April 11thMako Mining Reports Fourth Quarter and Full Year 2024 Financial Results, Including 2024 Adjusted EBITDA(1) of US$42.2 million and EPS of US$0.27 from 39,001 oz Gold Sold at an Average Price of US$2,397/oz

Mako Mining (MAKOF) has reported its Q4 and full-year 2024 financial results, highlighting strong performance at its San Albino gold mine in Nicaragua. Q4 2024 delivered record gold sales of $28.9 million, generating $14.7 million in Mine Operating Cash Flow and $4.7 million in Net Income.

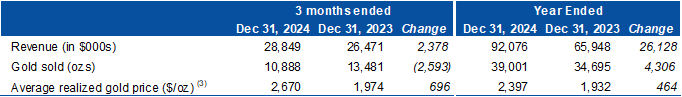

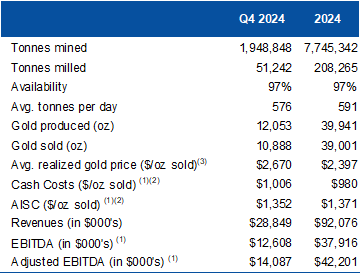

The company sold 10,888 oz of gold in Q4 at an average price of $2,670/oz with an All-In Sustaining Cost of $1,352/oz. Full-year metrics showed impressive returns with ROE of 39.3% and ROA of 25.7%. The company achieved $42.2 million in Adjusted EBITDA and earnings per share of $0.27 from 39,001 oz gold sold at an average price of $2,397/oz.

Post year-end, Mako acquired the Moss gold mine in Arizona through its subsidiary for $6.49 million, with net acquisition costs reduced to approximately $2 million after accounting for existing cash, bullion, and bond collateral releases.

Mako Mining (MAKOF) ha riportato i risultati finanziari del Q4 e dell'intero anno 2024, evidenziando una forte performance nella sua miniera d'oro San Albino in Nicaragua. Il Q4 2024 ha registrato vendite di oro record per $28,9 milioni, generando un flusso di cassa operativo della miniera di $14,7 milioni e un reddito netto di $4,7 milioni.

L'azienda ha venduto 10.888 oz di oro nel Q4 a un prezzo medio di $2.670/oz, con un costo di sostenibilità totale di $1.352/oz. Le metriche dell'intero anno hanno mostrato ritorni impressionanti con un ROE del 39,3% e un ROA del 25,7%. L'azienda ha raggiunto $42,2 milioni in EBITDA rettificato e un utile per azione di $0,27 da 39.001 oz di oro vendute a un prezzo medio di $2.397/oz.

Dopo la chiusura dell'anno, Mako ha acquisito la miniera d'oro Moss in Arizona tramite la sua controllata per $6,49 milioni, con i costi netti di acquisizione ridotti a circa $2 milioni dopo aver considerato la liquidità esistente, i lingotti e il rilascio delle garanzie obbligazionarie.

Mako Mining (MAKOF) ha reportado sus resultados financieros del Q4 y del año completo 2024, destacando un fuerte desempeño en su mina de oro San Albino en Nicaragua. El Q4 2024 entregó ventas récord de oro por $28.9 millones, generando $14.7 millones en flujo de caja operativo de la mina y $4.7 millones en ingresos netos.

La compañía vendió 10,888 oz de oro en el Q4 a un precio promedio de $2,670/oz con un costo total de sostenibilidad de $1,352/oz. Las métricas del año completo mostraron retornos impresionantes con un ROE del 39.3% y un ROA del 25.7%. La compañía logró $42.2 millones en EBITDA ajustado y ganancias por acción de $0.27 de 39,001 oz de oro vendidas a un precio promedio de $2,397/oz.

Después del cierre del año, Mako adquirió la mina de oro Moss en Arizona a través de su subsidiaria por $6.49 millones, con costos netos de adquisición reducidos a aproximadamente $2 millones después de contabilizar el efectivo existente, el lingote y la liberación de garantías de bonos.

마코 마이닝 (MAKOF)은 2024년 4분기 및 연간 재무 결과를 보고하며 니카라과의 산 알비노 금광에서 강력한 성과를 강조했습니다. 2024년 4분기는 기록적인 금 판매액 $28.9 백만 달러를 달성하여, 광산 운영 현금 흐름 $14.7 백만 달러와 순이익 $4.7 백만 달러를 생성했습니다.

회사는 4분기에 10,888 온스의 금을 평균 가격 $2,670/온스로 판매하며, 총 지속 가능 비용은 $1,352/온스였습니다. 연간 지표는 39.3%의 자기자본이익률(ROE)과 25.7%의 자산이익률(ROA)을 기록하며 인상적인 수익을 보여주었습니다. 이 회사는 $42.2 백만 달러의 조정 EBITDA와 39,001 온스의 금 판매로 주당 $0.27의 수익을 달성했습니다. 평균 판매 가격은 $2,397/온스였습니다.

회계 연도 종료 후, 마코는 자회사를 통해 아리조나의 모스 금광을 $6.49 백만 달러에 인수했으며, 기존 현금, 금괴 및 채권 담보 해제를 고려한 후 순 인수 비용이 약 $2 백만 달러로 줄어들었습니다.

Mako Mining (MAKOF) a publié ses résultats financiers du 4e trimestre et de l'année 2024, mettant en avant une forte performance de sa mine d'or San Albino au Nicaragua. Le 4e trimestre 2024 a enregistré des ventes d'or record de 28,9 millions de dollars, générant un flux de trésorerie d'exploitation minier de 14,7 millions de dollars et un revenu net de 4,7 millions de dollars.

L'entreprise a vendu 10 888 oz d'or au 4e trimestre à un prix moyen de 2 670 $/oz avec un coût total de durabilité de 1 352 $/oz. Les indicateurs de l'année entière ont montré des rendements impressionnants avec un ROE de 39,3 % et un ROA de 25,7 %. L'entreprise a réalisé 42,2 millions de dollars d'EBITDA ajusté et un bénéfice par action de 0,27 $ sur 39 001 oz d'or vendues à un prix moyen de 2 397 $/oz.

Après la clôture de l'année, Mako a acquis la mine d'or Moss en Arizona par l'intermédiaire de sa filiale pour 6,49 millions de dollars, les coûts nets d'acquisition étant réduits à environ 2 millions de dollars après prise en compte de la trésorerie existante, des lingots et des libérations de garanties obligataires.

Mako Mining (MAKOF) hat seine finanziellen Ergebnisse für das 4. Quartal und das gesamte Jahr 2024 veröffentlicht und hebt die starke Leistung seiner Goldmine San Albino in Nicaragua hervor. Das 4. Quartal 2024 verzeichnete Rekordgoldverkäufe von 28,9 Millionen Dollar, was einen Betriebscashflow von 14,7 Millionen Dollar und einen Nettogewinn von 4,7 Millionen Dollar generierte.

Das Unternehmen verkaufte 10.888 Unzen Gold im 4. Quartal zu einem Durchschnittspreis von 2.670 Dollar/Unze mit Gesamtkosten von 1.352 Dollar/Unze. Die Kennzahlen für das gesamte Jahr zeigten beeindruckende Renditen mit einem ROE von 39,3% und einem ROA von 25,7%. Das Unternehmen erzielte 42,2 Millionen Dollar EBITDA bereinigt und einen Gewinn pro Aktie von 0,27 Dollar aus dem Verkauf von 39.001 Unzen Gold zu einem Durchschnittspreis von 2.397 Dollar/Unze.

Nach dem Jahresende erwarb Mako die Goldmine Moss in Arizona über seine Tochtergesellschaft für 6,49 Millionen Dollar, wobei die Nettokosten für die Akquisition auf etwa 2 Millionen Dollar gesenkt wurden, nachdem bestehendes Bargeld, Barren und die Freigabe von Anleihenberichten berücksichtigt wurden.

- Record Q4 gold sales of $28.9 million with strong average selling price of $2,670/oz

- Robust Q4 profitability with $14.7M Mine Operating Cash Flow and $4.7M Net Income

- Strong full-year performance with $42.2M Adjusted EBITDA and $0.27 EPS

- Impressive ROE of 39.3% and ROA of 25.7% for 2024

- Strategic acquisition of Moss gold mine at favorable terms ($2M net cost)

- $3.2 million non-current deferred tax liability due to higher operating income

- Cash costs of $1,006/oz and AISC of $1,352/oz indicate significant operational expenses

VANCOUVER, BC / ACCESS Newswire / April 11, 2025 / Mako Mining Corp. (TSX-V:MKO)(OTCQX:MAKOF) ("Mako" or the "Company") is pleased to provide financial results for the three months ended December 31st, 2024 ("Q4 2024") and the 4th full year of financial results since declaring commercial production on July 1st, 2021 at its San Albino gold mine ("San Albino") in northern Nicaragua. All dollar amounts referred to herein are expressed in United States dollars unless otherwise stated.

The Company's financial results for Q4 2024 reflect record gold sales of

Q4 2024 Highlights

Financial

$28.9 million in Revenue$14.1 million in Adjusted EBITDA (1)$14.7 million in Mine Operating Cash Flow ("MineOCF") (1) (4)$4.7 million Net Income (after accruing a$3.2 million non-current deferred tax liability)$1,006 Cash Costs ($/oz sold) (1) (2)$1,352 All-In Sustaining Costs ("AISC") ($/oz sold) (1) (2)Full year Return on Equity ("ROE") (1) of

39.3% and Return on Assets ("ROA") of25.7% (1)Delivered 40,500 oz of silver in Q4 2024 to the Sailfish Silver Loan

Growth

$1.2 million in exploration and evaluation expenses ($0.5 million in areas surrounding San Albino in Nicaragua and approximately$0.7 million at Eagle Mountain, Guyana)

Subsequent to December 31, 2024

On March 27, 2025, the Company's subsidiary Mako US Corp. completed the acquisition of EG Acquisition LLC ("EGA"), acquiring

100% of the issued and outstanding common shares from Wexford EG Acquisition LLC ("Wexford EGA"), an entity owned by the Company's controlling shareholder, for US$6.49 million . EGA, is a private corporation incorporated in Delaware and owns100% of the shares of Golden Vertex Corp. ("GVC") which owns the Moss gold mine located in Arizona. Upon acquisition, there was approximately US$3.0 million of cash and bullion on GVC's balance sheet. Furthermore, Trisura Guarantee Insurance Company has agreed to release approximately US$1.5 million of the US$3.0 million held as collateral for various environmental bonds held at the Moss Mine. The two aforementioned cash inflows have effectively reduced Mako's net cash acquisition cost to approximately US$2.0 million .

Akiba Leisman, Chief Executive Officer, states that "2024 represented a major inflection point for Mako, demonstrating the inherent profitability of our asset base. Not only did we generate

Table 1 - Revenue

Table 2 - Operating and Financial Data

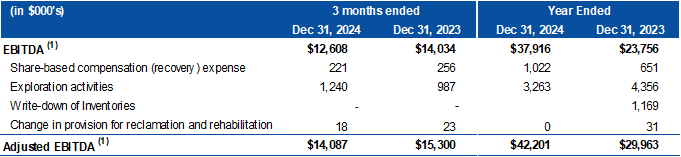

Table 3 - EBITDA Reconciliation

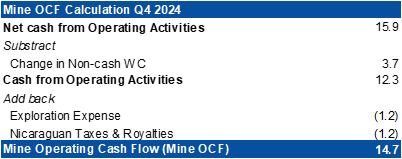

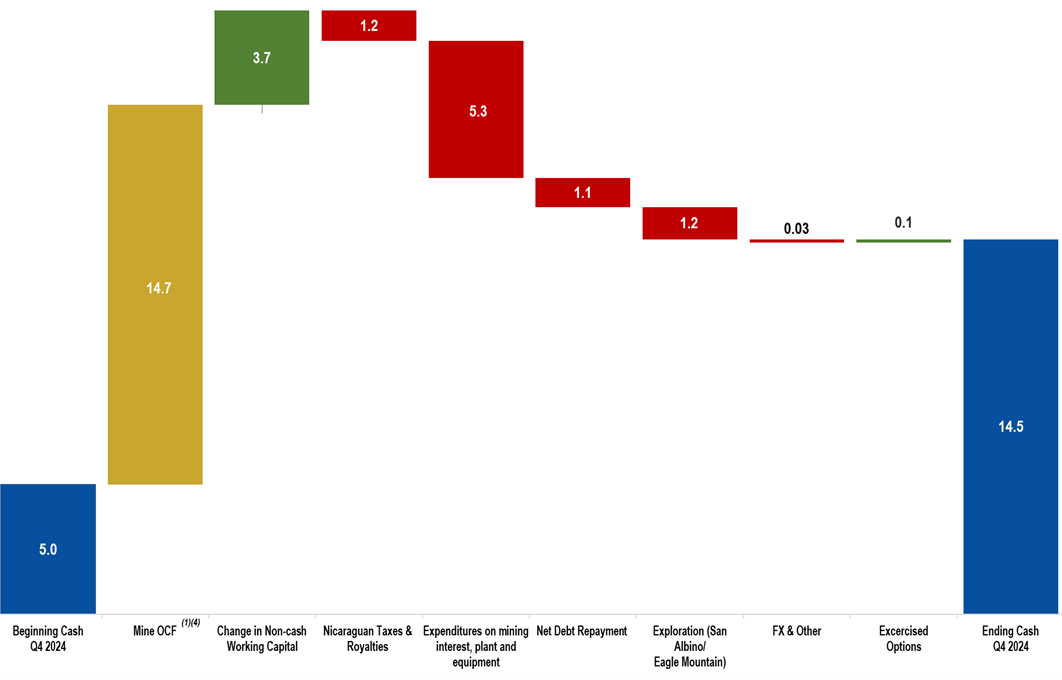

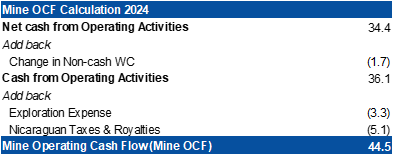

Chart 1

Q4 2024 - Mine OCF Calculation and Cash Reconciliation (in $ million)

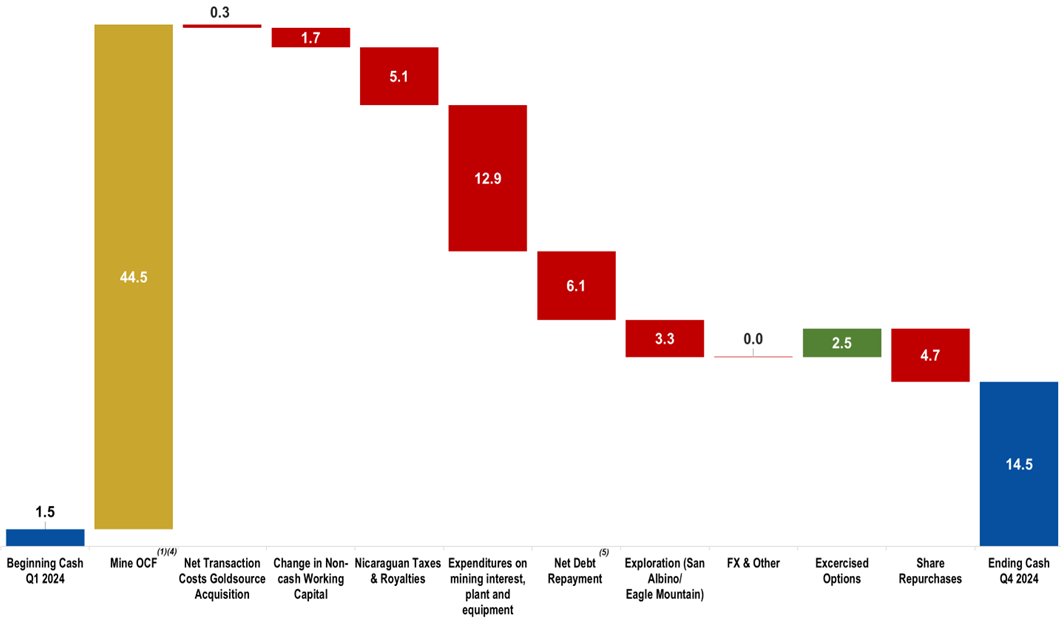

Chart 2

2024 - Mine OCF Calculation and Cash Reconciliation (in $ millions)

End Notes

Refers to a Non-GAAP financial measure within the meaning of National Instrument 52-112 - Non-GAAP and Other Financial Measures Disclosure ("NI 52-112"). Refer to information under the heading "Non-GAAP Measures" as well as the reconciliations later in this press release.

Refers to a Non-GAAP ratio within the meaning of NI-52-112. Refer to information under the heading "Non-GAAP Measures" later in this press release.

Realized price before deductions from Sailfish gold streaming agreement.

Refer to "Chart 1 & 2 - Mine OCF Calculation and Cash Reconciliation (in $ millions)" for a reconciliation of the beginning and ending cash position of the Company, including OCF.

Includes Repayment Silver Loan, Wexford Loan, Wexford Bridge Loan related to Goldsource Acquisition, Payment to GR Silver and other lease payments

For complete details, please refer to the financial statements and the associated management discussion and analysis for the twelve months ended December 31st, 2024, available on SEDAR+ (www.sedarplus.ca) or on the Company's website (www.makominingcorp.com).

Non-GAAP Measures

The Company has included certain non-GAAP financial measures and non-GAAP ratios in this press release such as EBITDA, Adjusted EBITDA, Mine Operating Cash Flow cash cost per ounce sold, total cash cost per ounce sold, AISC per ounce sold. These non-GAAP measures are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In the gold mining industry, these are commonly used performance measures and ratios, but do not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company's underlying performance of its core operations and its ability to generate cash flow.

"EBITDA" represents earnings before interest (including non-cash accretion of financial obligation and lease obligations), income taxes and depreciation, depletion and amortization.

"Adjusted EBITDA" represents EBITDA, adjusted to exclude exploration activities, share-based compensation and change in provision for reclamation and rehabilitation.

"Cash costs per ounce sold" is calculated by deducting revenues from silver sales and dividing the sum of mining, milling and mine site administration cost.

"Total cash costs per ounce sold" is calculated by deducting revenues from silver sales from production cash costs and production taxes and royalties and dividing the sum by the number of gold ounces sold. Production cash costs include mining, milling, mine site security and mine site administration costs.

"AISC per ounce sold" includes total cash costs (as defined above) and adds the sum of G&A, sustaining capital and certain exploration and evaluation ("E&E") costs, sustaining lease payments, provision for environmental fees, if applicable, and rehabilitation costs paid, all divided by the number of ounces sold. As this measure seeks to reflect the full cost of gold production from current operations, capital and E&E costs related to expansion or growth projects are not included in the calculation of AISC per ounce. Additionally, certain other cash expenditures, including income and other tax payments, financing costs and debt repayments, are not included in AISC per ounce.

"Mine OCF" represents operating cash flow, excluding Nicaraguan taxes and royalties, changes in non-cash working capital and exploration expense

"ROE" is calculated by dividing the twelve trailing months Net Income by the average shareholder's equity. The average shareholder's equity is calculated by adding the total equity at the end of the period to the total equity at the beginning of the period and dividing by two.

"ROA" is calculated by dividing the twelve trailing months Net Income by the average total assets. The average total assets is calculated by adding the total assets at the end of the period to the total assets at the beginning of the period and dividing by two.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally and offers district-scale exploration potential. Mako also owns the Moss Mine in Arizona, an open pit gold mine in northwestern Arizona. Mako also holds a

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 917-558-5289, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedar.ca.

Forward-Looking Information: Some of the statements contained herein may be considered "forward-looking information" within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, "estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company's current beliefs and expectations, based on management's reasonable assumptions, and includes, without limitation, management's expectation that the Moss mine will be a substantial cash flowing mine when full scale mining operations begin next month and the expectation that 2025 will show the results from the work by the Company in 2024. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company's exploration and development plans and growth parameters and its ability to fund its growth to reach its expected new record production numbers; unanticipated costs; the October 24 measures having impacts on business operations not current expected, or new sanctions being imposed by the U.S. Treasury Department or other government entity in Nicaragua in the future; and other risks and uncertainties as disclosed in the Company's public disclosure filings on SEDAR+ at www.sedarplus.ca. Such information contained herein represents management's best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with information regarding the Company's Q4 2024 and full year 2024 financial results and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Mako Mining Corp.

View the original press release on ACCESS Newswire