Lithium Ionic Extends Payment Schedule for Acquisition of the Vale and Borges Claims

- None.

- None.

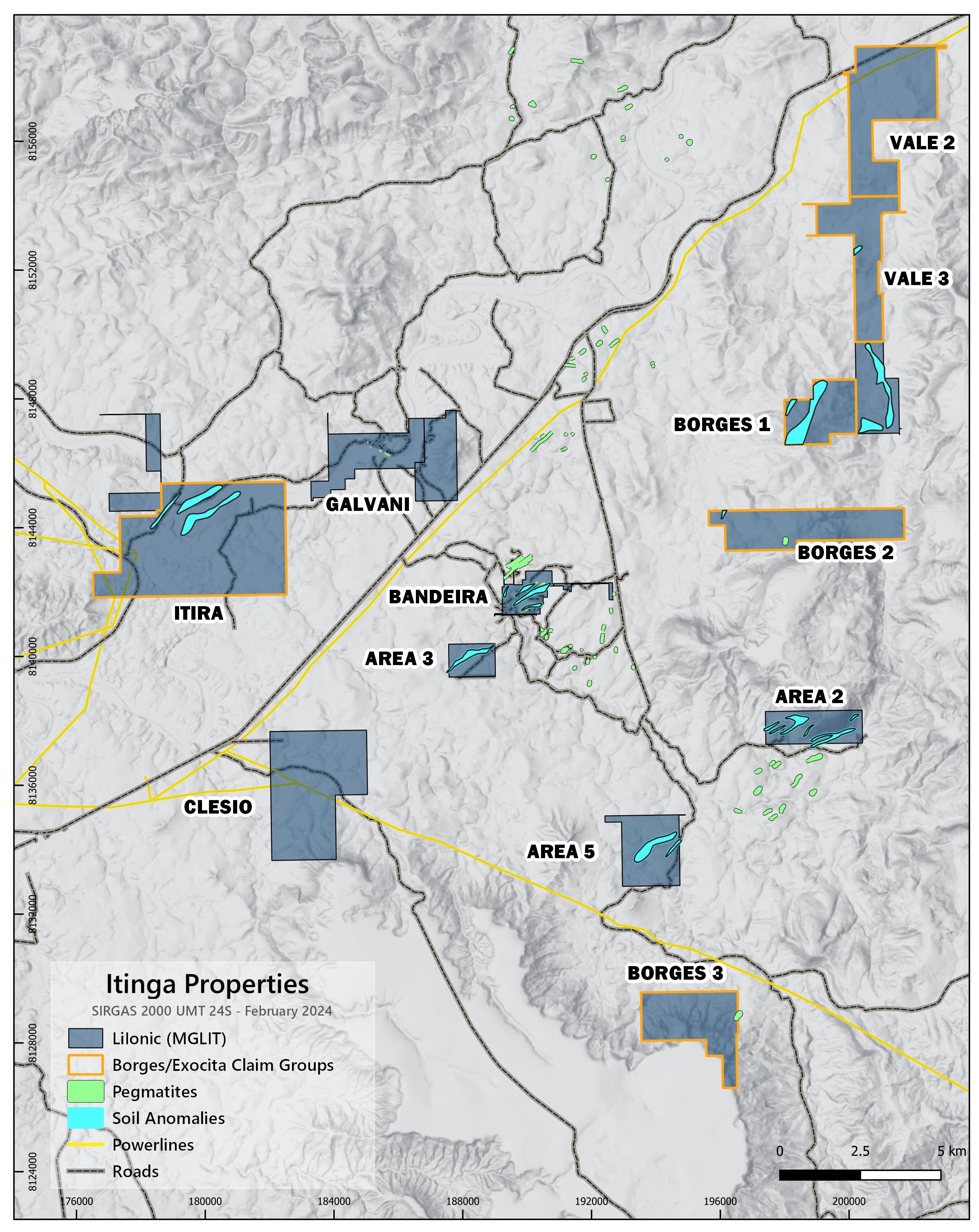

TORONTO, Feb. 29, 2024 (GLOBE NEWSWIRE) -- Lithium Ionic Corp. (TSXV: LTH; OTCQX: LTHCF; FSE: H3N) (“Lithium Ionic” or the “Company”) reports that is has amended the purchase agreements related to the acquisition of certain of its Itinga properties, in Minas Gerais, Brazil. The amendments are as follows:

Vale Claims:

- On January 20, 2023, Lithium Ionic’s

100% -owned Brazilian subsidiary, MGLIT Empreendimentos Ltda. (“MGLIT”), entered into a purchase agreement with Exotic Mineração Ltda. pursuant to which MGLIT had the option to acquire up to a100% equity interest in Vale do Lítio Mineração Ltda. (respectively, the “Vale do Lítio Agreement” and “Vale do Lítio”). Vale do Lítio has a100% beneficial ownership interest in three lithium mining claims covering a total of 3,140 hectares (the “Vale Claims”; see Figure 1). Based on the payments that have been made to date, Lithium Ionic own7.4% of the Vale Claims. - The amendment to the Vale do Lítio Agreement is as follows:

- The payment schedule for the remaining

92.6% is as follows:- R

$50,000 (~C$13,700) t o be paid to the vendor on July 20, 2024, to acquire0.15% interest in Vale do Lítio; - R

$29,950,000 (~C$8.2 million ) to be paid to the vendor on January 20, 2025, to acquire the remaining92.45% in Vale do Lítio.

- R

- The payment schedule for the remaining

Lithium Ionic may terminate the Vale do Litio Agreement at any time without incurring any additional financial penalties.

Borges Claims:

- On December 5, 2022, MGLIT entered into a binding asset purchase agreement with Mineração Borges Ltda. (“Borges”) to acquire from Borges a

100% ownership interest in three mining claims (the “Borges Claims”) covering a total of 1,478 hectares (the “Borges Agreement”; see Figure 1). - Amendments to the Borges Agreement are as follows:

- R

$50,000 (~C$13,700) t o be paid to the vendor by March 9, 2024; - R

$14,950,000 (~C$4.1 million ) to be paid to the vendor on the establishment of an NI 43-101 mineral resource estimate (minimum of 2 million tonnes with a Li2O content of over1.30% ), whose deadline to completion has been extended to June 5, 2025.

- R

Lithium Ionic may terminate the Borges Agreement at any time without incurring any additional financial penalties.

Figure 1. Lithium Ionic’s Itinga Group of Properties Showing the Vale and Borges Claims

View Figure 1 here:

https://www.globenewswire.com/NewsRoom/AttachmentNg/6415dedf-2d00-46b6-91f6-fec2830ebd2c

About Lithium Ionic Corp.

Lithium Ionic is a Canadian mining company exploring and developing its lithium properties in Brazil. Its flagship Itinga and Salinas projects cover 14,182 hectares in the northeastern part of Minas Gerais state, a mining-friendly jurisdiction that is quickly emerging as a world-class hard-rock lithium district. The Itinga Project is situated in the same region as CBL’s Cachoeira lithium mine, which has produced lithium for +30 years, as well as Sigma Lithium Corp.’s Grota do Cirilo project, which hosts the largest hard-rock lithium deposit in the Americas.

Investor and Media Inquiries:

+1 647.316.2500

info@lithiumionic.com

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements that constitute “forward-statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. When used in this press release, the words “estimate”, “project”, “belief”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may” or “should” and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the prospectivity and development of the Company’s mineral properties, the amendments to the Vale do Litio Agreement and the Borges Agreement and the Company’s future plans. Such statements and information reflect the current view of the Company. Risks and uncertainties that may cause actual results to differ materially from those contemplated in those forward-looking statements and information. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Information and links in this press release relating to other mineral resource companies are from their sources believed to be reliable, but that have not been independently verified by the Company.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

FAQ

What amendments were made to the purchase agreements by Lithium Ionic Corp.?

What is the payment schedule for the remaining 92.6% interest in Vale do Lítio?

How can Lithium Ionic terminate the Vale do Litio Agreement?

What are the amendments to the Borges Agreement?