Lithium Ionic Enters Option Agreement to Acquire Up to 90% Interest in New Itinga Properties totaling 2,983 ha in the Lithium Valley, Minas Gerais, Brazil

Lithium Ionic has announced an option agreement allowing its subsidiary, Neolit Minerals, to acquire up to a 90% interest in select properties in Brazil's Lithium Valley, Minas Gerais. The properties total 2,983.22 hectares and are within the lithium-rich Araçuaí Pegmatite District. Neolit must invest approximately C$5.5 million by Q1 2030 and deliver a feasibility study to achieve the 90% stake. This acquisition is part of Lithium Ionic's strategy to expand its footprint in promising lithium districts. The company plans extensive exploration to delineate resources and engage local communities for sustainable development.

- Neolit Minerals can acquire up to a 90% interest in 2,983.22 hectares of lithium-rich properties in Brazil.

- The properties are located in the strategically significant Araçuaí Pegmatite District, known for significant spodumene deposits.

- Neolit is required to invest a minimum of R$21.3 million (~C$5.5 million) by Q1 2030.

- This transaction aligns with the company's strategy to expand in high-potential lithium districts.

- Extensive exploration, including geological mapping, geochemical surveys, and drilling, will be conducted.

- Significant investment of approximately C$5.5 million required by Q1 2030, which may strain financial resources.

- Risks associated with fulfilling the terms of the agreement to acquire up to a 90% interest.

- Potential challenges in engaging with local communities and stakeholders for sustainable project development.

TORONTO, July 03, 2024 (GLOBE NEWSWIRE) -- Lithium Ionic Corp. (TSXV: LTH; OTCQX: LTHCF; FSE: H3N) (“Lithium Ionic” or the “Company”) is pleased to announce that its wholly-owned subsidiary, Neolit Minerals Participações Ltda (“Neolit”), has entered into an option agreement (the “Agreement”) with K2 Mineração e Exportação EIRELI, Super Clássico Comércio, Importação e Exportação Ltda. and Minerales Empreendimentos, Mineração e Participações Ltda. to acquire up to a

Transaction Details:

The Agreement grants Neolit the option to acquire up to a

Key Terms of the Agreement:

- Neolit, at its option, has the right to conduct an exploration program and deliver a feasibility study for each SPV to acquire up to a

90% interest in the applicable SPV. - To achieve a

90% interest in each SPV, Neolit will be required to invest a minimum of R$21.3 million (~C$5.5 million ) by Q1 2030. - The properties are strategically located within the lithium-rich Araçuaí Pegmatite District, known for its significant spodumene deposits.

Blake Hylands, P.Geo., Chief Executive Officer of Lithium Ionic, commented, “This transaction marks a significant milestone in our growth strategy, allowing us to expand our presence in Brazil’s premier lithium district. We are excited about the potential these properties hold and are committed to advancing them responsibly to create value for our shareholders and stakeholders.”

The Transaction aligns with the Company’s strategy to expand its footprint in one of the most promising lithium districts globally. The properties under option have demonstrated potential for significant lithium mineralization, which the Company aims to further explore and develop.

Next Steps:

Neolit will commence an extensive exploration program, including geological mapping, geochemical surveys, and drilling, to delineate potential resources within these properties. The Company will also engage with local communities and stakeholders to ensure the sustainable development of these projects.

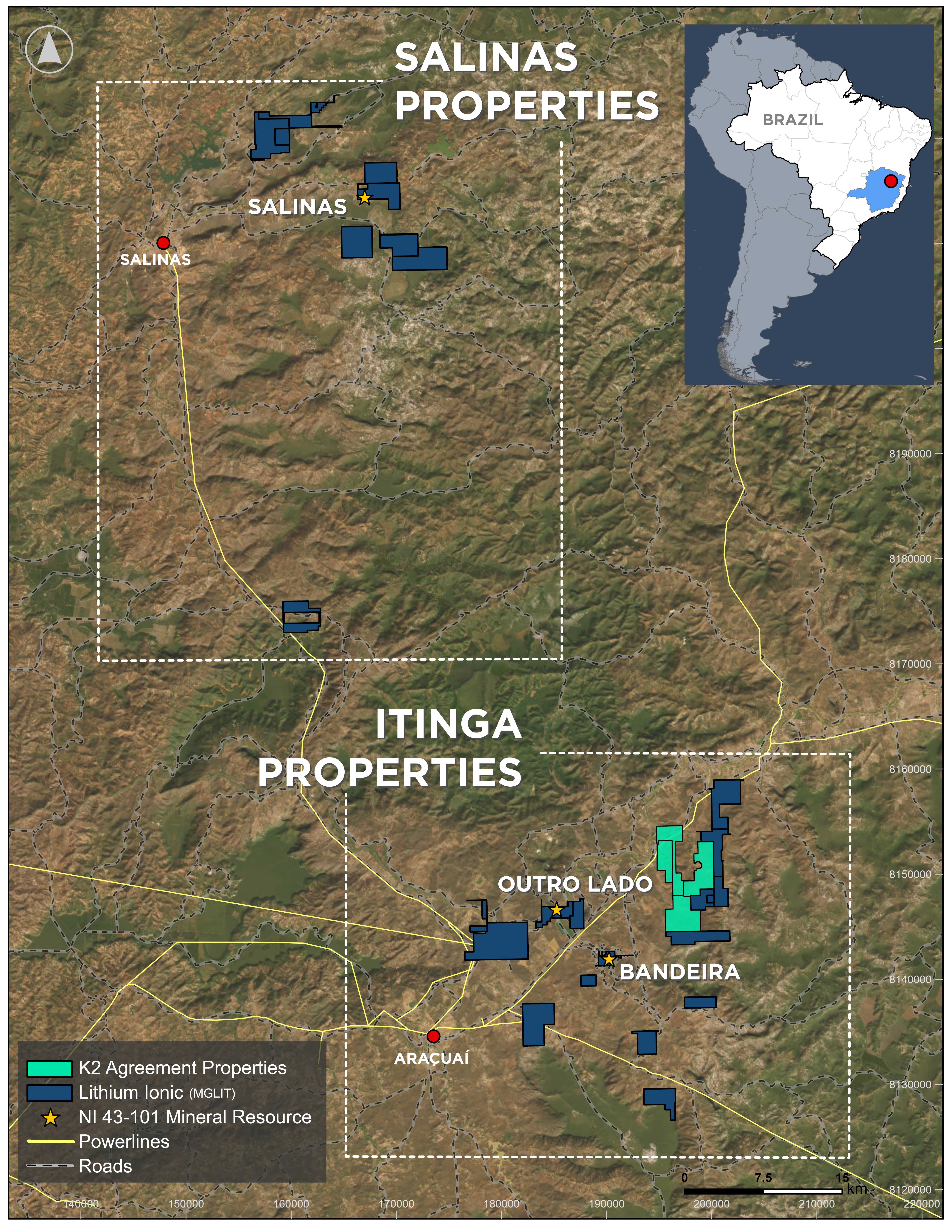

Figure 1. Lithium Ionic Properties in the Lithium Valley and the Agreement Properties

On behalf of the Board of Directors of Lithium Ionic Corp.

Blake Hylands

Chief Executive Officer, Director

About Lithium Ionic Corp.

Lithium Ionic is a Canadian mining company exploring and developing its lithium properties in Brazil. Its flagship Itinga and Salinas projects cover ~17,000 hectares in the northeastern part of Minas Gerais state, a mining-friendly jurisdiction that is quickly emerging as a world-class hard-rock lithium district. The Itinga Project is situated in the same region as CBL’s Cachoeira lithium mine, which has produced lithium for +30 years, as well as Sigma Lithium Corp.’s Grota do Cirilo project, which hosts the largest hard-rock lithium deposit in the Americas.

Qualified Persons

The scientific and technical information in this news release has been reviewed and approved by Carlos Costa, Vice President Exploration of Lithium Ionic and Blake Hylands, CEO and director of Lithium Ionic, and both are “qualified persons” as defined in NI 43-101.

Investor and Media Inquiries:

+1 647.316.2500

info@lithiumionic.com

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements that constitute “forward-statements.” Such forward looking statements involve known and unknown risks, uncertainties and other factors that may cause the Company’s actual results, performance or achievements, or developments to differ materially from the anticipated results, performance or achievements expressed or implied by such forward-looking statements. Although the Company believes, in light of the experience of its officers and directors, current conditions and expected future developments and other factors that have been considered appropriate that the expectations reflected in this forward-looking information are reasonable, undue reliance should not be placed on them because the Company can give no assurance that they will prove to be correct. When used in this press release, the words “estimate”, “project”, “belief”, “anticipate”, “intend”, “expect”, “plan”, “predict”, “may” or “should” and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. The forward-looking statements and information in this press release include information relating to the prospectivity and development of the Company’s mineral properties, the timing and results of the Agreement, the Transaction, the Company’s ability to complete the Transaction, the Company’s ability to obtain adequate financing and the Company’s future plans. Such statements and information reflect the current view of the Company. Risks and uncertainties that may cause actual results to differ materially from those contemplated in those forward-looking statements and information. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking information contained in this news release represents the expectations of the Company as of the date of this news release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date. The Company undertakes no obligation to update these forward-looking statements in the event that management’s beliefs, estimates or opinions, or other factors, should change.

Information and links in this press release relating to other mineral resource companies are from their sources believed to be reliable, but that have not been independently verified by the Company.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this press release.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/02b3df41-dc69-44db-861a-1ab826fa0505

FAQ

What properties are included in Lithium Ionic's new option agreement?

What is the transaction value for Lithium Ionic's recent acquisition in Brazil?

What is the significance of the Araçuaí Pegmatite District for Lithium Ionic?

What are the next steps for Neolit Minerals in the Lithium Valley properties?