Mastercard Platform Delivers Data-Driven Treasury Intelligence

On display at Sibos is the latest innovation in Mastercard’s expansive services suite which will be used by banks, corporates, and governments to gain greater visibility into payment flows, enabling collaborative, data-driven business decisions

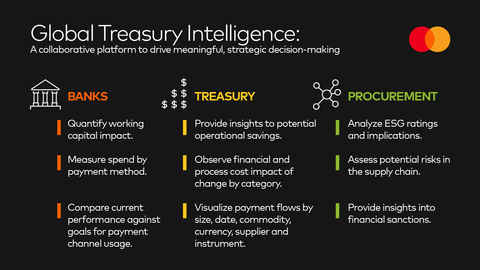

Global Treasury Intelligence: A collaborative platform to drive meaningful, strategic decision-making (Graphic: Business Wire)

By automating data ingestion from clients’ Enterprise Resource Planning (ERP) systems, Global Treasury Intelligence provides a view of all payment flows across suppliers, commodities, and lines of business, integrated with relevant third-party data. This holistic view means companies can more efficiently and collaboratively analyze global payments and manage risks. It can be used for narrow applications like identifying opportunities for expansion of commercial cards, as well as broader applications like cash management, source to settle pay strategies, treasury services optimization, supplier ESG scoring, and Know Your Supplier assessments.

“HSBC is an early adopter of Mastercard’s Global Treasury Intelligence because of the insights it gives us into the needs of our clients. By unlocking this data-driven collaboration with our customers, we see how to best help them achieve their goals for treasury,” said

The latest commercial-focused solution from

“The health of the business does not sit in just one team or silo. With Global Treasury Intelligence, we are providing the broad, interconnected views our customers need to make smarter decisions with better outcomes across their enterprises,” said

Starting today, the analytics platform will be available to customers in most markets around the world and you can view a digital interactive preview of the service here. For those attending the annual Sibos financial conference,

Mastercard Global Treasury Intelligence was developed in collaboration with Robobai, a global provider of source-to-settle analytics with nearly

About

1 Strategic Treasurer. 2021 Cash Forecasting & Visibility Survey Results

View source version on businesswire.com: https://www.businesswire.com/news/home/20221009005039/en/

Julia.Monti@Mastercard.com

(914) 249-6135

Source: Mastercard Investor Relations