J.P. Morgan Launches Private Markets Data Solutions for Institutional Investors

Fusion by J.P. Morgan releases a new suite of private markets data services that delivers standardized data aggregated from multiple vendors and sources, allowing investors to analyze their complete portfolio across private and publicly traded holdings.

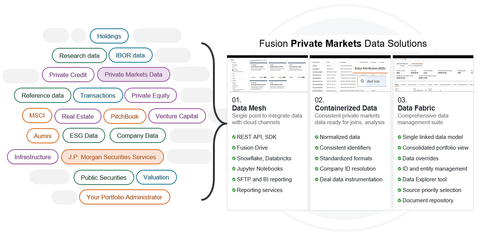

Flowchart shows the capabilities of J.P. Morgan Fusion’s new suite of private markets data services. (Graphic: Business Wire)

The growth of alternative portfolios has presented investors with unique data challenges. The lack of a single, standardized source for private markets means investors are left with incomplete and fragmented data that is difficult to analyze. The process of manually extracting and integrating data from unstructured sources is time-consuming, costly, and error prone. Managing multiple vendors, data feeds, and portfolio administrators complicates data consolidation and transparency, affecting decision-making and necessitating specialized expertise and scalable technology, which further escalates costs and delays time to market.

Fusion minimizes the need for resource-intensive processes by offloading this workload to algorithms that work automatically, accelerating time to insights. Data is ingested from J.P. Morgan Securities Services and portfolio administrators, which is then complemented with reference data from vendors. Developed by J.P. Morgan’s data experts, Fusion’s proprietary AI-ML technology helps correct discrepancies and incompleteness and applies standard identifiers for consistency and easy interoperability. Clients receive standardized, enriched data that is consistent across diverse asset classes like private equity, real estate, venture capital, natural resources, and infrastructure, while preserving granular detail and linkage.

Tim Fitzgerald, Global Head of Securities Services, said, “Securities Services is committed to helping clients meet the challenges of an increasingly competitive private asset market with innovative data-driven solutions. Our platform empowers clients with more information to drive their decision making, while optimizing their workflow.”

To offer clients a single source for more complete, high-quality data that works across public and private assets, Fusion has incorporated data from Aumni, J.P. Morgan's private capital platform, and external leading data providers like Canoe Intelligence, MSCI Private Capital Solutions, and PitchBook. Investors can analyze and manage their data with the Fusion Data Explorer tool, allowing them to drill down into underlying assets and navigate across linked data points, for a deeper understanding of their holdings.

Gerard Francis, Head of Fusion, said, “Fusion is uniquely positioned to integrate private markets and client investment data, leveraging proprietary graph technology and AI-ML models for comprehensive portfolio transparency and interoperability. Our cloud-native platform supports data from multiple portfolio administrators and vendors, ensuring seamless integration, scalability, and a streamlined experience without legacy infrastructure constraints."

Fusion’s Data Mesh supports a variety of cloud-native channels, designed to simplify the process of integrating Fusion data into clients’ existing technology stack. For business users, the newly launched Fusion Drive enables desktop applications like Excel, Tableau, and Alteryx to connect directly to Fusion data, and receive updates automatically.

Learn more: fusion.jpmorgan.com/solutions/private-markets

Key Capabilities:

- Private markets data integration: Fusion takes in reference data from leading providers like Aumni (J.P. Morgan’s private capital platform), Canoe Intelligence, MSCI Private Capital Solutions, and PitchBook.

- Data ingestion from multiple fund and portfolio administrators: Fusion supports portfolio data from J.P. Morgan Securities Services and other portfolio administrators that clients use. Data is harmonized for seamless interoperability across administrators.

- Data normalization: Data is normalized to look and feel the same, so it’s ready to be used across investors’ operating models. Fusion models data for clarity and consistency, applying standard identifiers and linking relevant datapoints.

- Complete portfolio view and Data Explorer: Investors can view, analyze, and drill down into private market data using an intuitive exploration tool. The linked data model enables interoperability between private and public asset classes, portfolios and accounts, to easily dive deep and analyze.

- Data management: Fusion gives clients powerful controls to apply rules-based adjustments and overrides to data. This functionality allows users to ensure data is fit-for-purpose across multiple lines of business without altering the underlying data or linkage.

- Data Mesh: Fusion offers a suite of cloud-native channels for clients to integrate Fusion data directly into their tech stacks, including API, Jupyter Notebook, Snowflake, Databricks and more. Connect data directly to your desktop applications with Fusion Drive.

About Fusion by J.P. Morgan

Fusion is a cloud-native data technology solution that provides data management, analytics and reporting for institutional investors. Fusion builds on J.P. Morgan’s global operating model and rich data foundation as an industry-leading Securities Services provider to deliver benefits of scale and reduce costs. With a broad array of integrated solutions that span investment strategies, fund structures, asset types and geographies, J.P. Morgan Securities Services delivers the expertise, scale and capabilities to help our clients protect and grow their assets, optimize efficiency and maximize opportunities in diverse global markets.

About the Commercial & Investment Bank

J.P. Morgan’s Commercial & Investment Bank is a global leader in banking, payments, markets and securities services. Start-ups, companies, governments and institutions entrust us with their business in more than 100 countries worldwide. With

View source version on businesswire.com: https://www.businesswire.com/news/home/20241016890254/en/

Media Contact:

Gurpreet Kaur 212-270-8894

gurpreet.x3.kaur@jpmorgan.com

Source: JPMorgan Chase & Co.