Mawson Infrastructure Group Inc. Announces January 2022 Bitcoin Production and Operational Update

Mawson produced 140 Bitcoin in January

Bitcoin Self-Mining operating at approximately 1.1 EH end of January

Bitcoin Self-Mining expected to be at approximately 1.35 EH end of February, +

Luna Squares Hosting Co-location operations at 2 MW in January

(Graphic: Business Wire)

Bitcoin Self-Mining Update

-

In

January 2022 Mawson produced 140 Bitcoin - January average hash rate at approximately 0.9 EH

- January end of month hash rate at approximately 1.1 EH

- February end of month hash rate expected to be 1.35 EH, producing approximately 6.5 bitcoin per day2

Luna Squares Hosting Co-location Update

- 2 MW of hosting online in January

- Pipeline of industrial scale hosting co-location customers continues to grow

Operational Update

-

Midland, Pennsylvania facility: civil works ongoing, first Modular Data Centers (MDCs) with full complement of Bitcoin miners expected to be online inMarch 2022 . -

Sandersville, Georgia facility: 60 MW expansion ongoing with an additional 13 MDCs to be deployed in February. -

Australian facility: expansion ongoing with civil works continuing, transformers arriving in February and an additional 7 MDCs expected on site in March, with the facility expected to be fully online by

April 2022 .

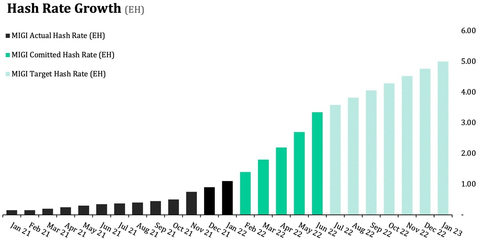

Expected Hash Rate Growth

Mawson expects Bitcoin Self-Mining to be at 3.35 EH by Q2 2022, and target of 5 EH online by early Q1 2023 reiterated.

About

For more information, visit: www.mawsoninc.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Mawson cautions that statements in this press release that are not a description of historical fact are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words referencing future events or circumstances such as “expect,” “intend,” “plan,” “anticipate,” “believe,” and “will,” among others. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon Mawson’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation, the possibility that Mawson’s need and ability to raise additional capital, the development and acceptance of digital asset networks and digital assets and their protocols and software, the reduction in incentives to mine digital assets over time, the costs associated with digital asset mining, the volatility in the value and prices of cryptocurrencies and further or new regulation of digital assets. More detailed information about the risks and uncertainties affecting Mawson is contained under the heading “Risk Factors” included in Mawson’s Quarterly Report on Form 10-Q filed with the

1 Based on network difficulty as at

2 Based on network difficulty as at

View source version on businesswire.com: https://www.businesswire.com/news/home/20220215005148/en/

Investor Contact:

646-536-7331

brett@haydenir.com

www.haydenir.com

Source: