MultiSensor AI Announces First Quarter 2024 Results

Rhea-AI Summary

MultiSensor AI (NASDAQ: MSAI) reported robust financial results for Q1 2024, with a 132% YoY revenue increase from $980k to $2,275k.

Annual recurring revenue surged over 450%, reaching $2,500k. The company converted $7.05 million of convertible notes and other debts to equity.

Strategic developments include launching with new customers, enhancing MSAI's software platforms, and expanding service offerings through MSAI Inspections.

Additional actions included terminating a 2.4 million share earnout provision and waiving lock-up restrictions on 2.1 million shares.

Chair David Gow highlighted the significant growth within the existing customer base and new relationships. The company aims to increase revenue through blue-chip customers and strengthen its product offerings.

Positive

- Revenue increased 132% year over year from $980k to $2,275k.

- Annual recurring revenue surged over 450%, reaching $2,500k.

- Completed conversion of $7.05 million of convertible notes and other debts to equity.

- Initiated SaaS contracts with new enterprise customers.

- Announced multiple upgrades in the scope and functionality of MSAI Cloud and MSAI Edge.

- Expanded service offerings through the launch of MSAI Inspections.

- Terminated a 2.4 million share earnout provision, reducing potential share overhang.

- Waived lock-up restrictions on 2.1 million shares, improving equity free float.

Negative

- Waiving lock-up restrictions on 2.1 million shares could lead to increased share volatility.

- Conversion of $7.05 million of debt to equity may dilute existing shareholders.

News Market Reaction 1 Alert

On the day this news was published, MSAI declined 1.52%, reflecting a mild negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Strong top-line expansion and balance sheet improvements support the foundation for further growth

HOUSTON, TX / ACCESSWIRE / May 16, 2024 / MultiSensor AI Holdings, Inc. (NASDAQ:MSAI), a pioneer in AI-powered industrial condition-based maintenance and process control solutions announced results for the first quarter ended March 31, 2024.

Financial Highlights for Q1 2024:

- Revenue increased

132% year over year from$980 k to$2,275 k - Annual recurring revenue1 increased more than

450% from approximately$425 k to$2,500 k - Completed conversion of

$7.05 million of convertible notes and other debts to equity

(including conversions subsequent to Q1)

Strategic Business Highlights:

- The Company continued its revenue expansion with launch customers and initiated SaaS contract with new enterprise customers. Anticipated revenue scaling is expected from expansion of existing relationships and a robust pipeline of new customers.

- Completed corporate name change and re-branding from Infrared Cameras to MultiSensor AI.

- Announced multiple upgrades in scope and functionality of MSAI Cloud and MSAI Edge software platforms.

- Subsequent to quarter end, launched MSAI Inspections business, expanding service offerings to include additional sensor modalities and services to meet the needs of enterprise customers.

- On March 7th announced the termination of an earnout provision that would have required the Company to issue up to 2.4 million shares of the Company's common stock to former stakeholders of Infrared Cameras.

- Also on March 7th agreed to waive the lock-up restriction with respect to roughly 2.1 million shares of the Company's common stock.

David Gow, MultiSensor AI's Chair, commented: "Our strong first quarter results are an early indication of the future prospects for MultiSensor AI. During the quarter we demonstrated significant year-over-year growth, driven primarily by greater presence within our existing customer base and the addition of new relationships. We improved our equity free float by releasing restricted shareholders early from their lock-ups. By converting our debt obligations into equity we eliminated significant future cash payments for interest and principal liabilities. And by terminating the 2.4 million share earnout provision we eliminated a potential share overhang. Having a balance sheet that is nearly all equity positions the Company well for future growth."

Mr. Gow continued, "As we progress through the remainder of the year, we remain focused on increasing our revenues through existing and new blue-chip customers. Additionally, we continue to scale our commercial capabilities, add new sensor modalities and services lines, and strengthen our implementation teams. We are excited to continue building a strong foundation of annual recurring revenue through increased sales of our MSAI Edge and MSAI Cloud software offerings."

The Company's Quarterly Report is filed with the SEC, and is available at www.sec.gov as well as in the Investor Relations section of the Company's website (www.multisensorai.com).

About MultiSensor AI

MultiSensor AI provides turnkey condition-based maintenance and process control solutions, which combine cutting edge imaging and sensing technologies with AI-powered enterprise software. Powered by AWS, MSAI's software leverages a continuous stream of data from thermal imaging, visible imaging, acoustic imaging, vibration sensing, and laser sensing devices to provide comprehensive, real-time condition monitoring for a customer's critical assets, processes, and manufactured outputs. This full-stack solution measures heat, vision, vibration, and gas in the surrounding environment, helping companies gain predictive insights to better manage their asset reliability and manufacturing processes. MSAI Cloud and MSAI Edge software solutions are deployed by customers to protect critical assets across a wide range of industries including distribution & logistics, manufacturing, utilities, and oil & gas.

For more information, please visit https://www.multisensorai.com

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. In some cases, forward-looking statements can be identified by words such as "will," "believe," "anticipate," "expect," "estimate," "intend," "plan," or their negatives or variations of these words, or similar expressions. All statements contained in this press release that do not strictly relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company management's expectations regarding its financial outlook, strategic priorities and objectives, future plans, business prospects and financial performance, and ability to demonstrate stockholders' equity in excess of

Media Contact:

MultiSensor AI

Andrew Klobucar

Director of Marketing

andrew.klobucar@multisensorai.com

Investor Contact:

Alpha IR Group

Mike Cummings or Griffin Morris

MSAI@alpha-ir.com

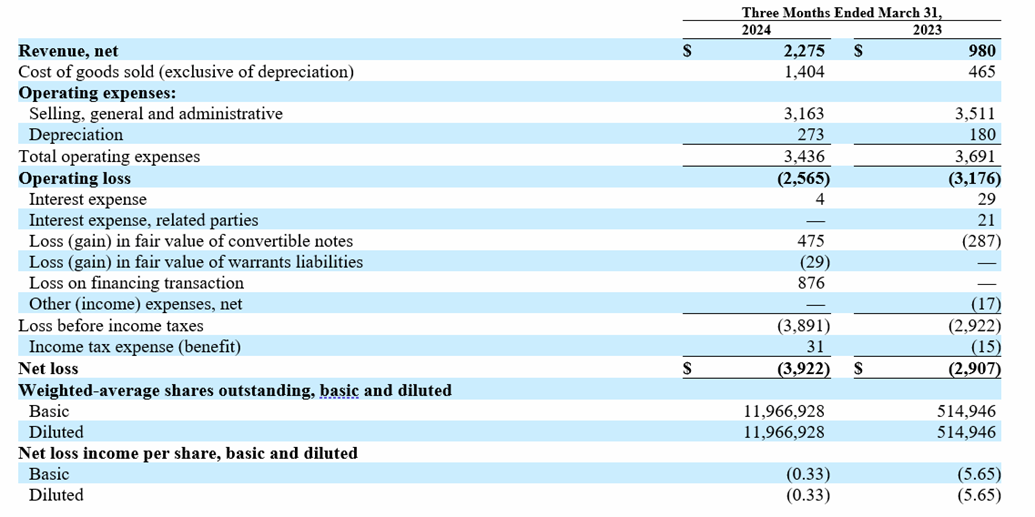

MultiSensor AI Holdings, Inc.

Condensed Consolidated Statements of Operations

(Amounts in thousands of U.S. dollars, except share and per share data)

SOURCE: MultiSensor AI Holdings, Inc.

View the original press release on accesswire.com