Klondike Gold Closes Oversubscribed Private Placement Raising $970,736

Rhea-AI Summary

Klondike Gold has successfully closed an oversubscribed non-brokered private placement financing, raising $970,736.85. This financing involved the issuance of 10,785,965 units at $0.09 per unit, consisting of one common share and one share purchase warrant exercisable at $0.15 per share until May 17, 2026. Additional finder's fees were paid in cash and warrants to Haywood Securities and Canaccord Genuity. The funds will be used for exploration, drill programs, and general working capital for the Klondike District Property in Yukon. Notably, three insiders participated, acquiring 3,613,888 units, but no new insiders were created or control changes occurred. All securities are subject to a four-month hold period. The company also announced participation in several upcoming investment conferences.

Positive

- Successfully raised $970,736.85 through oversubscribed private placement.

- Issued 10,785,965 units at $0.09 per unit, including common shares and share purchase warrants.

- Warrants exercisable at $0.15 per share until May 17, 2026.

- Proceeds to fund exploration, drill programs, and general working capital in the Klondike District Property.

- Three insiders participated, showing confidence in the company's prospects.

- No new insiders or change of control occurred, maintaining stable governance.

Negative

- Cash finder's fees of $8,640 were paid, increasing expenses.

- All securities issued are subject to a four-month hold, limiting immediate liquidity for investors.

- Participation of insiders in the financing could raise concerns about potential conflicts of interest.

- Securities not registered under the U.S. Securities Act, limiting access to U.S. investors.

News Market Reaction 1 Alert

On the day this news was published, KDKGF declined 6.20%, reflecting a notable negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

VANCOUVER, BC / ACCESSWIRE / May 21, 2024 / Klondike Gold Corp. (TSXV:KG)(FRA:LBDP)(OTCQB:KDKGF) ("Klondike Gold" or the "Company") is pleased to announce that further to its news release of May 14, 2024, the Company has closed its oversubscribed non-brokered private placement financing, raising

In closing the Private Placement, the Company issued an aggregate of 10,785,965 units (each, a "Unit") at a price of

All warrants are exercisable at a price of

The Company also paid an aggregate of cash finder's fees

All securities issued in connection with the Private Placement are subject to a four month and one day statutory hold period expiring on September 18, 2024, in accordance with applicable securities laws and the policies of the TSX Venture Exchange.

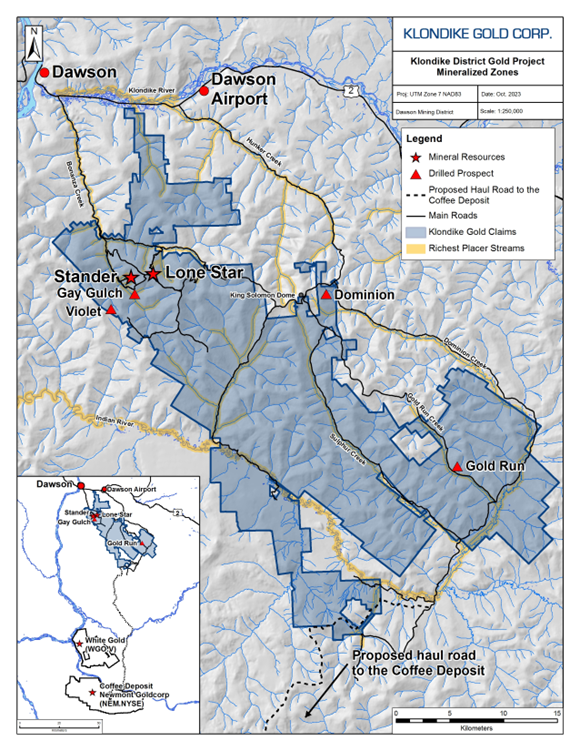

The Company intends to use the proceeds from the financing to fund ongoing and future exploration and drill programs and general working capital at the Company's

Three insiders of the Company participated in the Private Placement and acquired an aggregate of 3,613,888 Units. The purchases by these insiders constitute "related party transactions" within the meaning of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The issuances are exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 as they are distributions of securities for cash and the fair market value of the Units issued to, and the consideration paid by, the insider did not exceed

The securities have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any U.S. state securities laws, and may not be offered or sold in the United States without registration under the U.S. Securities Act and all applicable state securities laws or compliance with the requirements of an applicable exemption therefrom. This press release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

UPCOMING EVENTS

Klondike Gold will be participating in the following upcoming events:

- June 21 - 26: Invest Yukon Investment Conference/Property Tour (Dawson, YT)

- July 19 - 21: CEM TSX Venture Growth Conference (Kelowna, BC)

- August 12 - 16: Klondike Investment Conference/Property Tour (Dawson, YT)

- November 22 - 24: CEM Florida Capital Event (Miami, FL)

ABOUT KLONDIKE GOLD CORP.

Klondike Gold is a Vancouver based gold exploration company advancing its

1 The Mineral Resource Estimate for the Klondike District Property was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., an independent Qualified Person in accordance with the requirements of NI 43-101. The technical report supporting the Mineral Resource Estimate entitled "NI 43-101 Technical Report on the Klondike District Gold Project, Yukon Territory, Canada" has been filed on SEDAR+ at www.sedarplus.ca effective November 10, 2022. Refer to news release of December 16, 2022.

ON BEHALF OF KLONDIKE GOLD CORP.

"Peter Tallman"

Peter Tallman,

President and CEO

FOR FURTHER INFORMATION:

Telephone: (604) 609-6138

E-mail: info@klondikegoldcorp.com

Website: www.klondikegoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain statements contained in this news release constitute "forward-looking statements". When used in this document, the words "anticipated", "expect", "estimated", "forecast", "planned", and similar expressions are intended to identify forward-looking statements or information. These statements are based on current expectations of management, however, they are subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking statements in this news release. Readers are cautioned not to place undue reliance on these statements. Klondike Gold does not undertake any obligation to revise or update any forward-looking statements as a result of new information, future events or otherwise after the hereof, except as required by securities laws.

SOURCE: Klondike Gold Corp.

View the original press release on accesswire.com