Mako Mining Announces Q4 2024 Production Results Generating Record Gold Revenue of US$ 28.8 million and an Increase in Cash of US$ 9.5 million

Mako Mining reported strong Q4 2024 production results from its San Albino gold mine in Nicaragua. The company achieved record gold revenue of US$28.8 million with 12,053 oz Au recovered and 10,803 oz Au sold. Mining operations processed 46,733 tonnes at an average grade of 9.73 g/t Au, while the mill operated at 576 tonnes per day, 15% above nameplate capacity, with 85% gold recovery.

Cash balance increased by US$9.5 million to US$14.5 million in Q4. The company mined from five different zones: Las Conchitas South (El Limon 47.5%, Las Dolores 13.5%, Mango 2%), Las Conchitas Central (Cruz Grande 18%) and San Albino (Southwest Pit 19%). Additionally, Mako announced plans to acquire the Moss gold mine in Arizona for US$4.9 million.

Mako Mining ha riportato risultati di produzione forti nel Q4 2024 dalla sua miniera d'oro San Albino in Nicaragua. L'azienda ha raggiunto entrate record di oro pari a 28,8 milioni di dollari USA, con 12.053 oz Au recuperate e 10.803 oz Au vendute. Le operazioni minerarie hanno trattato 46.733 tonnellate a un grado medio di 9,73 g/t Au, mentre il mulino ha operato a 576 tonnellate al giorno, il 15% sopra la capacità nominale, con un recupero dell'85% dell'oro.

Il saldo di cassa è aumentato di 9,5 milioni di dollari USA a 14,5 milioni di dollari USA nel Q4. L'azienda ha estratto da cinque diverse zone: Las Conchitas Sud (El Limon 47,5%, Las Dolores 13,5%, Mango 2%), Las Conchitas Centrale (Cruz Grande 18%) e San Albino (Southwest Pit 19%). Inoltre, Mako ha annunciato piani per acquisire la miniera d'oro Moss in Arizona per 4,9 milioni di dollari USA.

Mako Mining reportó sólidos resultados de producción en el Q4 2024 de su mina de oro San Albino en Nicaragua. La compañía logró ingresos récord de oro de 28,8 millones de dólares estadounidenses con 12,053 oz Au recuperadas y 10,803 oz Au vendidas. Las operaciones mineras procesaron 46,733 toneladas a un grado promedio de 9,73 g/t Au, mientras que el molino operó a 576 toneladas por día, un 15% por encima de la capacidad nominal, con un 85% de recuperación de oro.

El saldo de efectivo aumentó en 9,5 millones de dólares estadounidenses a 14,5 millones de dólares estadounidenses en el Q4. La compañía extrajo de cinco zonas diferentes: Las Conchitas Sur (El Limon 47,5%, Las Dolores 13,5%, Mango 2%), Las Conchitas Central (Cruz Grande 18%) y San Albino (Southwest Pit 19%). Además, Mako anunció planes para adquirir la mina de oro Moss en Arizona por 4,9 millones de dólares estadounidenses.

메이코 마이닝은 니카라과의 산 알비노 금광에서 2024년 4분기 강력한 생산 결과를 보고했습니다. 이 회사는 2880만 달러의 금 수익금 기록을 달성했으며, 12,053 온즈 Au를 회수하고 10,803 온즈 Au를 판매했습니다. 채굴 작업은 평균 9.73g/t Au의 등급으로 46,733톤을 처리했으며, 공장은 576톤/일로 운영되었고, 이는 정격 용량보다 15% 높은 수치이며, 85%의 금 회수율을 기록했습니다.

현금 잔고는 4분기에 950만 달러 증가하여 1450만 달러에 도달했습니다. 이 회사는 5개 지역에서 채굴을 했습니다: 라스 콘치타스 남부 (엘 리몬 47.5%, 라스 돌로레스 13.5%, 망고 2%), 라스 콘치타스 중앙 (크루즈 그란데 18%) 및 산 알비노 (남서부 구덩이 19%). 또한, 메이코는 애리조나에 있는 모스 금광을 490만 달러에 인수할 계획을 발표했습니다.

Mako Mining a annoncé de solides résultats de production pour le 4ème trimestre 2024 de sa mine d'or San Albino au Nicaragua. La société a réalisé un chiffre d'affaires record en or de 28,8 millions de dollars US avec 12 053 oz Au récupérées et 10 803 oz Au vendues. Les opérations minières ont traité 46 733 tonnes avec une teneur moyenne de 9,73 g/t Au, tandis que l'usine a fonctionné à 576 tonnes par jour, soit 15 % au-dessus de sa capacité nominale, avec un taux de récupération de l'or de 85 %.

Le solde de trésorerie a augmenté de 9,5 millions de dollars US pour atteindre 14,5 millions de dollars US au 4ème trimestre. La société a extrait de cinq zones différentes : Las Conchitas Sud (El Limon 47,5 %, Las Dolores 13,5 %, Mango 2 %), Las Conchitas Central (Cruz Grande 18 %) et San Albino (Southwest Pit 19 %). De plus, Mako a annoncé son intention d'acquérir la mine d'or Moss en Arizona pour 4,9 millions de dollars US.

Mako Mining hat im vierten Quartal 2024 starke Produktionszahlen aus seiner Goldmine San Albino in Nicaragua gemeldet. Das Unternehmen erzielte Rekordgoldumsätze von 28,8 Millionen US-Dollar mit 12.053 oz Au, die gewonnen wurden, und 10.803 oz Au, die verkauft wurden. Die Bergbauoperationen verarbeiteten 46.733 Tonnen bei einem Durchschnittsgehalt von 9,73 g/t Au, während die Mühle mit 576 Tonnen pro Tag, 15% über der Nennkapazität, betrieben wurde, mit einer Goldrückgewinnung von 85%.

Der Bargeldbestand stieg im Q4 um 9,5 Millionen US-Dollar auf 14,5 Millionen US-Dollar. Das Unternehmen baute aus fünf verschiedenen Zonen ab: Las Conchitas Süd (El Limon 47,5%, Las Dolores 13,5%, Mango 2%), Las Conchitas Zentral (Cruz Grande 18%) und San Albino (Southwest Pit 19%). Darüber hinaus kündigte Mako an, die Goldmine Moss in Arizona für 4,9 Millionen US-Dollar erwerben zu wollen.

- Record quarterly gold revenue of US$28.8 million

- Cash balance increased by US$9.5 million to US$14.5 million

- Gold recovery increased to 85%, highest since Q1 2022

- Mill throughput 15% above nameplate capacity at 576 tpd

- 134% increase in recovered gold ounces quarter-over-quarter

- High strip ratio of 27.6:1

VANCOUVER, BC / ACCESSWIRE / January 13, 2025 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide fourth quarter 2024 ("Q4 2024") production results for the Company's San Albino gold mine ("San Albino") in northern Nicaragua and an update on the Eagle Mountain Gold Project in Guyana. Certain amounts shown in this news release may not total to exact amounts due to rounding differences.

Q4 2024 Operational Highlights for San Albino

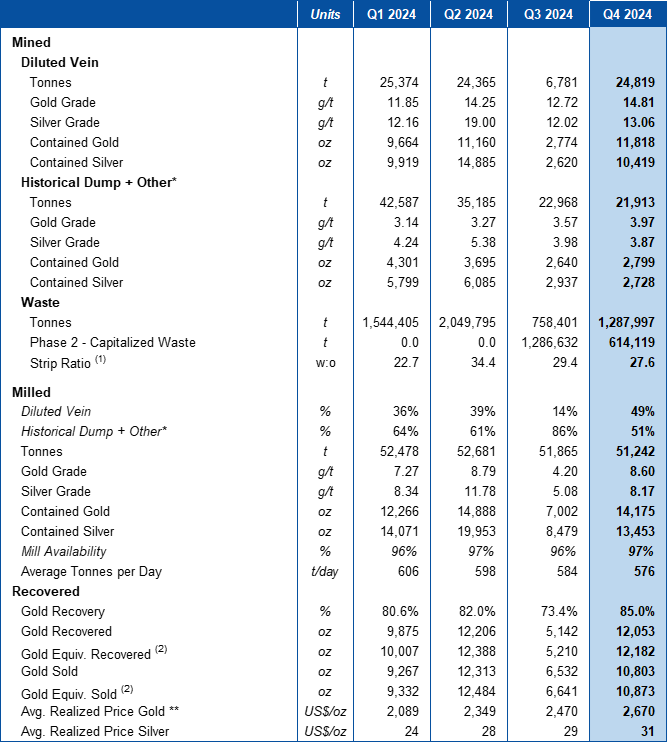

46,733 tonnes mined containing 14,616 ounces ("oz") of gold ("Au") at an average grade of 9.73 grams per tonne ("g/t") Au and 13,147 oz of silver ("Ag") at 8.75 g/t Ag

24,819 tonnes mined containing 11,818 oz Au at 14.81 g/t Au and 10,419 oz Ag at 13.06 g/t Ag from diluted vein material

21,913 tonnes mined containing 2,799 oz Au at 3.97 g/t Au and 2,728 oz Ag at 3.87 g/t Ag from historical dump and other mineralized material above cutoff grade ("historical dump + other")

27.6:1 strip ratio (1)

51,242 tonnes milled containing 14,175 oz Au at an average mill head grade of 8.60 g/t Au and 13,453 oz Ag at 8.17 g/t Ag

49% and51% from diluted vein and historical dump and other, respectively576tonnes per day ("tpd") milled at

97% availabilityMill recovery of

85.0% for gold

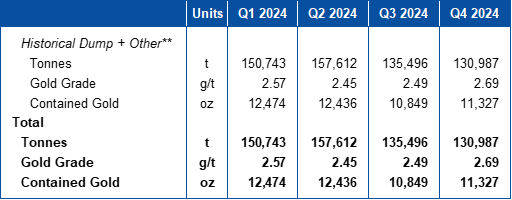

At quarter end, the stockpile was estimated at 130,987 tonnes at an average grade of 2.69 g/t Au for contained Au of 11,327 oz

12,053 oz Au recovered and 10,803 oz Au sold during Q4 2024 resulting in record gold revenues of US

$ 28.8 million Delivered 40,500 oz of silver as part of the Sailfish Silver Loan for a total of US

$ 1.1 million in Q4 2024Cash Balance of approx. US

$ 14.5 million in Q4 2024, an increase of US$ 9.5 million from Q3 2024

Akiba Leisman, Chief Executive Officer of Mako states that "Production in Q4 2024 was back to normal, after a relatively weak Q3 due to a brief delay in receiving an EIA permit which was received in July. Recovered gold ounces were up

Table 1 - Operating Results

* Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade.

**For the purpose of calculating revenue, payments to Sailfish are deducted from the Average Realized Price.

(1) Strip Ratio calculation does not include the Waste Capitalization

(2) Equiv. Gold ounces are calculated by: Silver Rec. or Silver Sold (oz) / Avg. Realized Price of Gold (US$/oz) / Avg. Realized Price of Silver (US$/oz)

Table 2 - Quarter End Stockpile Statistics

** Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade.

Mining

The mine produced an average of 508 tonnes per day of diluted vein and historical dump + other material in Q4 2024, with a strip ratio of 27.6:1, with an additional 614,119 tonnes of pre-stripping for the second phase of mining at Las Conchitas Central and the third phase of mining at Las Conchitas South.

The total production of diluted vein material in Q4 2024 came from five different zones: Las Conchitas South (El Limon

The Company is continuing its near mine RC drilling campaign focusing on Las Conchitas Central, to test the high-grade vein at Cruz Grande and the extension of the high-grade zone at Cruz Grande Southwest.

Milling

All components of the 500 tpd gravity and carbon-in-leach processing plant have been fully operational since the beginning of May 2021. During Q4 2024, the plant throughput rate averaged 576 tpd,

Mill availability remained high at

Eagle Mountain Gold Project

In Q4 2024, the Company's activities at Eagle Mountain focused on engineering and environmental work, advancing tailings and waste dump siting studies, geotechnical drilling, hydrogeology and hydrology, and environmental geochemistry. In December, the Company engaged consultants with substantial experience in Guyanese permitting processes to lead the preparation of the Eagle Mountain EIA, which is scheduled to be submitted later this year. The consultant has relevant and recent experience with the environmental permitting process in Guyana, successfully leading the permitting process for another large-scale gold mining project elsewhere in the country.

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

Related Party Transaction and Formation of Special Committee

As the Moss gold mine is beneficially owned by EG Acquisition LLC, a wholly-owned subsidiary of Mako's controlling shareholder, Wexford, the Proposed Transaction is a related party transaction for Mako within the meaning of Multilateral Instrument 61-101- Protection of Minority Security Holders in Special Transactions ("MI 61-101"). As a result, the Board of Directors of Mako has appointed a special committee (the "Special Committee") to assist in the evaluation, negotiation and supervision of all matters relating to the Proposed Transaction and to consider and make recommendations to the Board. The Proposed Transaction will not have any impact on the percentage of securities of Mako beneficially owned or controlled by Wexford Capital LP. Pursuant to Section 5.5(a) and 5.7(1)(a) of MI 61-101, Mako is exempt from obtaining a formal valuation and minority approval of its shareholders for the Proposed Transaction on the basis that the fair market value of the Proposed Transaction is below

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package. The Company also owns

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedarplus.ca.

Forward-Looking Information: Statements contained herein, other than historical fact, may be considered "forward-looking information" within the meaning of applicable securities laws. The forward-looking information contained herein is based on the Company's plans and certain expectations and assumptions, including that Q4, 2024 detailed operating costs and financial results will be available in April;This acquisition, and all associated capital expenditures required to restart mining operations will be funded out of a small fraction of the Company's cash generation from Q4 2024 and that the Company can operate San Albino profitably in order to fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation; the successful completion of due diligence by Mako, the negotiation and entering into of a Definitive Agreement and related ancillary documentation to complete the Proposed Transaction expectations regarding the timing for the Arizona court's ruling on the status of the two outstanding net smelter royalties at the Moss mine; that the Company is not successful in operating San Albino profitably and/or funding its exploration of prospectus targets on its district-scale land package; political risks and uncertainties involving the Company's exploration properties; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR at www.sedarplus.ca. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company's expectations regarding the Company's Q4 2024 production results at San Albino gold project, and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original press release on accesswire.com