John Marshall Bancorp, Inc. Surpasses $2 Billion in Assets; 9th Consecutive Quarter of Record Earnings

John Marshall Bancorp (OTCQB: JMSB) reported strong financial results for Q1 2021, achieving a record net income of $5.1 million, up 12.7% from Q1 2020. Earnings per diluted share rose to $0.37, a 12.1% year-over-year increase. Total assets reached $2.01 billion, reflecting a 23.8% growth. Pre-tax, pre-provision income also hit a record of $8.9 million, increasing 49.3% from the prior year. Notably, the asset quality remained strong with no non-performing loans reported.

- Record net income of $5.1 million, a 12.7% year-over-year increase

- Earnings per diluted share increased to $0.37, a 12.1% rise

- Total assets surpassed $2 billion, growing by 23.8%

- Record pre-tax, pre-provision income of $8.9 million, a 49.3% increase

- No non-performing loans for six consecutive quarters

- None.

John Marshall Bancorp, Inc. (OTCQB: JMSB) (the “Company”), parent company of John Marshall Bank (the “Bank”), reported its financial results for the three months ended March 31, 2021.

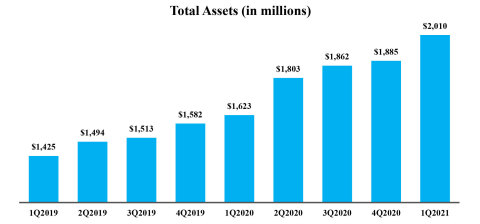

Total Assets (in millions) (Graphic: Business Wire)

Selected Highlights

-

Ninth Consecutive Quarter of Record Earnings - The Company reported net income of

$5.1 million for the three months ended March 31, 2021, a12.7% increase over the$4.5 million reported for the three months ended March 31, 2020. Earnings per diluted share for the three months ended March 31, 2021 were$0.37 , a12.1% increase over the$0.33 reported for the three months ended March 31, 2020. Return on average assets was1.05% and return on average equity was10.89% for the three months ended March 31, 2021. Return on average assets was1.14% and return on average equity was10.87% for the three months ended March 31, 2020.

-

Record Pre-Tax, Pre-Provision Income - The Company achieved record pre-tax, pre-provision (“PTPP”) income of

$8.9 million for the three months ended March 31, 2021, a49.3% increase from the same period a year ago. Management believes PTPP income enables financial statement users to assess the Company’s ability to generate capital to cover potential credit losses which could arise before the COVID pandemic’s eradication. PTPP annualized return on average assets was1.84% for the three months ended March 31, 2021 versus1.50% for the three months ended March 31, 2020.

-

Strong Growth as Assets Surpass

$2.0 Billion - Total assets increased23.8% or$386.9 million to$2.01 billion at March 31, 2021. Gross loans net of unearned income increased$269.0 million or20.1% from March 31, 2020 to March 31, 2021. Gross loans net of unearned income and Paycheck Protection Program (“PPP”) loans grew$151.2 million or11.3% from March 31, 2020 to March 31, 2021. Total deposits grew$381.9 million or27.7% from March 31, 2020 to March 31, 2021. Non-interest bearing demand deposits grew52.7% or$144.9 million from March 31, 2020 to March 31, 2021.

-

Asset Quality Remains Pristine - For the sixth consecutive quarter, the Company had no non-performing loans, no loans 30 days or more past due and no real estate owned at quarter-end March 31, 2021. The Company had

$1 thousand in charge-offs during the first quarter of 2021 and no charge-offs during the first quarter of 2020. Trouble

FAQ

What were JMSB's earnings for Q1 2021?

How much did JMSB's assets grow in Q1 2021?

What was the earnings per share for JMSB in Q1 2021?

Did JMSB experience any non-performing loans in Q1 2021?