells. Titanium is used in various lightweight alloys and is a key component of pigments used in paper, paint and plastics and is also used for aerospace applications, armor, and medical implants. Magnetic rare earths, such as neodymium, praseodymium, terbium, and dysprosium are critical to the making of Neodymium-Iron-Boron ("NdFeB") magnets, which are used across a wide variety of defense and civilian applications.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements may include, but are not limited to, statements about NioCorp's expectation and ability to mine ore from the Elk Creek Project, NioCorp's expectations regarding overall recovery of TiCl4, the likelihood of higher titanium production levels from NioCorp from the same mining tonnage based on the results of the new recovery process at the demonstration plant, NioCorp's plans to produce and supply titanium products and market demand for titanium products, NioCorp's expectation and ability to produce niobium, scandium, and titanium at the Elk Creek Project, the efficacy of the new production process, and NioCorp's ability to obtain sufficient project financing to launch contruction of the Elk Creek Project and move it to commercial operation. Forward-looking statements are typically identified by words such as "plan," "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "continue," "could," "may," "might," "possible," "potential," "predict," "should," "would" and other similar words and expressions, but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of NioCorp and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of such statement. There can be no assurance that future developments will be those that have been anticipated. Forward-looking statements reflect material expectations and assumptions, including, without limitation, expectations, and assumptions relating to: the translatability of the demonstration-scale process to recover titanium from ore to the ore that NioCorp expects to extract from the Elk Creek Project. Such expectations and assumptions are inherently subject to uncertainties and contingencies regarding future events and, as such, are subject to change. Forward-looking statements involve a number of risks, uncertainties or other factors that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those discussed and identified in public filings made by NioCorp with the SEC and with the applicable Canadian securities regulatory authorities and the following: NioCorp's ability to recognize the anticipated benefits of the business combination with GX Acquisition Corp. II (the "Business Combination") and the standby equity purchase agreement (the "Yorkville Equity Facility Financing Agreement" and, together with the Business Combination, the "Transactions") with YA II PN, Ltd., an investment fund managed by Yorkville Advisors Global, LP, including NioCorp's ability to access the full amount of the expected net proceeds under the Yorkville Equity Facility Financing Agreement over the next three years; unexpected costs related to the Transactions; the outcome of any legal proceedings that may be instituted against NioCorp following closing of the Transactions; NioCorp's ability to receive a final commitment of financing from the Export-Import Bank of the United States on the anticipated timeline, on acceptable terms, or at all; NioCorp's ability to continue to meet the listing standards of The Nasdaq Stock Market LLC; NioCorp's ability to operate as a going concern; risks relating to NioCorp's common shares, including price volatility, lack of dividend payments and dilution or the perception of the likelihood any of the foregoing; NioCorp's requirement of significant additional capital; the extent to which NioCorp's level of indebtedness and/or the terms contained in agreements governing NioCorp's indebtedness or the Yorkville Equity Facility Financing Agreement may impair NioCorp's ability to obtain additional financing; covenants contained in agreements with NioCorp's secured creditors that may affect its assets; NioCorp's limited operating history; NioCorp's history of losses; the restatement of NioCorp's consolidated financial statements as of and for the fiscal years ended June 30, 2022 and 2021 and the interim periods ended September 30, 2021, December 31, 2021, March 31, 2022, September 30, 2022, and December 31, 2022 and the impact of such restatement on NioCorp's future financial statements and other financial measures; the material weakness in NioCorp's internal control over financial reporting, NioCorp's efforts to remediate such material weakness and the timing of remediation; the possibility that NioCorp may qualify as a passive foreign investment company under the U.S. Internal Revenue Code of 1986, as amended (the "Code"); the potential that the Transactions could result in NioCorp becoming subject to materially adverse U.S. federal income tax consequences as a result of the application of Section 7874 and related sections of the Code; cost increases for NioCorp's exploration and, if warranted, development projects; a disruption in, or failure of, NioCorp's information technology systems, including those related to cybersecurity; equipment and supply shortages; current and future off take agreements, joint ventures, and partnerships; NioCorp's ability to attract qualified management; the effects of the COVID-19 pandemic or other global health crises on NioCorp's business plans, financial condition and liquidity; estimates of mineral resources and reserves; mineral exploration and production activities; feasibility study results; the results of metallurgical testing; changes in demand for and price of commodities (such as fuel and electricity) and currencies; competition in the mining industry; changes or disruptions in the securities markets; legislative, political or economic developments, including changes in federal and/or state laws that may significantly affect the mining industry; the impacts of climate change, as well as actions taken or required by governments related to strengthening resilience in the face of potential impacts from climate change; the need to obtain permits and comply with laws and regulations and other regulatory requirements; the timing and reliability of sampling and assay data; the possibility that actual results of work may differ from projections/expectations or may not realize the perceived potential of NioCorp's projects; risks of accidents, equipment breakdowns, and labor disputes or other unanticipated difficulties or interruptions; the possibility of cost overruns or unanticipated expenses in development programs; operating or technical difficulties in connection with exploration, mining, or development activities; management of the water balance at the Elk Creek Project site; land reclamation requirements related to the Elk Creek Project; the speculative nature of mineral exploration and development, including the risks of diminishing quantities of grades of reserves and resources; claims on the title to NioCorp's properties; potential future litigation; and NioCorp's lack of insurance covering all of NioCorp's operations.

Should one or more of these risks or uncertainties materialize or should any of the assumptions made by the management of NioCorp prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

All subsequent written and oral forward-looking statements concerning the matters addressed herein and attributable to NioCorp or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements contained or referred to herein. Except to the extent required by applicable law or regulation, NioCorp undertakes no obligation to update these forward-looking statements to reflect events or circumstances after the date hereof to reflect the occurrence of unanticipated events.

SOURCE: NioCorp Developments Ltd.

View source version on accesswire.com:

https://www.accesswire.com/757422/NioCorp-Demonstrates-the-Ability-to-Potentially-Double-Projected-Titanium-Recovery-Rates-for-the-Elk-Creek-Project