Mako Mining Announces Its Intent to Acquire the Moss Mine in Arizona Expanding its Operations in the Americas

Rhea-AI Summary

Mako Mining Corp. (MAKOF) has announced a non-binding letter of intent to acquire 100% of EG Acquisition (EGA), which will own the Moss gold mine in Arizona. The purchase price ranges from US$4.9 million to US$6.4 million, payable in cash, with closing expected by February 2025.

The acquisition follows a bankruptcy process that eliminated over US$60 million of liabilities associated with the Moss mine. The deal includes the elimination of a silver stream and potential extinguishment of two material royalties. Mako plans to restart mining operations after optimizing the mine plan and debottlenecking the crushing plant.

The company's current cash and gold sales receivables have increased by over US$6 million to nearly US$13 million at year end. A pre-arranged bonding facility will release approximately US$1.5 million of the US$3.0 million held as collateral, effectively reducing the acquisition cost.

Positive

- Acquisition cost of only US$4.9-6.4M for a producing gold mine

- Elimination of over US$60M in liabilities through bankruptcy process

- Strong cash position with US$13M in cash and receivables

- US$1.5M reduction in acquisition cost through bonding facility release

- Expansion into top-tier mining jurisdiction (Arizona, USA)

Negative

- Mining operations temporarily suspended, requiring restart

- Plant optimization and debottlenecking needed before full operations

- Pending resolution of disputed royalties could affect final purchase price

- US$12M indemnity requirement for bonding facility

News Market Reaction

On the day this news was published, MAKOF gained 15.45%, reflecting a significant positive market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESSWIRE / December 31, 2024 / Mako Mining Corp. ("Mako") (TSXV:MKO)(OTCQX:MAKOF) is pleased to announce the entering into of a non-binding letter of intent to acquire

EGA´s acquisition of GVC is pursuant to a court-approved sale process under the Companies' Creditors Arrangement Act and Chapter 15 of Title 11 of the United States Code (collectively the "Bankruptcy Process"), the terms of which included, among other things, the elimination of over US

Prior to the Bankruptcy Process, there were several royalties and a silver stream on the Moss mine which entitled the silver stream holder to

The Proposed Transaction will allow Mako to add a producing asset located in a top tier jurisdiction funded solely out of cash flow generated from the last quarter of Mako's current mining operations. The Moss mine has been producing gold throughout the Bankruptcy Process through its beneficiation facilities. Mining was temporarily suspended at the beginning of the Bankruptcy Process and Mako plans to restart mining operations upon completion of the Proposed Transaction once it has had an opportunity to optimize the mine plan and debottleneck the crushing plant. This is expected to be achieved within a few months of closing of the Proposed Transaction. Mako currently operates the high-grade San Albino Mine in northern Nicaragua and owns the Eagle Mountain project in Guyana. Over the last quarter, even after an extensive drill program at both properties, the cash and gold in sales receivables balance in Mako has increased by over US

In connection with the Proposed Transaction, Trisura Guarantee Insurance Company has pre-arranged the terms and conditions of a bonding facility for Mako in connection with the completion of the Proposed Transaction which provides that Trisura will release approximately US

For more details about the Proposed Transaction see below.

The Moss gold mine is an open pit heap leach operation located in the historic Oatman District in western Arizona. The operation is currently at limited capacity during the Bankruptcy Process while heap leaching continues to operate while producing minor amounts of gold and silver. All operating permits are in good standing.

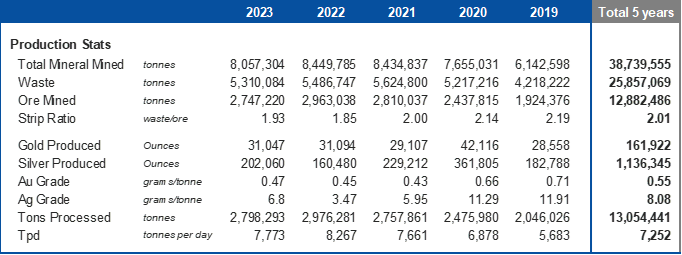

Moss Mine - Historical Gold Production and Revenues

Source: Elevation Gold Website https://elevationgold.com/investors/financial-statements/

Akiba Leisman, Chief Executive Officer of Mako, commented: "the acquisition of the producing Moss gold mine in Arizona, after the elimination of over US

Proposed Transaction Terms

Under the terms of the non-binding letter of intent, it is proposed that Mako will acquire all of the issued and outstanding common shares of EGA for a total consideration value of US

Definitive Agreement and Voting and Support Agreements

Following execution of this letter, the parties will in good faith negotiate a definitive agreement to effect the Transaction (the "Definitive Agreement") incorporating terms and provisions as are customary for transactions of this nature, as well as customary voting support and lock-up agreements with the senior officers, directors and any significant shareholder of EGA (the "Voting and Support Agreements") with Mako on terms satisfactory to Mako pursuant to which, among other things, they will agree to vote the EGA shares that they own or over which they have control or direction in favor of the Transaction and against any other transaction that would prevent, delay or interfere in any way with the Transaction, not to solicit other transactions and otherwise support the Transaction, and not sell, dispose of or otherwise encumber any of their EGA shares (including any EGA shares under outstanding options, warrants or other convertible securities). Such Voting and Support Agreement shall be terminable by the shareholder in the event that the Definitive Agreement between Mako and EGA is validly terminated in accordance with its terms.

In the Definitive Agreement, each of Mako and EGA will make such representations and warranties as are customary in transactions of this nature including, without limitation, representations as to the power, authority and standing of such parties to engage in the Proposed Transaction; the absence of material pending or threatened litigation and liabilities (contingent or otherwise) affecting the business of GVC or Mako in relation to the Proposed Transaction; the absence of any encumbrances of any kind and nature relating to the outstanding shares of EGA; the absence of any material default by the parties under any material contracts; and will also provide covenants and restrictions customary for transactions of this nature, including, without limitation, on the conduct of business by EGA during the period preceding the completion of the Proposed Transaction.

The obligations of the parties to complete the Proposed Transaction in accordance with the Definitive Agreement will be subject to specified conditions precedent including, but not limited to, the completion of satisfactory due diligence by Mako, the formal approval of the definitive agreement and all ancillary matters related to the Proposed Transaction by Mako's Board of Directors upon the recommendation of the Special Committee and the approval of the TSX Venture Exchange (the "TSXV"). No approval by Mako's shareholders is expected to be required for the Proposed Transaction. The Proposed Transaction is expected to close by February 2025.

Qualified Persons

John Rust, SME, is a "qualified person" within the meaning of National Instrument 43-101- Standards of Disclosure for Mineral Projects ("NI 43-101") and has reviewed and approved the scientific and technical information in this news release on behalf of Mako. Mr. Rust has verified the data disclosed in this news release based on a review of the source noted and no limitations were imposed on his verifications process.

Related Party Transaction and Formation of Special Committee

As EGA is a wholly-owned subsidiary of Mako's controlling shareholder, Wexford,the Proposed Transaction is a related party transaction for Mako within the meaning of Multilateral Instrument 61-101- Protection of Minority Security Holders in Special Transactions ("MI 61-101"). As a result, the Board of Directors of Mako has appointed a special committee (the "Special Committee") to assist in the evaluation, negotiation and supervision of all matters relating to the Proposed Transaction and to consider and make recommendations to the Board. The Proposed Transaction will not have any impact on the percentage of securities of Mako beneficially owned or controlled by Wexford Capital LP.Pursuant to Section 5.5(a) and 5.7(1)(a) of MI 61-101, Mako is exempt from obtaining a formal valuation and minority approval of its shareholders for the Proposed Transaction on the basis that the fair market value of the Proposed Transaction is below

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako's primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package. The Company also owns

For further information about Mako, please contact Akiba Leisman, Chief Executive Officer, at (917) 558-5289 or aleisman@makominingcorp.com, or visit our website at www.makominingcorp.com and our profile on SEDAR+ at www.sedarplus.ca.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking information" within the meaning of applicable Canadian securities laws. Forward-looking information may be identified by the use of forward-looking terminology such as "plans", "targets", "expects", "is expected", "scheduled", "estimates", "outlook", "forecasts", "projection", "prospects", "strategy", "intends", "anticipates", "believes", or variations of such words and phrases or terminology which states that certain actions, events or results "may", "could", "would", "might", "will", "will be taken", "occur" or "be achieved". Forward-looking information in this news release includes, without limitation, the proposed non-binding terms and completion of the Proposed Transaction and expected customary terms to be included in the Definitive Agreement; the strengths, characteristics and expected benefits associated with the Proposed Transaction; obtaining all required recommendations of the Special Committee and approvals of the Mako Board and TSXV to complete the Proposed Transaction; Mako's plans to restart mining operations at the Moss mine upon completion of the Proposed Transaction once it has had an opportunity to optimize the mine plan and debottleneck the crushing plant expected to be achieved within a few months of closing of the Proposed Transaction; potential adjustments to the base US

Although Mako has attempted to identify important risk factors that could cause actual results or future events to differ materially from those contained in forward-looking information, there may be other risk factors not presently known or that they presently believe are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking information. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information, which speaks only as of the date made. The forward-looking information contained in this news release represents Mako's expectations as of the date of this news release and is subject to change after such date. Mako disclaims any intention or obligation to update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by applicable securities laws. All of the forward-looking information contained in this news release is expressly qualified by the foregoing cautionary statements.

SOURCE: Mako Mining Corp.

View the original press release on accesswire.com