Mako Mining Provides Q3 Financial Results

Mako Mining Corp. (TSX-V: MKO; OTCQX: MAKOF) reported Q3 2021 financial results, marking its first full quarter since declaring commercial production at the San Albino gold mine on July 1, 2021. The company generated $14.3 million in revenue and $6.7 million in adjusted EBITDA. Operating cash flow stood at $5.6 million, with cash costs at $660 per ounce. Working capital increased by $15.3 million. The processing plant operated at 429 tonnes per day at 85% availability. CEO Akiba Leisman anticipates continued growth in Q4 2021 as production ramps up further.

- $14.3 million in revenue

- $6.7 million adjusted EBITDA

- $5.6 million operating cash flow

- $15.3 million increase in working capital

- Cash costs at $660 per ounce

- Processing plant operating at 429 tonnes per day at 85% availability

- None.

TSX-V: MKO; OTCQX: MAKOF

VANCOUVER, BC, Nov. 29, 2021 /PRNewswire/ - Mako Mining Corp. (TSXV: MKO) (OTCQX: MAKOF) ("Mako" or the "Company") is pleased to provide financial results for the three months ended September 30, 2021 ("Q3 2021"), which is the first full quarter of financial results since declaring commercial production on July 1, 2021 at its San Albino gold mine ("San Albino") in northern Nicaragua. For detailed Q3 2021 operating statistics, please see the press release dated October 12, 2021. All dollar amounts referred to herein are expressed in United States dollars unless otherwise stated.

Q3 2021 Highlights

Financial

$14.3 million in Revenue$6.7 million in Adjusted EBITDA(1)$5.6 million in operating cash flow ("OCF") (1) (2)$15.3 million increase in working capital$660 Cash Costs ($/oz sold) (1)$949 Total Cash Costs ($/oz sold) (1)$1,086 All-in Sustaining Costs ("AISC") ($/oz sold) (1)

(1) | Refer to information under the heading "Non-IFRS Measures" later in this press release. |

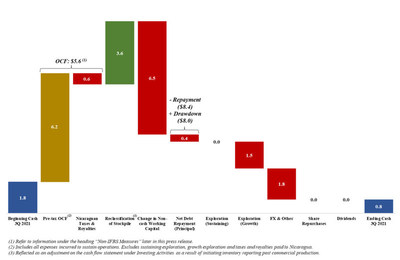

(2) | Refer to "Chart 1 – Q3 2021 Cash Reconciliation (US$ millions)" for a reconciliation of the beginning and ending cash position of the Company, including OCF. |

Growth

$1.5 million in exploration and evaluation expenses ($1 million at San Albino and$0.5 million at Las Conchitas)

Subsequent to September 30, 2021

$2.7 million in principal debt repayment ($2.0 million to the Wexford Loan and$0.7 million to the Sailfish Loan, both as defined in the Condensed Interim Consolidated Financial Statements for the three and nine months ended September 30, 2021)

Akiba Leisman, Chief Executive Officer of Mako states that, "Q3 2021 was the first full quarter of financial results since declaring commercial production at San Albino. The processing plant was operating at 429 tonnes per day at

Table 1 – Revenue

(in | Three months ended | Nine months ended | |||||

Sep 30, 2021 | Sep 30, 2020 | Change | Sep 30, 2021 | Sep 30, 2020 | Change | ||

Revenue | |||||||

Gold sold (oz) | 8,280 | 318 | 7,962 | 8,280 | 349 | 7,931 | |

Average realized gold price ($/oz) | 1,726 | 1,359 | 369 | 1,726 | 1,581 | 146 | |

Table 2 – Operating and Financial Data

(in units denoted) | Jul | Aug | Sep | Q3 2021 |

Tonnes mined | 15,536 | 19,393 | 16,280 | 51,210 |

Tonnes milled | 10,914 | 11,517 | 11,010 | 33,441 |

Availability | ||||

Avg. tonnes per day | 407 | 426 | 456 | 429 |

Gold sold (oz) | 2,958 | 2,921 | 2,402 | 8,280 |

Avg. realized gold price ($/oz sold) | ||||

Cash Costs ($/oz sold) (1) | ||||

Total Cash Costs ($/oz sold) (1) | ||||

AISC ($/oz sold) (1) | ||||

EBITDA (in | ||||

Adjusted EBITDA (in | ||||

(1) Refer to information under the heading "Non-IFRS Measures" later in this press release. | ||||

Table 3 – EBITDA Reconciliation

(in | Q3 2021 |

Net Income (loss) | 1,830 |

Income tax expense (Recovery) | 15 |

Finance cost, net of finance income | 828 |

Depreciation and amortization | 2,413 |

EBITDA (1) | |

Share-based compensation (recovery) expense | 127 |

Exploration activities | 1,526 |

Change in provision for reclamation and rehabilitation | (41) |

Adjusted EBITDA (1) | |

(1) Refer to information under the heading "Non-IFRS Measures" later in this press release. | |

For complete details, please refer to the Condensed Interim Consolidated Financial Statements for the three and nine months ended September 30, 2021 and associated Management Discussion and Analysis for the three and nine months ended September 30, 2021, available on SEDAR (www.sedar.com) or on the Company's website (www.makominingcorp.com).

Non-IFRS Measures

The Company has included non-IFRS measures in this press release such as Adjusted EBITDA, cash cost per ounce sold, total cash cost per ounce sold, AISC per ounce sold. These non-IFRS measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. In the gold mining industry, this is a common performance measure but does not have any standardized meaning. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's underlying performance of its core operations and its ability to generate cash flow. Accordingly, it is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

"Adjusted EBITDA" represents earnings before interest (including non-cash accretion of financial obligations and lease obligations), income taxes and depreciation, depletion and amortization ("EBITDA"), adjusted to exclude exploration activities, share-based compensation and change in provision for reclamation and rehabilitation.

"Cash costs per ounce sold" is calculated by deducting revenues from silver sales and dividing the sum of mining, milling and mine site administration cost.

"Total cash costs per ounce sold" is calculated by deducting revenues from silver sales from production cash costs and production taxes and royalties and dividing the sum by the number of gold ounces sold. Production cash costs include mining, milling, mine site security and mine site administration costs.

"AISC per ounce sold" includes total cash costs (as defined above) and adds the sum of G&A, sustaining capital and certain exploration and evaluation ("E&E") costs, sustaining lease payments, provision for environmental fees, if applicable, and rehabilitation costs paid, all divided by the number of ounces sold. As this measure seeks to reflect the full cost of gold production from current operations, capital and E&E costs related to expansion or growth projects are not included in the calculation of AISC per ounce. Additionally, certain other cash expenditures, including income and other tax payments, financing costs and debt repayments, are not included in AISC per ounce.

"OCF" represents operating cash flow, including taxes and royalties, but before changes in non-cash working capital, sustaining exploration and growth exploration.

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, that the financial results for Q3 2021, including detailed reporting of operating costs and other financial data; and that grades will continue to improve as we continue mining the Porcelana Zone. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and parameters; unanticipated costs; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR at www.sedar.com. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with information regarding the Company's Q3 production results at San Albino and its plans and expectations for its San Albino mine, and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/mako-mining-provides-q3-financial-results-301432806.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/mako-mining-provides-q3-financial-results-301432806.html

SOURCE Mako Mining Corp.

FAQ

What were Mako Mining's Q3 2021 revenue results?

How much adjusted EBITDA did Mako Mining achieve in Q3 2021?

What is the cash cost per ounce sold for Mako Mining in Q3 2021?

What was the operating cash flow for Mako Mining in Q3 2021?