Klondike Gold announces $850,000 Private Placement

Rhea-AI Summary

Klondike Gold Corp. (TSXV:KG) (OTCQB:KDKGF) has announced a non-brokered private placement aiming to raise up to $850,000. The offering consists of 9,444,444 units priced at $0.09 per unit. Each unit includes one common share and one share purchase warrant. The warrant allows the holder to purchase an additional share at $0.15 for up to 24 months. The funds will support ongoing and future exploration, drill programs, and general working capital. This financing is subject to TSX Venture Exchange approval and a four-month plus one-day hold period.

Positive

- Klondike Gold aims to raise $850,000 through private placement.

- Price per unit set at $0.09, potentially attracting investors.

- Each unit includes a warrant for additional shares at $0.15, offering more value to investors.

- Funds to be used for exploration and drill programs, promising potential resource discoveries.

- Additional funds allocated for general working capital, ensuring ongoing operations.

Negative

- The financing is subject to TSX Venture Exchange approval, introducing regulatory risk.

- All securities are subject to a four-month and one-day hold period, limiting liquidity for investors.

- Dilution risk as 9,444,444 new units are issued, potentially impacting existing shareholders.

- The 24-month period for warrant exercise introduces long-term uncertainty.

News Market Reaction 1 Alert

On the day this news was published, KDKGF declined 3.57%, reflecting a moderate negative market reaction.

Data tracked by StockTitan Argus on the day of publication.

NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES

VANCOUVER, BC / ACCESSWIRE / May 14, 2024 / Klondike Gold Corp. (TSXV:KG)(FRA:LBDP)(OTCQB:KDKGF) ("Klondike Gold" or the "Company") is pleased to announce a non-brokered private placement of up to 9,444,444 units at a price of

Each unit will consist of one common share and one share purchase warrant (the "Units"). Each full warrant will entitle the holder to purchase one common share at a price of

The Company intends to use the proceeds from the financing to fund ongoing and future exploration and drill programs and general working capital.

The securities issued in connection with the Financing are subject to TSX Venture Exchange approval and all securities will be subject to a four-month and one day statutory hold period in accordance with applicable securities laws and the policies of the TSX Venture Exchange.

ABOUT KLONDIKE GOLD CORP.

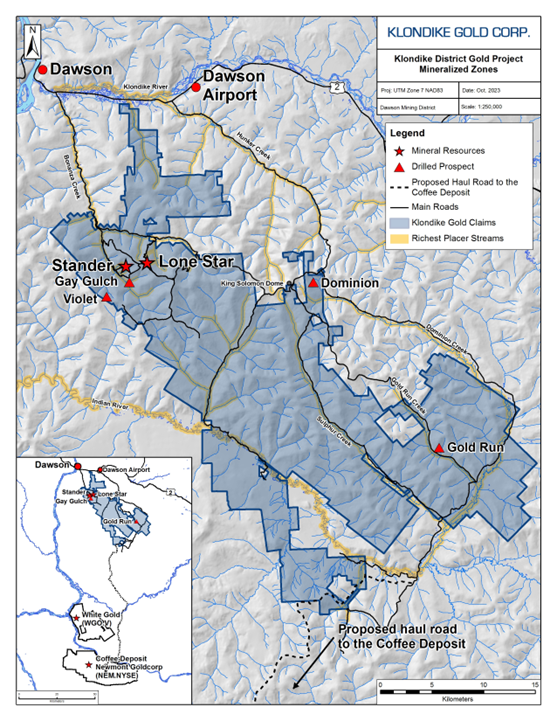

Klondike Gold is a Vancouver based gold exploration company advancing its

1 The Initial Mineral Resource Estimate for the Klondike District Property was prepared by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc., an independent Qualified Person in accordance with the requirements of NI 43-101. The technical report supporting the Mineral Resource Estimate entitled "NI 43-101 Technical Report on the Klondike District Gold Project, Yukon Territory, Canada" has been filed on SEDAR+ at www.sedarplus.ca effective November 10, 2022. Refer to news release of December 16, 2022.

ON BEHALF OF KLONDIKE GOLD CORP.

"Peter Tallman"

Peter Tallman

President and CEO

FOR FURTHER INFORMATION:

Telephone: (604) 609-6138

E-mail: info@klondikegoldcorp.com

Website: www.klondikegoldcorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information:

"This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities laws. This information and statements address future activities, events, plans, developments and projections. All statements, other than statements of historical fact, constitute forward-looking statements or forward-looking information. Such forward-looking information and statements are frequently identified by words such as "may," "will," "should," "anticipate," "plan," "expect," "believe," "estimate," "intend" and similar terminology, and reflect assumptions, estimates, opinions and analysis made by management of Klondike Gold in light of its experience, current conditions, expectations of future developments and other factors which it believes to be reasonable and relevant. Forward-looking information and statements involve known and unknown risks and uncertainties that may cause Klondike Gold's actual results, performance and achievements to differ materially from those expressed or implied by the forward-looking information and statements and accordingly, undue reliance should not be placed thereon. Risks and uncertainties that may cause actual results to vary include but are not limited to the availability of financing; fluctuations in commodity prices; changes to and compliance with applicable laws and regulations, including environmental laws and obtaining requisite permits; political, economic and other risks; as well as other risks and uncertainties which are more fully described in our annual and quarterly Management Discussion and Analysis and in other filings made by Klondike Gold with Canadian securities regulatory authorities and available at www.sedarplus.ca. Klondike Gold disclaims any obligation to update or revise any forward-looking information or statements except as may be required."

SOURCE: Klondike Gold Corp.

View the original press release on accesswire.com