TRxADE HEALTH Reports First Quarter Revenue Growth of 6% and Q1 2022 Financial Results

Rhea-AI Summary

TRxADE Health reported a 6% revenue increase to $3.2 million in Q1 2022, driven by its TRxADE and TRxADE Prime platforms. However, gross profit fell 4% to $1.3 million, reflecting rising costs. Operating expenses rose to $2.3 million, primarily due to IT initiatives and increased salaries. The net loss widened to $1.0 million, compared to $0.7 million a year ago. The company registered 339 new members, totaling approximately 13,475. Notably, processed sales volume on TRxADE Prime surged over 600%. Management remains optimistic about growth opportunities.

Positive

- Q1 2022 revenue increased 6% to $3.2 million.

- Registered members in TRxADE grew by 339 to over 13,475.

- Processed sales volume on TRxADE Prime rose over 600%.

- New unique buyers on TRxADE Prime increased by 184%.

Negative

- Gross profit decreased 4% to $1.3 million.

- Operating expenses rose to $2.3 million, up from $2 million.

- Net loss increased to $1.0 million from $0.7 million.

- Adjusted EBITDA worsened to ($0.7) million compared to ($0.5) million.

News Market Reaction – MEDS

On the day this news was published, MEDS declined 9.62%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

Continues Nationwide Expansion of Breakthrough Digital Healthcare Services IT Platform

TAMPA, FL / ACCESSWIRE / May 9, 2022 / TRxADE HEALTH, INC. (NASDAQ:MEDS)("TRxADE" or the "Company"), a health services IT company focused on digitalizing the retail pharmacy experience by optimizing drug procurement, the prescription journey and patient engagement in the U.S., today announced its financial results for the 2022 first quarter (Q1) ended March 31, 2022.

First Quarter 2022 and Subsequent Operational Highlights

TRxADE continued to expand the TRxADE drug procurement marketplace nationwide, adding 339 new registered members in Q1 2022, bringing the total registered members to approximately 13,475+ at March 31, 2022.

TRxADE announced a venture with Exchange Health, LLC, SOSRx, LLC. SOSRx will provide pharmaceutical manufacturers a single platform to optimize the sale and distribution of their inventory directly to large pharmaceutical buyers across multiple classes of trade. SOSRx opens the market to short dated, over stock and slow-moving pharmaceuticals that would otherwise be subject to destruction. TRxADE anticipates growth in 2022 as more progressive manufacturers are expected to address the public need for enhanced medication accessibility and reliable supply of cost-effective pharmaceuticals.

Management Commentary

"I am pleased with the growth we have experienced in our TRxADE and TRxADE Prime platforms for the first quarter of 2022. We have continued to drive our business forward, achieving several key milestones in our internal roadmap with a focus on innovation and development through our various complementary growth opportunities.

Our new venture, SOSRx, is an exciting addition that provides additional availability to short dated and overstocked drugs, with a goal to positively impact the public need for cost effective medication.

The TRxADE marketplace connects wholesalers and independent pharmacies and our SOSRx marketplace connects the manufacturers and wholesalers. Both the TRxADE and SOSRx marketplaces deliver radical price transparency, economies of scale and competition that benefit the independent pharmacies and wholesalers, while expanding the selling potential for such participants.

We believe the TRxADE and SOSRx platforms provide the opportunity to deliver more affordable prescription costs for consumers.

This is an exciting time for TRxADE, as we continue to position ourselves to create sustainable value for our shareholders," concluded Mr. Suren Ajjarapu, the Company's Chairman and Chief Executive Officer.

First Quarter 2022 Financial Summary

Revenues for the first quarter of 2022, increased

Gross profit in the first quarter of 2022, decreased

Operating expenses in the first quarter of 2022 were

Net loss in the first quarter of 2022 was (

Adjusted EBITDA, a non-GAAP financial measure, decreased to (

Additional metrics related to our key performance are as follows:

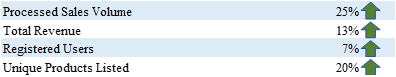

As of March 31, 2022, the TRxADE Platform increased its registered users by 915 or

The table below summarizes the key metrics that management evaluated in relation to the activity on the TRxADE Platform for the three month period ended March 31, 2022 compared to the same period in 2021:

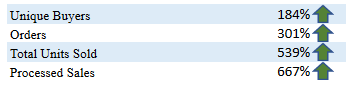

As of March 31, 2022, compared to the same period in 2021, Integra Pharma Solutions, LLC ("TRxADE Prime") increased processed sales volume over

The table below summarizes the key metrics that management evaluated in relation to the activity for TRxADE Prime for the three month period ended March 31, 2022, compared to the same period in 2021:

Conference Call and Webcast

Management will host a conference call on Monday, May 9, 2022, at 5:00 p.m. Eastern time to discuss TRxADE's first quarter 2022 financial results. The call will conclude with Q&A from participants. To participate, please use the following information:

Q1 2022 Conference Call and Webcast

Date: Monday, May 9, 2021

Time: 5:00 p.m. Eastern time

U.S. Dial-in: 1-877-425-9470

International Dial-in: 1-201-389-0878

Conference ID: 13728738

Webcast: https://viavid.webcasts.com/starthere.jsp?ei=1541816&tp_key=cbf4963985

Please dial in at least 10 minutes before the start of the call to ensure timely participation.

A playback of the call will be available through June 9, 2022. To listen, call 1-844-512-2921 within the United States or 1-412-317-6671 when calling internationally and enter replay pin number 13728738. A webcast will also be available for 30 days on the IR section of the TRxADE website or by clicking the webcast link above.

About TRxADE HEALTH, Inc.

TRxADE HEALTH, Inc. (NASDAQ:MEDS) is a health services IT company focused on digitalizing the retail pharmacy experience by optimizing drug procurement, the prescription journey and patient engagement in the U.S. The Company operates the TRxADE drug procurement marketplace serving a total of 13,475+ members nationwide, fostering price transparency and under the Bonum Health brand, offering patient centric telehealth services. For more information on TRxADE Health, please visit the Company's IR website at investors.trxadehealth.com.

Use of Non-GAAP Financial Information

In addition to our results calculated under generally accepted accounting principles in the United States ("GAAP"), in this earnings release we also present EBITDA and Adjusted EBITDA which are "non-GAAP financial measures" presented as supplemental measures of the Company's performance. They are not presented in accordance with GAAP. EBITDA represents net income before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA before stock-based compensation expense, litigation expense and loss (gain) on impairment of goodwill. EBITDA and Adjusted EBITDA are presented because we believe they provide additional useful information to investors due to the various noncash items during the period. EBITDA and Adjusted EBITDA are also frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We believe these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the health of our business. EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation, or as a substitute for analysis of our operating results as reported under GAAP. Some of these limitations are: EBITDA and Adjusted EBITDA do not reflect cash expenditures, future requirements for capital expenditures, or contractual commitments; EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, working capital needs; and EBITDA and Adjusted EBITDA do not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on debt or cash income tax payments. Although depreciation and amortization are noncash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements. Additionally, other companies in our industry may calculate EBITDA and Adjusted EBITDA differently than TRxADE HEALTH, Inc. does, limiting its usefulness as a comparative measure. EBITDA and Adjusted EBITDA are not recognized in accordance with GAAP, are unaudited, and have limitations as analytical tools, and you should not consider them in isolation, or as substitutes for analysis of the Company's results as reported under GAAP. The Company's presentation of these measures should not be construed as an inference that future results will be unaffected by unusual or nonrecurring items. We compensate for these limitations by providing a reconciliation of each of these non-GAAP measures to the most comparable GAAP measure. We encourage investors and others to review our business, results of operations, and financial information in their entirety, not to rely on any single financial measure, and to view these non-GAAP measures in conjunction with the most directly comparable GAAP financial measure. For more information on these non-GAAP financial measures, please see the section titled "Reconciliation of Net Income attributable to TRxADE HEALTH, INC., to Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) and Adjusted EBITDA", included at the end of this release.

Forward-Looking Statements

This press release may contain forward-looking statements, including information about management's view of TRxADE's future expectations, plans and prospects, within the meaning of the federal securities laws, including the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. In particular, when used in the preceding discussion, the words "may," "could," "expect," "intend," "plan," "seek," "anticipate," "believe," "estimate," "predict," "potential," "continue," "likely," "will," "would" and variations of these terms and similar expressions, or the negative of these terms or similar expressions are intended to identify forward-looking statements. Any statements made in this news release other than those of historical fact, about an action, event or development, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors, which may cause the results of TRxADE, its divisions and concepts to be materially different than those expressed or implied in such statements. These risks include risks relating to agreements with third parties, including Coborn's; the planned benefits, expected users of, and projected revenues of our venture with Exchange Health; amounts we owe and may owe to Exchange Health in connection with the Joint Venture; security interests under certain of our credit arrangements; the fact that we are exploring strategic alternatives for our Bonum Health, Inc. subsidiary; our operations not being profitable; the commercial viability of new business lines, applications, products and technologies, and the costs of such items; the Company's stock repurchase program; the adoption of the Company's product offerings; claims relating to alleged violations of intellectual property rights of others; our ability to monetize our technological solutions; technical problems with our websites, apps and products; risks relating to implementing our acquisition strategies; challenges to the pharmaceutical supply chain posted by the COVID-19 pandemic and related matters; our ability to manage our growth; negative effects on our operations associated with the opioid pain medication health crisis; regulatory and licensing requirement risks; risks related to changes in the U.S. healthcare environment; the status of our information systems, facilities and distribution networks; risks associated with the operations of our more established competitors; regulatory changes; new competitors which may have more resources than we do; increases in direct to consumer sales of drugs; healthcare fraud; COVID-19, governmental responses thereto, economic downturns and increased inflation and possible recessions caused thereby; changes in laws or regulations relating to our operations; privacy laws; system errors; dependence on current management; our growth strategy; dilution which may be caused by future offerings; our ability to raise funding in the future, as and if needed, and the terms of such funding; increased inflation; and others that are included from time to time in filings made by TRxADE with the Securities and Exchange Commission, including, but not limited to, in the "Risk Factors" sections in its Form 10-Ks and Form 10-Qs and in its Form 8-Ks, which it has filed, and files from time to time, with the U.S. Securities and Exchange Commission (SEC), and more particularly in the Quarterly Report on Form 10-Q filed today with the SEC and our Annual Report on Form 10-K for the year ended December 31, 2021. These reports are available at www.sec.gov. Other unknown or unpredictable factors also could have material adverse effects on TRxADE's future results and/or could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements. The forward-looking statements included in this press release are made only as of the date hereof. TRxADE cannot guarantee future results, levels of activity, performance or achievements. Accordingly, you should not place undue reliance on these forward-looking statements. We undertake no obligation to update publicly any of these forward-looking statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

Investor Relations:

IR@trxade.com

Investors.trxadegroup.com

TRxADE HEALTH, INC.

Consolidated Balance Sheets

March 31, 2022, and December 31, 2021

| March 31, | December 31, | |||||||

| 2022 | 2021 | |||||||

Assets | ||||||||

| Current Assets | ||||||||

Cash | $ | 1,870,682 | $ | 3,122,578 | ||||

Accounts Receivable, net | 1,040,893 | 978,973 | ||||||

Inventory | 273,950 | 56,279 | ||||||

Prepaid Assets | 400,376 | 216,414 | ||||||

Undeposited funds | 11,166 | - | ||||||

Total Current Assets | 3,597,067 | 4,374,244 | ||||||

Property Plant and Equipment, Net | 73,679 | 98,751 | ||||||

Intangible Asset, net | 792,500 | - | ||||||

Other Assets | ||||||||

Deposits | 49,031 | 60,136 | ||||||

Right of use Leased Assets | 1,178,705 | 1,233,033 | ||||||

Research and Development | 149,229 | - | ||||||

Total Assets | $ | 5,840,211 | $ | 5,766,164 | ||||

Liabilities and Stockholders' Equity | ||||||||

Current Liabilities | ||||||||

Accounts Payable | 908,495 | 477,028 | ||||||

Accrued Liabilities | 344,938 | 270,437 | ||||||

Current Portion Lease Liabilities | 175,237 | 178,561 | ||||||

Customer Deposits | 996 | - | ||||||

Notes Payable- Related Party | 166,667 | - | ||||||

Total Current Liabilities | 1,596,333 | 926,026 | ||||||

Long Term Liabilities | ||||||||

Notes Payable-Related Party | 333,333 | - | ||||||

Other Long-Term Liabilities - Leases | 1,022,967 | 1,069,965 | ||||||

Total Liabilities | 2,952,633 | 1,995,991 | ||||||

Stockholders' Equity | ||||||||

Series A Preferred Stock, | ||||||||

Common Stock, | 82 | 82 | ||||||

Additional Paid-in Capital | 20,083,269 | 20,017,528 | ||||||

Retained Deficit | (17,213,273 | ) | (16,247,437 | ) | ||||

Total TRxADE HEALTH, INC. stockholders' equity | 2,870,078 | 3,770,173 | ||||||

Non-Controlling Interest | 17,500 | - | ||||||

Total Stockholders' Equity | 2,887,578 | 3,770,173 | ||||||

Total Liabilities and Stockholders' Equity | $ | 5,840,211 | $ | 5,766,164 | ||||

TRxADE HEALTH, INC.

Consolidated Statements of Operations

For the Three Months Ended March 31, 2022, and 2021

(unaudited)

| Three Months Ended March 31, | ||||||||

| 2022 | 2021 | |||||||

Revenues | $ | 3,240,272 | $ | 3,053,235 | ||||

Cost of Sales | 1,904,569 | 1,669,924 | ||||||

Gross Profit | 1,335,703 | 1,383,311 | ||||||

Operating Expense | ||||||||

Wage and Salary Expense | 1,069,958 | 939,634 | ||||||

Professional Fees | 101,009 | 264,819 | ||||||

Accounting and Legal Expense | 236,221 | 160,047 | ||||||

Technology Expense | 245,785 | 214,890 | ||||||

General and Administrative | 651,302 | 448,176 | ||||||

Total Operating Expenses | 2,304,275 | 2,027,566 | ||||||

Operating Loss | (968,572 | ) | (644,255 | ) | ||||

Gain on Disposal of Asset | 4,100 | - | ||||||

Interest Expense | (1,364 | ) | (7,264 | ) | ||||

Net Loss | $ | (965,836 | ) | $ | (651,519 | ) | ||

Net loss attributable to TRxADE HEALTH, Inc. | (960,147 | ) | (651,519 | ) | ||||

Net loss attributable to non-controlling interests | (5,689 | ) | - | |||||

Net loss per Common Share - Basic and Diluted | $ | (0.12 | ) | $ | (0.08 | ) | ||

Weighted average Common Shares Outstanding - Basic and Diluted | 8,178,124 | 8,093,199 | ||||||

TRxADE HEALTH, INC.

Consolidated Statements of Cash Flows

For the Three months ended March 31, 2022, and 2021

(unaudited)

| 2022 | 2021 | |||||||

Operating Activities: | ||||||||

Net Loss | $ | (965,836 | ) | $ | (651,519 | ) | ||

Adjustments to reconcile net income (loss) to net cash used in Operating activities: | ||||||||

Depreciation Expense | 3,972 | 1,750 | ||||||

Options Expense | 32,783 | 75,738 | ||||||

Common Stock Issued for Services | 32,083 | 98,247 | ||||||

Bad Debt Expense | 1,317 | - | ||||||

Gain on sale of asset | (1,900 | ) | - | |||||

Amortization of Right of Use Assets | 54,328 | 31,678 | ||||||

Changes in Operating assets and liabilities: | ||||||||

Other assets | (149,229 | ) | - | |||||

Accounts Receivable, net | (63,237 | ) | (1,131,807 | ) | ||||

Prepaid Assets | (172,857 | ) | (306,490 | ) | ||||

Inventory | (217,671 | ) | 787,632 | |||||

Undeposited Customer Funds | (11,166 | ) | - | |||||

Investment in Sub | - | 6,425 | ||||||

Lease Liability | (50,322 | ) | (31,517 | ) | ||||

Accounts Payable | 431,467 | 109,642 | ||||||

Accrued Liabilities | 74,501 | 299,923 | ||||||

Customer Deposits | 996 | - | ||||||

Net Cash Used in operating activities | (1,000,771 | ) | (710,298 | ) | ||||

Investing Activities: | ||||||||

Sale of Fixed Assets | 23,000 | - | ||||||

Net Cash Provided by investing activities | 23,000 | - | ||||||

Financing Activities: | ||||||||

Distributions to Non-Controlling Interest | (275,000 | ) | - | |||||

Proceeds from Exercise of Warrants | 875 | - | ||||||

Net Cash Used in financing activities | (274,125 | ) | - | |||||

Net Increase (Decrease) in Cash | (1,251,896 | ) | (710,298 | ) | ||||

Cash at beginning of the Period | 3,122,578 | 5,919,578 | ||||||

Cash at End of the Period | $ | 1,870,682 | $ | 5,209,280 | ||||

Supplemental Cash Flow Information | ||||||||

Cash Paid for Interest | $ | 1,364 | $ | 1,639 | ||||

Cash Paid for Income Taxes | $ | - | $ | - | ||||

Non-Cash Transactions | ||||||||

Insurance Premium Financed | $ | 220,354 | $ | - | ||||

Note Issued as SOSRx Contribution | $ | 500,000 | $ | - | ||||

Intangible Asset Contribution from Non-controlling interest | $ | 792,500 | $ | - | ||||

Reconciliation of Net Income (Loss) attributable to TRxADE HEALTH, INC., to Earnings before Interest, Taxes, Depreciation and Amortization (EBITDA) and Adjusted EBITDA*

| For the three months ended March 31, | ||||||||

| 2022 | 2021 | |||||||

Net Income (Loss) attributable to TRxADE HEALTH, INC. | $ | (965,836 | ) | $ | (651,519 | ) | ||

Add (deduct): | ||||||||

Interest, net | 1,364 | 7,264 | ||||||

Depreciation and amortization | 3,971 | 1,750 | ||||||

EBITDA | (960,501 | ) | (642,505 | ) | ||||

Add (deduct): | ||||||||

Loss on Impairment of Goodwill | - | - | ||||||

Litigation Expenses | 225,000 | - | ||||||

Stock-based compensation | 64,866 | 173,985 | ||||||

Adjusted EBITDA * | $ | (670,635 | ) | $ | (468,520 | ) | ||

* EBITDA and Adjusted EBITDA are non-GAAP financial measures. These measurements are not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. See also "Use of Non-GAAP Financial Information", above.

SOURCE: TRxADE HEALTH, INC.

View source version on accesswire.com:

https://www.accesswire.com/700429/TRxADE-HEALTH-Reports-First-Quarter-Revenue-Growth-of-6-and-Q1-2022-Financial-Results