Lithium Ionic Completes Acquisition of Remaining 15% of Salinas Properties, Minas Gerais, Brazil

Lithium Ionic has finalized the acquisition of the remaining 15% interest in its Salinas properties in Minas Gerais, Brazil, thereby gaining full ownership.

The transaction involved a cash payment equivalent to USD 2 million and the issuance of 2.5 million shares of Lithium Ionic. An additional payment of USD 1 million is due by April 4, 2025.

A Preliminary Economic Assessment is underway by GE21 Consultoria Mineral Ltda and is expected in the second half of 2024. This arm's-length transaction involved no finder’s fees.

- Lithium Ionic now owns 100% of the Salinas properties, improving control over strategic assets.

- The total acquisition cost was USD 3 million plus 2.5 million shares, potentially reasonable given the strategic importance of the property.

- No finder's fees were incurred, saving additional costs.

- The ongoing Preliminary Economic Assessment can provide strategic insights and possibly enhance the valuation of the Salinas properties.

- The acquisition necessitated a cash payment of USD 2 million and issuance of 2.5 million shares, potentially diluting existing shareholders.

- An additional USD 1 million payment is required by April 4, 2025, impacting future cash flows.

- Pending results from the Preliminary Economic Assessment create uncertainty regarding the project's immediate economic value.

TORONTO, June 11, 2024 (GLOBE NEWSWIRE) -- Lithium Ionic Corp. (TSXV: LTH; OTCQX: LTHCF; FSE: H3N) (“Lithium Ionic” or the “Company”) reports that, further to its May 30, 2024 press release, its wholly owned subsidiary, Neolit Minerals Participações Ltda (“Neolit”), has completed the acquisition of the remaining

As consideration pursuant to the Transaction, the Company has paid the vendor:

- A cash payment of the Brazilian Real equivalent of US

$2 million - The issuance of 2.5 million shares of Lithium Ionic

Additionally, the Company is required to make a subsequent payment of the Brazilian Real equivalent of US

A Preliminary Economic Assessment for Salinas is currently being conducted by the independent Brazilian consultancy, GE21 Consultoria Mineral Ltda, based in Belo Horizonte, Minas Gerais, and is expected to be completed in the second half of 2024.

The Transaction is an arm's-length transaction, and no finder’s fees were paid in connection with it.

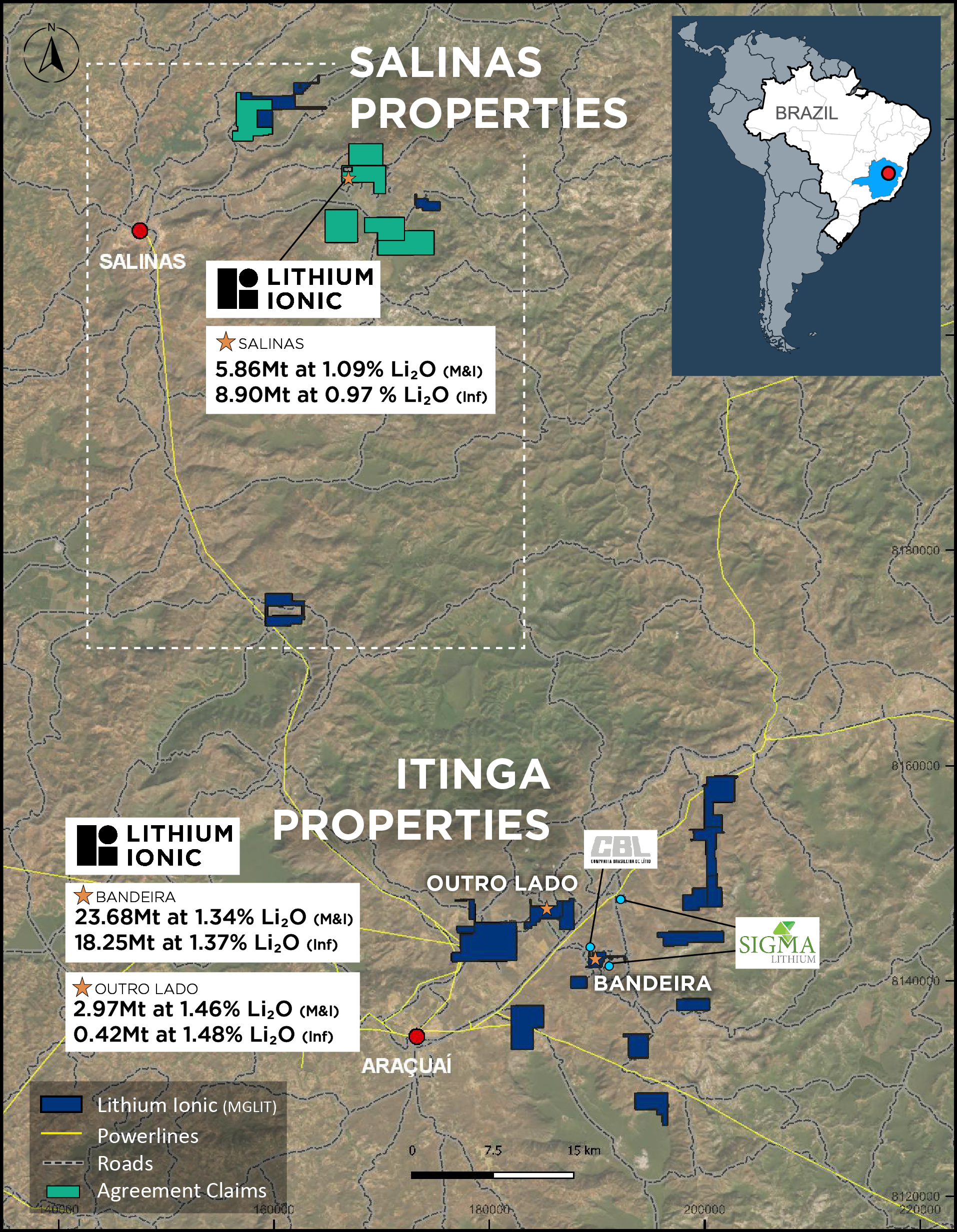

Figure 1: Salinas Properties Location Map

* See NI 43-101 compliant technical report related to the Bandeira Bandeira MRE titled “NI 43-101 Technical Report – Mineral Resource Update on Bandeira Project, Araçuaí and Itinga, Minas Gerais State, Brazil” (effective date of March 5, 2024; QP: Leonardo Soares of GE21); See NI 43-101 compliant technical report related to the Salinas MRE titled “Independent Technical Report on Mineral Resources Estimate” (effective date of January 4, 2024; QP: Leonardo Soares, P.Geo., M.Sc., of GE21); and the NI 43-101 compliant technical reports related to the Outro Lado deposit titled “Mineral Resource Estimate for Lithium Ionic, Itinga Project” (effective date of June 24, 2023; authored by Maxime Dupéré, B. Sc., P.Geo. and Faisal Sayeed, B. Sc., P.Geo).

View Figure 1 here:

https://www.globenewswire.com/NewsRoom/AttachmentNg/483ec3cc-de4b-4c12-b05b-5eeb5da6e7f3

On behalf of the Board of Directors of Lithium Ionic Corp.

Blake Hylands

Chief Executive Officer, Director

About Lithium Ionic Corp.

Lithium Ionic is a Canadian mining company exploring and developing its lithium properties in Brazil. Its flagship Itinga and Salinas projects cover 14,182 hectares in the northeastern part of Minas Gerais state, a mining-friendly jurisdiction that is quickly emerging as a world-class hard-rock lithium district. The Itinga Project is situated in the same region as CBL’s Cachoeira lithium mine, which has produced lithium for +30 years, as well as Sigma Lithium Corp.’s Grota do Cirilo project, which hosts the largest hard-rock lithium deposit in the Americas.

Qualified Persons

The scientific and technical information in this news release has been reviewed and approved by Carlos Costa, Vice President Exploration of Lithium Ionic and Blake Hylands, CEO and director of Lithium Ionic, and both are “qualified persons” as defined in NI 43-101.

Investor and Media Inquiries:

+1 647.316.2500

info@lithiumionic.com

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements that constitute “forward-statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. When used in this press release, the words “estimate”, “project”, “belief”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may” or “should” and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the prospectivity and development of the Company’s mineral properties, the timing and results of a PEA on Salinas, the Transaction, TSXV approval of the Transaction, the Company’s ability to complete the Transaction, the Company’s ability to obtain adequate financing and the Company’s future plans. Such statements and information reflect the current view of the Company. Risks and uncertainties that may cause actual results to differ materially from those contemplated in those forward-looking statements and information. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Information and links in this press release relating to other mineral resource companies are from their sources believed to be reliable, but that have not been independently verified by the Company.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

FAQ

What is the recent acquisition by Lithium Ionic?

How much did Lithium Ionic pay for the Salinas properties acquisition?

When will the Preliminary Economic Assessment for Salinas be completed?

How does the acquisition impact Lithium Ionic's ownership?